Restricted Stock Purchase Agreement With Dividends

Description

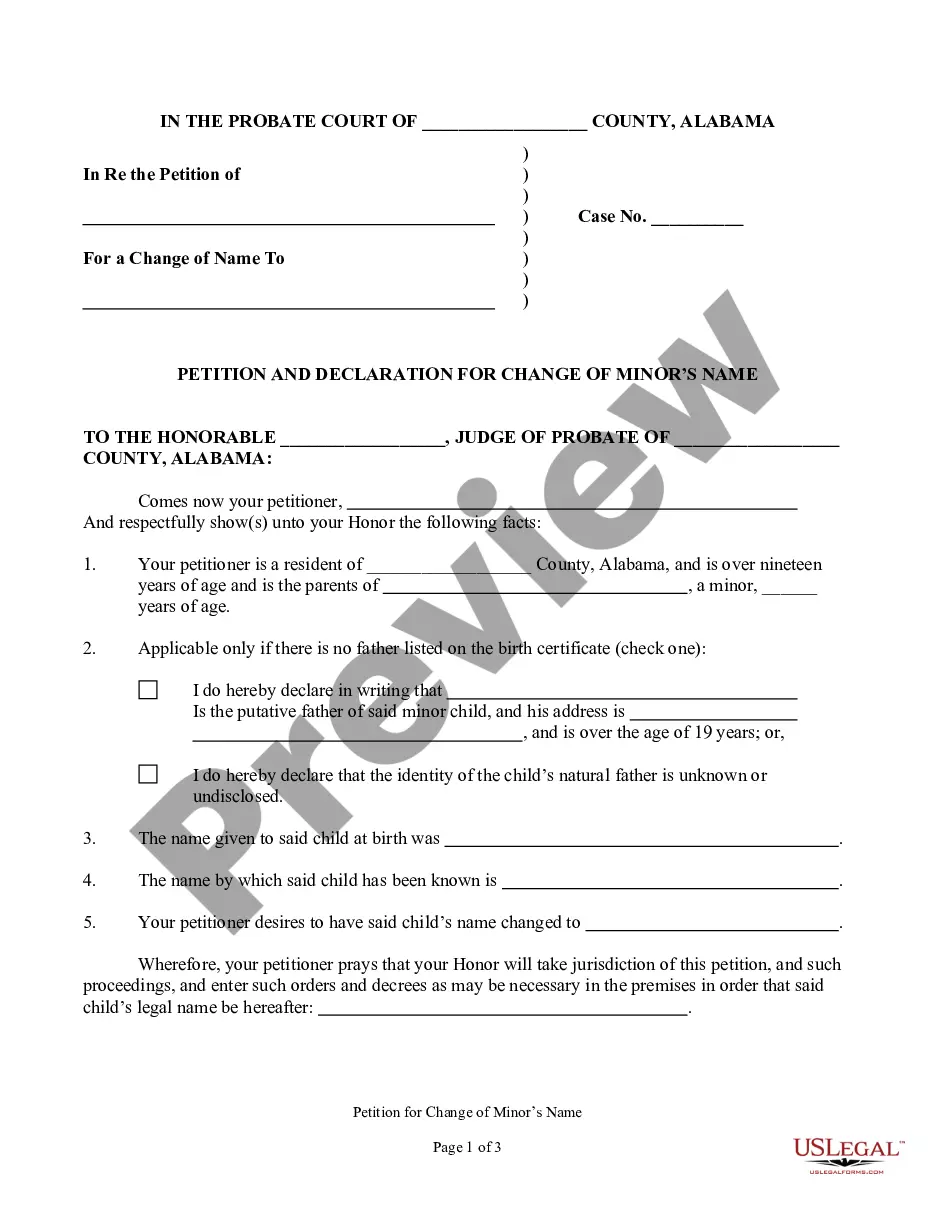

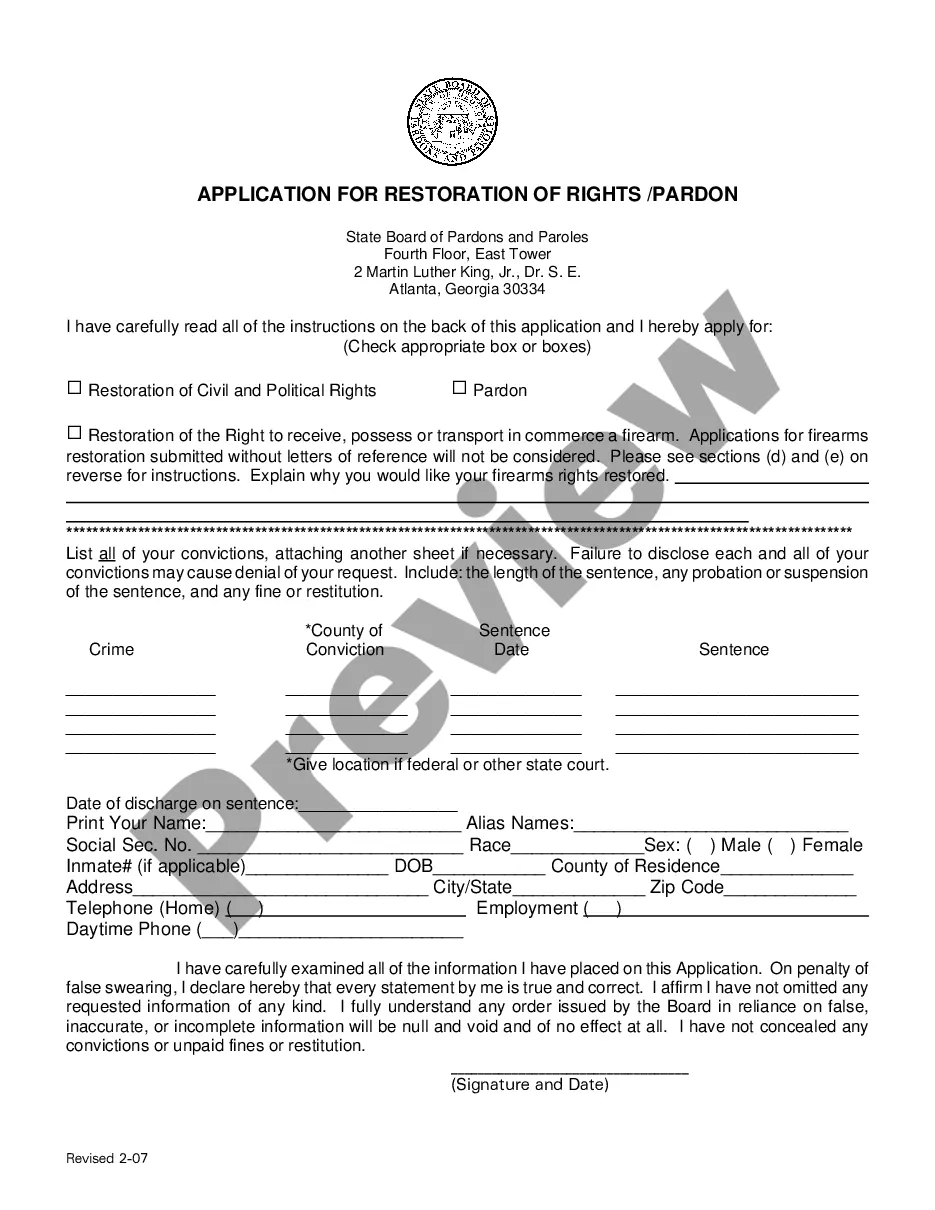

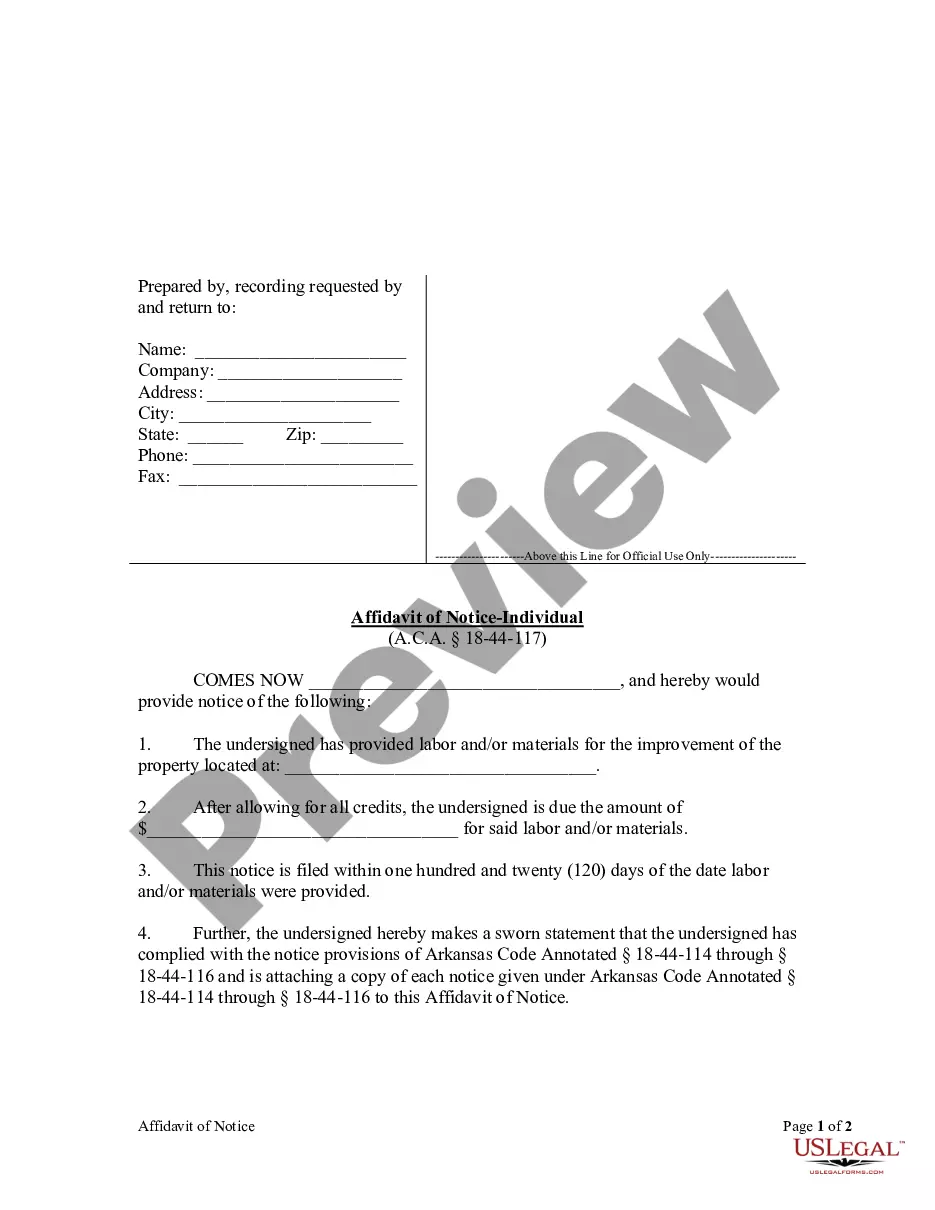

How to fill out Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

Obtaining legal document samples that comply with federal and regional laws is crucial, and the internet offers many options to choose from. But what’s the point in wasting time looking for the appropriate Restricted Stock Purchase Agreement With Dividends sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and personal scenario. They are easy to browse with all documents organized by state and purpose of use. Our specialists stay up with legislative changes, so you can always be sure your form is up to date and compliant when obtaining a Restricted Stock Purchase Agreement With Dividends from our website.

Obtaining a Restricted Stock Purchase Agreement With Dividends is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the instructions below:

- Analyze the template utilizing the Preview feature or through the text outline to make certain it meets your requirements.

- Look for another sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Restricted Stock Purchase Agreement With Dividends and download it.

All templates you find through US Legal Forms are reusable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Holders of RSUs have no voting rights nor do they receive any dividends paid. Some companies may elect to pay dividend equivalents. For example, they may let dividends accrue and allocate those funds to cover some of the taxes due at vesting. Usually, vesting halts if the employee is terminated.

Since shares are not issued until vesting, RSUs don't pay dividends. However, an employer may provide employees with dividend equivalent payments on unvested RSUs. These equivalents are typically held in an escrow account to pay for tax withholding or purchase additional shares.

First and most importantly, RSUs are treated and taxed as earned income in the tax year they vest. The taxable amount is the current market price of your shares on the vesting date. They will appear on your W-2 and include the following: Federal taxes.

For the majority of companies, you won't receive any dividends (or have voting rights) on any of your unvested shares. Some companies provide a dividend equivalent payment upon your award vesting and being exercised, while other companies pay dividends each year on your unvested and unexercised shares.

RSUs are taxed as income to you when they vest. If you sell your shares immediately, there is no capital gain tax, and you only pay ordinary income taxes. If instead, the shares are held beyond the vesting date, any gain (or loss) is taxed as a capital gain (or loss).