Fort Real Estate

Description

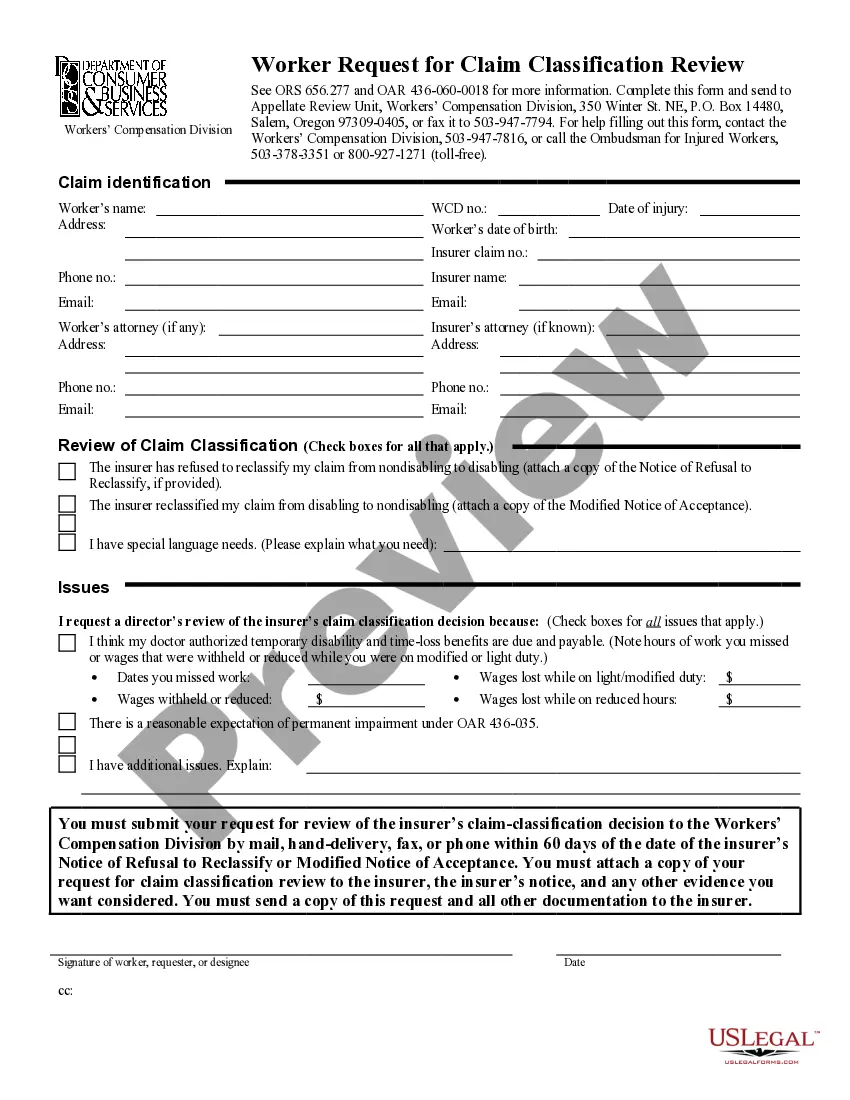

How to fill out Right Of Way And Easement For Additional Pipeline?

- Log into your US Legal Forms account if you're a returning user. Ensure your subscription is active; if it isn’t, renew it according to your current plan.

- For new users, start by checking the Preview mode and reading the form description to confirm that it meets your local fort real estate requirements.

- If needed, utilize the Search tab to find the right document if inconsistencies arise. Make sure it aligns with your needs before proceeding.

- Purchase the document by clicking the Buy Now button. Select a subscription plan and register for an account to access the full library.

- Complete your transaction by providing your credit card information or using PayPal to finalize your purchase.

- Once purchased, download your form to your device for completion and access it anytime from the My Forms section in your profile.

In conclusion, US Legal Forms not only streamlines the process of obtaining legal documents but also provides access to premium expertise to ensure accuracy. With over 85,000 templates available, this tool is designed to meet diverse legal needs efficiently.

Get started today by visiting US Legal Forms and empower yourself with the legal tools needed for your fort real estate ventures.

Form popularity

FAQ

To be classified as a real estate professional for tax purposes, you must meet specific IRS criteria, including spending a minimum of 750 hours per year on real estate activities. Keeping detailed logs of your hours spent on property management, sales, and other related tasks is essential. This classification can provide significant tax benefits for those engaged in Fort real estate.

Filing for real estate involves several steps, including completing the necessary paperwork, ensuring you meet legal requirements, and possibly working with a real estate attorney. On platforms like US Legal Forms, you can find templates and resources that simplify this process. Proper documentation is key to managing your Fort real estate effectively.

Completing real estate school in New Jersey usually takes around 75 hours of coursework. After that, you'll need to pass a state licensing exam. This process provides essential knowledge about the Fort real estate market and prepares you for a successful career in the field.

In New Jersey, the seller typically pays the transfer tax when a property is sold. However, terms can vary based on the sales contract, so it’s crucial to negotiate this part during the transaction process. Understanding your obligations can help you navigate the financial aspects of Fort real estate more smoothly.

A 1099 form in Fort real estate is a tax document used to report income from real estate transactions. At closing, the form outlines payments made to real estate agents or service providers. It is important to keep track of this form for your tax records to ensure compliance with IRS requirements.

To begin your journey in Fort real estate, start by educating yourself about the market. Consider taking local real estate classes or workshops that cover basics like property valuation, contracts, and financing. Joining a local real estate group or finding a mentor can also provide you with guidance and support.

Investing $5,000 in Fort real estate may not secure a property outright, but it can be an excellent starting point. You might consider using that amount for a down payment on a multi-family unit or to invest in real estate crowdfunding opportunities. Additionally, platforms like US Legal Forms can assist you with the necessary paperwork to make informed investment decisions.

While the 2% rule can provide a helpful benchmark in Fort real estate, its practicality often varies by location and market conditions. In many areas, finding properties that meet this criteria can be challenging, especially in competitive markets. Therefore, always verify the local rental rates and consider additional factors like property management costs.

To make $100,000 in your first year in Fort real estate, focus on learning the market, building a network, and mastering sales skills. Start by identifying profitable properties and understand the nuances of property valuation. Additionally, consider using US Legal Forms to ensure your contracts and agreements are sound, giving you peace of mind as you close deals.

Typically, a Letter of Intent does not need to be notarized to be valid. However, it is advisable to check local regulations or consult with a legal professional, especially when dealing with substantial transactions in Fort real estate. Having a notarized document can enhance its credibility during negotiations.