Pre Trial Forms For Credit Card Debt

Description

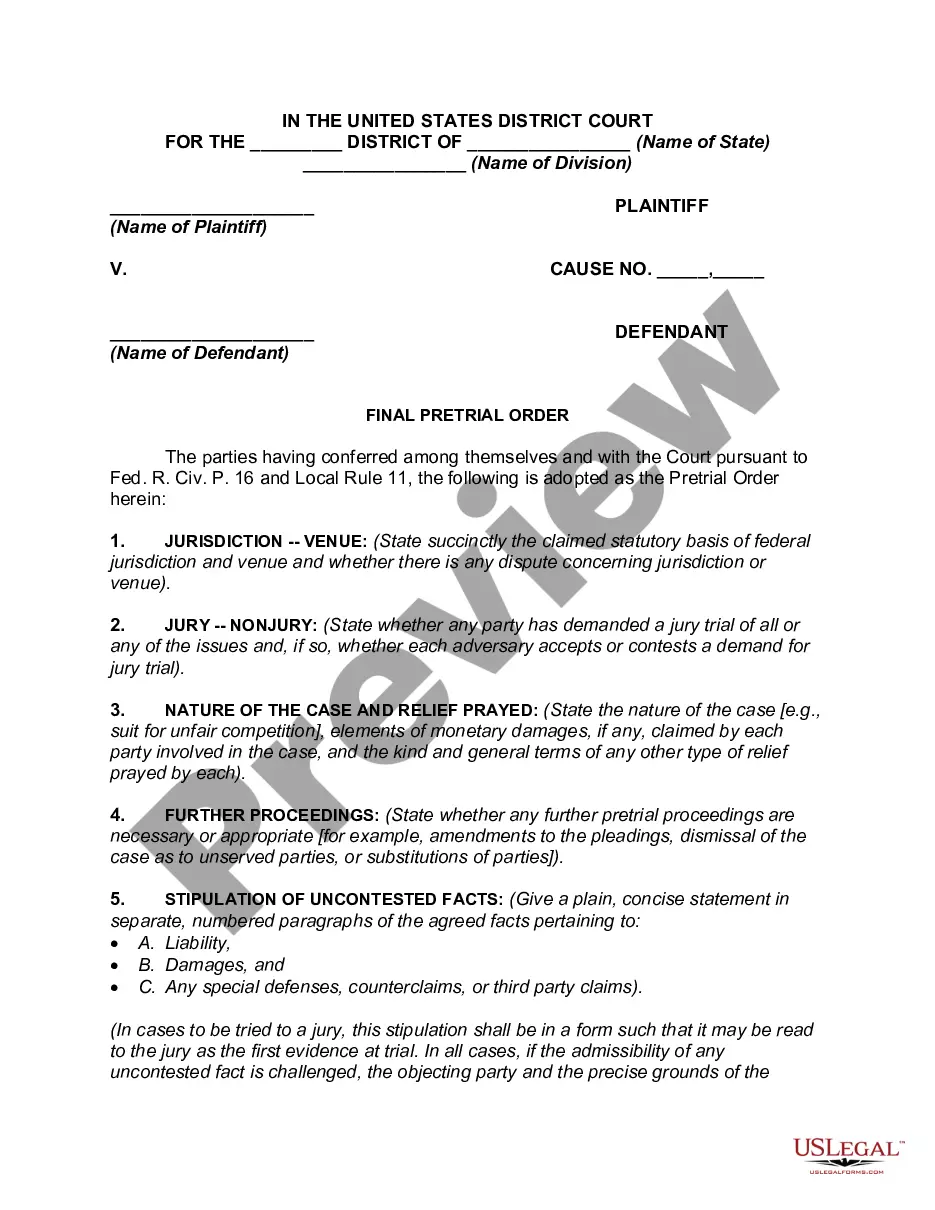

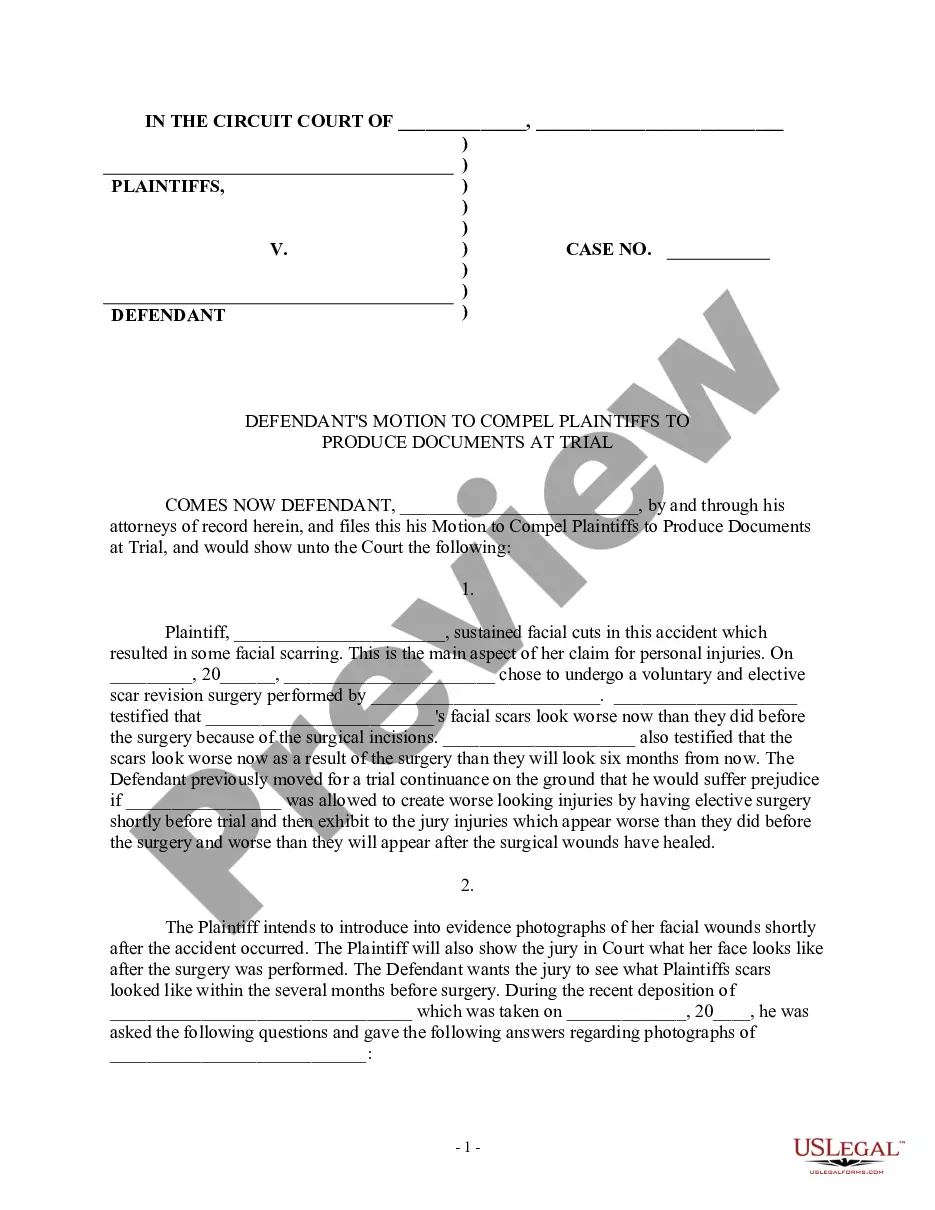

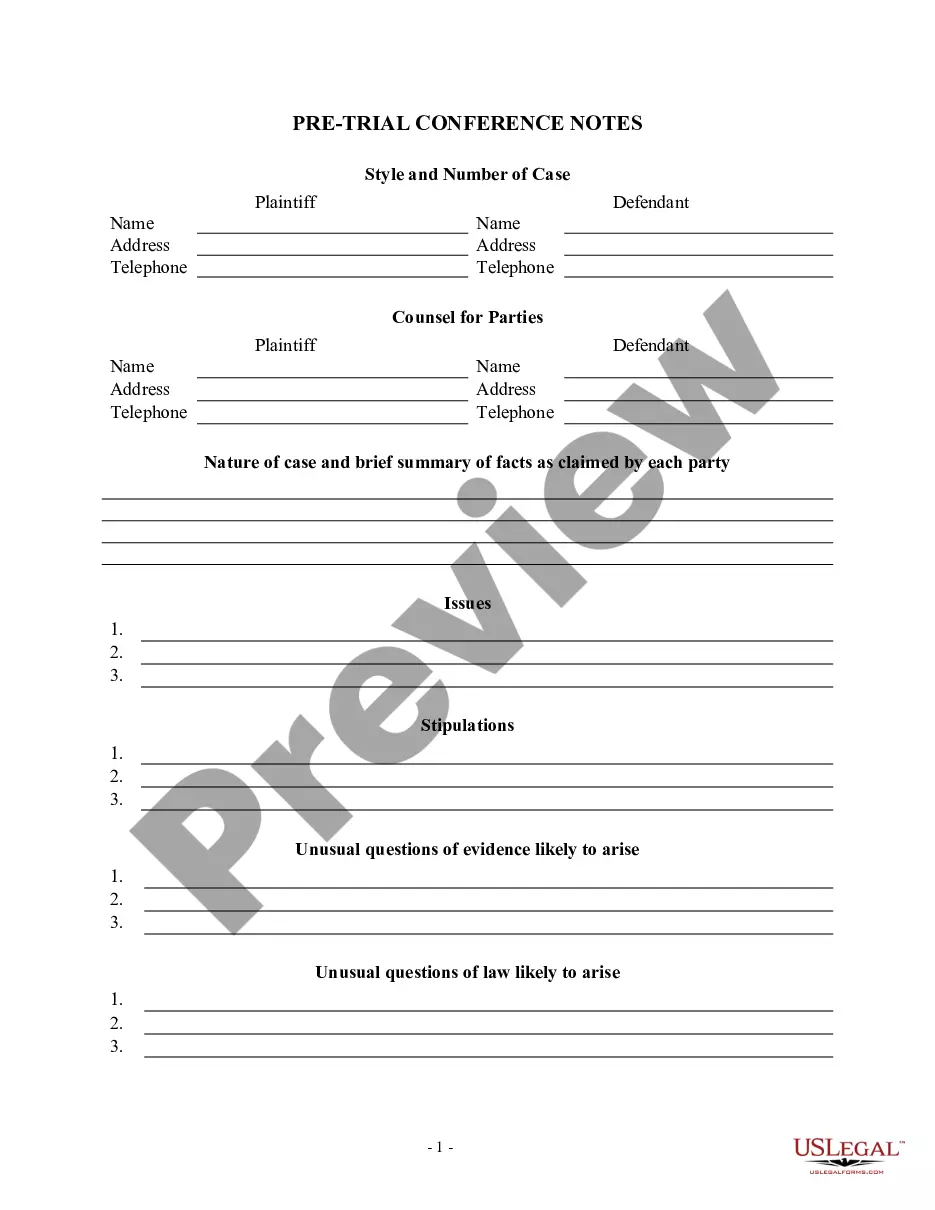

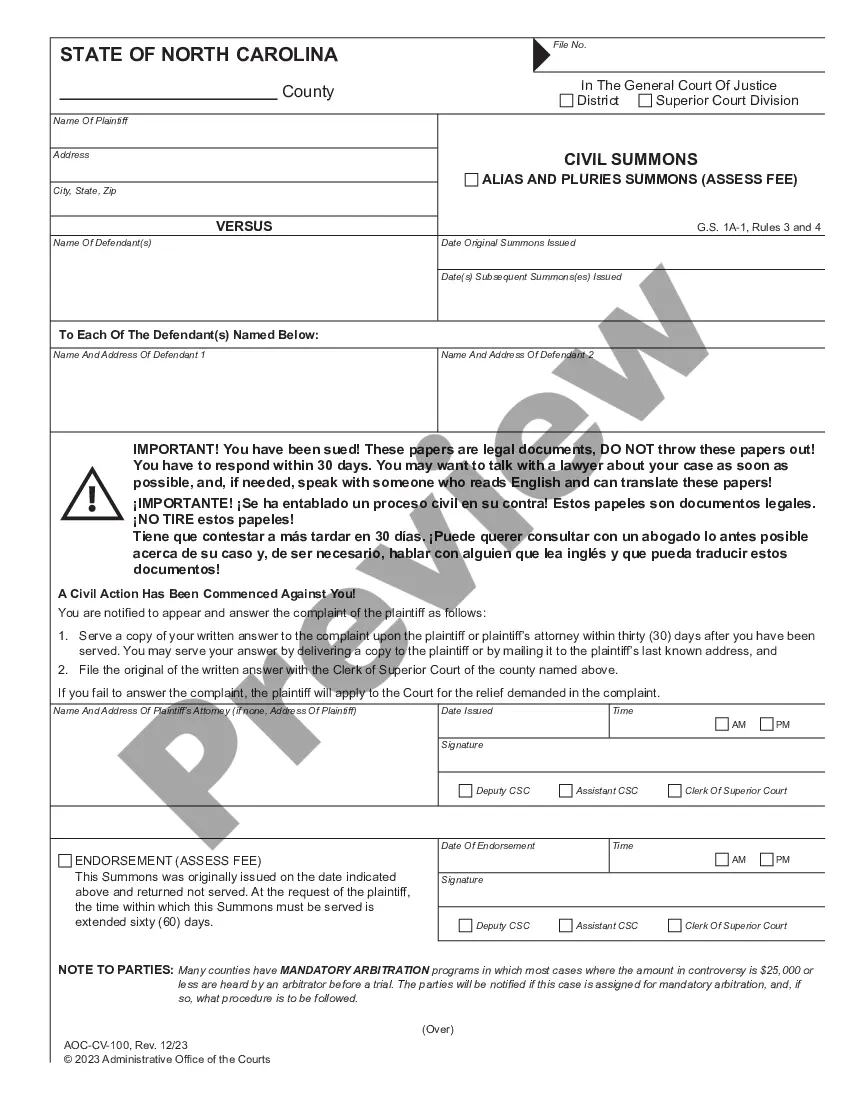

How to fill out Plaintiff's Pretrial Memorandum For A Bench Trial In A Patent Case?

It’s clear that you cannot transform into a legal expert in a single night, nor can you swiftly acquire the ability to draft Pre Trial Forms For Credit Card Debt without possessing a distinct set of competencies.

Drafting legal documents is a lengthy process that demands specific education and expertise. So, why not entrust the preparation of the Pre Trial Forms For Credit Card Debt to the professionals.

With US Legal Forms, one of the largest libraries of legal templates, you can discover anything from judicial documents to templates for internal business communication.

If you require another form, restart your search.

Establish a free account and select a subscription plan to purchase the template. Choose Buy now. After the transaction is finalized, you can obtain the Pre Trial Forms For Credit Card Debt, fill it out, print it, and deliver it to the necessary parties or organizations.

- We recognize the significance of compliance and adherence to federal and local laws and regulations.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how you can begin utilizing our platform and acquire the form you require in just minutes.

- Identify the form you are looking for using the search bar at the top of the webpage.

- Preview it (if this option is available) and peruse the supporting description to determine if Pre Trial Forms For Credit Card Debt is what you are seeking.

Form popularity

FAQ

Credit card companies and debt collectors don't usually sue borrowers until their account has been in default for six months or more. In that six-month period, if you keep missing payments, the creditor will report them to the major credit bureaus and they'll be reflected on your credit report.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

Apply for a settlement via a formal letter in which you will again explain in detail why you can't pay the entire debt amount. The lender may decide on a lump sum settlement amount based on the severity of your circumstances. As part of the debt settlement process, provide the whole amount that your lender decides.

Resolving debt before a lawsuit A partial one-time payment is often the least expensive way to pay off a debt. ... You may be able to negotiate payments in monthly installments. ... If you are being harassed by debt collectors, you can ask them to stop. ... When debt expires, you can't be sued for it.

Debt Management Programs A nonprofit credit counseling agency can work with you and your creditors to consolidate your debt, lower your interest rate, and set up a payment plan. A debt management plan (DMP) is part of a debt management program.