Stock Redemption With Foreign Stock

Description

How to fill out Stock Redemption Agreements With Exhibits Of Fair Lanes, Inc.?

Getting a go-to place to take the most recent and appropriate legal templates is half the struggle of working with bureaucracy. Finding the right legal papers demands accuracy and attention to detail, which explains why it is vital to take samples of Stock Redemption With Foreign Stock only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You can access and see all the details regarding the document’s use and relevance for your circumstances and in your state or county.

Take the following steps to finish your Stock Redemption With Foreign Stock:

- Utilize the library navigation or search field to find your sample.

- Open the form’s information to check if it suits the requirements of your state and region.

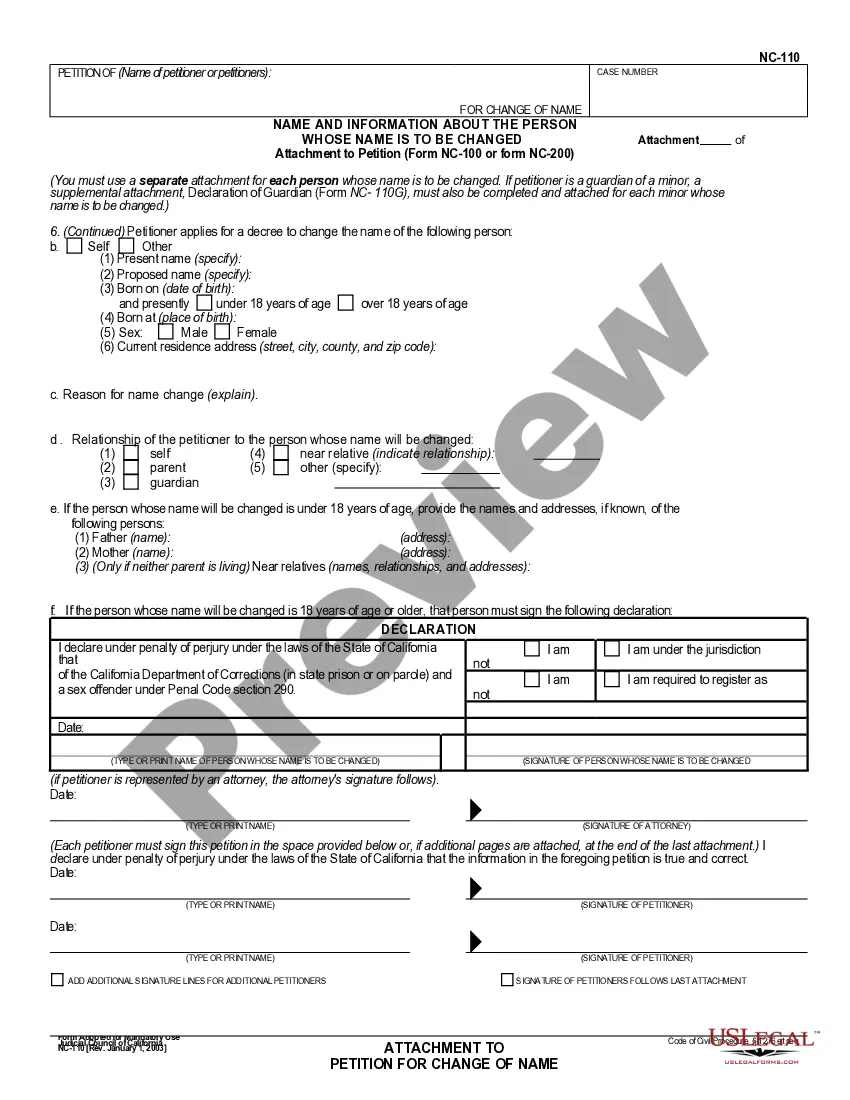

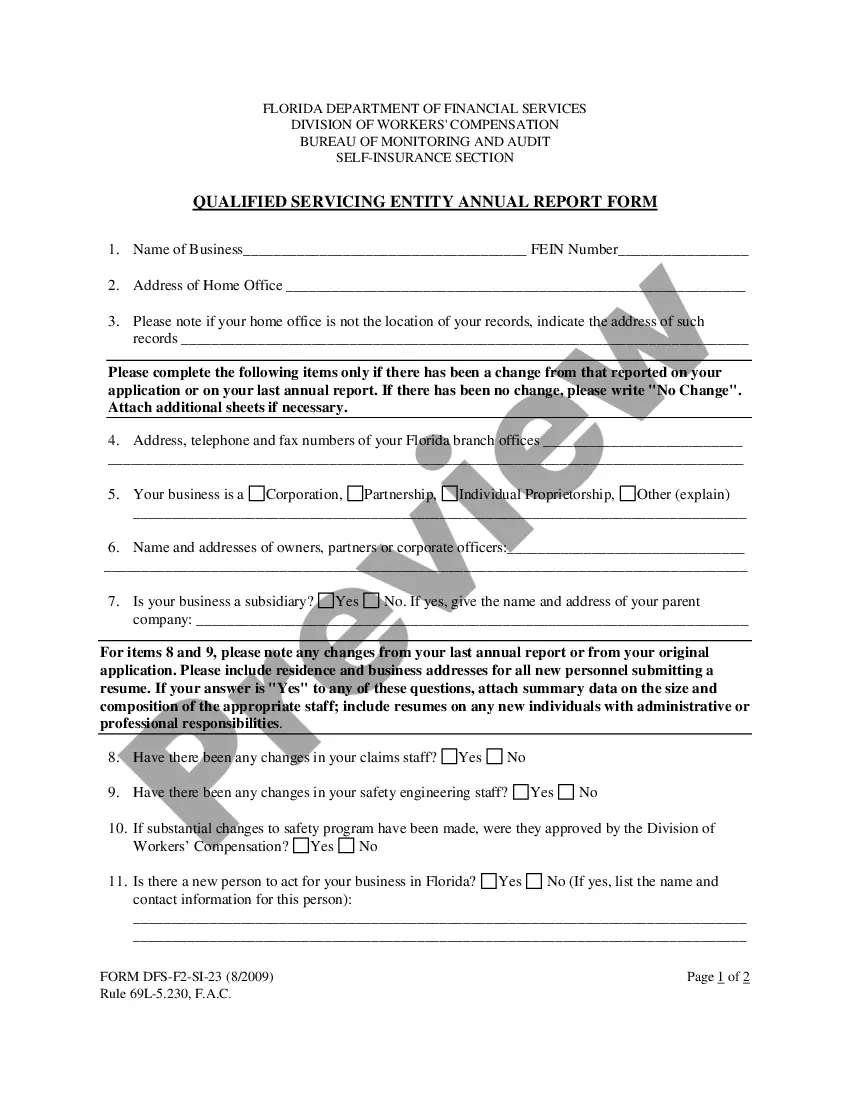

- Open the form preview, if available, to make sure the form is the one you are interested in.

- Go back to the search and find the appropriate document if the Stock Redemption With Foreign Stock does not fit your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Select the pricing plan that fits your requirements.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by choosing a transaction method (bank card or PayPal).

- Select the file format for downloading Stock Redemption With Foreign Stock.

- Once you have the form on your device, you can modify it with the editor or print it and complete it manually.

Get rid of the inconvenience that accompanies your legal paperwork. Explore the comprehensive US Legal Forms collection to find legal templates, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

The company must record the reacquisition of stock on its general ledger. Include all relevant details in the journal entry backup, such as redemption date, number of shares, summary of sale contract terms and payment structure. Debit the treasury stock account for the amount the company paid for the redemption.

For tax purposes, redeeming shares implies disposition of the shares. ingly, redeeming shares may give rise to a capital gain or loss. In short, a capital gain is taxable under normal tax rules, while a loss for tax purposes must be reduced by any tax credit already obtained.

A stock redemption agreement is a buy-sell agreement between a private corporation and its shareholders. The agreement stipulates that if a triggering event occurs, the company will purchase shares from the shareholder upon their exit from the company.

If, after the redemption transaction, you actually or constructively own any stock in the redeeming corporation, you're ineligible for the complete termination exception. That means the stock redemption payments will be taxed under the general corporate distribution rules.