Charitable Nonprofit Exempt Withdrawal

Description

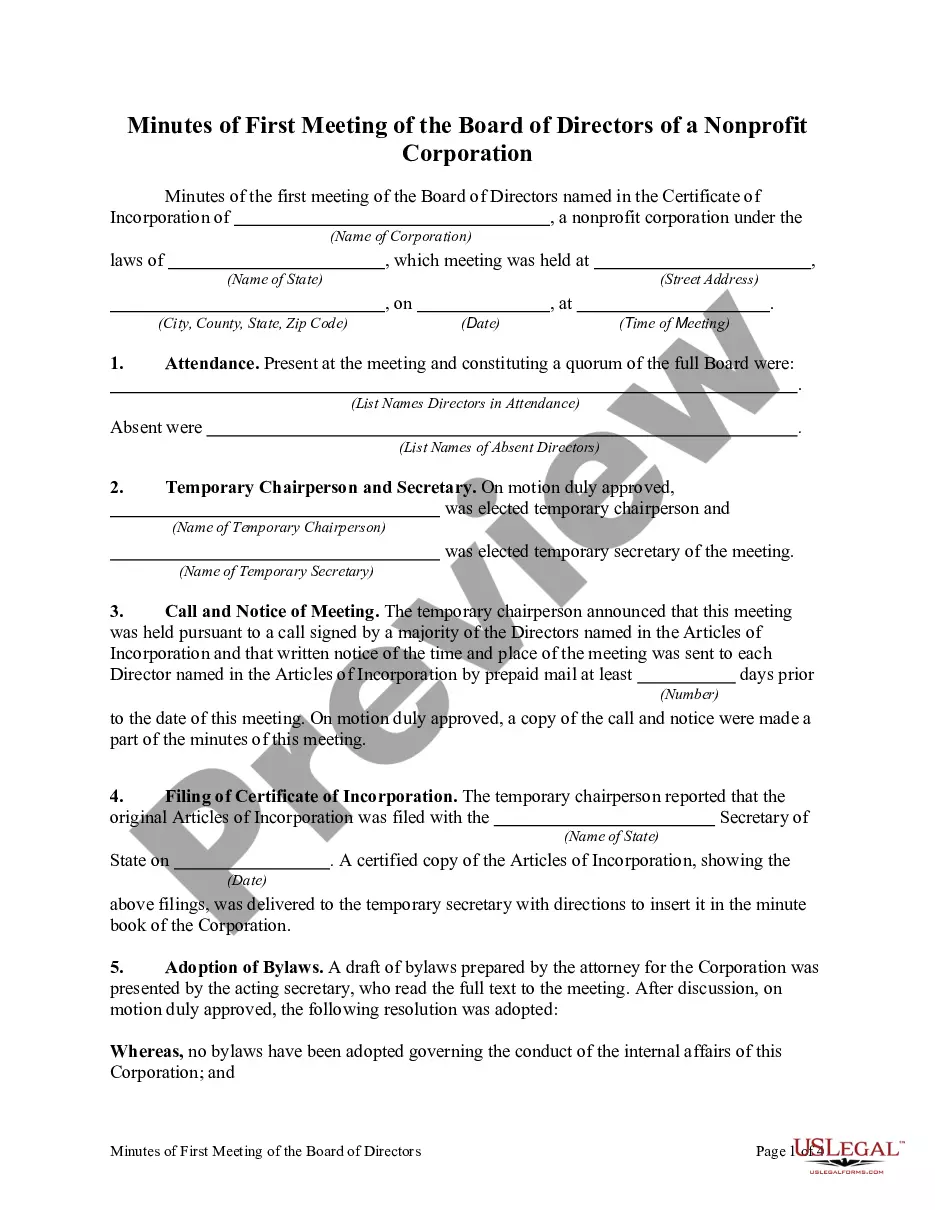

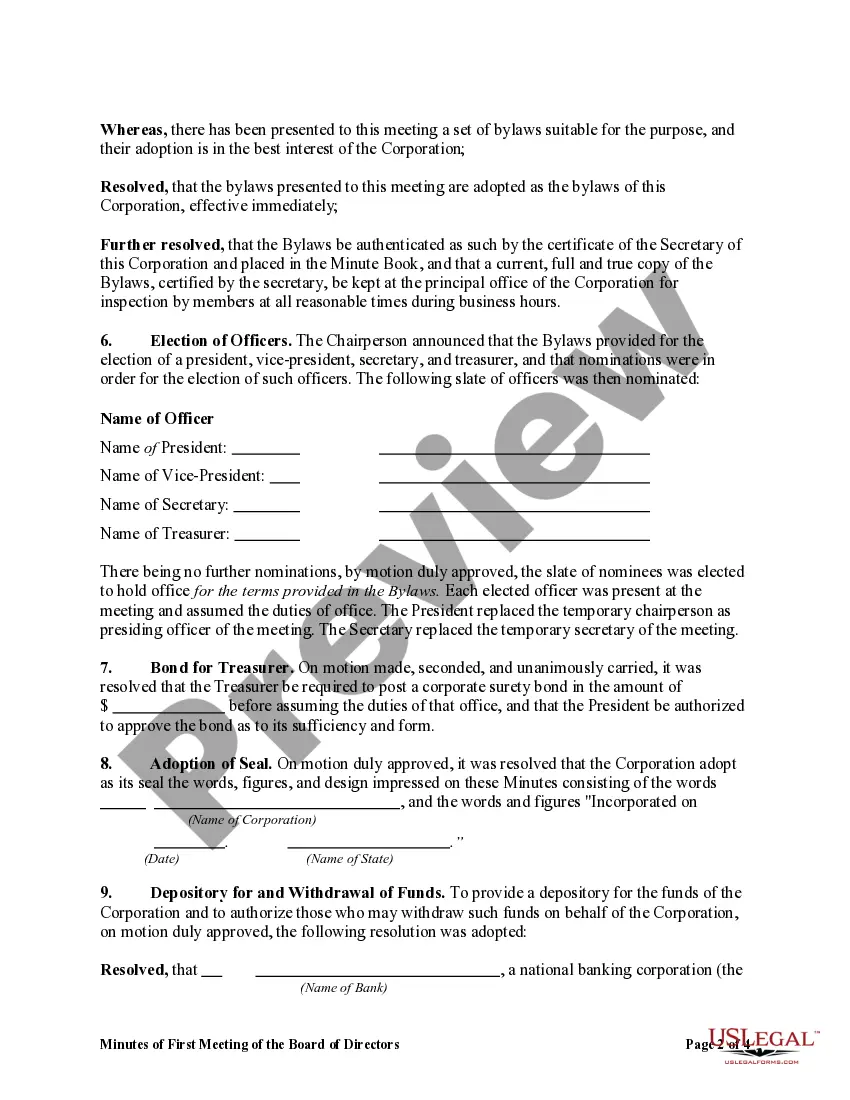

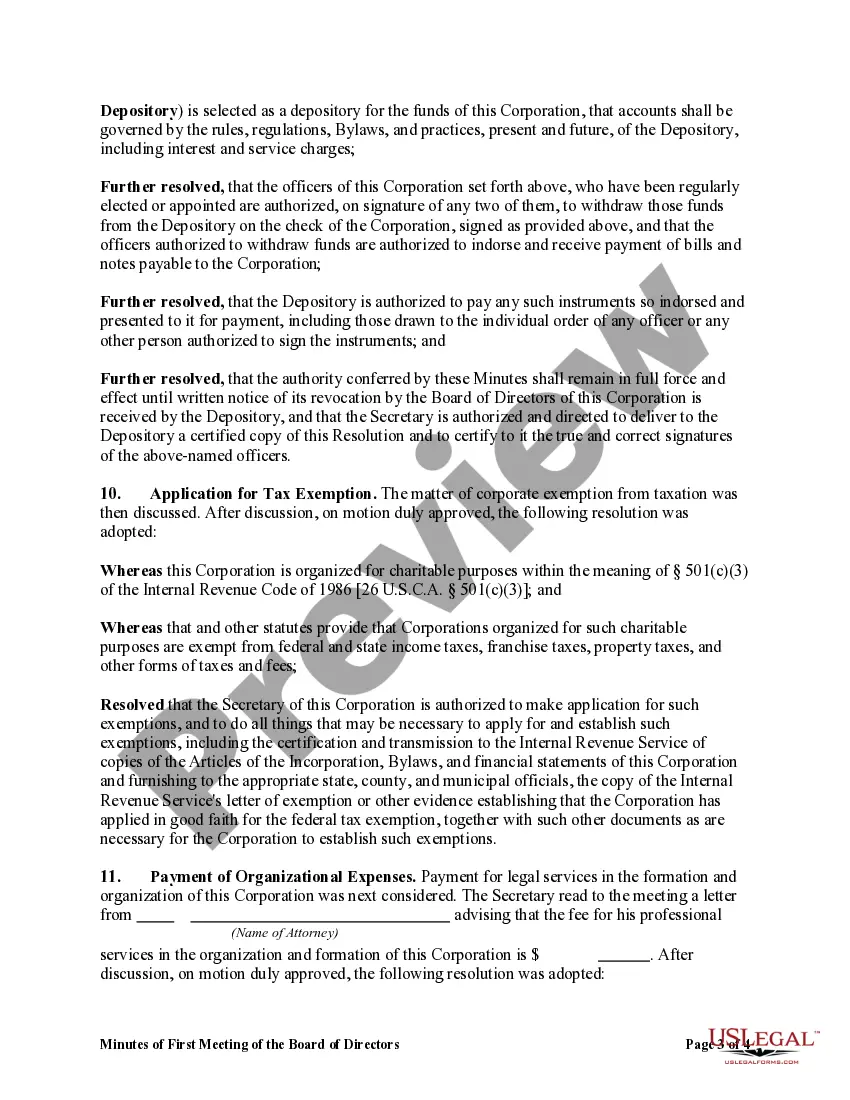

How to fill out Minutes Of First Meeting Of The Board Of Directors Of A Nonprofit Corporation?

Working with legal papers and operations could be a time-consuming addition to your day. Charitable Nonprofit Exempt Withdrawal and forms like it usually need you to look for them and navigate how to complete them properly. Consequently, if you are taking care of financial, legal, or individual matters, using a comprehensive and practical web library of forms on hand will significantly help.

US Legal Forms is the number one web platform of legal templates, featuring more than 85,000 state-specific forms and numerous tools to help you complete your papers effortlessly. Discover the library of pertinent papers available with just one click.

US Legal Forms provides you with state- and county-specific forms offered by any moment for downloading. Safeguard your document management procedures by using a top-notch services that lets you put together any form in minutes without having additional or hidden charges. Simply log in to your account, locate Charitable Nonprofit Exempt Withdrawal and download it right away within the My Forms tab. You may also gain access to previously saved forms.

Would it be your first time making use of US Legal Forms? Sign up and set up up an account in a few minutes and you’ll gain access to the form library and Charitable Nonprofit Exempt Withdrawal. Then, adhere to the steps below to complete your form:

- Ensure you have discovered the correct form by using the Preview option and reading the form description.

- Pick Buy Now as soon as all set, and choose the subscription plan that meets your needs.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of expertise supporting users handle their legal papers. Obtain the form you want right now and improve any operation without breaking a sweat.

Form popularity

FAQ

Your Form 990 should include your organization's mission statement, all financial data, a summary of activities, specifics of your nonprofit's governing body, and your organization's accomplishments from the prior year.

After the board of directors and/or membership vote to dissolve, a certificate evidencing the election to wind up and dissolve must be filed with the Secretary of State and also forwarded to the Attorney General's Registry of Charitable Trusts. (Corporations Code, sections 6611, 8611, 9680.)

Learn How to Fill the Form 990 Return of Organization Exempt ... - YouTube YouTube Start of suggested clip End of suggested clip Tax year and the current year indicate. Total assets total liabilities and net assets. On the booksMoreTax year and the current year indicate. Total assets total liabilities and net assets. On the books and lines 20 through 22. For both the previous.

The user fee for Form 1023 is $600. The user fee for Form 1023-EZ is $275. The user fees must be paid through Pay.gov when the application is filed.

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. ... Choose your federal tax classification. ... Choose your exemptions. ... Enter your street address. ... Enter the rest of your address. ... Enter your requester's information.