Underwriting Securities By Banks

Description

How to fill out Underwriting Agreement Of Ameriquest Mortgage Securities, Inc.?

It’s no secret that you can’t become a law professional overnight, nor can you grasp how to quickly draft Underwriting Securities By Banks without the need of a specialized set of skills. Creating legal forms is a time-consuming venture requiring a specific education and skills. So why not leave the preparation of the Underwriting Securities By Banks to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and get the document you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

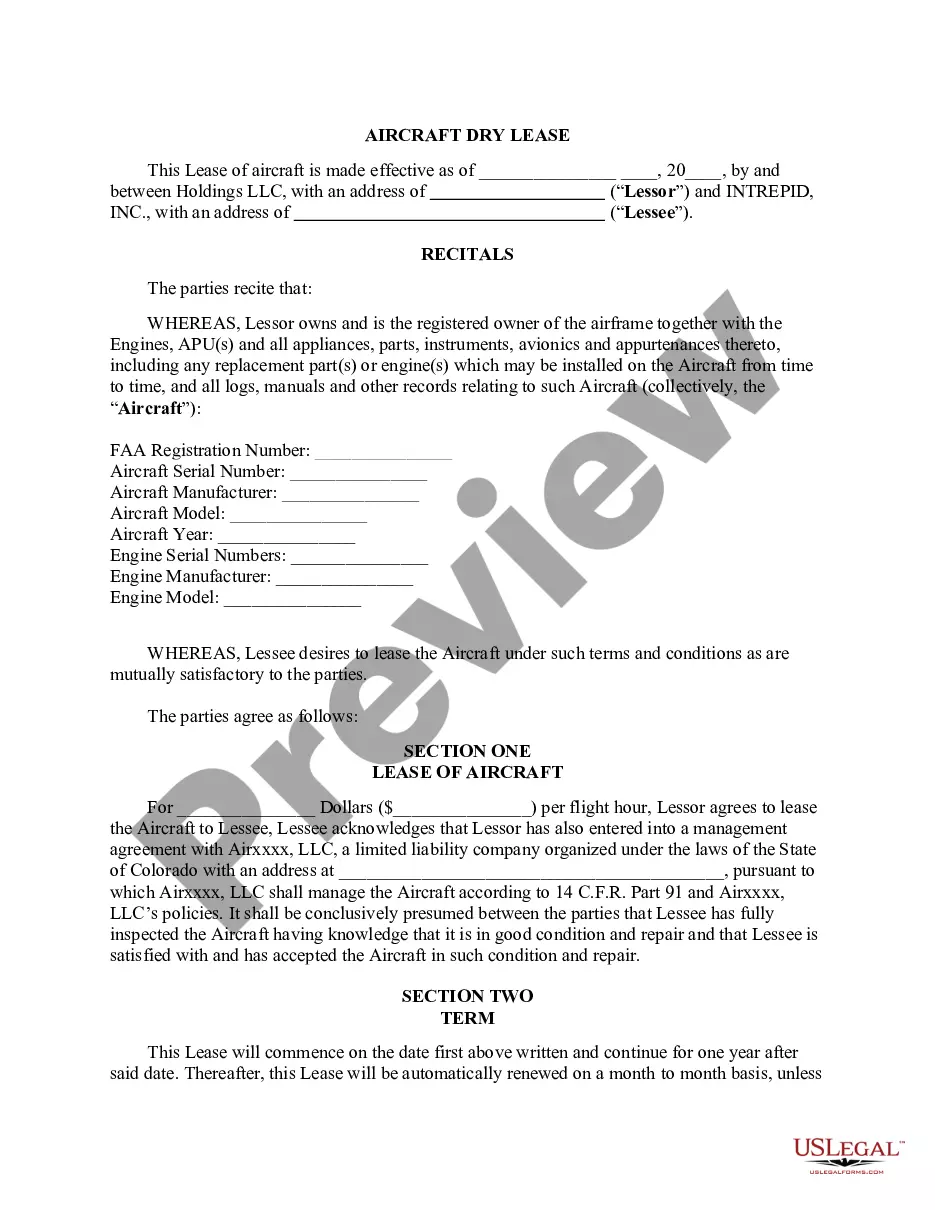

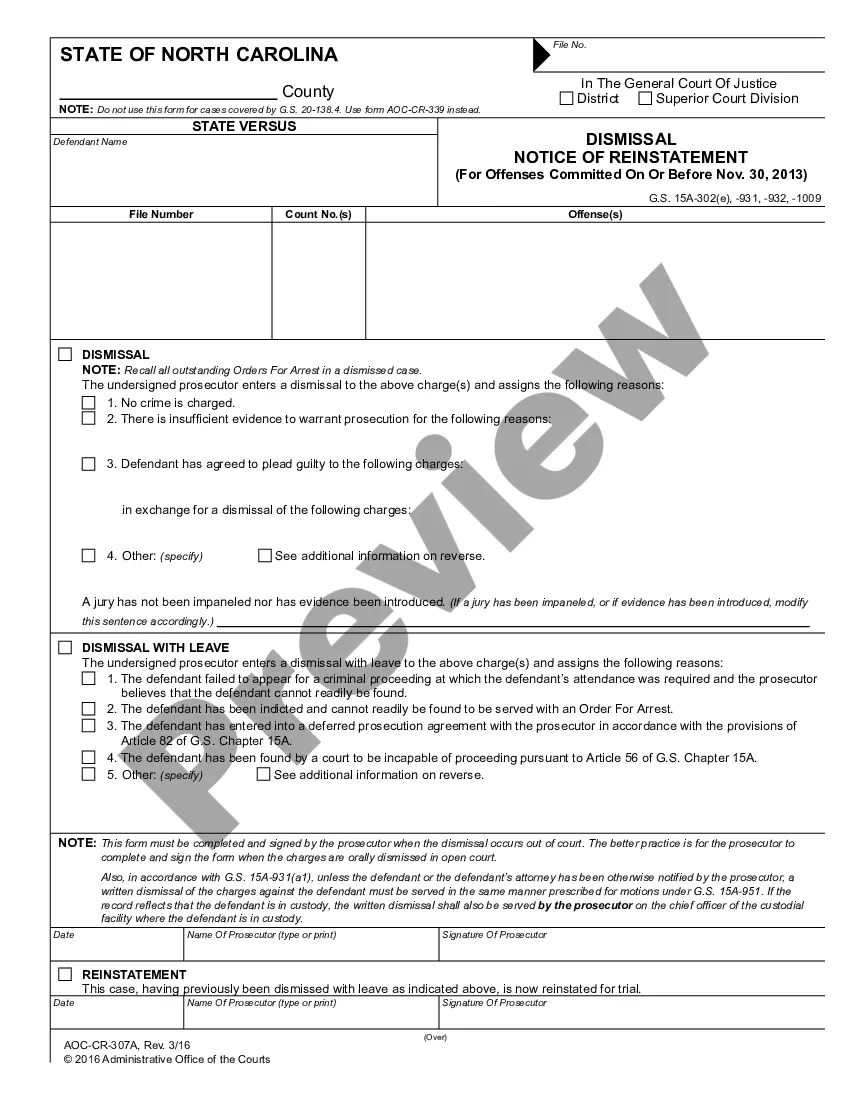

- Preview it (if this option provided) and check the supporting description to figure out whether Underwriting Securities By Banks is what you’re searching for.

- Start your search over if you need a different template.

- Register for a free account and choose a subscription plan to buy the form.

- Pick Buy now. Once the transaction is through, you can get the Underwriting Securities By Banks, fill it out, print it, and send or send it by post to the necessary individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your paperwork-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

When a company wants to issue, say, new bonds to get funds to retire an older bond or to pay for an acquisition or new project, the company hires an investment bank. The investment bank then determines the value and riskiness of the business to price, underwrite, and then sell the new bonds.

An underwriter is any party, usually a member of a financial organization, that evaluates and assumes another party's risk in mortgages, insurance, loans, or investments for a fee, usually in the form of a commission, premium, spread, or interest.

Underwriting is the process by which the lender decides whether an applicant is creditworthy and should receive a loan. An effective underwriting and loan approval process is a key predecessor to favorable portfolio quality, and a main task of the function is to avoid as many undue risks as possible.

In the securities market, underwriting involves determining the risk and price of a particular security. It is a process seen most commonly during initial public offerings, wherein investment banks first buy or underwrite the securities of the issuing entity and then sell them in the market.

For instance, an insurance company uses underwriting to judge applicants for coverage and decide whether to accept or deny their application. Similarly, a mortgage lender relies on underwriting to evaluate a loan application and determine whether to approve or reject a home loan.