Assignment Promissory Note With Balloon Payment

Description

How to fill out Assignment Of Promissory Note And Liens?

Getting a go-to place to access the most current and appropriate legal templates is half the struggle of dealing with bureaucracy. Finding the right legal documents demands precision and attention to detail, which is the reason it is important to take samples of Assignment Promissory Note With Balloon Payment only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You can access and check all the details about the document’s use and relevance for the circumstances and in your state or region.

Consider the listed steps to complete your Assignment Promissory Note With Balloon Payment:

- Utilize the catalog navigation or search field to find your template.

- View the form’s description to see if it matches the requirements of your state and county.

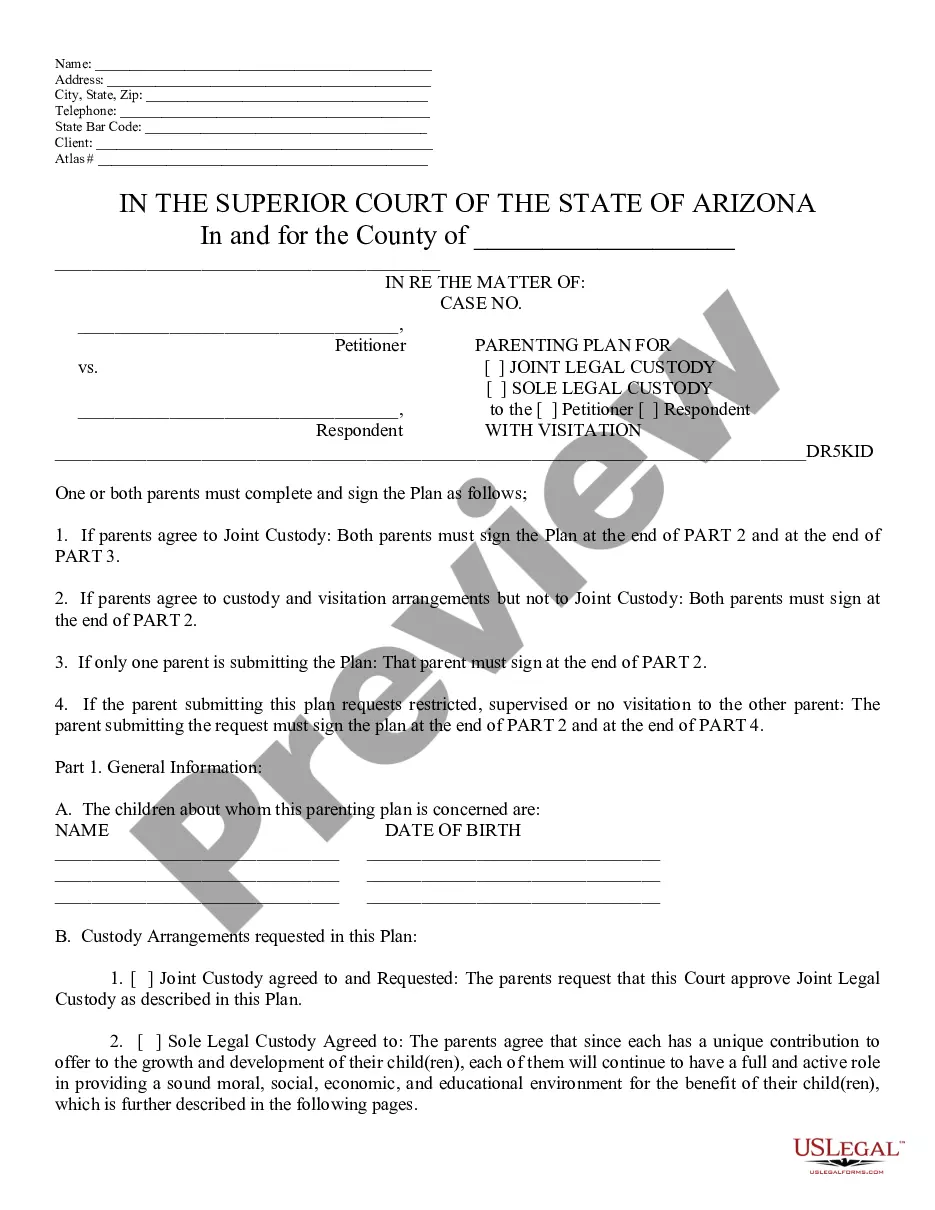

- View the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Return to the search and find the appropriate document if the Assignment Promissory Note With Balloon Payment does not match your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Select the pricing plan that fits your requirements.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by picking a payment method (credit card or PayPal).

- Select the document format for downloading Assignment Promissory Note With Balloon Payment.

- Once you have the form on your device, you may modify it with the editor or print it and complete it manually.

Remove the headache that accompanies your legal paperwork. Check out the extensive US Legal Forms collection where you can find legal templates, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

If you are the borrower, issue the promissory note to the institution or individual that needs it to obtain a loan for you. This should be done with an addendum stating the assignment of your rights or the completion of the assignment paperwork required by the lender.

A balloon payment is the final amount due on a loan that is structured as a series of small monthly payments followed by a single much larger sum at the end of the loan period. The early payments may be all or almost all payments of interest owed on the loan, with the balloon payment being the principal of the loan.

Balloon Loan Your loan has a balloon payment. At the end of the loan term, any balance remaining will have to be paid. In the case of a balloon loan, often very little, if any, of the loan balance is paid down, therefore, the last payment, the balloon payment can be most of the initial loan balance.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

We can use the below formula to calculate the future value of the balloon payment to be made at the end of 10 years: FV = PV*(1+r)n?P*[(1+r)n?1/r] The rate of interest per annum is 7.5%, and monthly it shall be 7.5%/12, which is 0.50%.