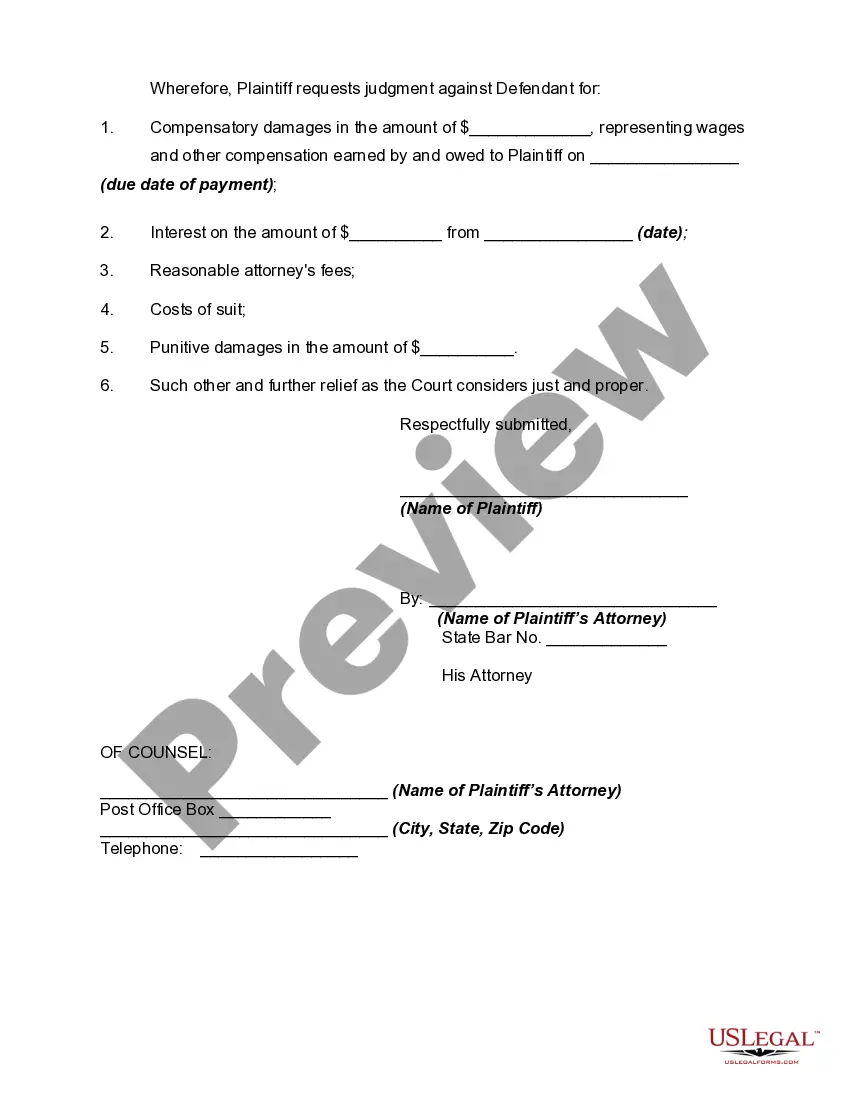

Wages Form With Example

Description

How to fill out Complaint For Recovery Of Unpaid Wages?

Legal document administration may be perplexing, even for seasoned professionals.

If you seek a Wage Form With Example and lack the time to invest in finding the accurate and current version, the procedures can be demanding.

US Legal Forms meets any requirements you may have, ranging from personal to business documentation, all in one location.

Utilize cutting-edge tools to complete and manage your Wage Form With Example.

Here are the steps to follow after obtaining the necessary form: Verify that it is the correct document by previewing and reviewing its details. Ensure that the template is sanctioned in your state or county. Click Buy Now when you're ready. Select a subscription plan. Choose your preferred format and Download, complete, sign, print, and dispatch your documents. Experience the US Legal Forms online library, bolstered by 25 years of experience and reliability. Streamline your daily document management into a straightforward and user-friendly process today.

- Access a valuable repository of articles, guidelines, handbooks, and resources relevant to your circumstances and needs.

- Conserve time and effort searching for the documents you require by employing US Legal Forms’ advanced search and Preview tool to locate your Wage Form With Example and download it.

- For those holding a subscription, Log In to your US Legal Forms account, search for the required form, and download it.

- Examine your My documents tab to review the documents you have previously saved and to organize your folders as desired.

- If using US Legal Forms for the first time, create a free account and gain unrestricted access to all the library benefits.

- A comprehensive online form library can be transformative for anyone aiming to manage these scenarios effectively.

- US Legal Forms is a frontrunner in online legal documents, boasting over 85,000 state-specific legal forms accessible at any given moment.

- With US Legal Forms, you can access customized legal and business documents specific to your state or county.

Form popularity

FAQ

Zoho Forms is a online form maker that lets you create web forms. Create customizable business forms, configure email notifications, and collaborate with your team with this simple drag-and-drop form builder. An efficient data collection tool that helps you gather and manage data from anywhere, even offline.

Best Online Form Builders for Websites WPForms. Formidable Forms. Gravity Forms. Ninja Forms. Zoho Forms. Google Forms. Jotform. Microsoft Forms.

Whether you need to create a form for school, work, business, or personal needs, Canva's free form builder got you covered! Our easy-to-use tool lets you make printable survey forms, quizzes, sign-up forms, order forms, and many more.

16 Best Online Form Builders | Free & Paid [2023] Paperform. Typeform. Cognito Forms. Microsoft Forms. Hubspot Forms. Formsite. Wufoo. ClickUp.

Key components of Form 16A: Name and address of the employer. Name and address of the employee. PAN (Permanent Account Number) of the employer. TAN (Tax Collection Account Number) of the employer. PAN of the employee. The period for which the employer has calculated the tax on salary.

It is mandatory for every employer who has deducted any tax at source to issue Form 16 to you. Employers can issue Form 16 in print or soft copy downloaded from their account on the TRACES website. Your employer can also guide you to any outsourced online payroll platform, from where you can download your Form 16.

Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. Some components of your salary are exempt from tax, such as telephone bills reimbursement, leave travel allowance. If you receive HRA and live on rent, you can claim exemption on HRA.

Now, one pays tax on his/her net taxable income. For the first Rs. 2.5 lakh of your taxable income you pay zero tax. For the next Rs. 2.5 lakhs you pay 5% i.e. Rs 12,500. For the next 5 lakhs you pay 20% i.e. Rs 1,00,000. For your taxable income part which exceeds Rs. 10 lakhs you pay 30% on the entire amount.