Agreement Level Sample With Collateral

Description

How to fill out License Subscription Agreement With Service Level Options?

It’s clear that you cannot transform into a legal expert instantly, nor can you swiftly learn how to draft Agreement Level Sample With Collateral without a specialized background.

Producing legal documents is a laborious process that demands specific training and expertise.

So why not entrust the creation of the Agreement Level Sample With Collateral to the specialists.

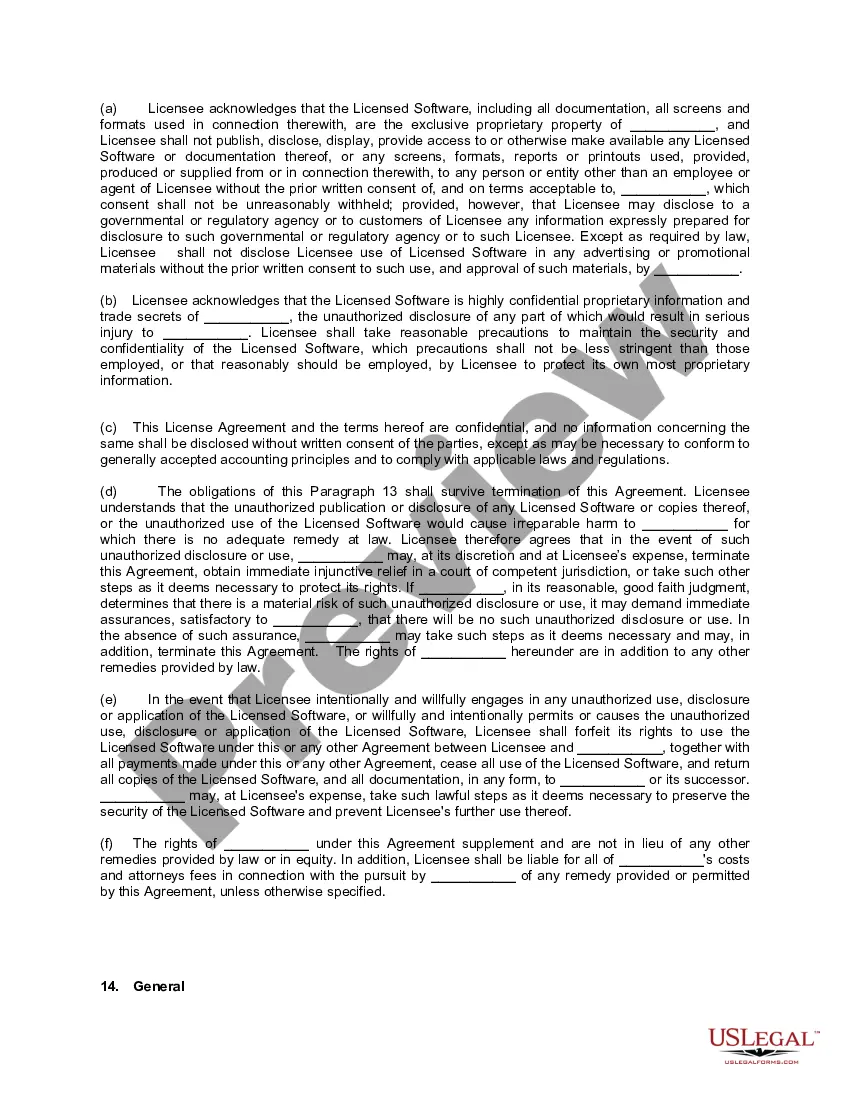

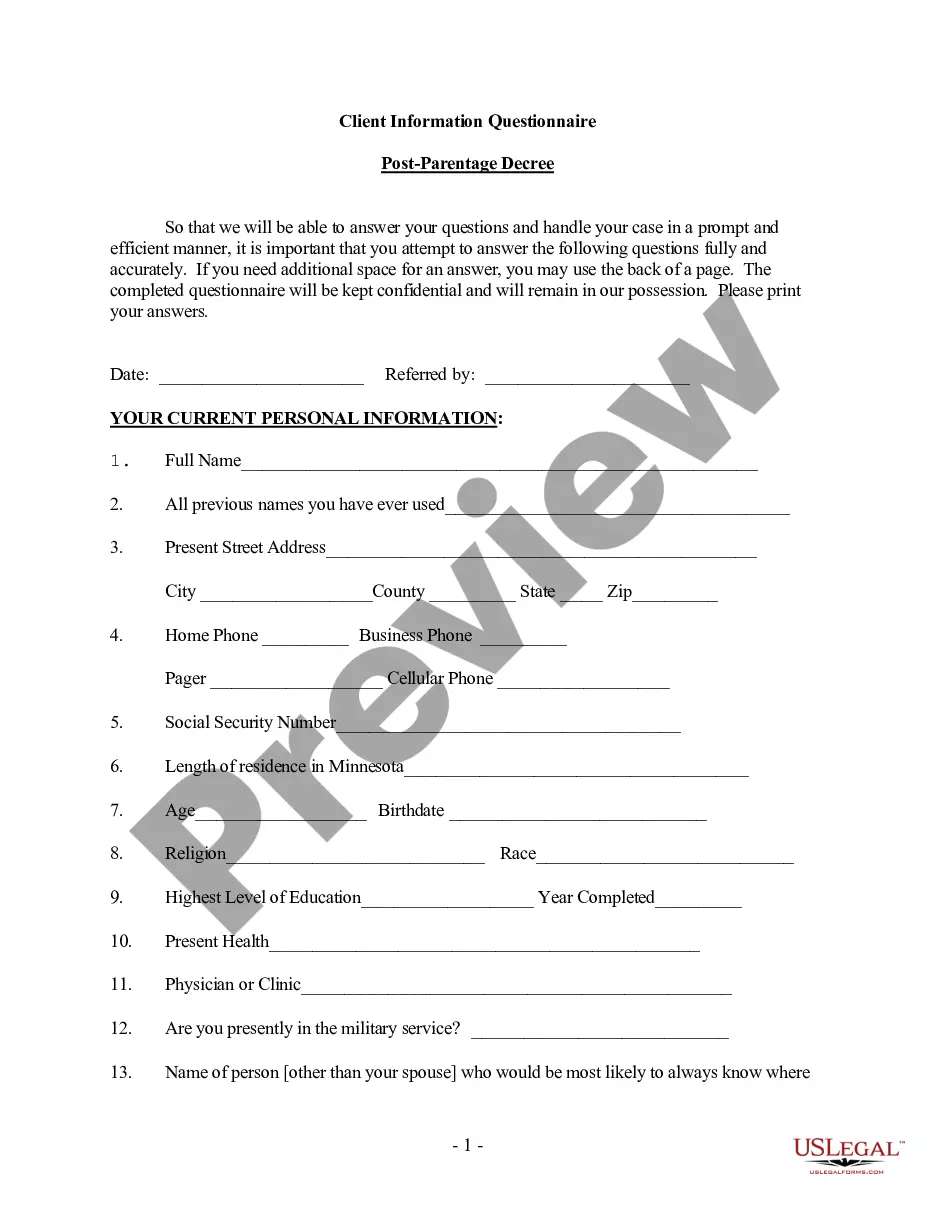

Preview it (if this option is available) and review the accompanying description to determine if Agreement Level Sample With Collateral is what you require.

Create a free account and select a subscription plan to acquire the form.

- With US Legal Forms, one of the largest legal document repositories, you can discover everything from court forms to templates for internal corporate correspondence.

- We recognize how vital compliance and adherence to federal and local statutes and regulations are.

- That’s why, on our platform, all forms are location-specific and current.

- Here’s how you can initiate your experience with our platform and obtain the document you need in just minutes.

- Find the document you are seeking using the search bar at the top of the page.

Form popularity

FAQ

Collateral is something a borrower promises to a lender in case they can't repay the loan. For home, personal, or business loans, lenders usually require collateral. If the borrower defaults on the loan, the lender can claim the assets offered as collateral.

Collateral is an item of value pledged to secure a loan. Collateral reduces the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses.

For example, if X agrees to buy goods from Y that will, ingly, be manufactured by Z, and does so on the strength of Z's assurance as to the high quality of the goods, X and Z may be held to have made a collateral contract consisting of Z's promise of quality given in consideration of X's promise to enter into the ...

A contract for a collateral loan should clearly state what asset(s) are being used to secure the loan and include a clause on what could happen to the asset if the borrower defaults. It should also clearly outline the circumstances under which the collateral could be forfeited to the lender.

Suppose you agree to rent an apartment. The lease agreement you sign with the landlord is the main contract. However, your landlord promises to fix the toilet drainage. Therefore, this is the collateral contract.