Mortgage Servicing Transfer Rules

Description

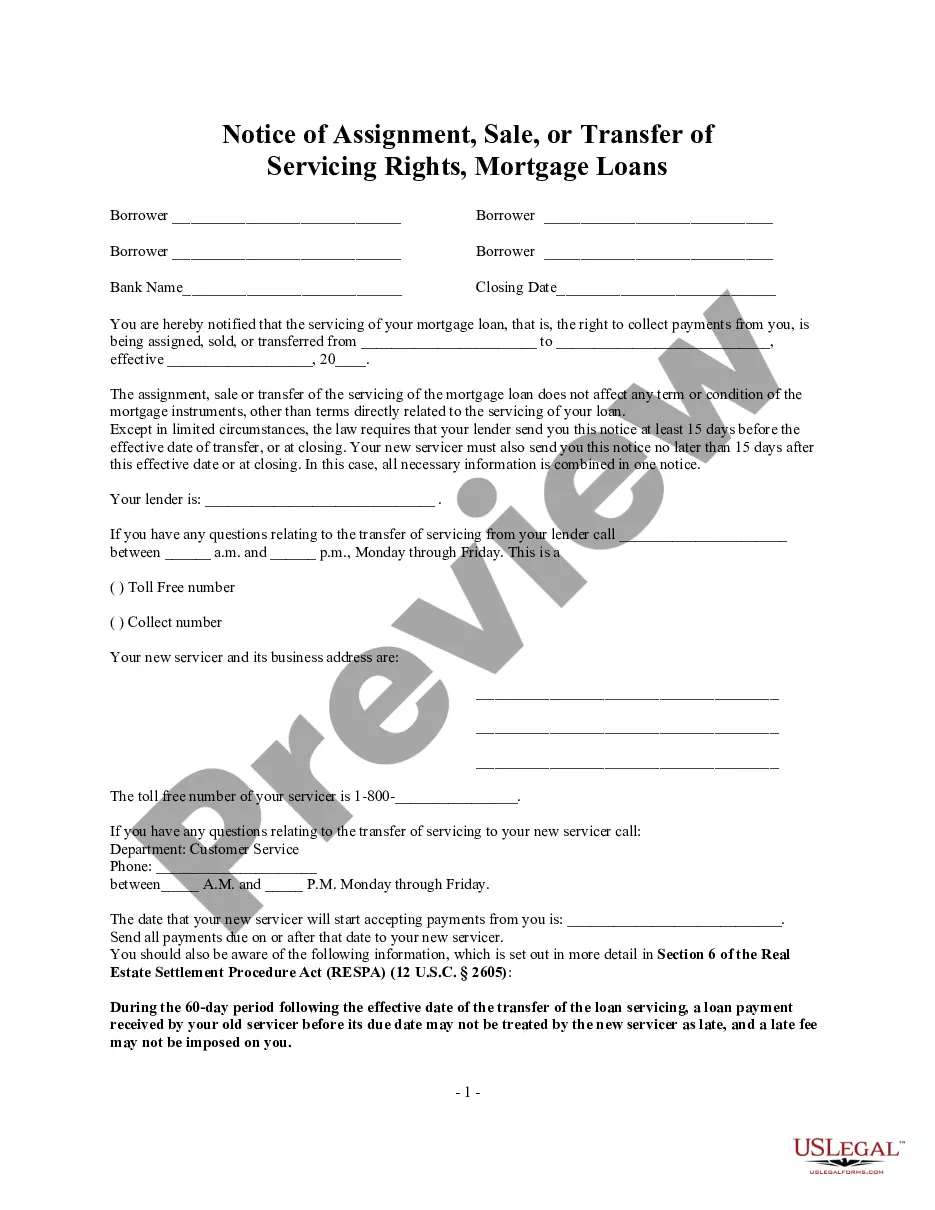

How to fill out Notice Of Assignment, Sale, Or Transfer Of Servicing Rights, Mortgage Loans?

The Mortgage Servicing Transfer Regulations visible on this site is a reusable official framework crafted by expert attorneys in line with national and local statutes.

For over 25 years, US Legal Forms has offered individuals, enterprises, and legal experts with over 85,000 validated, state-specific documents for various business and personal needs. It is the fastest, simplest, and most dependable method to obtain the necessary paperwork, as the service ensures the highest standards of data safety and anti-malware measures.

Register for US Legal Forms to have authenticated legal templates for all of life's situations readily available.

- Search for the document required and examine it.

- Investigate the sample you searched and preview it or check the form description to confirm it meets your requirements. If it doesn't, utilize the search bar to locate the appropriate one. Click Buy Now once you have found the template you desire.

- Register and Log In.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the editable template.

- Choose the format you prefer for your Mortgage Servicing Transfer Regulations (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the documents.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and accurately fill out and sign your form with a legally binding electronic signature.

- Download your documents once more.

- Utilize the same document again as needed. Access the My documents tab in your profile to redownload any previously purchased documents.

Form popularity

FAQ

The only thing that changes with the transfer of servicing rights for your mortgage is who you make your payment to. You'll receive communication from your current servicer with additional information, including contact information for your new servicer.

You can transfer a mortgage to another person if the terms of your mortgage say that it is ?assumable.? If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

As a borrower, all a servicing transfer means is that you'll send your payments to a different company. That company will now also handle your escrow account, answer questions about your loan, and manage the foreclosure process if you default on the payments.

Know your rights under the law You have a 60-day grace period after a transfer to a new servicer. That means you can't be charged a late fee if you send your on-time mortgage payment to the old servicer by mistake ? and your new servicer can't report that payment as late to a credit bureau.

Transfer of mortgage is a transaction where either the borrower or lender assigns an existing mortgage (a loan to purchase a property?usually a residential one?using the property as collateral) from the current holder to another person or entity.