Llc Transfer Of Interest Form For Llc

Description

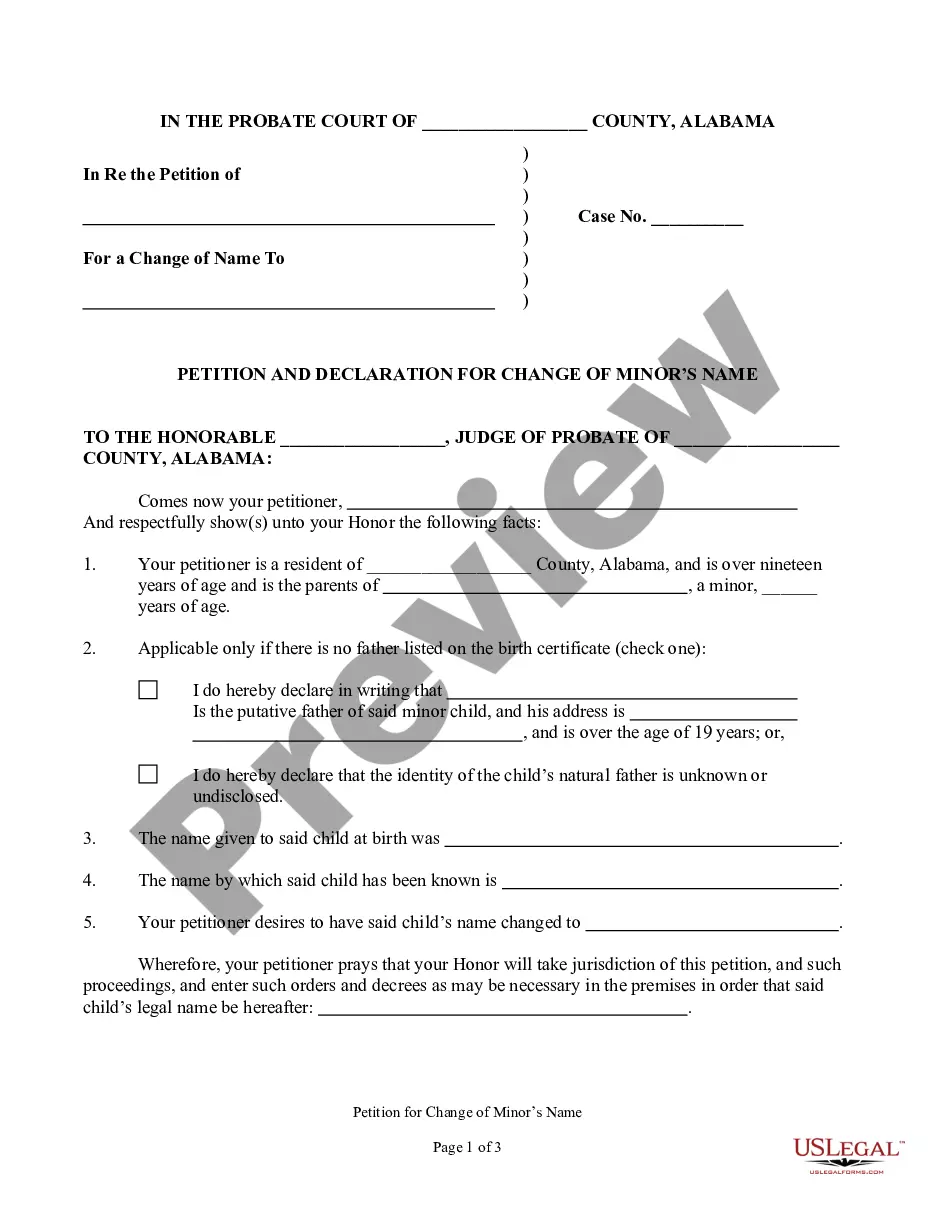

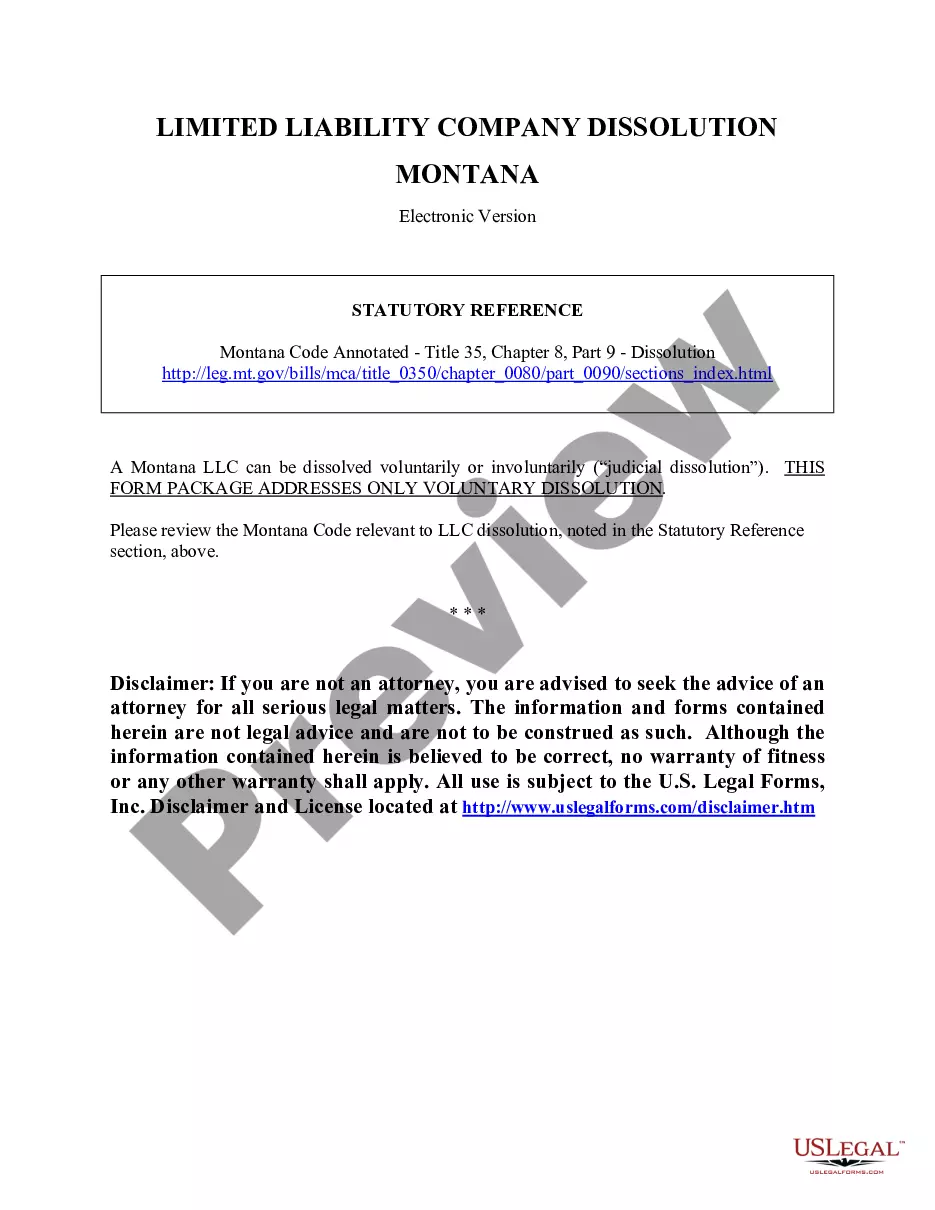

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

Identifying a reliable source for obtaining the most up-to-date and pertinent legal templates is a significant portion of navigating through bureaucracy.

Finding the appropriate legal documents requires accuracy and meticulousness, which is why it is essential to take samples of the Llc Transfer Of Interest Form For Llc exclusively from trustworthy sources, such as US Legal Forms. An incorrect template could squander your time and prolong the issue you are facing.

Remove the hassle associated with your legal paperwork. Browse the extensive US Legal Forms catalog to locate legal templates, assess their relevance to your scenario, and download them instantly.

- Utilize the library navigation or search bar to find your template.

- Examine the form's description to verify if it meets the criteria of your state and locality.

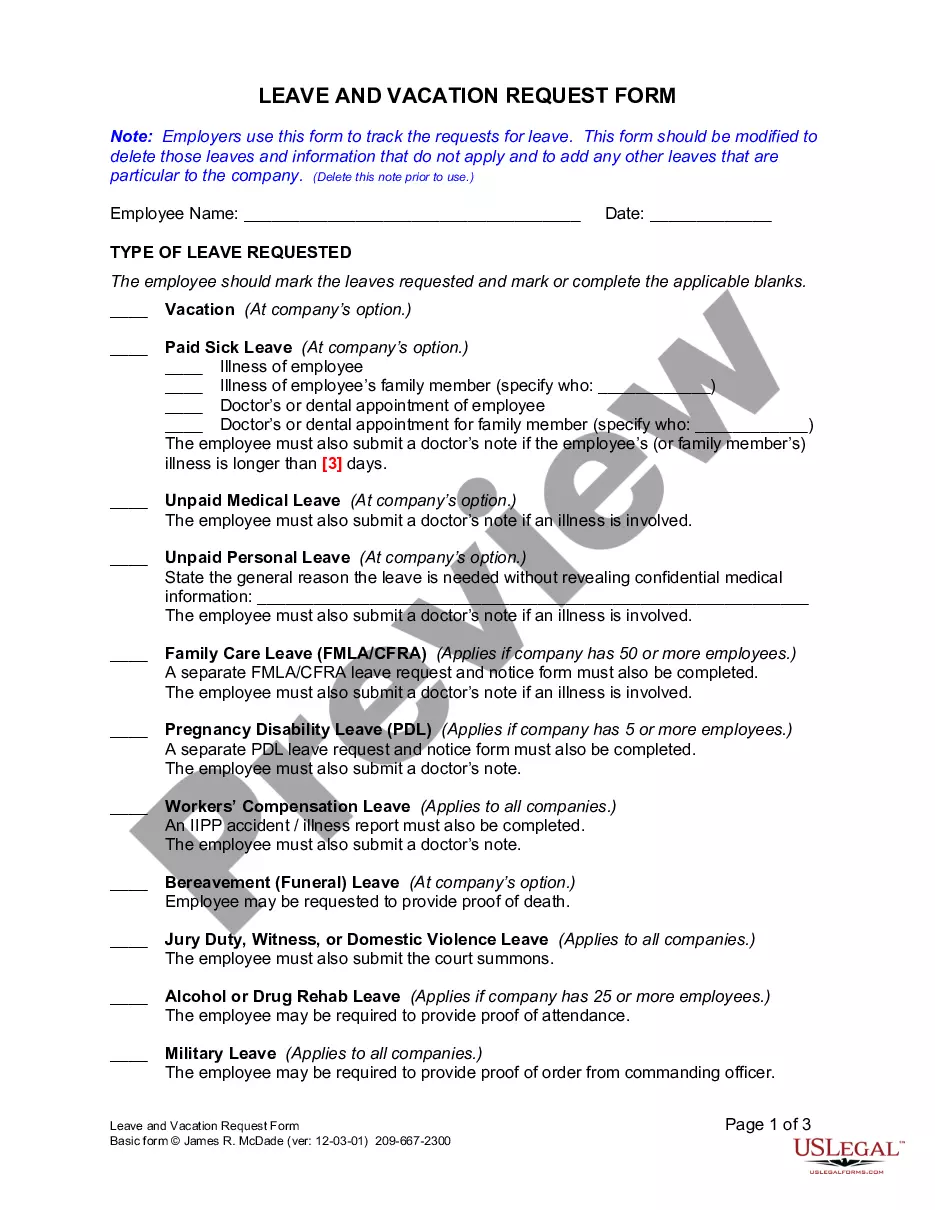

- Preview the form, if available, to confirm it is indeed what you seek.

- Return to the search if the Llc Transfer Of Interest Form For Llc does not suit your needs.

- If you are confident about the form's applicability, download it.

- As a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the payment plan that aligns with your needs.

- Proceed to register to finalize your transaction.

- Complete your purchase by choosing a payment option (credit card or PayPal).

- Select the document format for downloading the Llc Transfer Of Interest Form For Llc.

- Once you have the form on your device, you can modify it using the editor or print it out and fill it out manually.

Form popularity

FAQ

Businesses in the state of Alaska must pay $50 when first filing to receive a business license with the state government.

To start an LLC in Alaska, you'll need to choose an Alaska registered agent, file business formation paperwork with the Alaska Division of Corporations, and pay a $250 state filing fee.

Alaska LLCs are taxed as pass-through entities by default, which means the LLC does not pay federal taxes directly. Instead, the revenue from the LLC passes through the business to the members/owners, who then pay personal income tax on the revenue.

Alaska LLC Approval Times Mail filings: In total, mail filing approvals for Alaska LLCs take 4-5 weeks. This accounts for the 10-15 business day processing time, plus the time your documents are in the mail. Online filings: Online filings for most Alaska LLCs are approved immediately.

All businesses in Alaska need a business license?even sole proprietors. Depending on the type of business you own, you might need multiple state, local, and/or federal licenses before you can legally begin operations. Alaska has a state-issued business license that most Alaska businesses need.

Alaska LLC Formation Filing Fee: $250 The main cost of starting an Alaska LLC is the $250 fee to file the Alaska Articles of Organization with the Division of Corporations. Filing this document officially forms your LLC, and you can file online, by mail, or in person.

If any portion of a business activity occurs within the State of Alaska then the expectation, per Alaska Statutes (law), is the business will have an Alaska Business License. Per AS 43.70. 020(a) a business license is required for the privilege of engaging in a business in the State of Alaska.

Alaska does not impose a state income tax, providing potential tax savings for LLC members, which can be especially appealing for businesses aiming to maximize profits. Forming an LLC in Alaska also offers robust asset protection, ensuring that personal assets remain separate from business debts and legal liabilities.