Form Rent Certification Form 1a

Description

How to fill out Rent Roll Certification?

Creating legal documents from the beginning can occasionally feel a bit daunting.

Certain situations may require extensive research and significant financial investment.

If you seek a simpler and more cost-effective method of preparing Form Rent Certification Form 1a or other documents without unnecessary complications, US Legal Forms is readily available.

Our online repository of over 85,000 current legal templates covers nearly every aspect of your financial, legal, and personal matters.

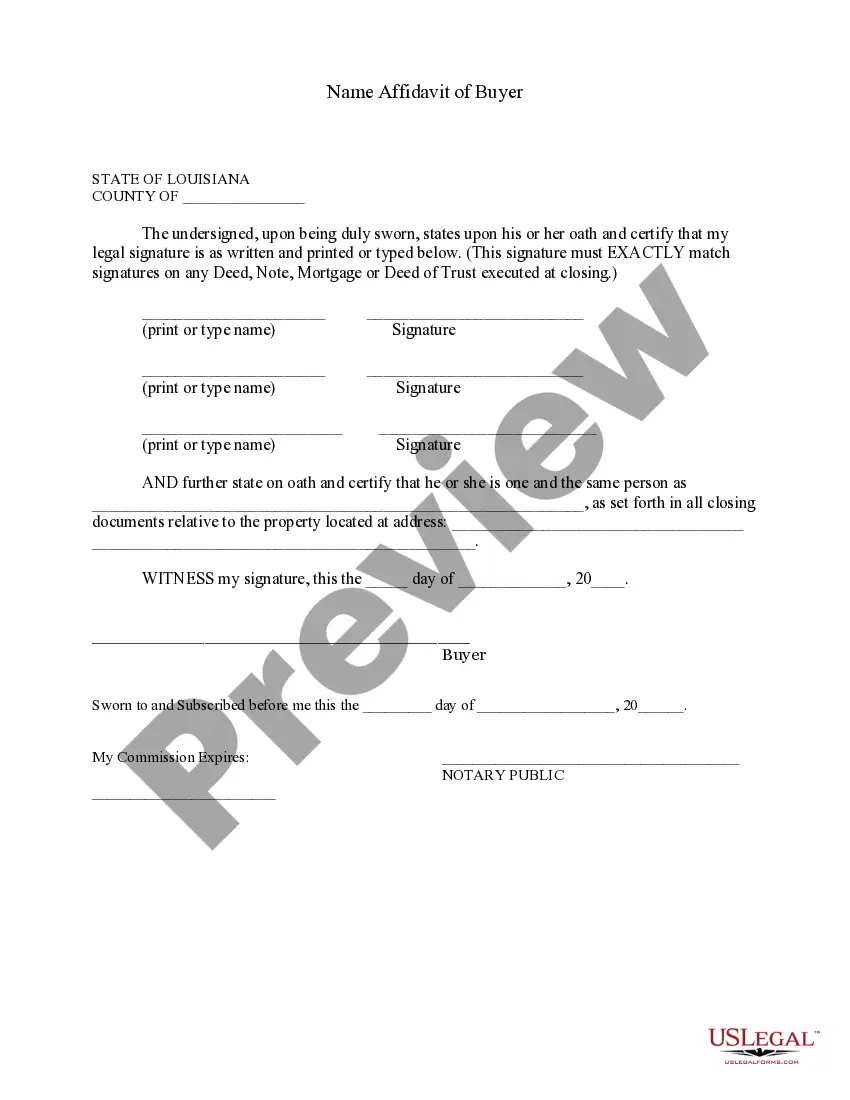

Examine the form preview and descriptions to ensure it’s the correct document you need. Confirm that the template you choose aligns with the statutes and regulations of your state and county. Select the most appropriate subscription option to acquire Form Rent Certification Form 1a. Download the document, then complete, sign, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document completion simple and efficient!

- With just a few clicks, you can quickly obtain state- and county-specific templates meticulously crafted by our legal experts.

- Utilize our service whenever you require a dependable and trustworthy platform to swiftly find and download Form Rent Certification Form 1a.

- If you are already familiar with our site and have previously established an account, simply Log In, find the template, and download it or re-download it later from the My documents section.

- Not registered yet? No worries. Registration takes just a few minutes, allowing you to access the library.

- Before diving into downloading Form Rent Certification Form 1a, consider these suggestions.

Form popularity

FAQ

Certificate of Rent Paid (CRP) Requirements If you own or manage a rental property and rent living space to someone, you must provide a CRP to each renter if either of these apply: Property tax was payable in 2022 on the property. The property is tax-exempt, but you made payments in lieu of property taxes.

To fill out the Certificate of Rent Paid information in the TaxAct program: From within your TaxAct return (Online or Desktop), click State, then click Minnesota (or MN). ... Click Property Tax Refund in the Minnesota Quick Q&A Topics menu to expand, then click Certificate of rent paid.

Your landlord, or your landlord's authorized agent, must sign this PA Rent Certificate. If your landlord, or your landlord's authorized agent, does not sign this PA Rent Certificate, you must complete Lines 1 through 8 and the Rental Occupancy Affidavit below. Your Rental Occupancy Affidavit must be notarized.

The CRP shows how much rent you paid during the previous year. You must include all CRPs when applying for your Renter's Property Tax Refund. Your landlord must give you a completed CRP by January 31.

A rent certificate or property tax bill is used to verify the amount of rent paid or property tax accrued you are claiming for purposes of homestead credit. If a copy of the property tax bill is not available, you may use a printout from the county or municipal treasurer or their website.