Separation Agreement Utah Withholding

Description

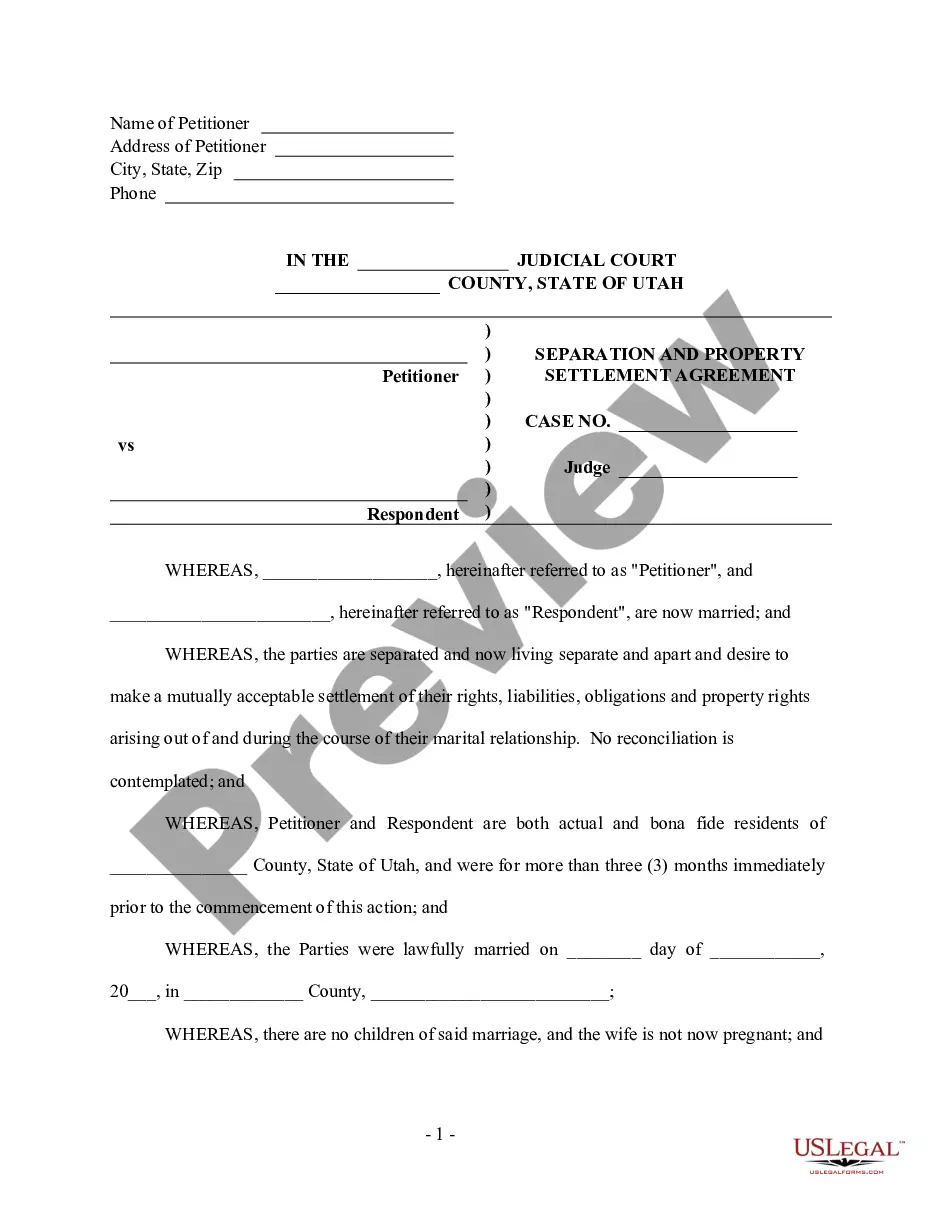

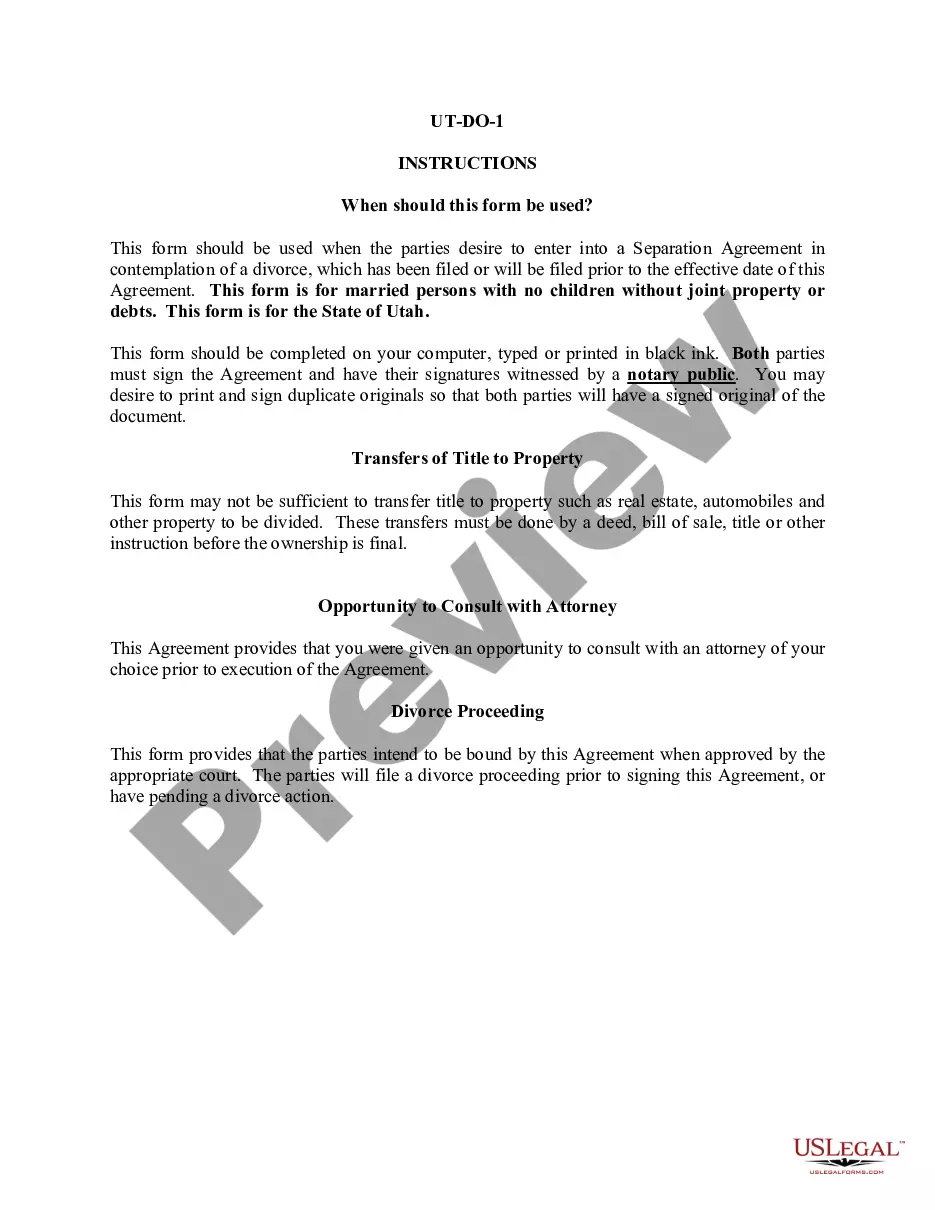

How to fill out Utah Marital Domestic Separation And Property Settlement Agreement No Children Parties May Have Joint Property Or Debts Where Divorce Action Filed?

How can you locate professional legal documents that align with your state's regulations and create the Separation Agreement Utah Withholding without resorting to a lawyer? Numerous online services offer templates to address various legal situations and procedures.

However, it might take a while to ascertain which of the existing samples meet both your usage and legal specifications.

US Legal Forms is a trusted resource that assists you in locating official documents crafted according to the latest updates in state law, saving you expenses on legal counsel.

If you don’t have an account with US Legal Forms, follow the steps below: Look at the webpage you've opened and check if the form meets your needs. Use the form description and preview options when accessible. If needed, search for another template in the header that lists your state. Click the Buy Now button when you discover the correct document. Choose the most appropriate pricing plan, then Log In or register for an account. Select your payment option (credit card or PayPal). Change the file format for your Separation Agreement Utah Withholding and click Download. The downloaded templates will remain with you: you can always return to them in the My documents section of your profile. Join our collection and create legal documents independently like a seasoned legal expert!

- US Legal Forms is not just a typical online library.

- It is a compilation of over 85,000 validated templates for diverse business and personal circumstances.

- All documents are categorized by industry and state to streamline your search process.

- Additionally, it integrates with powerful tools for PDF editing and electronic signatures, enabling users with a Premium membership to effortlessly finish their documentation online.

- It requires minimal time and effort to obtain the necessary documents.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Separation Agreement Utah Withholding by clicking the corresponding button next to the document name.

Form popularity

FAQ

The state of Utah has a single personal income tax, with a flat rate of 4.95%.

Withholding Formula (Effective Pay Period 10, 2018)Multiply the adjusted gross biweekly wages by the number of pay dates in the tax year to obtain the gross annual wages. Multiply the annual taxable wages by 4.95 percent to determine the annual gross tax amount.

You may file your withholding returns online at tap.utah.gov. You must include your FEIN and withholding account ID number on each return. You can pay electronically by: Electronic Funds Transfer (EFT) ACH credit You initiate this payment through your financial institution.

The income tax withholding formula for the State of Utah has been updated to eliminate the withholding allowance for employees who have not filed a W-4 form. The tax withheld will be at a flat 4.95 percent for those employees. No action on the part of the employee or the personnel office is necessary.

Two allowances at one job and zero at the other. If you are married and have one child, you should claim three allowances.