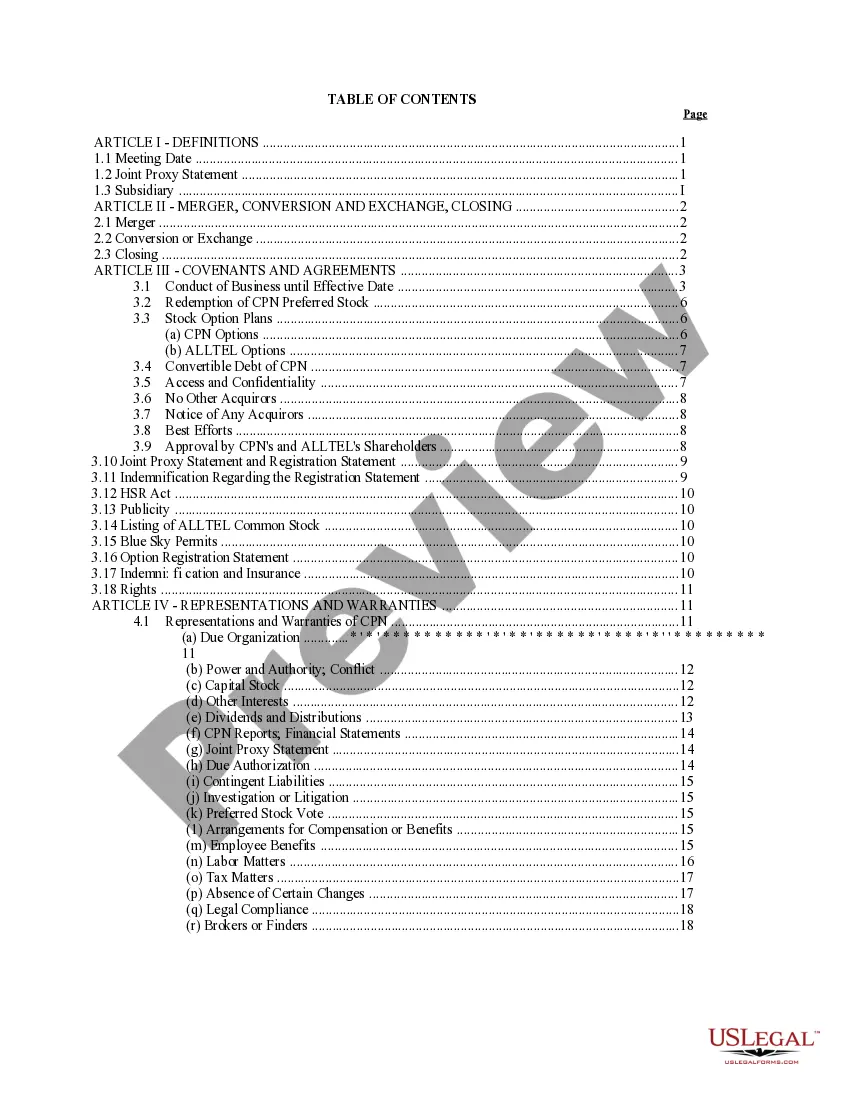

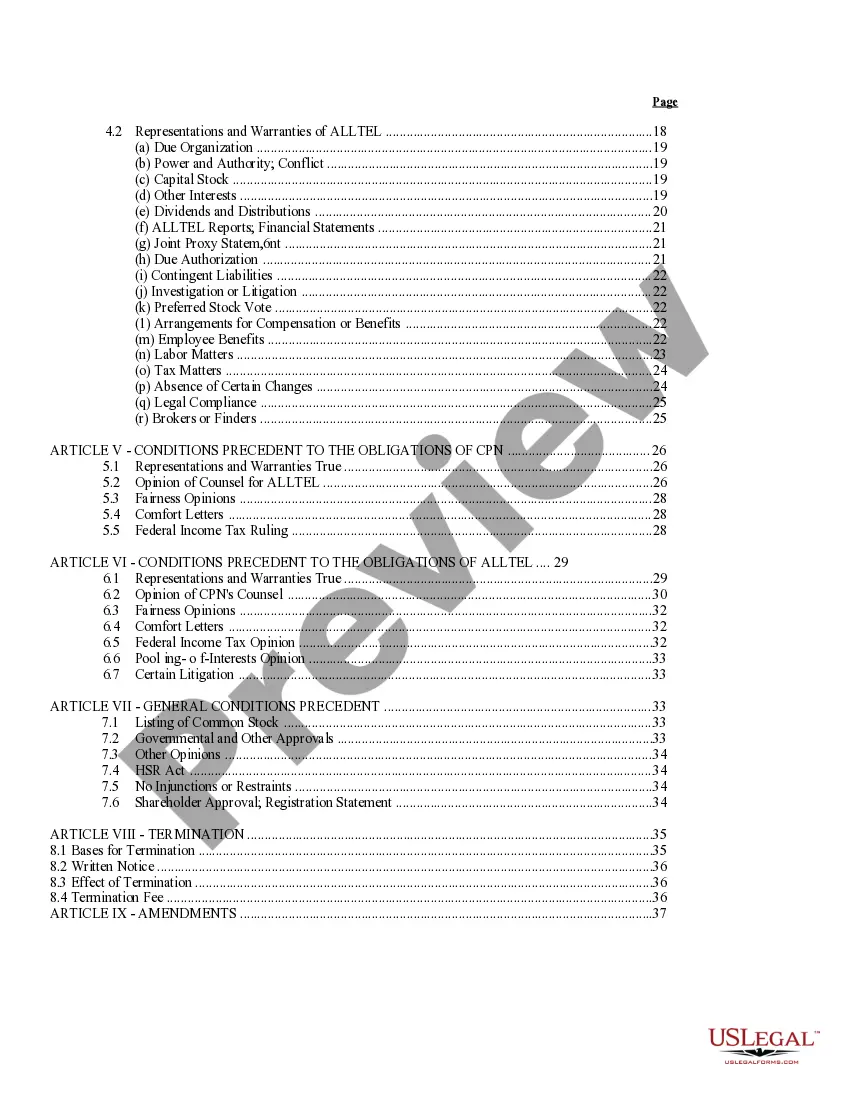

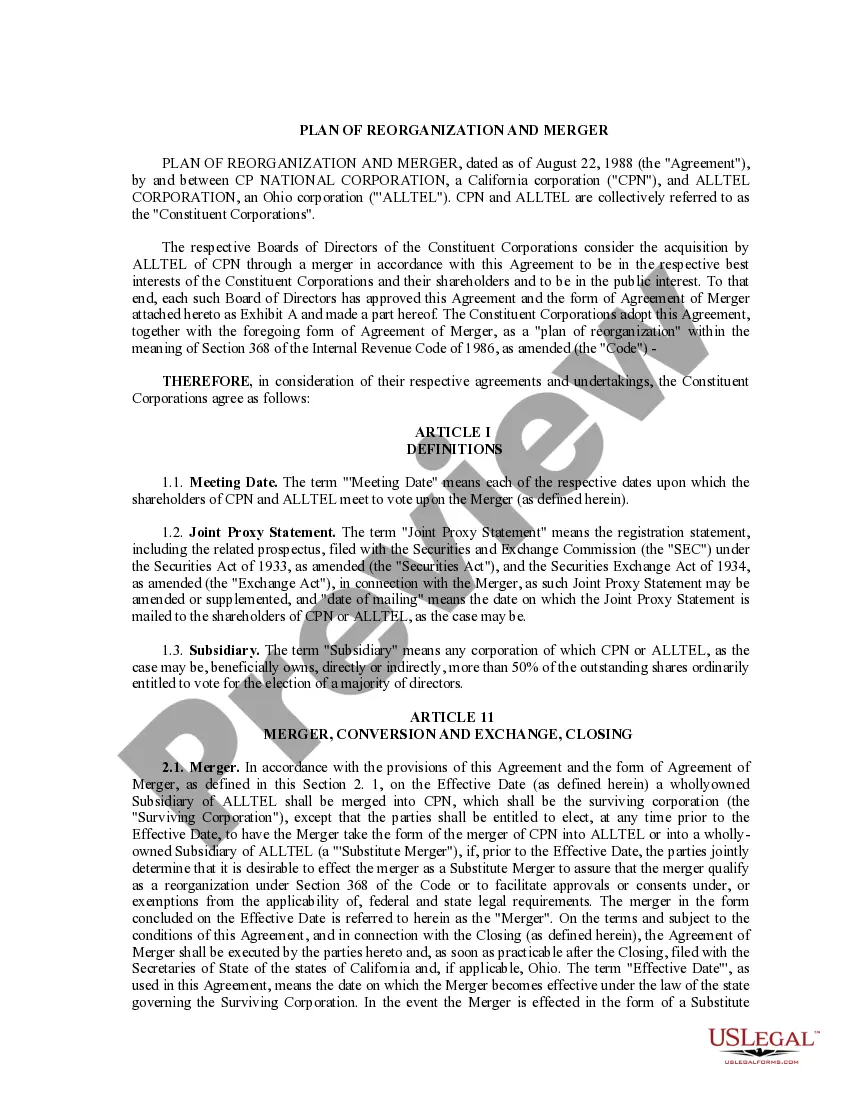

Merger Between Corp With Company

Description

How to fill out Plan Of Reorganization And Merger Between CP National Corp. And Alltel Corp.?

The Merger Between Corp With Company you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and local laws. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Merger Between Corp With Company will take you just a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or check the form description to confirm it fits your needs. If it does not, make use of the search bar to find the appropriate one. Click Buy Now when you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Pick the format you want for your Merger Between Corp With Company (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your paperwork one more time. Make use of the same document again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Buy-Side M&A Process Steps Developing an M&A Strategy. Develop a search criteria. Develop a long list of companies for acquisition. Contact target companies. Perform valuation analysis. Negotiations. Letter of Intent sending. M&A Due Diligence.

You must prepare a sales agreement to move forward with the sale or merger. This document allows for the purchase of assets or stock of a corporation. An attorney should review it to make sure it's accurate and comprehensive. List all inventory in the sale along with names of the businesses and owners.

If you already own multiple companies, you can choose to merge them into a single entity. Another option is to purchase an existing business owned by another individual or organization and join it with your own business.

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies.

A company merger is when two companies combine to form a new company. Companies merge to expand their market share, diversify products, reduce risk and competition and increase profits. Common types of company mergers include conglomerates, horizontal mergers, vertical mergers, market extensions and product extensions.