Validate Debt You Withdraw

Description

How to fill out Letter Requesting A Collection Agency To Validate A Debt That You Allegedly Owe A Creditor?

Whether for commercial reasons or personal affairs, everyone must deal with legal matters at some point in their lifetime.

Filling out legal forms requires meticulous care, beginning with selecting the appropriate form template.

After downloading, you can either fill out the form using editing software or print it and complete it by hand. With a vast collection of US Legal Forms available, you do not have to waste time searching for the right sample online. Utilize the library’s straightforward navigation to find the appropriate template for any situation.

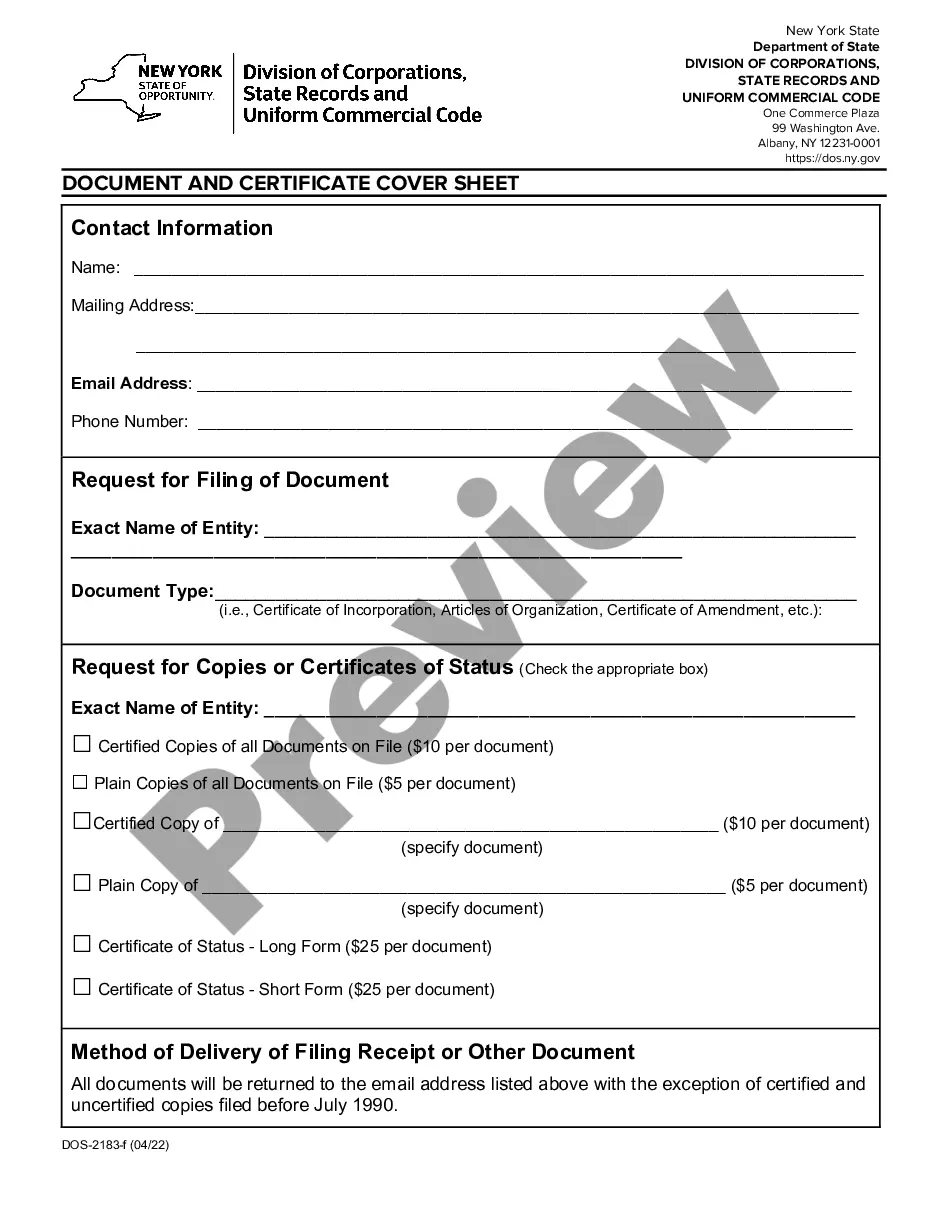

- Locate the form you require by utilizing the search bar or catalog navigation.

- Review the description of the form to ensure it aligns with your circumstances, state, and county.

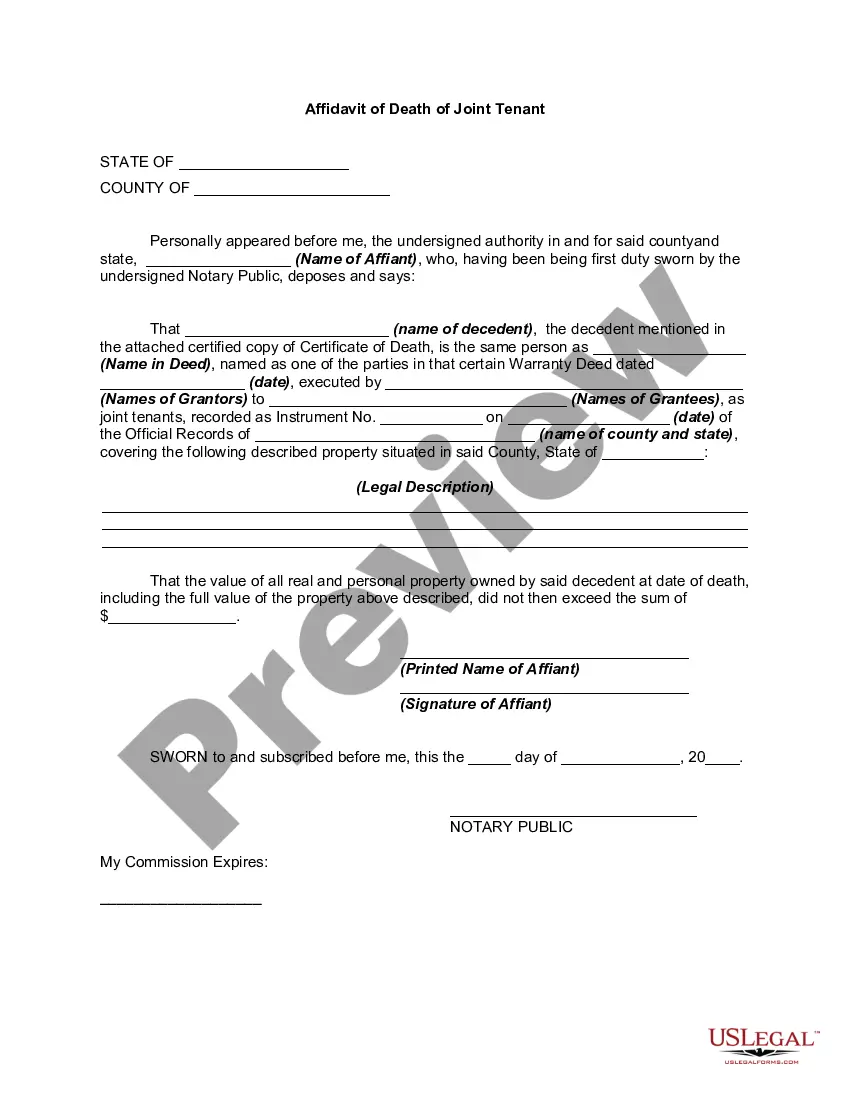

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to find the Validate Debt You Withdraw sample you need.

- Obtain the template when it fulfills your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the desired document format and download the Validate Debt You Withdraw.

Form popularity

FAQ

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. You can use this sample dispute letter (PDF) as a model. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt.

If you don't think you owe the debt Once you receive the validation information or notice from the debt collector during or after your initial communication with them, you have 30 days to dispute all or part of the debt, if you don't believe that you owe it.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect from you. Under the FDCPA, a debt collector is someone who regularly collects debts owed to others.

Until the debt is either paid or forgiven, you still owe the money. This is true even if it's a credit card debt that is sold to a collection agency and even if you think it's unfair.

For collection of a debt on an account, where there is an agreement in writing, the statute of limitations is five years. (Refer to §5-216.) For collection of a debt on an account, where there is an oral agreement, the statute of limitations is four years. (Refer to §5-217.)

You can sue the debt collector for violating the FDCPA. If you sue under the FDCPA and win, the debt collector must generally pay your attorney's fees and may also have to pay you damages. If you're having trouble with debt collection, you can submit a complaint with the CFPB.

Your rights are the same as if you were dealing with the original creditor. If you do not believe you should pay the debt, for example, if a debt is stature barred or prescribed, then you can dispute the debt. Find out more about disputing debts.

Challenging the debt: You have a right to dispute the debt. If you challenge the debt within 30 days of first contact, the collector cannot ask for payment until the dispute is settled. After 30 days you can still challenge the debt, but the collector can seek payment while the dispute is being investigated.