Virginia Rent Application Withholding

Description

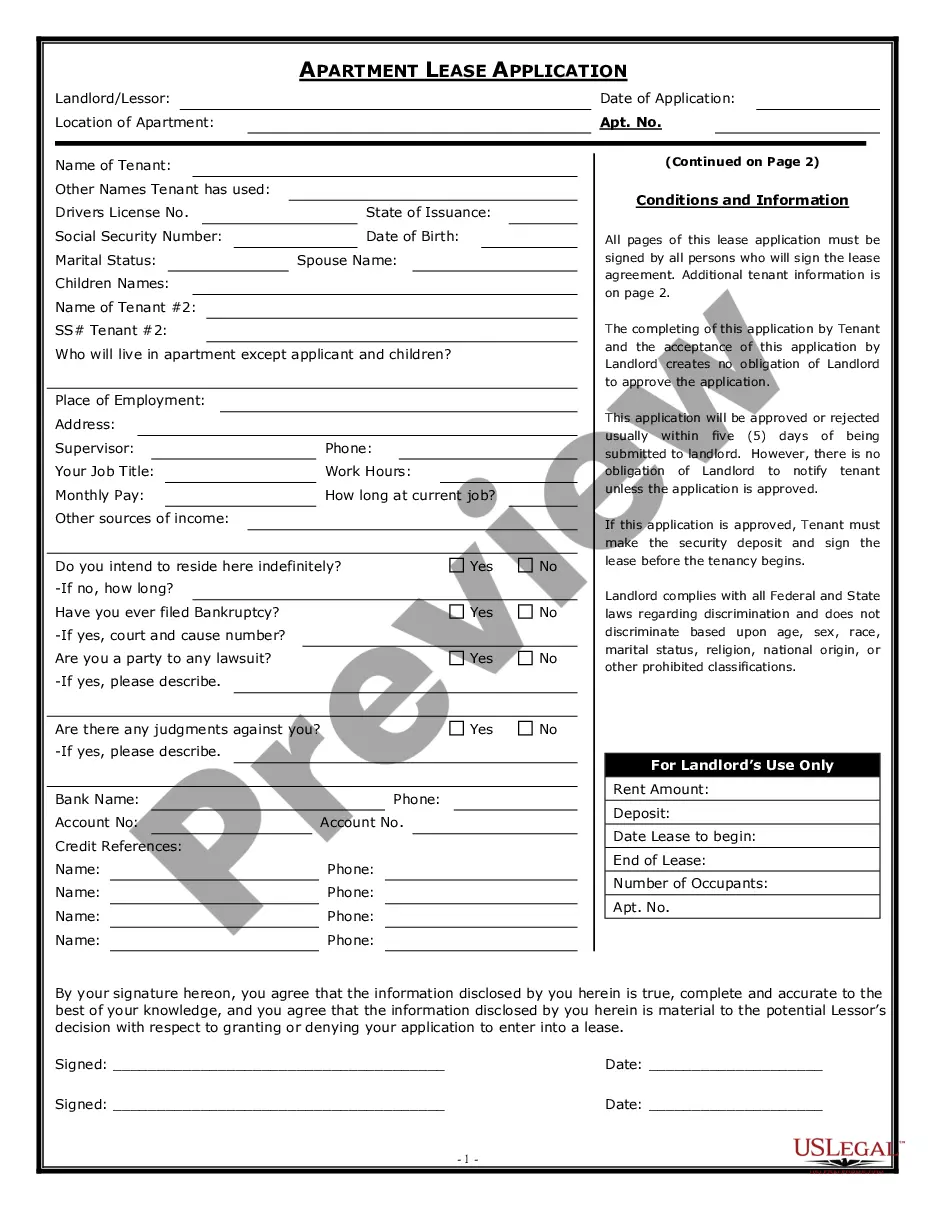

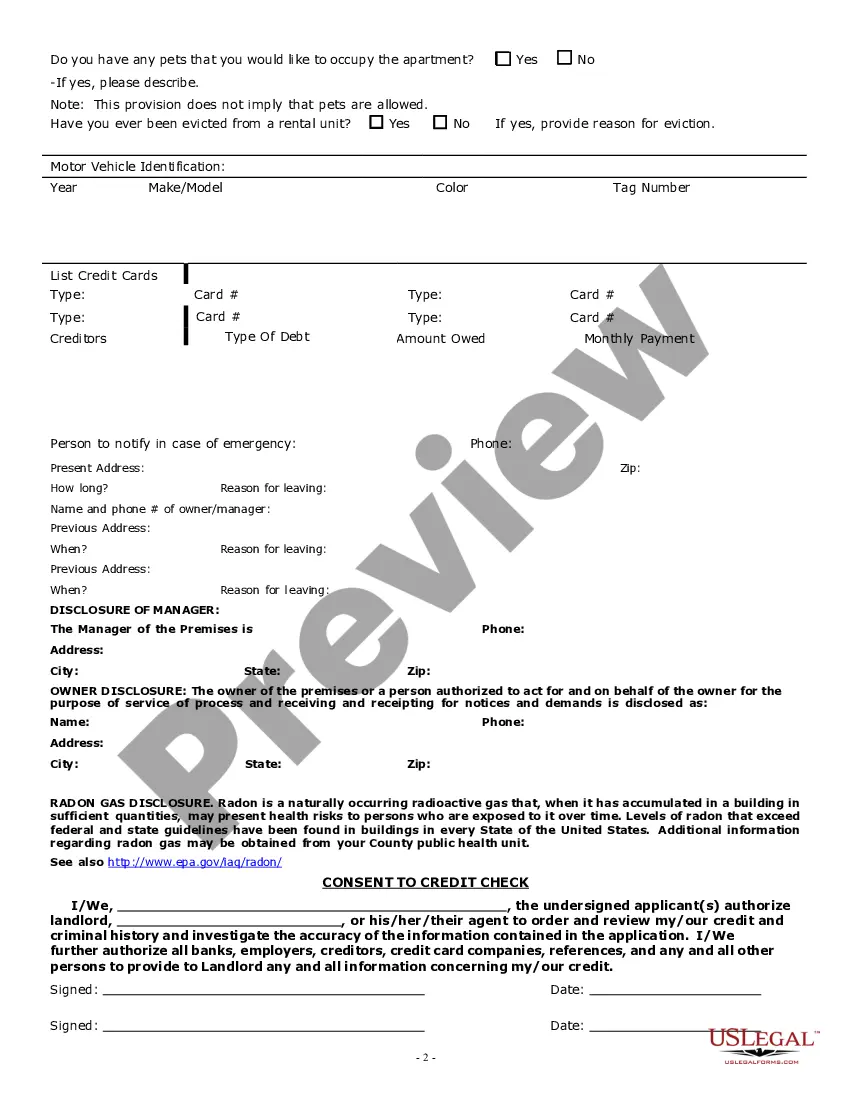

How to fill out Virginia Apartment Lease Rental Application Questionnaire?

Obtaining legal document examples that comply with federal and state regulations is essential, and the internet provides many alternatives to choose from.

However, what’s the use of squandering time looking for the accurately prepared Virginia Rent Application Withholding sample online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for any business and personal scenario.

Review the template using the Preview feature or through the text description to confirm it satisfies your requirements.

- They are simple to navigate with all documents categorized by state and intended use.

- Our experts keep up with legal updates, so you can always trust that your documents are current and compliant when obtaining a Virginia Rent Application Withholding from our site.

- Acquiring a Virginia Rent Application Withholding is straightforward and fast for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in your desired format.

- If you are new to our site, follow the guidelines below.

Form popularity

FAQ

In general, an employer who pays wages to one or more employees in Virginia is required to deduct and withhold state income tax from those wages. Since Virginia law substantially conforms to federal law, if federal law requires an employer to withhold tax from any payment, we also require Virginia withholding.

Tenant Rights to Withhold Rent in Virginia Tenants may exercise the right to withhold rent if a landlord fails to take care of important repairs, such as a broken heater. (Va. Code Ann. § 55.1-1244 (2020).)

If repairs are not made, a tenant can file a Tenant's Assertion in General District Court. This must be filed no later than 5 days after rent is due. There is no rent withholding in Virginia, except under ?repair and deduct.?

Also, remember that Virginia does not allow a tenant to withhold rent. Per the law, you must notify a landlord of problems. However, deciding what is required and what notices you should send can be complicated. Facing an eviction can only make the situation more urgent.

Virginia law conforms to the federal definition of income subject to withholding. Virginia withholding is generally required on any payment for which federal withholding is required. This includes most wages, pensions and annuities, gambling winnings, vacation pay, bonuses, and certain expense reimbursements.