Advance For Employee Formula

Description

How to fill out Advance Preparation For A New Employee?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re seeking a simpler and more budget-friendly method for generating Advance For Employee Formula or any other forms without excessive obstacles, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal templates covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously prepared by our legal experts.

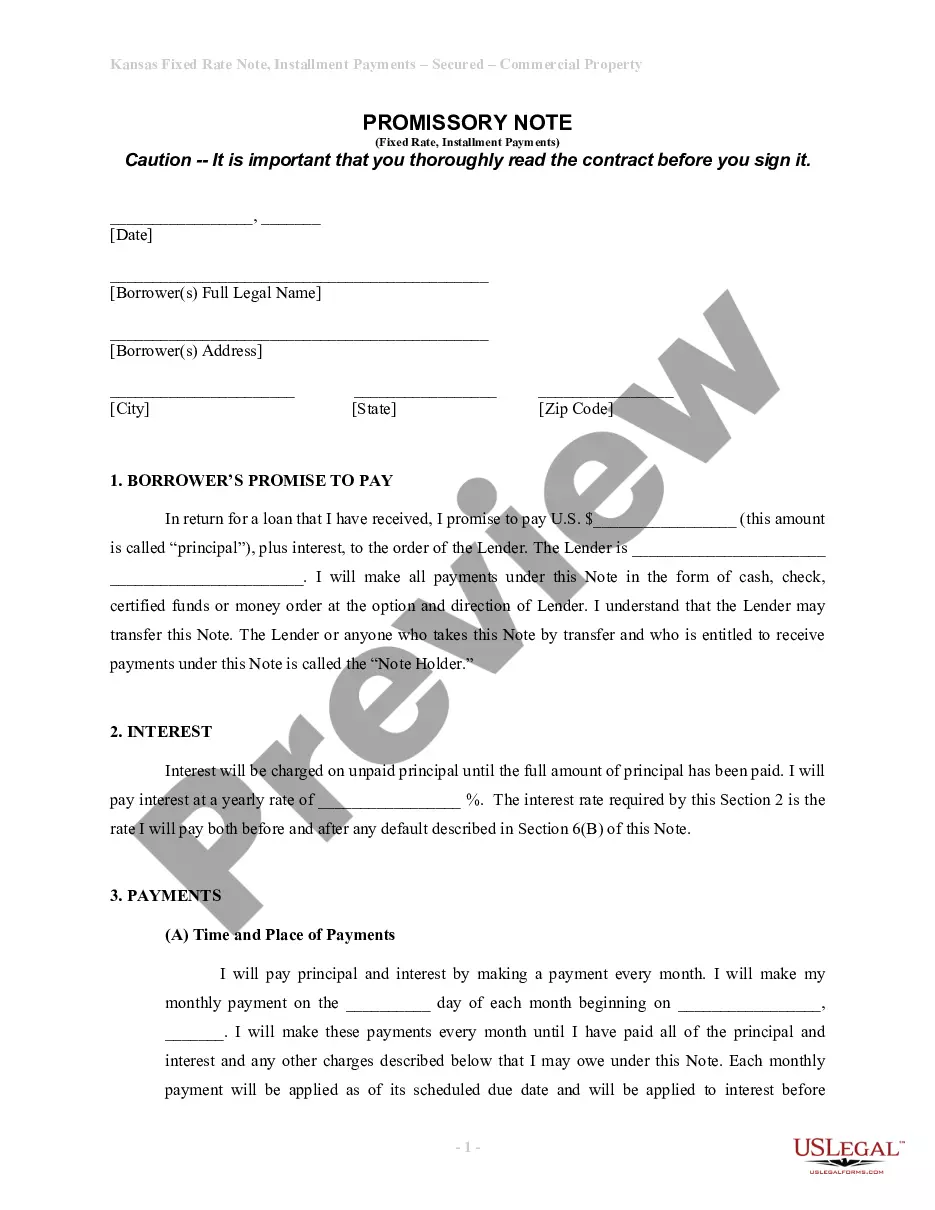

Examine the document preview and descriptions to ensure you are viewing the correct document. Verify that the form you choose aligns with the laws and regulations of your state and county. Select the appropriate subscription option to purchase the Advance For Employee Formula. Download the file, then complete, sign, and print it out. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us today and make form execution an effortless and efficient process!

- Utilize our website whenever you require dependable and trustworthy services to quickly locate and download the Advance For Employee Formula.

- If you’re familiar with our services and have already created an account, simply Log In to your account, choose the template, and download it right away or re-download it at any time later via the My documents tab.

- Don’t have an account? No worries. It only takes a few minutes to set one up and browse the catalog.

- But before you rush into downloading the Advance For Employee Formula, consider these suggestions.

Form popularity

FAQ

How does the salary advance calculation work? in general, the anticipated amount must correspond to 40% the employee's salary; the date chosen for the salary advance is variable, but it also follows a pattern that occurs between the days 15 or 20 of the month.

Salary advances are short-term loans given to employees that are deducted later from future salaries. Some companies allow such advances. The advance amount is deducted from the net income at the end of the month and over the forthcoming months.

QuickBooks Desktop Payroll Go to Lists, then Payroll Item List. Select Payroll Item ? dropdown, then New. Select Custom Setup, then Next. Select Addition, then Next. Enter the name of the item, such as Employee advance. Select the expense account where you want to track the item. ... Set the tax tracking type to None.

For example, if an employee is given money by a company and the money is expected to be repaid or spent for company purposes, the amount will be recorded in this current asset account until it is repaid or until the expense documentation is provided.

Here's how to record an advance to an employee: Record the Advance: When the advance is made, you would decrease (credit) your Bank Account and increase (debit) an Employee Advance account (a type of receivable account). This records the fact that the company has paid out money and is owed money by the employee.