Release Of A Home Loan With No Down Payment

Description

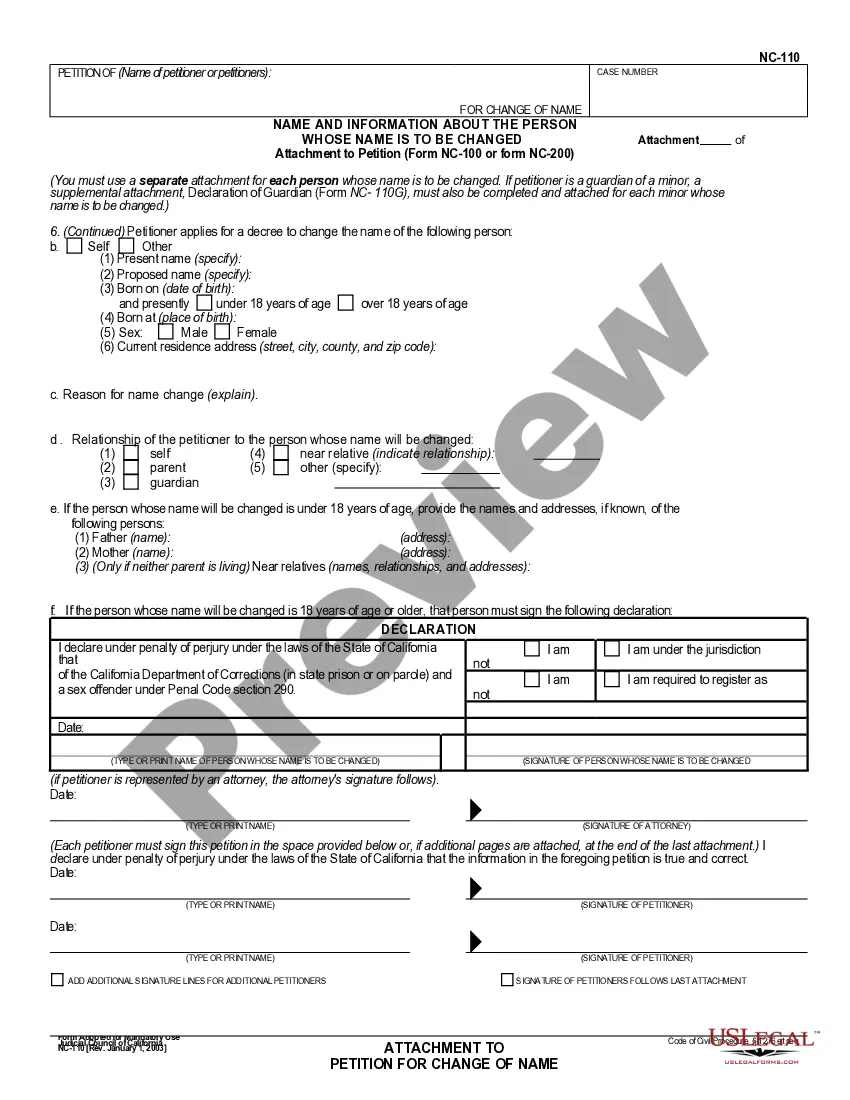

How to fill out Release Of Mortgage / Deed Of Trust - Full Release?

Maneuvering through the red tape of standard forms and templates can be challenging, particularly if one is not accustomed to doing so as a profession.

Even selecting the appropriate template for a Home Loan Release Without Down Payment will consume significant time, as it must be accurate and precise to the last detail.

Nonetheless, you will spend considerably less time sourcing a fitting template from a reliable resource.

Acquire the appropriate form in a few simple steps: Type the document name in the search box. Locate the right Home Loan Release Without Down Payment from the results list. Review the description of the sample or view its preview. If the template meets your needs, click Buy Now. Continue by selecting your subscription plan. Use your email to establish a security password for registering an account at US Legal Forms. Choose a payment method via credit card or PayPal. Download the template file to your device in your preferred format. US Legal Forms will save you ample time researching whether the form you discovered online is appropriate for your requirements. Create an account and gain unrestricted access to all the templates you require.

- US Legal Forms is a platform that streamlines the procedure for locating the correct forms online.

- US Legal Forms functions as a one-stop shop for obtaining the latest samples of forms, understanding their utilization, and downloading these samples for completion.

- This resource houses over 85,000 forms applicable in diverse sectors.

- When searching for a Home Loan Release Without Down Payment, you can trust its authenticity since all of the forms are authenticated.

- Creating an account at US Legal Forms guarantees you have all the necessary samples at your fingertips.

- You can either save them in your history or append them to the My documents collection.

- You can retrieve your saved forms from any device by navigating to Log In on the library's website.

- If you haven't created an account yet, you can always conduct a fresh search for the template you require.

Form popularity

FAQ

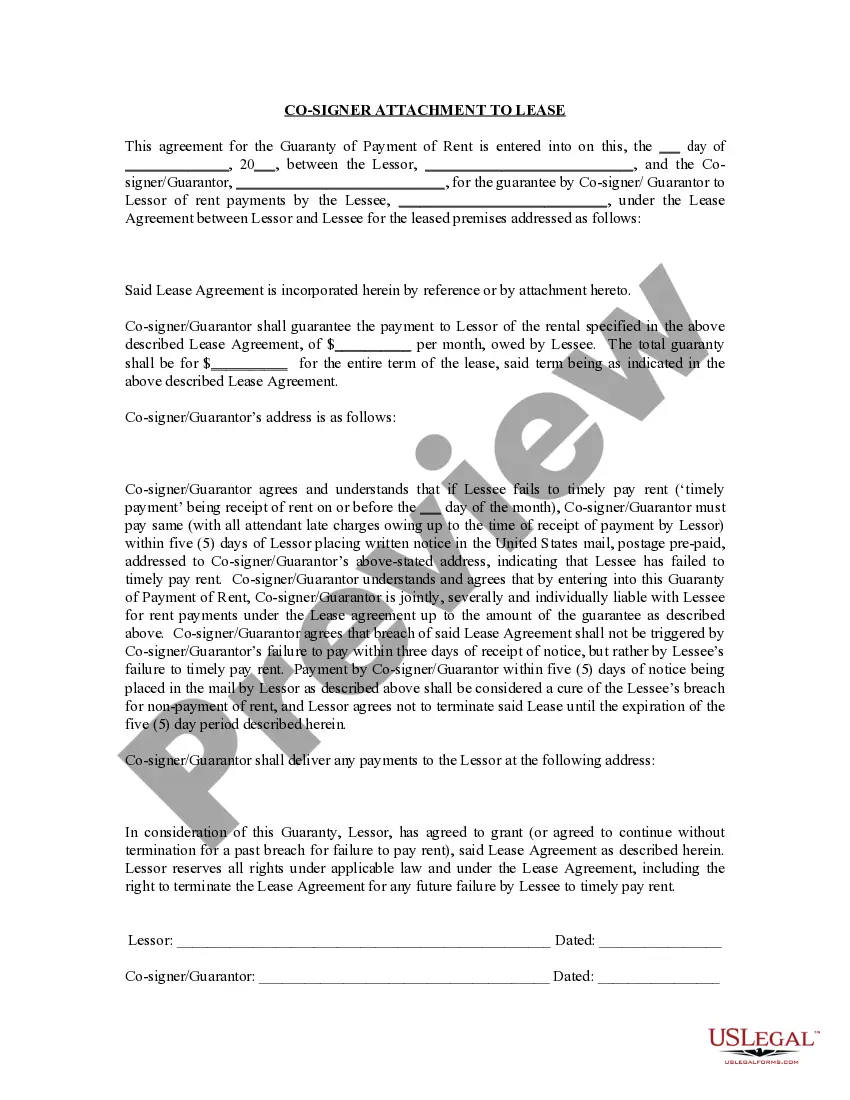

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.

What happens if you can't put down 20%? If your down payment is less than 20% and you have a conventional loan, your lender will require private mortgage insurance (PMI), an added insurance policy that protects the lender if you can't pay your mortgage.

How to Complete a Satisfaction of MortgageStep 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage.Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued.Step 3 File and Record the Form.

down home loan is really setup to help you get into a home if you don't have the money saved up to put towards the loan right away. It's also a good idea if you plan on staying put for a few years. The bottom line is this: it's best to put some money down because it will save you thousands in the long run.

What credit score do I need to buy a house with no money down? No-down-payment lenders usually set 620 as the lowest credit score to buy a house.