S Corp Form Filing For Llc

Description

How to fill out Small Business Startup Package For S-Corporation?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive investigation and significant financial investment.

If you’re looking for a simpler and more affordable method of preparing S Corp Form Filing For Llc or any other document without unnecessary complications, US Legal Forms is readily available to you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal issues.

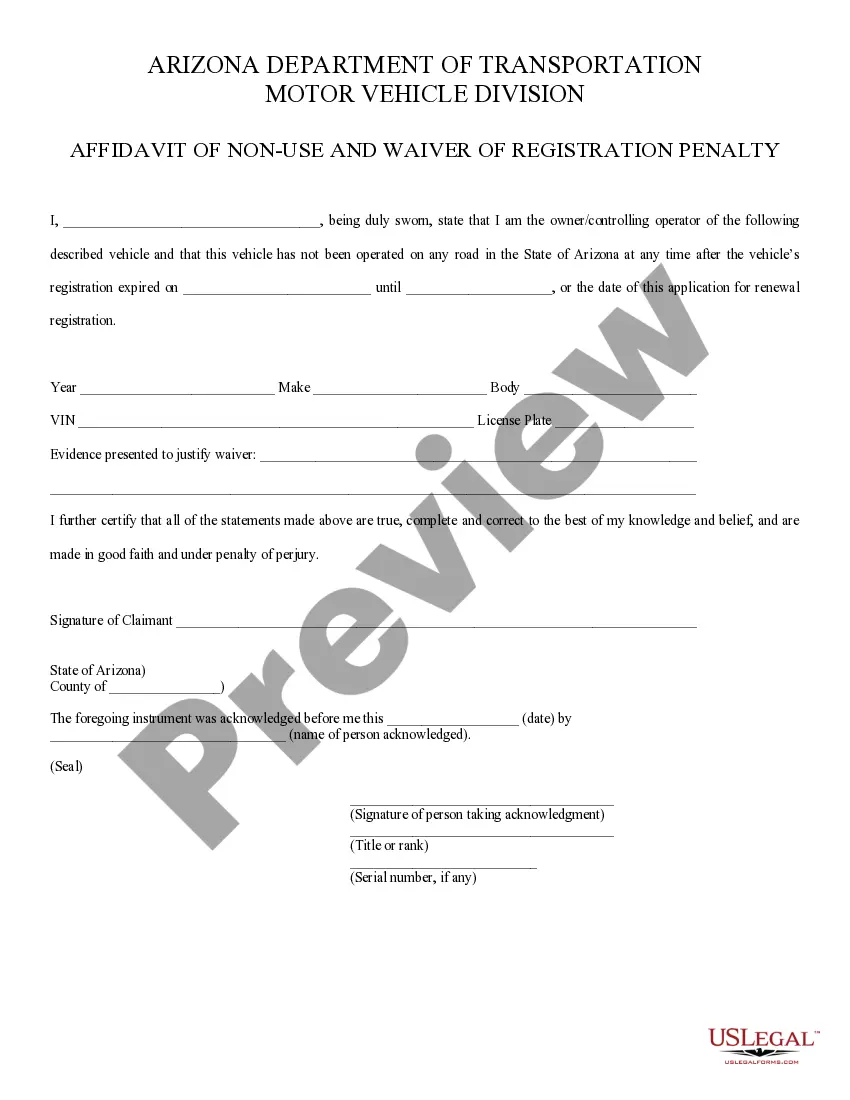

However, before proceeding to download the S Corp Form Filing For Llc, consider these suggestions: Review the document preview and descriptions to ensure that you have located the document you require.

- With just a few clicks, you can immediately access state- and county-compliant templates meticulously crafted for you by our legal experts.

- Use our website whenever you need dependable and trustworthy services to quickly find and download the S Corp Form Filing For Llc.

- If you’re familiar with our services and have previously created an account with us, just Log In to your account, choose the form, and download it, or retrieve it again anytime later from the My documents section.

- Don’t have an account? No problem. Setting it up and navigating the library takes minimal time.

Form popularity

FAQ

If you're a sole proprietor, you're not eligible to fill out Form 8832. To change how you're taxed, you'll need to form an LLC first. If you're an LLC who wants to be taxed as an S-corp, then you don't need Form 8832 at all. Instead, you'll file the much simpler Form 2553 (we'll chat more about that later).

For a single-member LLC, S Corp election offers significant tax savings on the profits above reasonable compensation that's passed on to the owner. This money is not subject to FICA payroll taxes like employee wages are and also not subject to self-employment tax, like sole proprietorship profits.

Form 8832 allows businesses to request to be taxed as a corporation, partnership, or sole proprietorship when filing the relevant income tax return. Form 2553 is the form corporations and Limited Liability Companies use to elect S Corp tax status. If you're filing Form 2553, do not file Form 8832.

If you want your LLC to be taxed as an S corp., you need to file IRS Form 2553, Election by a Small Business Corporation. If you file Form 2553, you do not need to file Form 8832, Entity Classification Election, as you would for a C corp. You may use online tax filing or file by fax or mail.

Prepare and File an S Corporation Tax Election with Form 2553. If you want to reduce the amount of tax you pay on your LLC earnings, an S Corporation Tax Election (form 2553) is a necessity.