Salary Form For Itr

Description

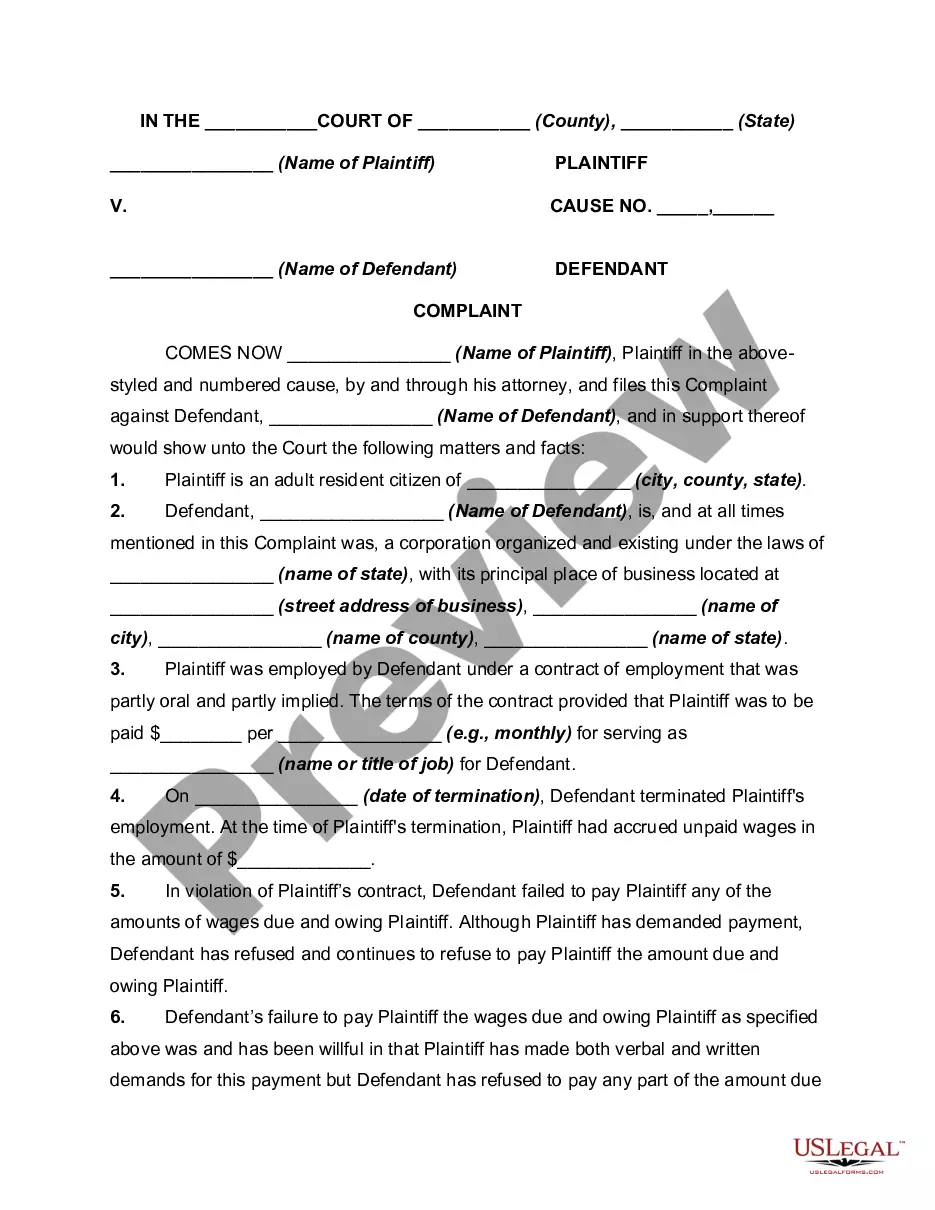

How to fill out Complaint For Recovery Of Unpaid Wages?

Creating legal documents from the ground up can occasionally be intimidating.

Certain cases may necessitate extensive research and significant financial investment.

If you're looking for a simpler and more affordable method to generate the Salary Form For Itr or other documents without complications, US Legal Forms is readily accessible.

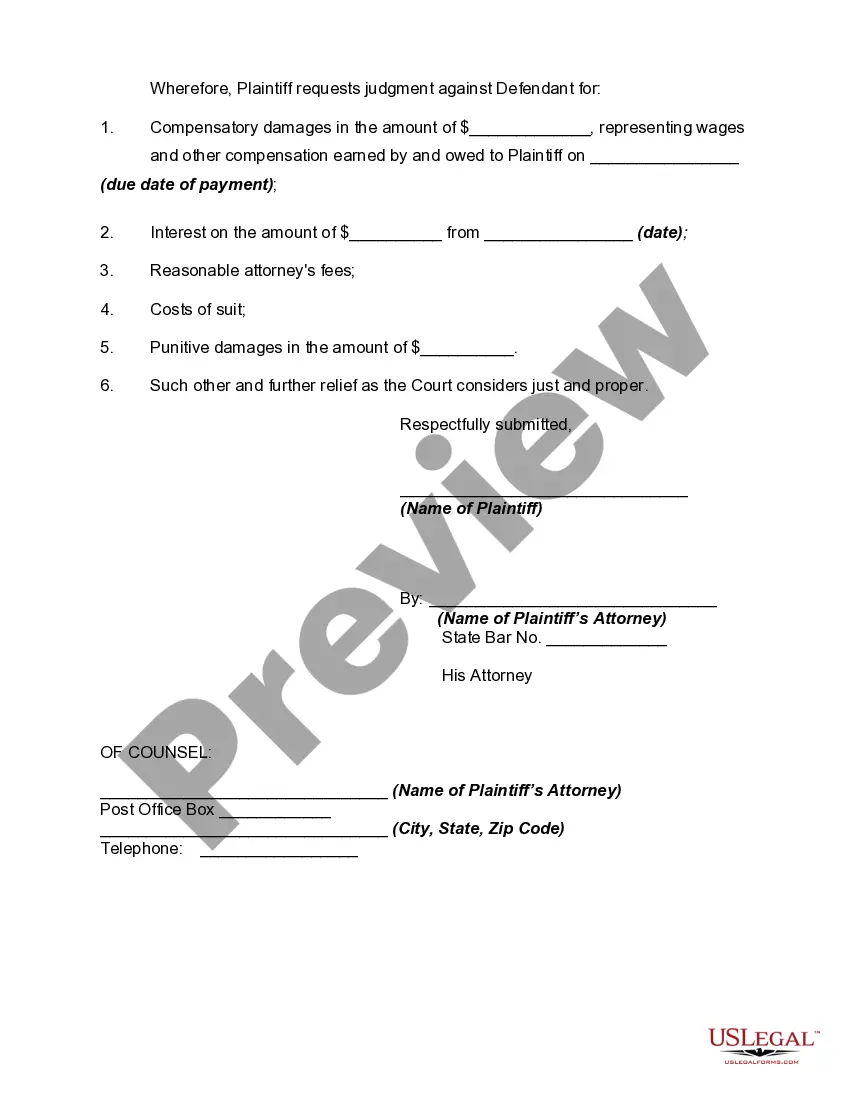

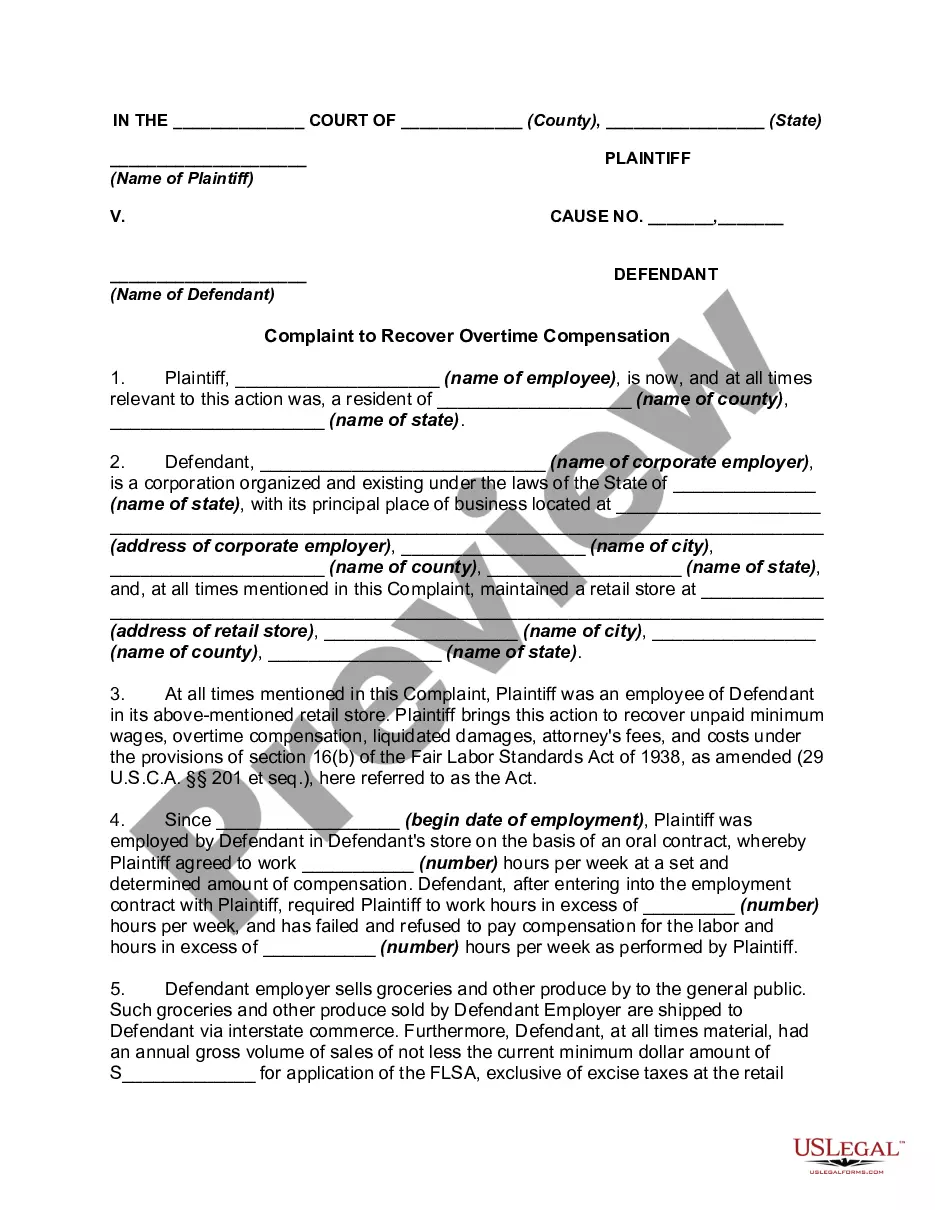

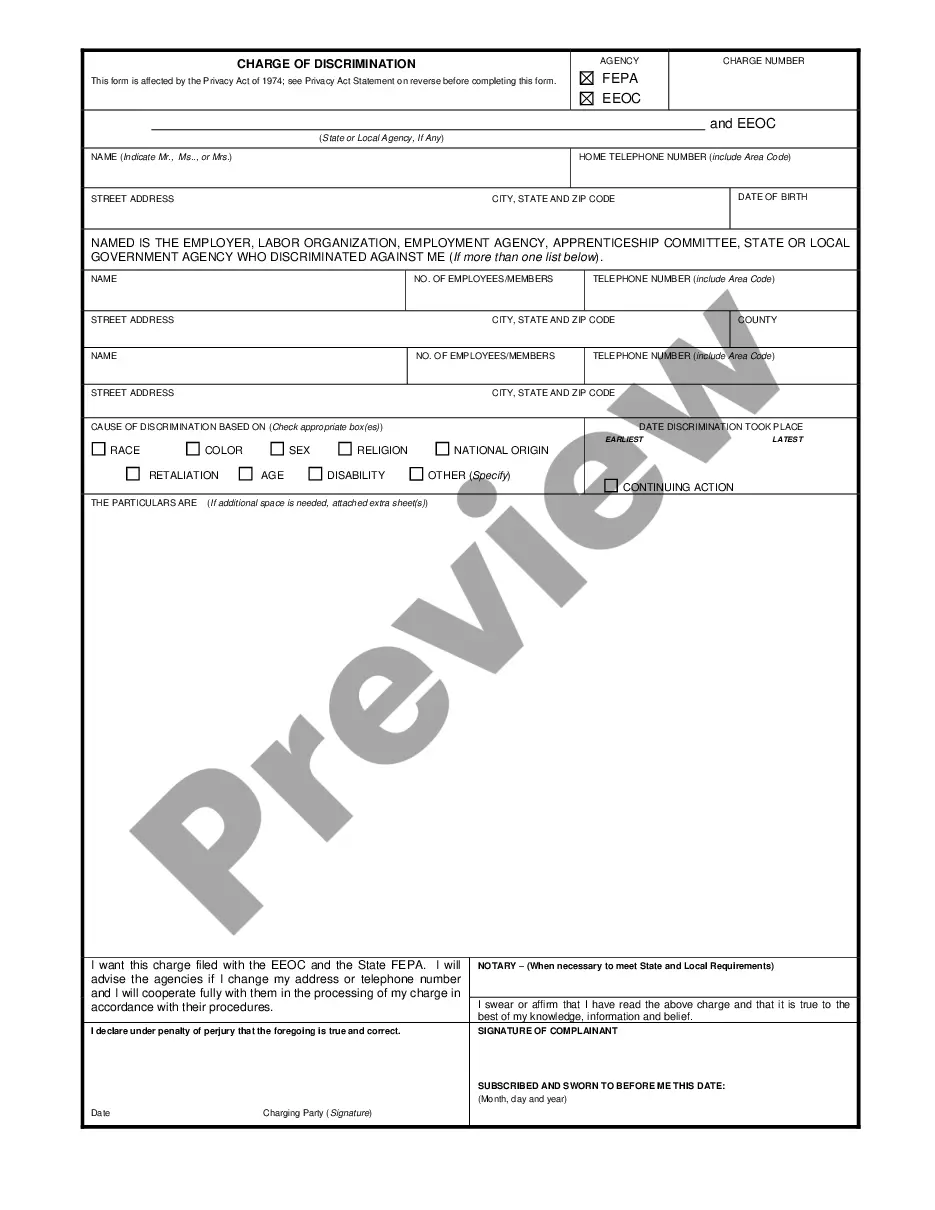

Our online repository of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs.

Check the document preview and descriptions to ensure you have the correct document. Ensure the form aligns with the regulations and laws of your state and county. Select the most appropriate subscription option to acquire the Salary Form For Itr. Download the form, complete, certify, and print it out. US Legal Forms has a strong reputation and over 25 years of expertise. Join us today and make form completion an easy and efficient process!

- With a few simple clicks, you can rapidly obtain state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our website whenever you require dependable services through which you can effortlessly locate and download the Salary Form For Itr.

- If you're already familiar with our offerings and have previously established an account with us, just Log In to your account, find the template, and download it or re-download it anytime from the My documents section.

- Don’t possess an account? No problem. It requires minimal time to sign up and browse the catalog.

- However, prior to proceeding with the download of Salary Form For Itr, heed these suggestions.

Form popularity

FAQ

ITR 1, ITR 2, ITR 3, and ITR 4 are income tax return forms used in India, each serving different taxpayer needs. ITR 1 is for individuals earning salary income only. ITR 2 is for those with additional income, while ITR 3 is for individuals with business income. ITR 4 is simplified for presumptive income. Choosing the right salary form for ITR is essential for correct filing.

ITR 1 applies to individuals who earn income from salary, rent, or interest. ITR 4 is applicable to people who have income from interest, salary, or rent and business income opted for a presumptive taxation scheme.

What is ITR-4 (Sugam) Form? ITR-4 (Sugam) is an income tax return form specifically designed for taxpayers who have opted for the presumptive income scheme under Sections 44AD, 44ADA, and 44AE of the Income Tax Act.

The ITR-5 Forms is to be used by firms, LLPs, Associations of Persons (AOPs), BOIs, Artificial Judicial Persons, Cooperative Societies, and Local Authorities. Bear in mind that persons who are required to file returns under Sections 139(4A), 139(4B), 139(4C), or 139(4D) need not use this form.

ITR-1 is a simplified one-page form for individuals receiving income of up to Rs 50 lakh from the following sources : Income from salary/pension. Income from one house property (excluding cases where loss is brought forward from previous years)

ITR-2 form is for individuals and HUF receiving income other than income from 'Profits and Gains from Business or Profession'. Thus, individuals with income from the following sources are eligible to file Form ITR-2: Income from salary/pension. Income from house property (income can be from more than one house property ...