Collect Debt Attempting For 43

Description

How to fill out Letter Informing Debt Collector Of False Or Misleading Misrepresentations In Collection Activities - Communicating Or Threatening To Communicate To Any Person False Credit Information, Including The Failure To Communicate That A Debt Is Disputed?

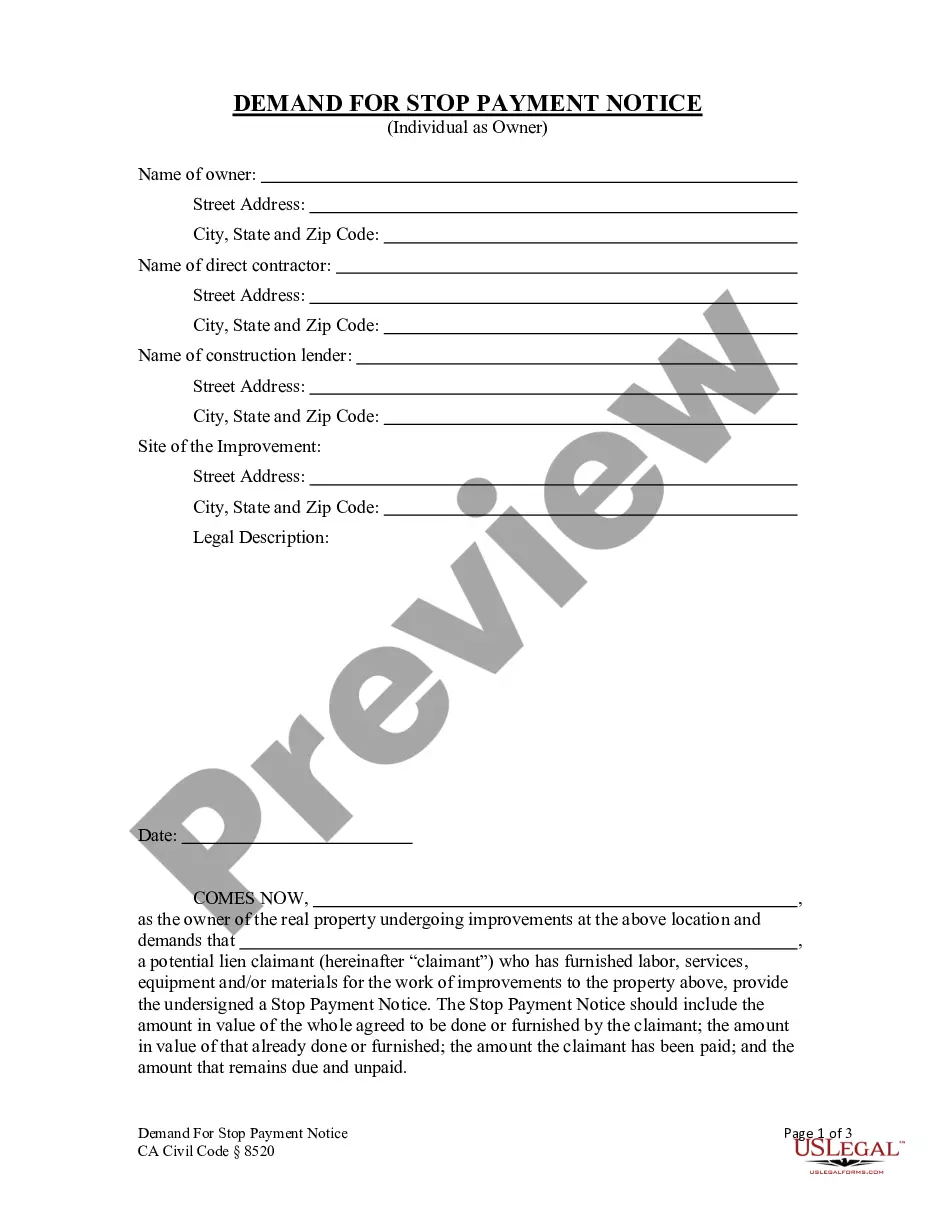

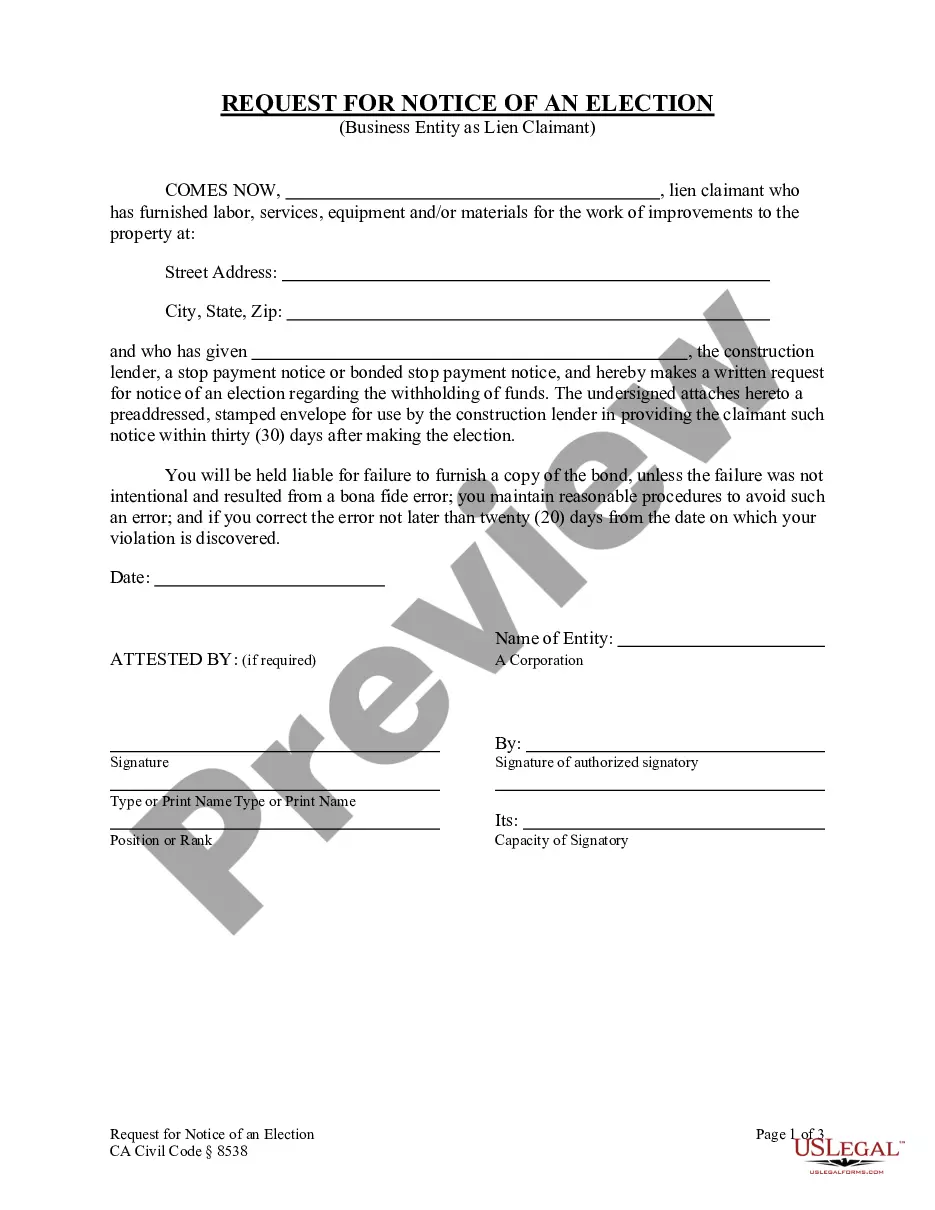

Accessing legal document samples that meet the federal and regional laws is essential, and the internet offers many options to choose from. But what’s the point in wasting time searching for the appropriate Collect Debt Attempting For 43 sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and personal scenario. They are easy to browse with all files collected by state and purpose of use. Our professionals keep up with legislative changes, so you can always be sure your form is up to date and compliant when obtaining a Collect Debt Attempting For 43 from our website.

Getting a Collect Debt Attempting For 43 is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, adhere to the instructions below:

- Take a look at the template utilizing the Preview option or via the text outline to make certain it meets your requirements.

- Locate another sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Collect Debt Attempting For 43 and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete earlier purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

Some want 75%?80% of what you owe. Others will take 50%, while others might settle for one-third or less. If you can afford it, proposing a lump-sum settlement is generally the best option?and the one most collectors will readily agree to.

Dispute in writing, and include any evidence that supports your claims (such as copies of cancelled checks showing you paid the debt or a police report in the case of identity theft). If the debt collector knows that you don't owe the money, it should not try to collect the debt.

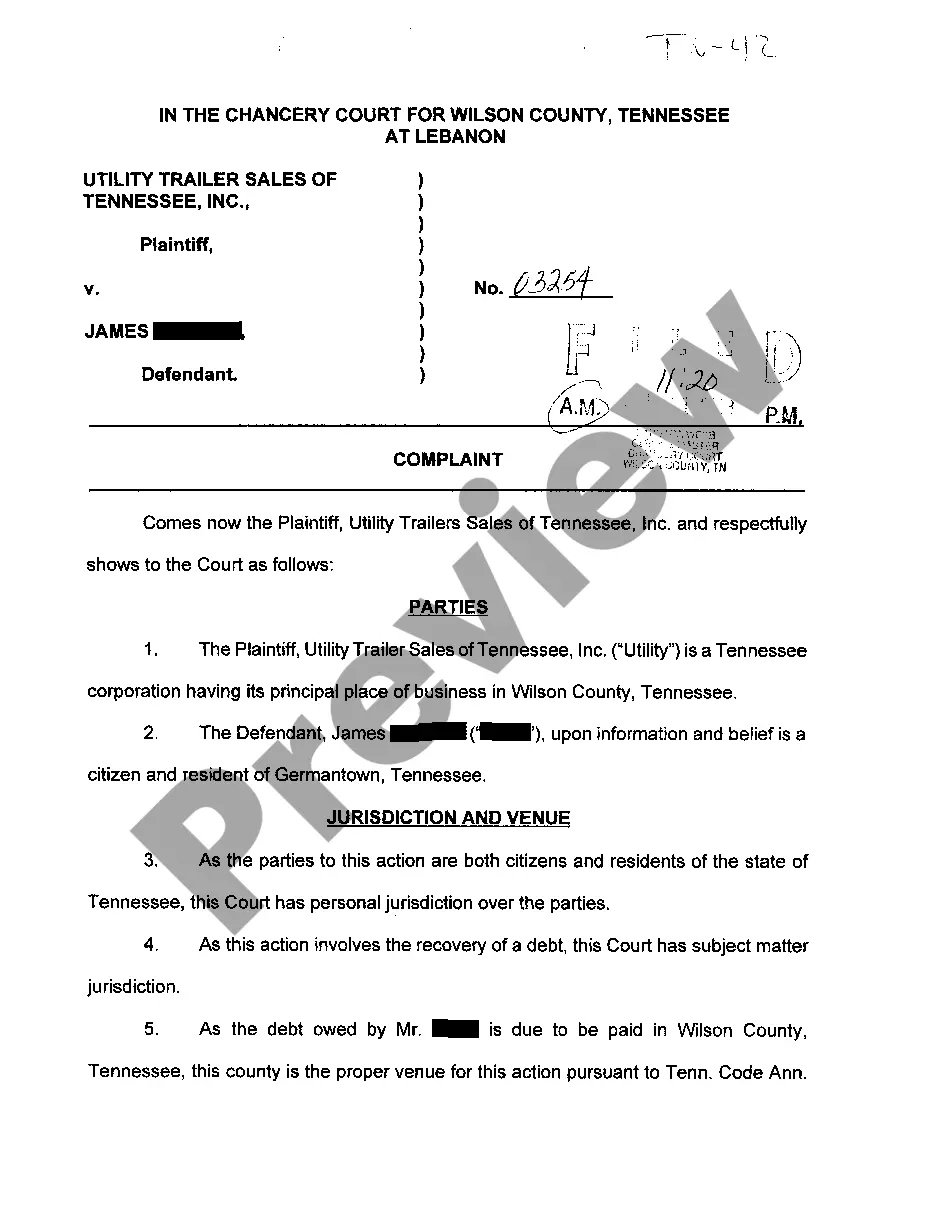

Debt collection is when a collection agency or company tries to collect past-due debts from borrowers. You might be contacted by a debt collector if you haven't made loan or credit card payments and those payments are severely past due.