Inheritance For Wife

Description

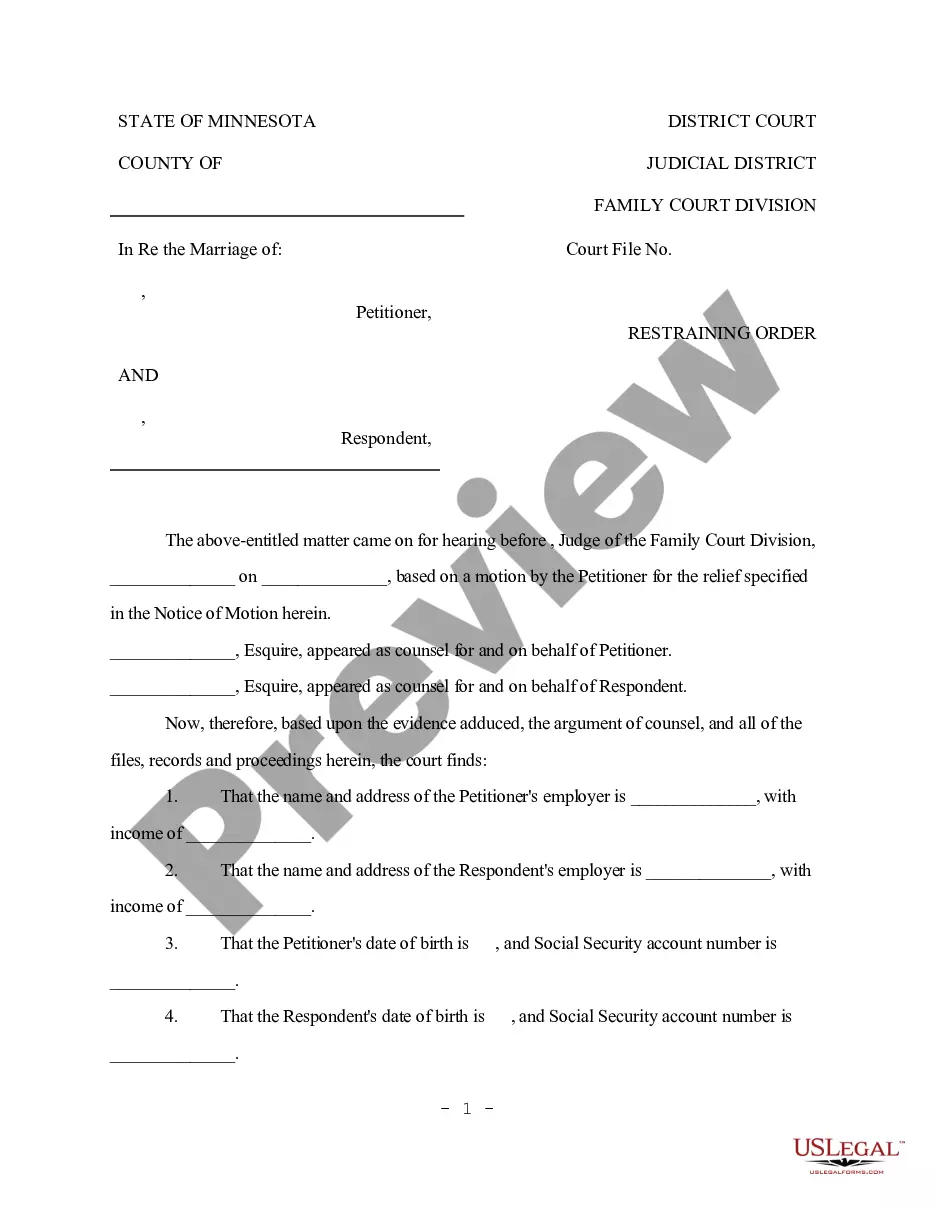

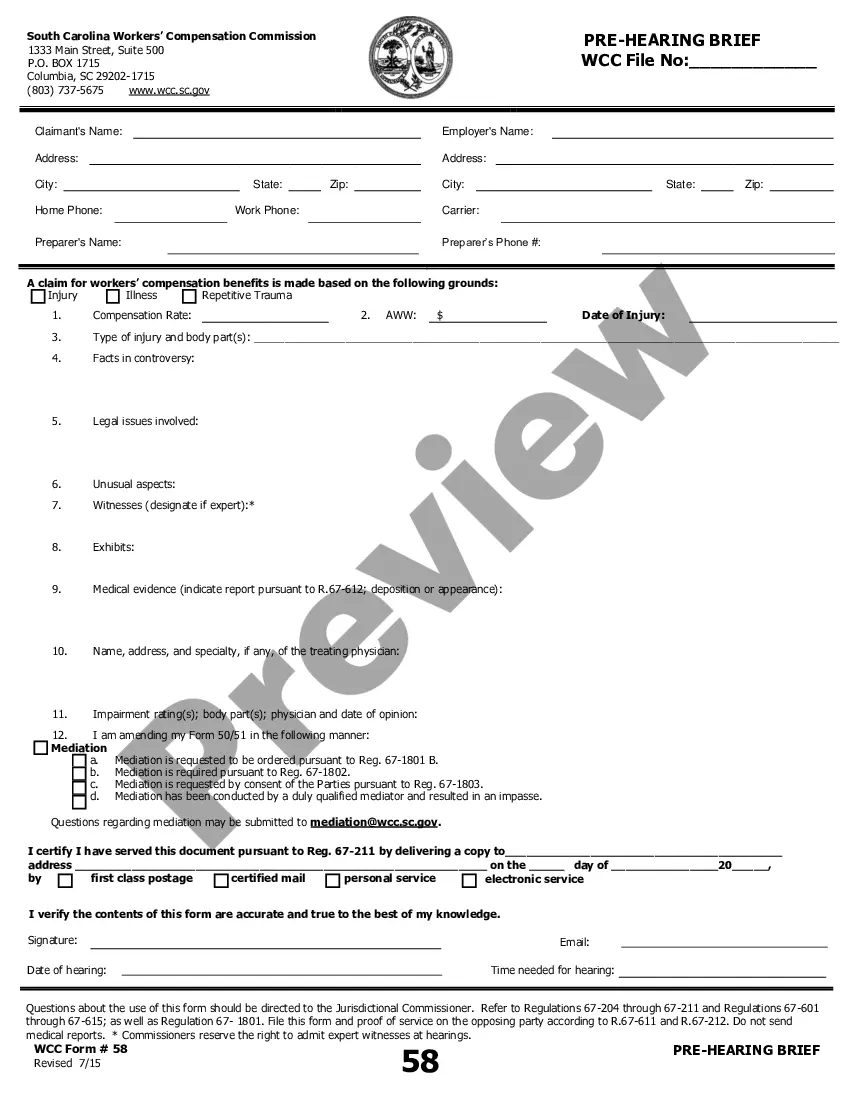

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

It’s clear that you cannot transform into a legal expert in an instant, nor can you easily learn how to swiftly create Inheritance For Wife without a specific expertise. Drafting legal documents is a lengthy endeavor necessitating particular training and abilities. So why not leave the drafting of the Inheritance For Wife to the experts.

With US Legal Forms, one of the largest legal document collections, you can locate anything from court documents to office communication templates. We recognize the significance of conformity and compliance with federal and state laws and regulations. That’s why, on our website, all documents are location-specific and current.

Let’s start with our platform and obtain the document you need in just minutes.

You can regain access to your documents from the My documents section at any time. If you’re an existing client, you can simply Log In, and locate and download the template from the same section.

Regardless of the objective of your paperwork—whether it’s financial, legal, or personal—our platform has you covered. Try US Legal Forms today!

- Find the document you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if Inheritance For Wife is what you’re looking for.

- Begin your search again if you need another document.

- Create a free account and choose a subscription plan to acquire the document.

- Select Buy now. Once the payment is processed, you can download the Inheritance For Wife, complete it, print it, and send or mail it to the designated individuals or organizations.

Form popularity

FAQ

A spouse is not automatically a beneficiary unless explicitly named in financial documents. To ensure your wife inherits smoothly, it's best to check and update all relevant documents accordingly. Using USLegalForms can help streamline the process and provide clarity regarding the status of your spouse's benefits.

While spouses are often primary beneficiaries, it’s not automatic unless specified in the policy. You need to confirm that your wife is clearly designated on any financial accounts or insurance policies as a beneficiary. This designation directly affects how inheritance for wife is handled and can simplify the transfer process.

As a spouse, you might have specific rights to your wife's inheritance, depending on state laws. Generally, if your wife passes away without a will, you may have a claim to a portion of her estate. It's always wise to consult with an attorney or use resources like USLegalForms for clarity on your specific entitlement.

In many cases, life insurance proceeds go directly to the designated beneficiary, which can include your spouse. It's crucial to ensure that your wife is listed as the beneficiary on your policy. Otherwise, the payout may go through probate, complicating her inheritance for wife unless specified in the will.

It is essential to understand that inheritances for wife are usually considered separate property. However, certain factors can change this outcome. For example, if the inheritance is used for joint expenses or placed in a joint account, it may become marital property. Consulting professionals can help you navigate these complexities and protect your assets effectively.

Whether your wife receives half of your inheritance largely depends on how you received the assets. Inheritances meant specifically for an individual often remain separate property. However, if you commingle those assets or include them in marital property, your spouse may be entitled to a portion of those assets. It's best to consult legal experts to clarify these details.

Inheritance for wife typically depends on state laws and the deceased's estate plan. In most cases, if you are married, your spouse has certain rights to inherit your assets. This means your wife may receive a portion of your estate, especially if you have no will. Creating a clear estate plan can help ensure that her inheritance meets your wishes.

Yes, your wife may have access to your inheritance if it is included in your estate. However, the type of access she has depends on how the assets are structured and what your will states. To ensure clarity and avoid confusion about inheritance for wife, it’s advisable to consult an attorney who can guide you through these legal intricacies.

Protecting your inheritance from being claimed by your wife can involve setting clear estate plans and keeping certain assets separate. This process may include creating a trust or clearly designating inheritance in a will. It is crucial to think this through, as legal advice can help you navigate the complexities of inheritance laws.

Whether your wife receives half of your inheritance or not depends on several factors, including state law and how assets are defined. In community property states, spouses often share equal ownership of marital assets acquired during the marriage. In non-community property states, inheritance distribution might differ, so consulting a legal professional is advisable.