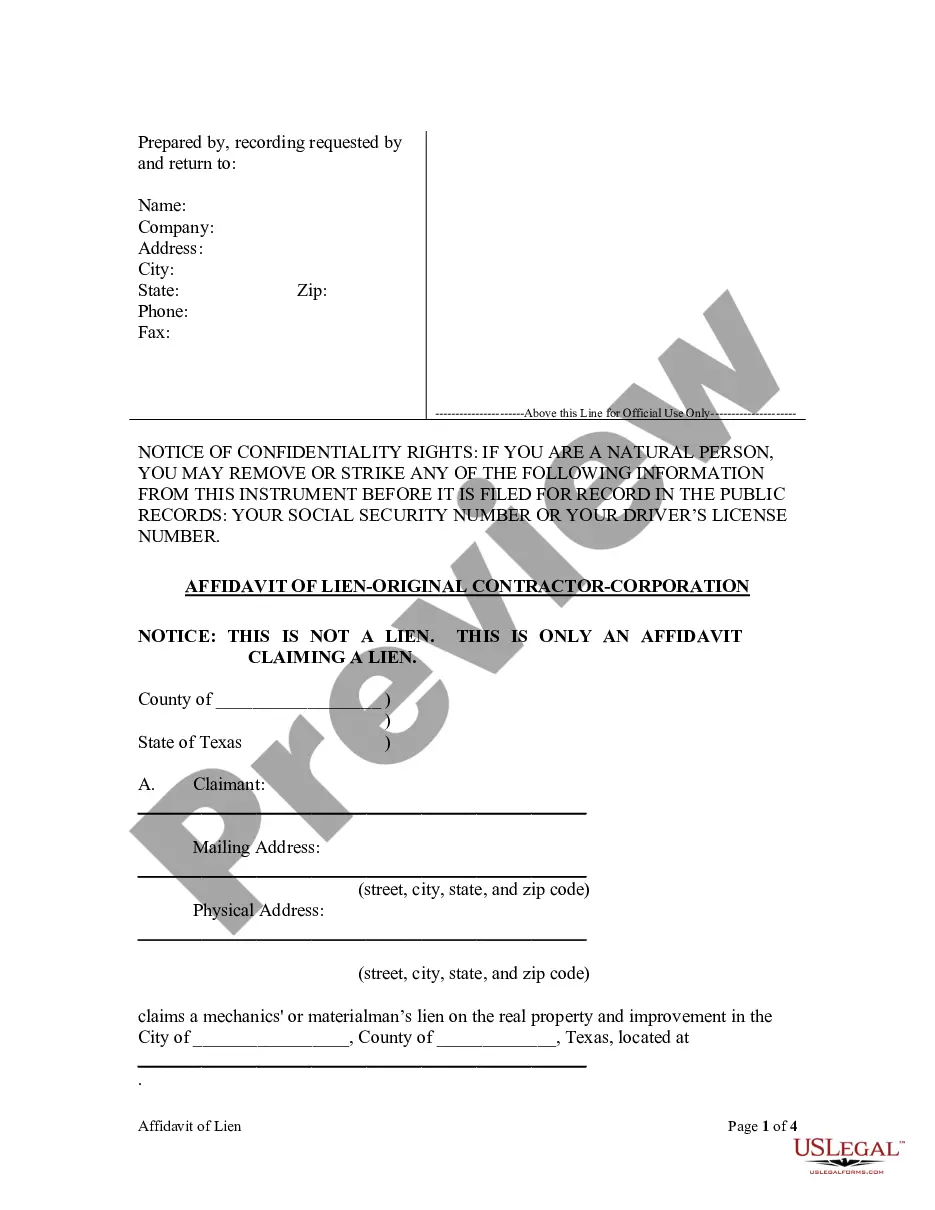

Agreement Mortgage Document Format

Description

How to fill out Agreement To Purchase Note And Mortgage?

Managing legal documents can be exasperating, even for proficient professionals.

When you seek an Agreement Mortgage Document Format and lack the time to search for the correct and up-to-date version, the processes can become overwhelming.

With US Legal Forms, you have the capability to.

Leverage innovative tools to complete and manage your Agreement Mortgage Document Format.

Here are the actions to undertake after acquiring the form you require.

- Access a rich database of articles, guidelines, and resources pertinent to your situation and needs.

- Save time and effort searching for necessary documents, utilizing US Legal Forms’ sophisticated search and Review tool to find and download the Agreement Mortgage Document Format.

- If you are a subscriber, Log In to your US Legal Forms account, search for the required form, and download it.

- Check your My documents tab to view documents you've previously saved and manage your collections accordingly.

- If you're new to US Legal Forms, register for an account to gain unlimited access to all the platform's benefits.

- Utilize an extensive online form library that can revolutionize the way you address these matters.

- US Legal Forms stands as a frontrunner in online legal forms, featuring over 85,000 state-specific legal forms at your disposal whenever needed.

- Access documents tailored to your specific state or county.

Form popularity

FAQ

1. The Mortgagees agree to lend to the Mortgagor and the Mortgagor agrees to borrow from the Mortgagees a sum of Rs. ______. The Mortgagor agrees that he will pay interest on the said sum at the rate of ____ percent per annum from the date of advance till repayment thereof by the Mortgagor to the Mortgagees.

Although many contracts are enforceable whether written or oral, contracts that involve a transfer of real estate are deemed important enough that they are required, under the Statute of Frauds, to be in writing to be enforceable.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

What is a Mortgage Agreement? A Mortgage Agreement is a contract between a borrower (called the mortgagor) and the lender (called the mortgagee) where a lien is created on the property in order to secure repayment of the loan.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.