Formato Acta Junta Socios

Description

How to fill out Minutes Of First Meeting Of The Board Of Directors Of A Nonprofit Corporation?

Whether for commercial reasons or personal matters, everyone must confront legal situations at some stage in their lives.

Filling out legal documents requires meticulous attention, starting with selecting the right form template.

With an extensive US Legal Forms catalog available, you don’t need to waste time searching for the correct template across the web. Utilize the library’s straightforward navigation to find the right form for any situation.

- Find the template you need using the search bar or catalog navigation.

- Review the form's description to ensure it matches your needs, state, and county.

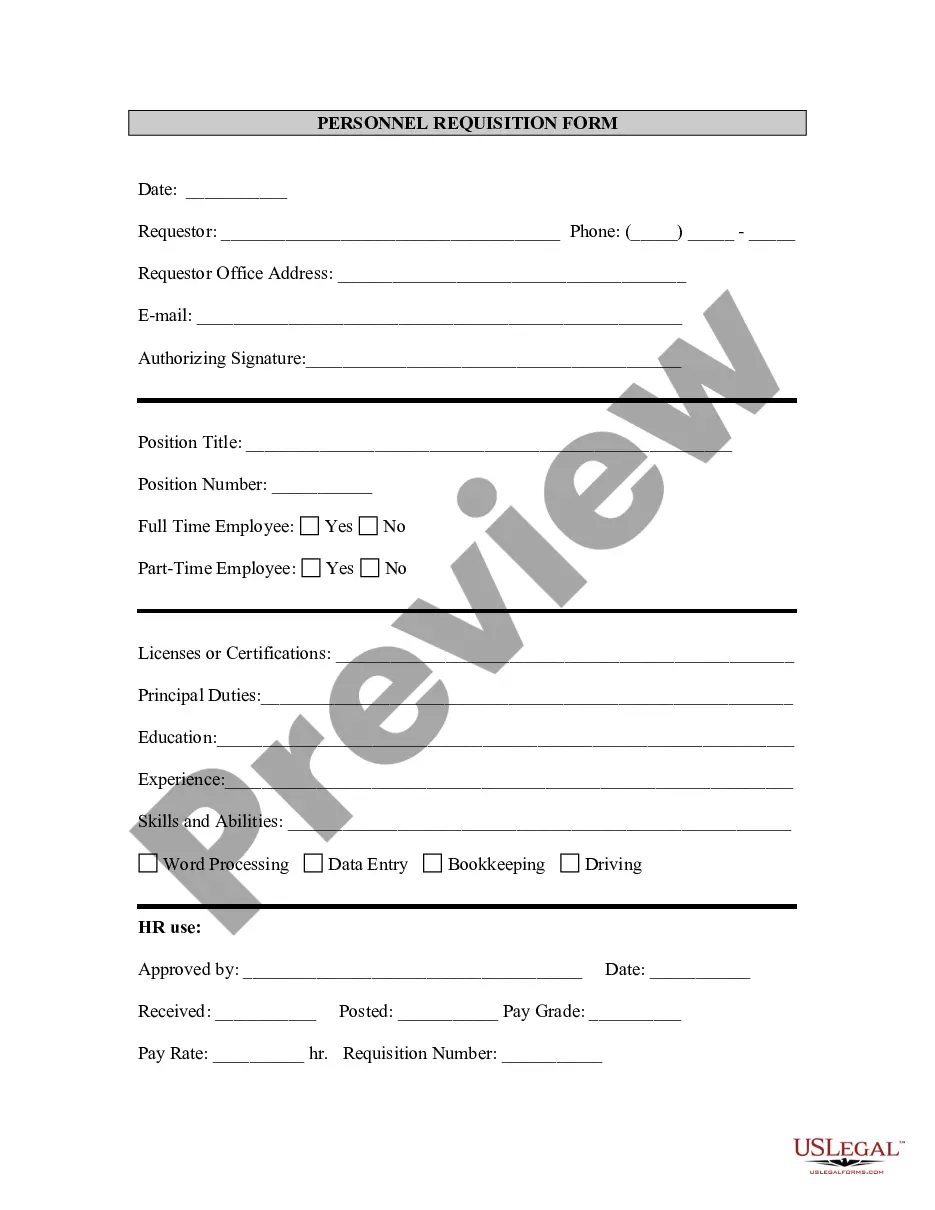

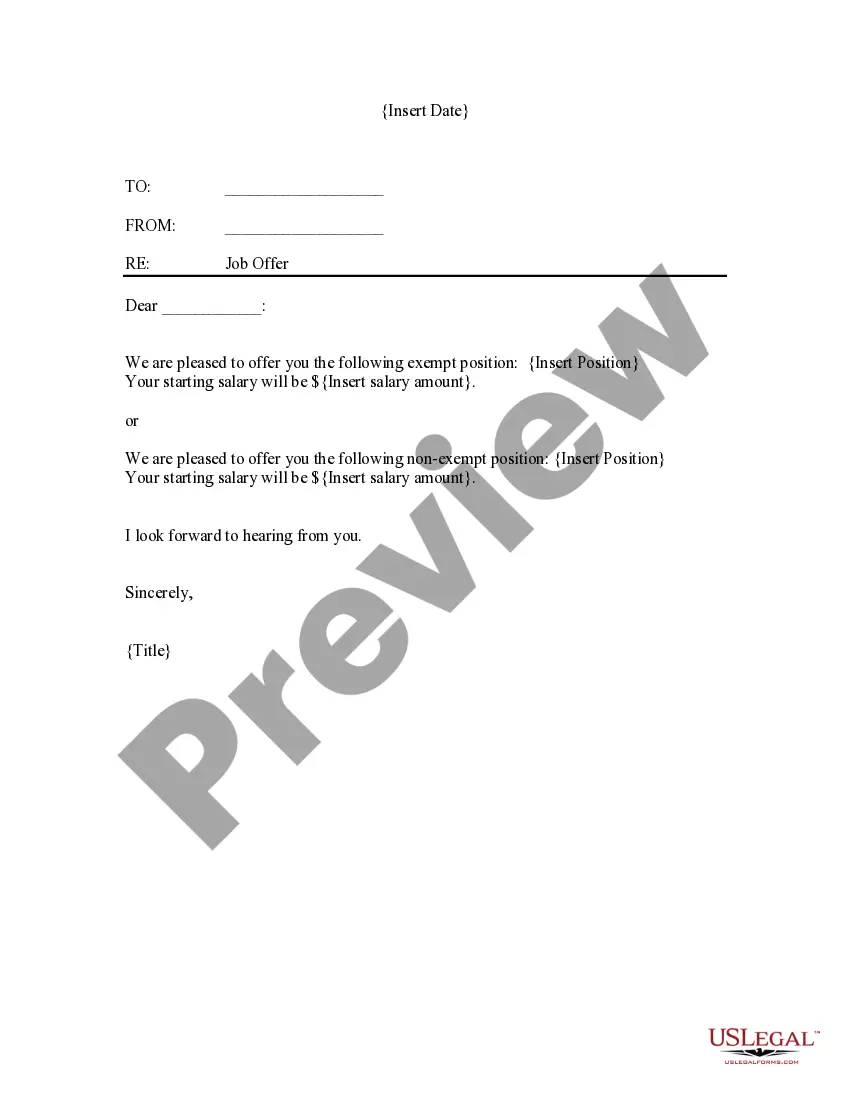

- Click on the form's preview to see it.

- If it is not the correct document, return to the search function to find the Formato Acta Junta Socios sample you need.

- Download the template when it aligns with your requirements.

- If you have a US Legal Forms account, click Log in to access previously saved templates in My documents.

- In case you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the document format you prefer and download the Formato Acta Junta Socios.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

You are a nonresident for the 2022 taxable year if you are neither a resident nor a part-year resident for the 2022 taxable year. If you are a nonresident and you meet the requirements for Who Must File Form CT?1040NR/PY for the 2022 taxable year, you must file Form CT?1040NR/PY.

Steps for Making a Financial Power of Attorney in Connecticut Create the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Land Records Office.

Connecticut State Department of Revenue Services NameDescriptionRevised DateCT-1040NR/PY2022 Nonresident/Part-Year Resident Tax Return12/2022Schedule CT-SINonresident or Part-Year Resident Schedule of Income From Connecticut Sources12/2022Schedule CT-1040 AWPart-Year Resident Income Allocation12/2022

A Connecticut durable statutory power of attorney form lets a principal appoint an agent to handle their financial affairs during their lifetime. The term ?durable? refers to the form remaining legal for use even if the principal can no longer make conscious decisions or think with a clear mind.

Under Connecticut law, a power of attorney must be signed in front of two witnesses and notarized in order to be considered enforceable. Once executed in this manner, the powers are immediately effective unless the document states otherwise.

A Connecticut tax power of attorney (LGL-001) designates an agent to represent the principal in front of the Connecticut Department of Revenue Services. The agent, usually a trusted accountant or tax advisor, can file returns, obtain information, or ask the agency representatives for answers on behalf of the principal.

Purpose: Use Form CT-3911 to report a missing or stolen Connecticut tax refund that was a direct deposit or issued as a check. Declaration: I declare under penalty of law that I have examined this document and, to the best of my knowledge and belief, it is true, complete, and correct.

You must obtain a Sales and Use Tax Permit from DRS if you intend to engage in any of the following activities in Connecticut: Sale, rental, or lease of goods; Sale of a taxable service; or. Operating a hotel, motel, lodging house, or bed and breakfast establishment.