Estate Questionnaire With Customers

Description

How to fill out Estate Planning Questionnaire?

It's clear that you cannot instantly become a legal authority, nor can you swiftly learn to draft an Estate Questionnaire With Customers without the necessary specialized knowledge.

Assembling legal documents is a labor-intensive task that demands specific training and expertise. So why not entrust the preparation of the Estate Questionnaire With Customers to the professionals.

With US Legal Forms, one of the most comprehensive repositories of legal documents, you can discover anything from court filings to templates for internal communication. We recognize how crucial it is to comply with and follow federal and local regulations. That's why, on our platform, all documents are tailored to your location and updated regularly.

Click Buy now. Upon completion of your payment, you can download the Estate Questionnaire With Customers, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

You can re-access your documents anytime from the My documents tab. If you are an existing user, you can simply Log In and find and download the template from the same tab.

- Begin by visiting our website to obtain the document you require in just a few minutes.

- Locate the form you need using the search bar at the top of the page.

- Preview it (if this feature is available) and read the accompanying description to determine if the Estate Questionnaire With Customers meets your needs.

- Start your search again if you require a different form.

- Create a free account and select a subscription plan to acquire the template.

Form popularity

FAQ

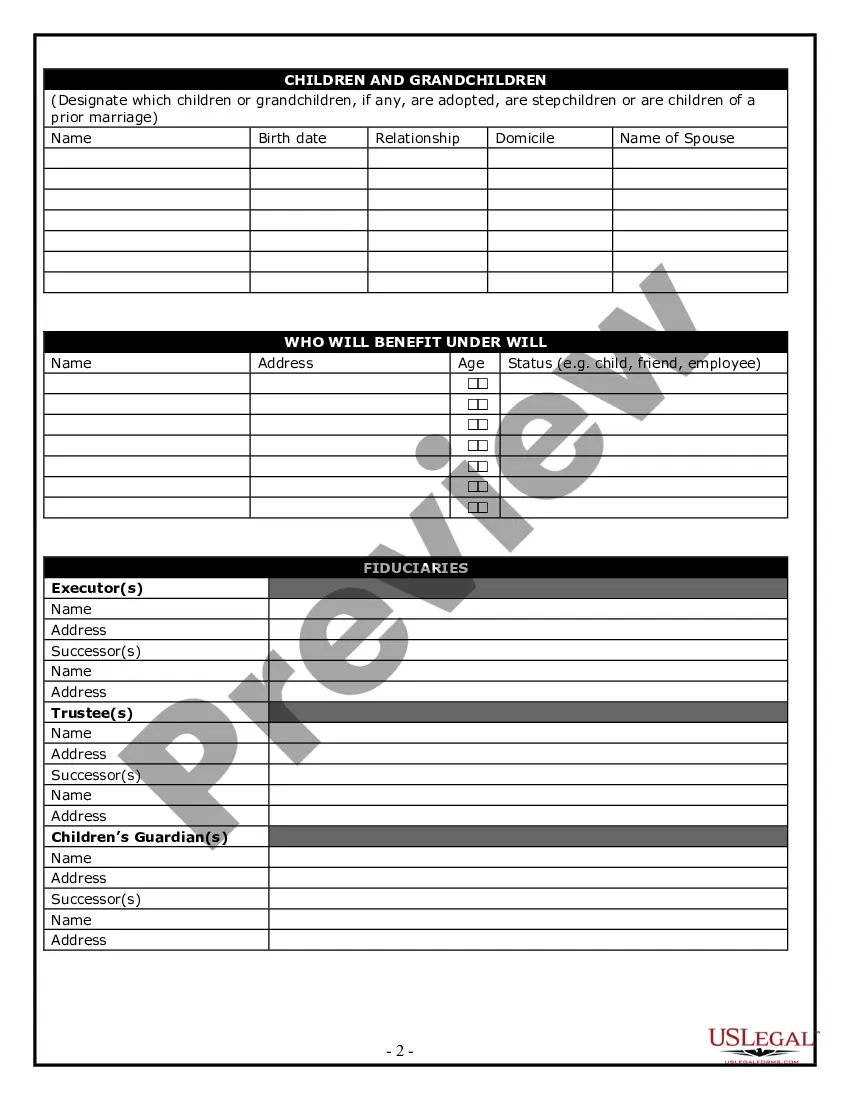

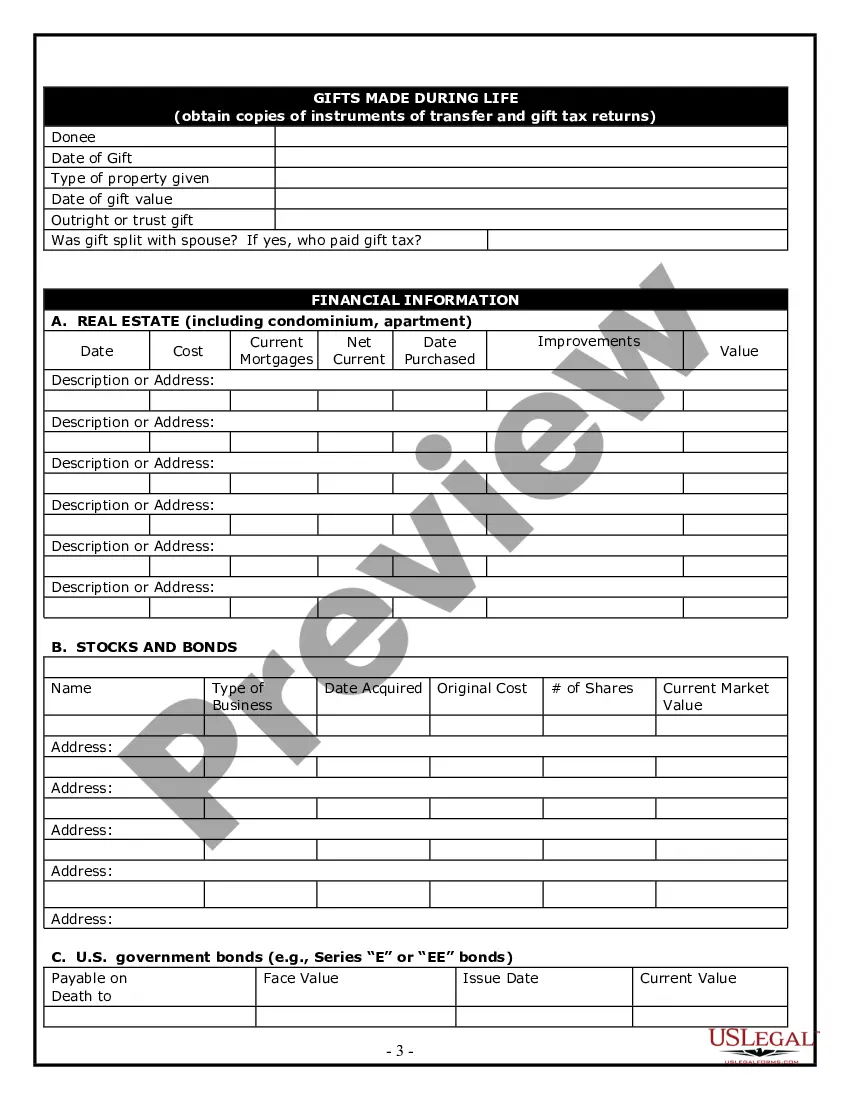

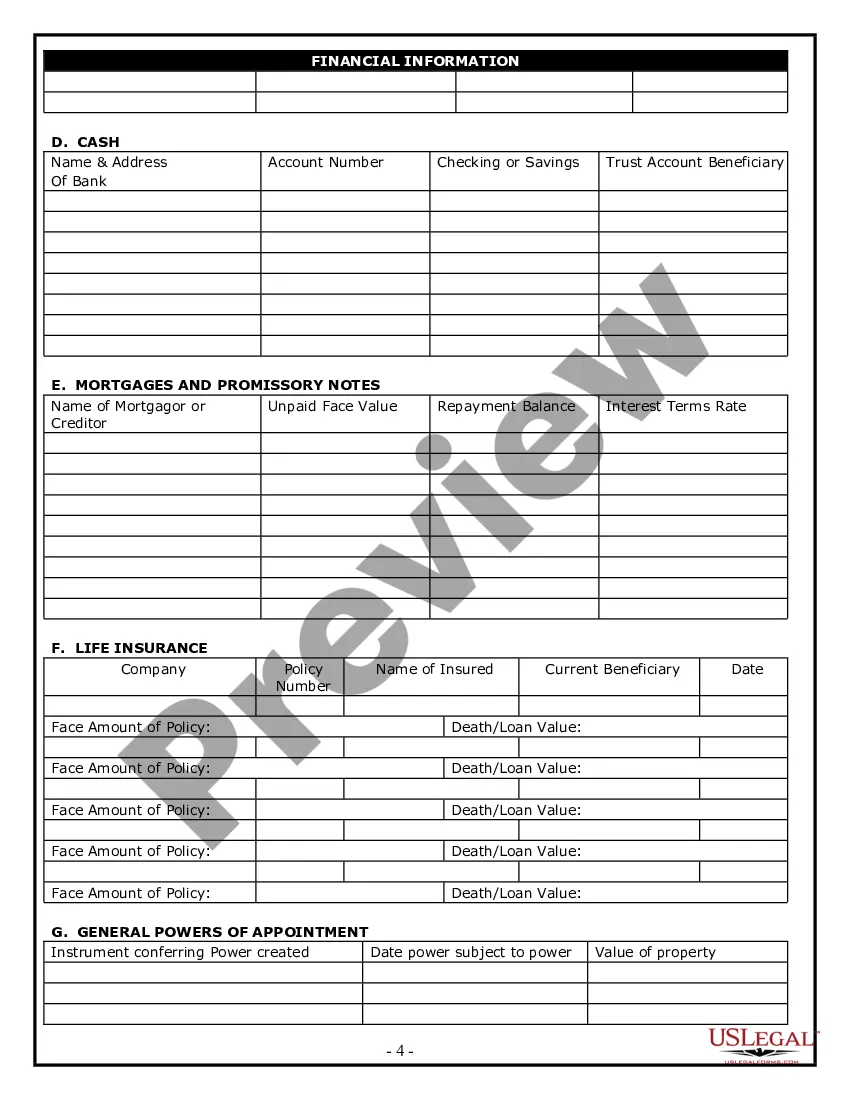

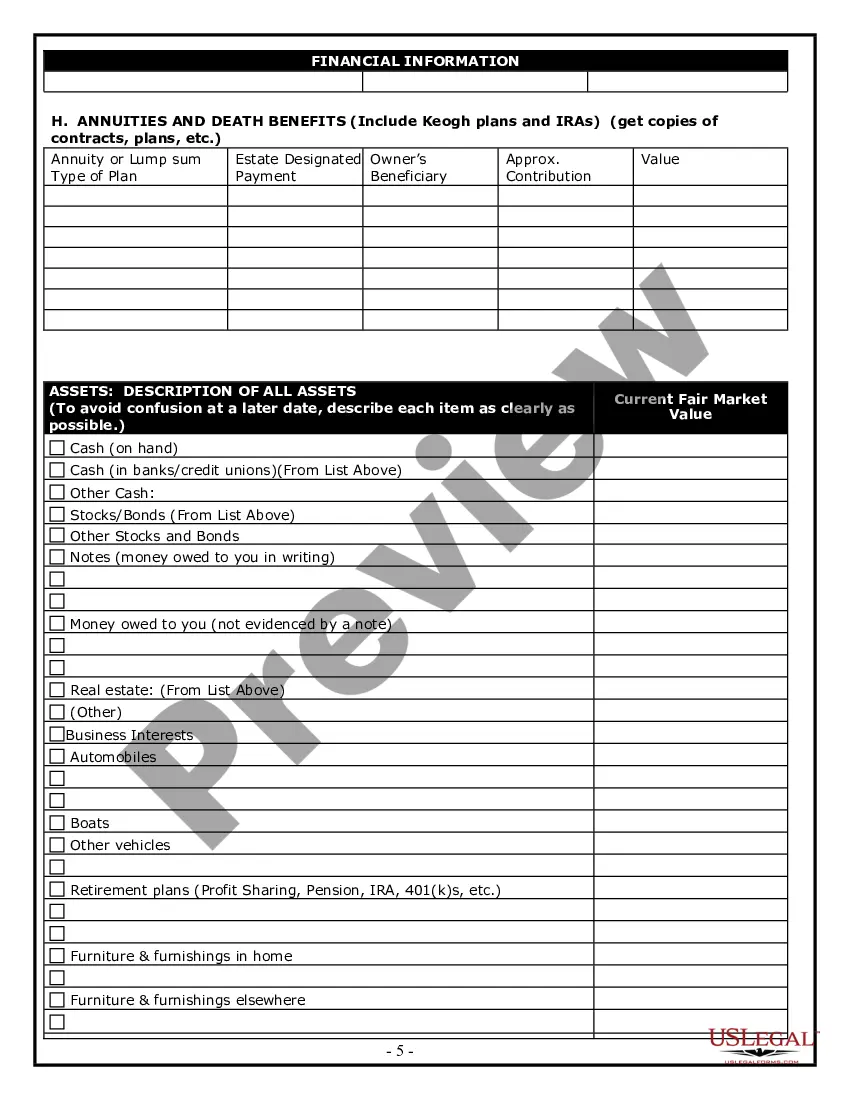

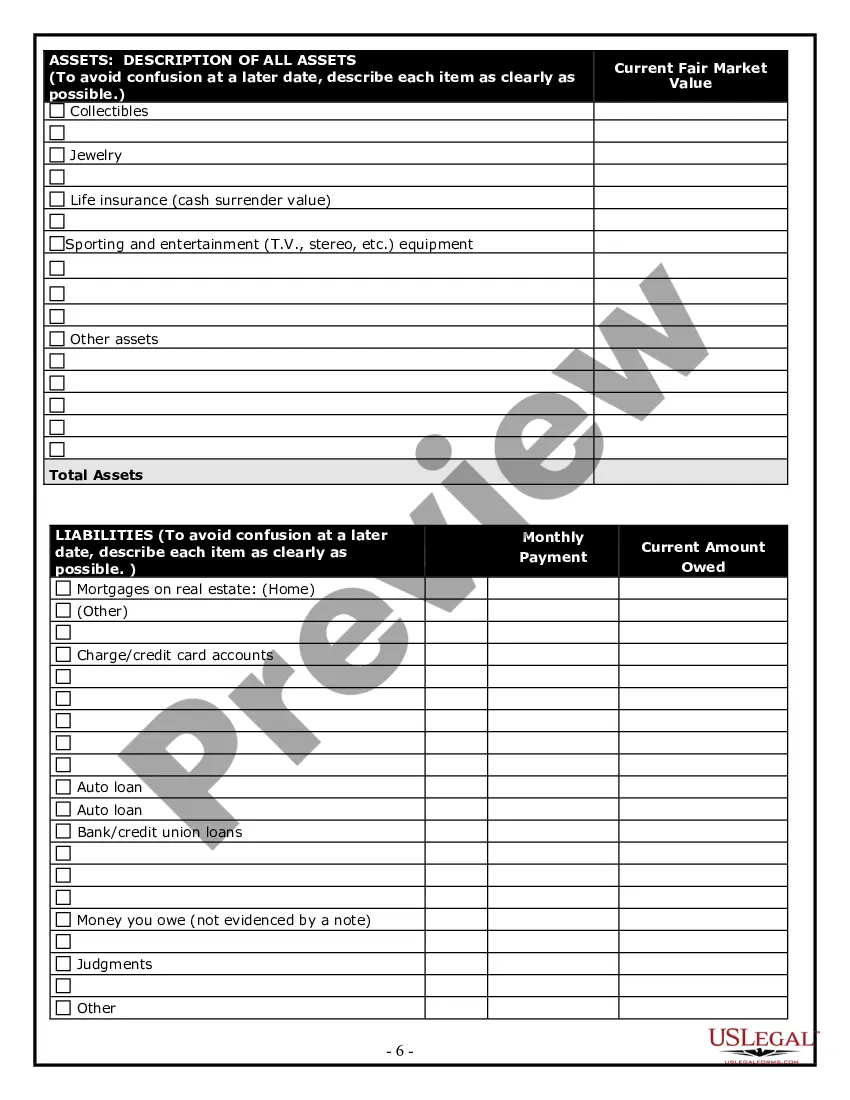

Filling out an estate inventory requires detailed documentation of all assets. Begin by listing each item, along with its description and estimated value. It’s helpful to categorize items by type, such as real estate, personal belongings, and financial accounts. You can utilize tools provided by uslegalforms to create a comprehensive inventory sheet, ensuring you do not overlook any valuable assets. An estate questionnaire with customers can also streamline this process, helping you gather all necessary information efficiently.

Determining the value of household items for an estate can be done by conducting a thorough inventory. Start by categorizing items, such as furniture, electronics, and collectibles. Research recent sales of similar items online or consult local appraisers for professional evaluations. Platforms like uslegalforms can assist you in creating an organized list of items and their values, making it easier to manage your estate. Utilizing an estate questionnaire with customers can help you gather and assess this valuable information effectively.

When filling out estate paperwork, begin by carefully reading each document to understand its purpose. Compile all necessary information, such as your assets, debts, and any specific bequests you wish to make. If you encounter complex forms, consider seeking assistance from professionals or using user-friendly platforms like uslegalforms, which can streamline the process. By staying organized and methodical, you can ensure that your paperwork is accurate and complete, making your estate planning smoother with the help of an estate questionnaire with customers.

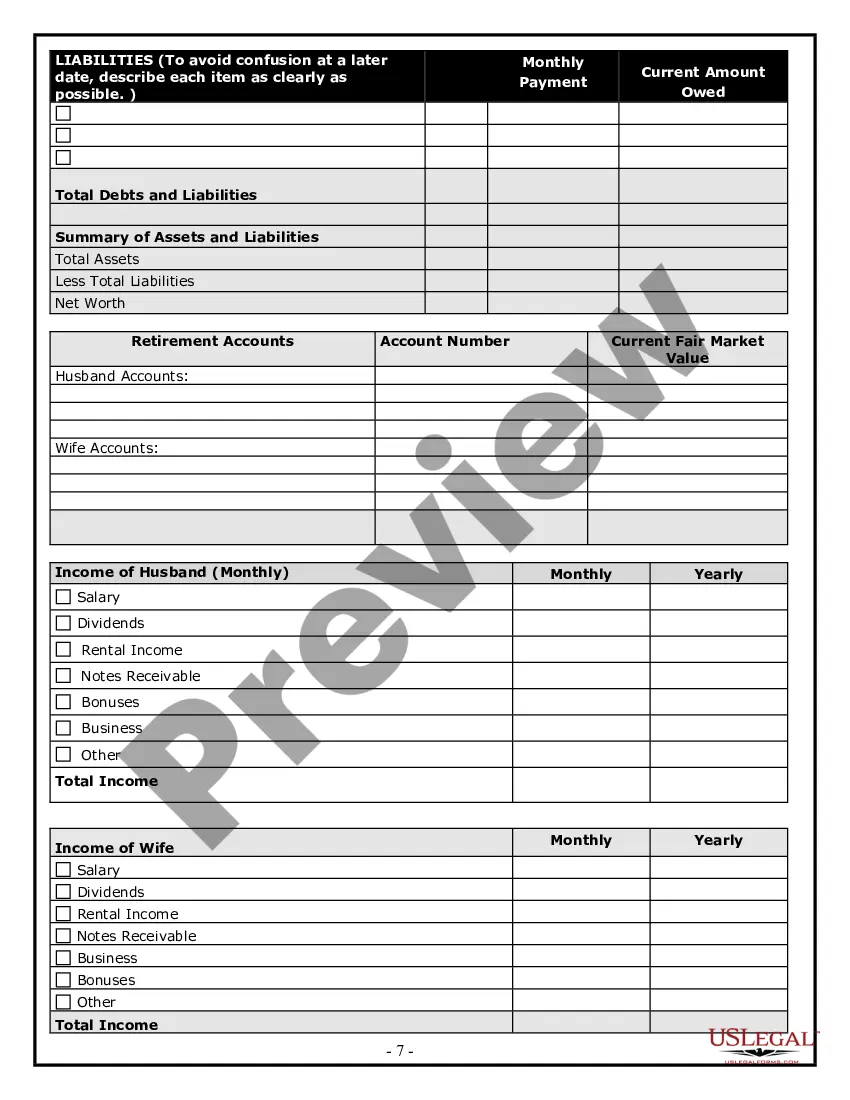

Filling out an estate questionnaire involves several straightforward steps. Start by gathering all relevant documents, including financial statements and property deeds. Next, answer each question thoroughly, providing complete information about your assets, liabilities, and personal wishes. You can use online platforms like uslegalforms to guide you through the process, ensuring you capture all necessary details accurately. By utilizing an estate questionnaire with customers, you can make the task easier and more organized.

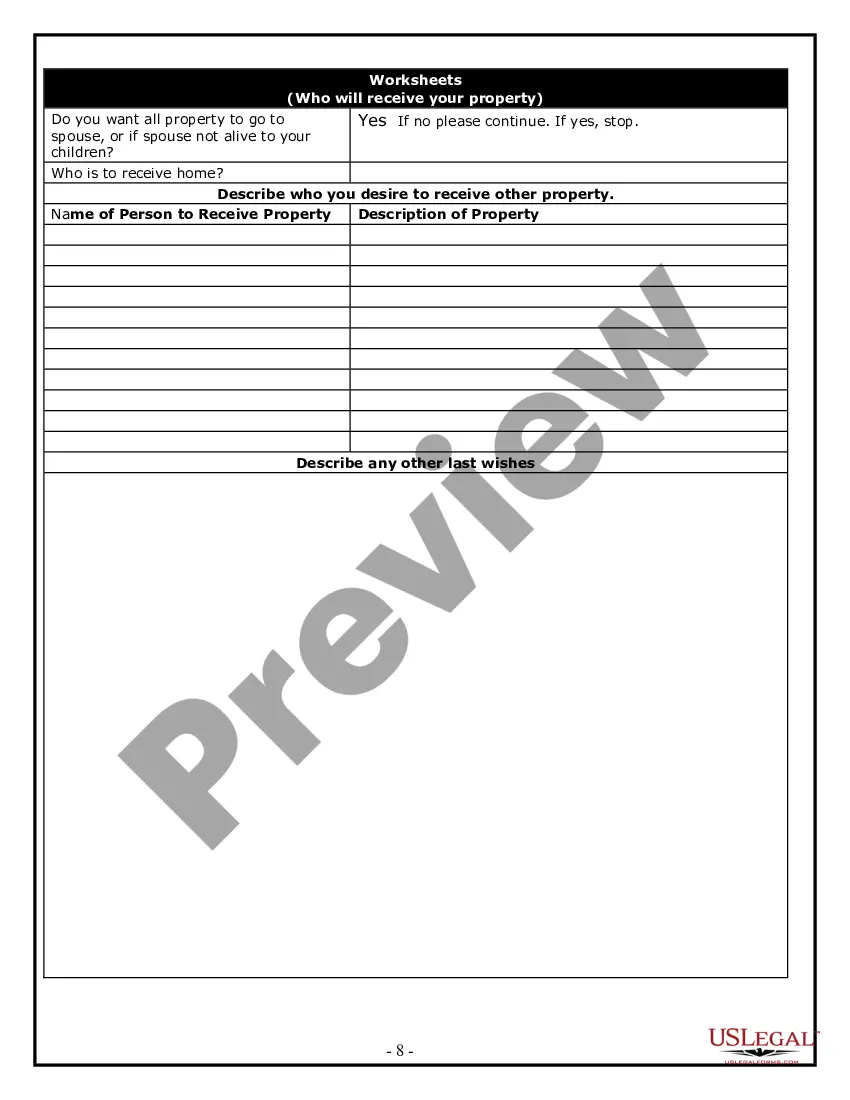

The estate planning process involves several crucial steps. First, identify your assets and liabilities to understand your financial situation. Next, choose your beneficiaries, considering who will inherit your estate. After that, you should select an executor to manage your estate after your passing. Additionally, you might want to create a will and consider setting up trusts for specific needs. Don’t forget to outline your healthcare and financial decisions through powers of attorney. Finally, regularly review and update your estate plan, ensuring it aligns with your current wishes and circumstances. Using an estate questionnaire with customers can simplify this process by helping you gather essential information.

The 5 by 5 rule refers to a provision in certain trusts allowing beneficiaries to withdraw up to $5,000 or 5% of the trust's value each year without tax penalties. This rule can help provide flexibility in accessing funds while maintaining the integrity of the trust. Understanding this rule can be beneficial when discussing options in an estate questionnaire with customers.

During an estate planning meeting, consider asking about the best ways to protect your assets, the implications of trusts, and how to minimize taxes. Additionally, inquire about potential challenges your heirs might face. Using an estate questionnaire with customers can help structure these discussions and ensure all critical topics are covered.

In real estate, a questionnaire often serves to gather information about a property or the buyer's needs and preferences. This can include details about financing, property features, and desired locations. While different from an estate questionnaire with customers, both tools aim to facilitate a clearer understanding of objectives.

An estate questionnaire is a tool designed to collect essential information about your assets, liabilities, and family dynamics. It helps guide the estate planning process by ensuring all relevant details are considered. By using an estate questionnaire with customers, you can streamline the planning process and avoid potential pitfalls.

Many individuals make common mistakes regarding inheritance, such as not updating their estate plan after major life events or failing to communicate their wishes clearly. These oversights can lead to disputes among heirs and unintended outcomes. Using an estate questionnaire with customers can help ensure that your wishes are clearly documented and understood.