Payroll Independent Contractor With Example

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

Regardless of whether it's for corporate reasons or personal affairs, everyone encounters legal matters at some stage in their life.

Completing legal documents demands meticulous attention, beginning with choosing the right form template.

Once downloaded, you can complete the form using editing software or print it out for manual completion. With an extensive catalog from US Legal Forms available, you won’t need to waste time searching for the correct template online. Utilize the library’s user-friendly navigation to find the appropriate form for any circumstance.

- For example, if you pick an incorrect version of the Payroll Independent Contractor With Example, it will be rejected upon submission.

- Thus, it's crucial to find a reliable source of legal documents such as US Legal Forms.

- To acquire a Payroll Independent Contractor With Example template, follow these easy steps.

- Locate the template you require by utilizing the search field or browsing the catalog.

- Review the form’s description to ensure it aligns with your circumstances, state, and county.

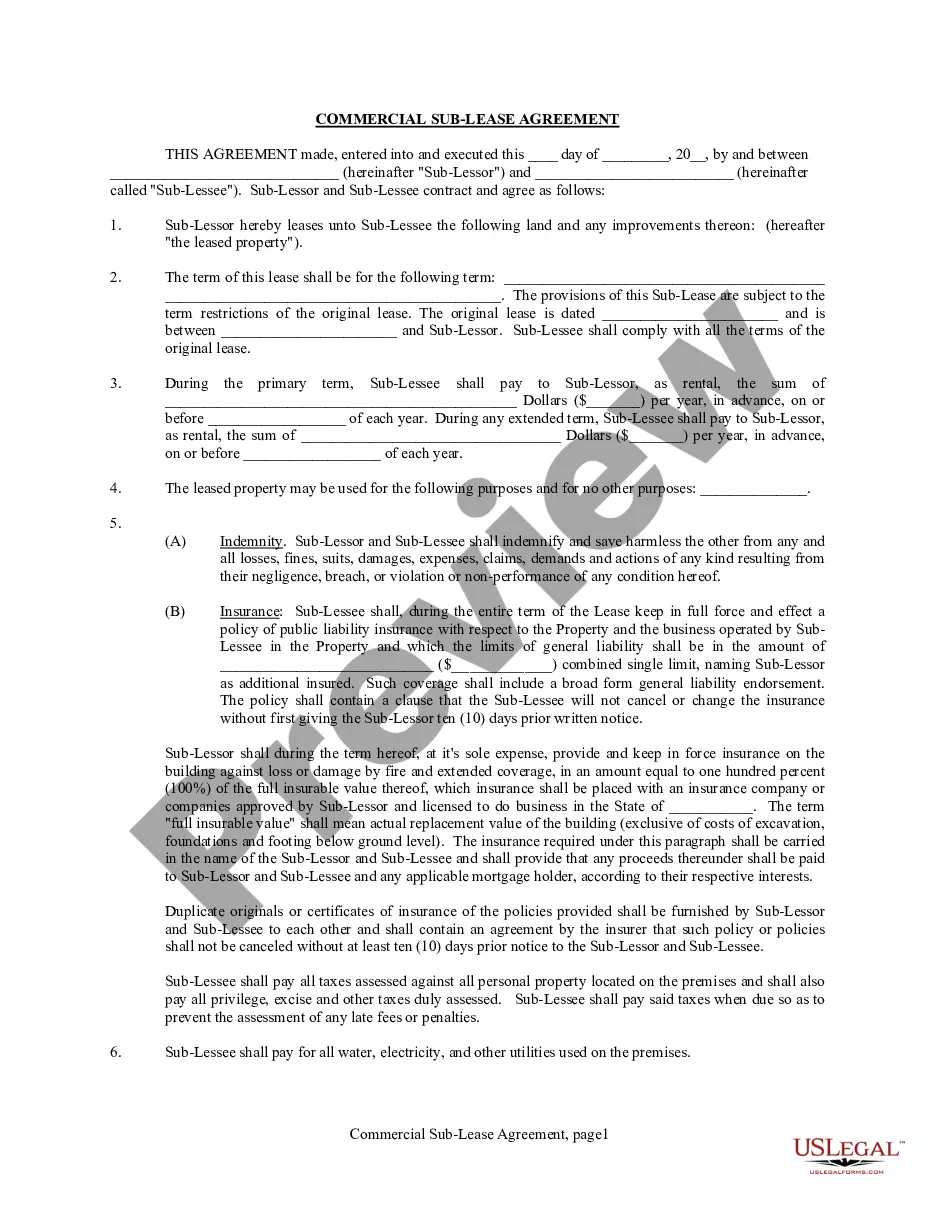

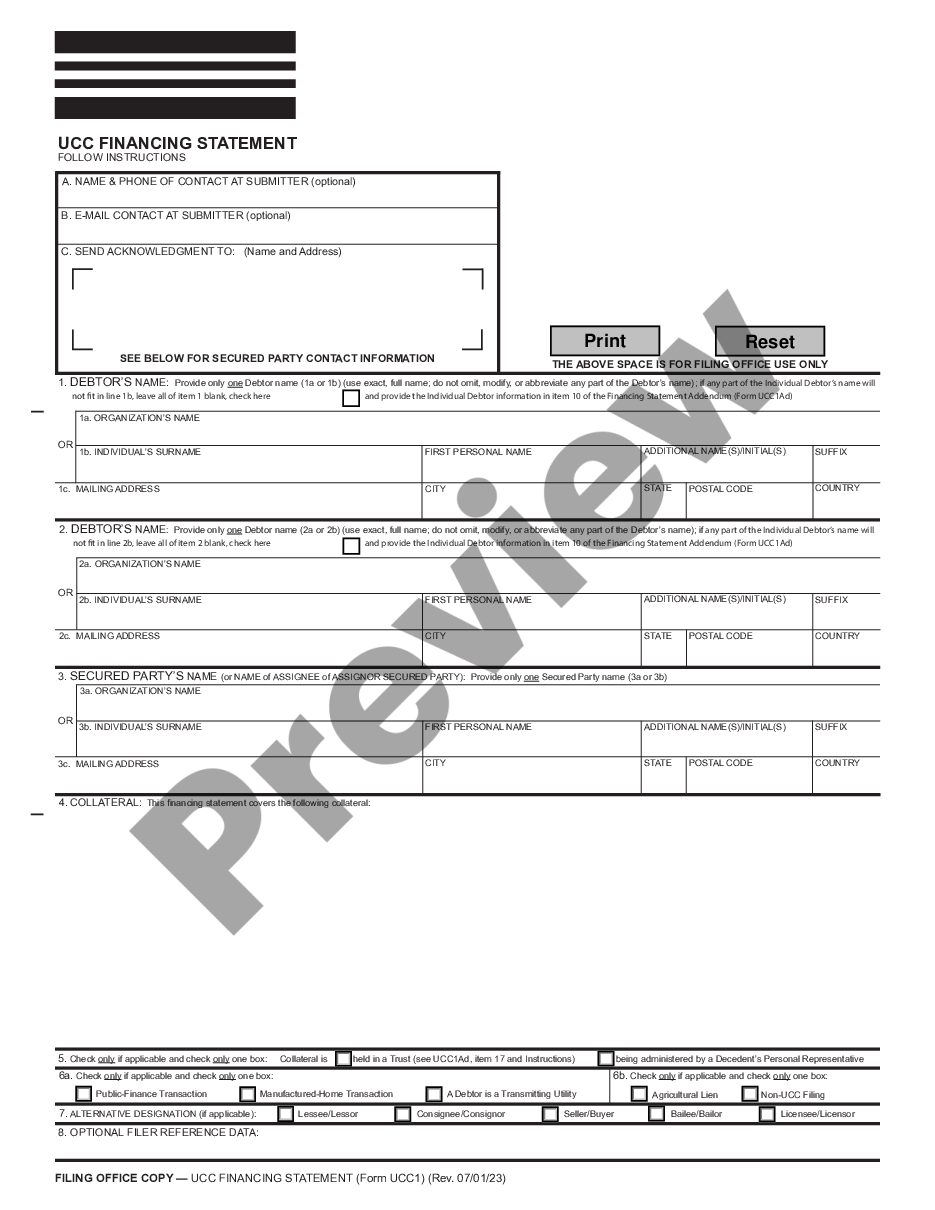

- Click on the form’s preview to inspect it.

- If it’s not the correct form, return to the search function to find the Payroll Independent Contractor With Example template you seek.

- Obtain the file if it satisfies your criteria.

- If you possess a US Legal Forms account, click Log in to retrieve previously saved documents in My documents.

- Should you not have an account yet, you can get the form by clicking Buy now.

- Select the suitable pricing option.

- Fill in the account registration form.

- Choose your payment method: you can use a credit card or PayPal.

- Select the document format you prefer and download the Payroll Independent Contractor With Example.

Form popularity

FAQ

If you are an independent contractor without a business, you will still need to fill out a W-9 as an individual, a sole proprietor, or a single-member LLC. Simply fill under your name and SSN to file form W-9 without a business.

Payer's TIN: List your company's taxpayer identification number (TIN) as Payer's TIN. Payer's information: List your business's name and address in the top left section of the form. Recipient's TIN: List the independent contractor's TIN. Recipient's name: List the independent contractor's name.

How to fill out a W-9 form Download the W-9 form from IRS.gov. ... Provide your full legal name and business name. ... Describe your business structure. ... Exemption. ... Enter your mailing address. ... Add any account numbers. ... Provide your Social Security number or Employer Identification Number. ... See if you need to sign and date the form.

How is an independent contractor paid? Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification. ... Provide compensation for work performed. ... Remit backup withholding payments to the IRS, if necessary. ... Complete Form 1099-NEC, Nonemployee Compensation.

Service-provider (independent contractor): First name, middle initial, and last name. Social Security number. Address. Start date of contract (if no contract, date payments equal $600 or more) Amount of contract, including cents (if applicable) Contract expiration date (if applicable)