Affidavit Support Form I-864a

Description

How to fill out Affidavit In Support Of Motion To Order Expungement Of Criminal Record?

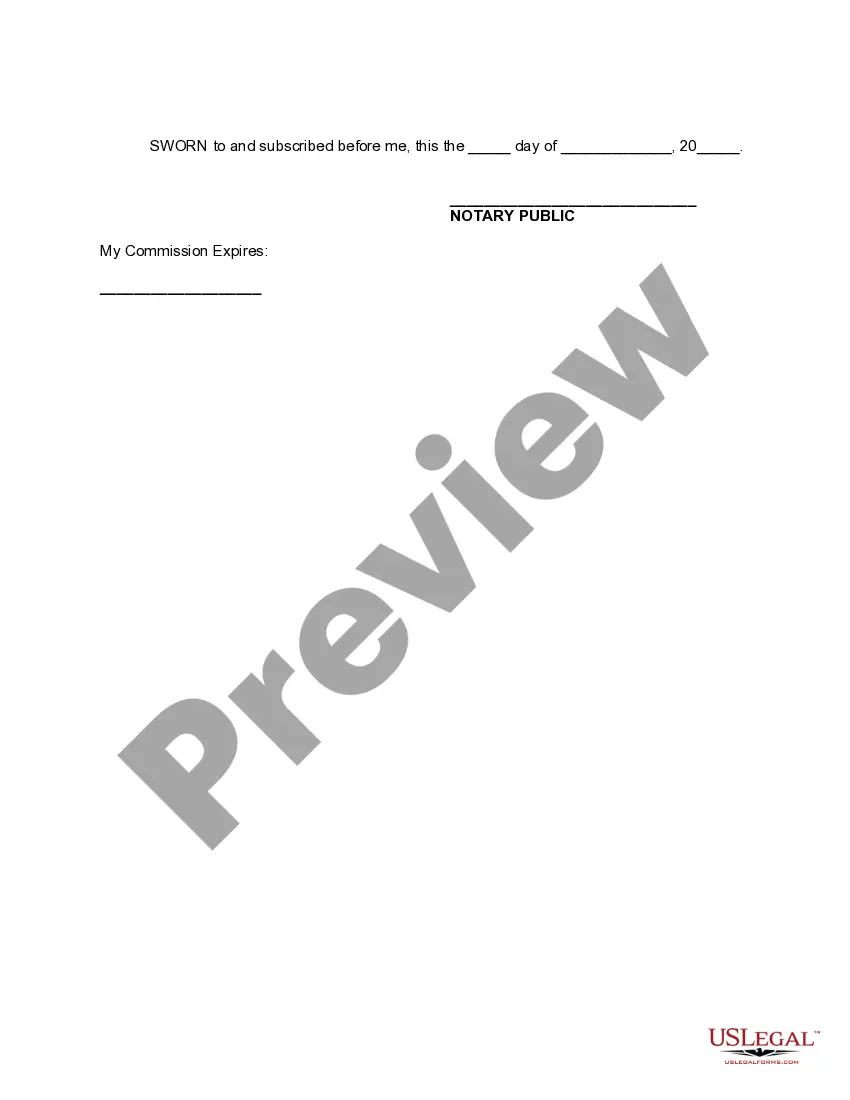

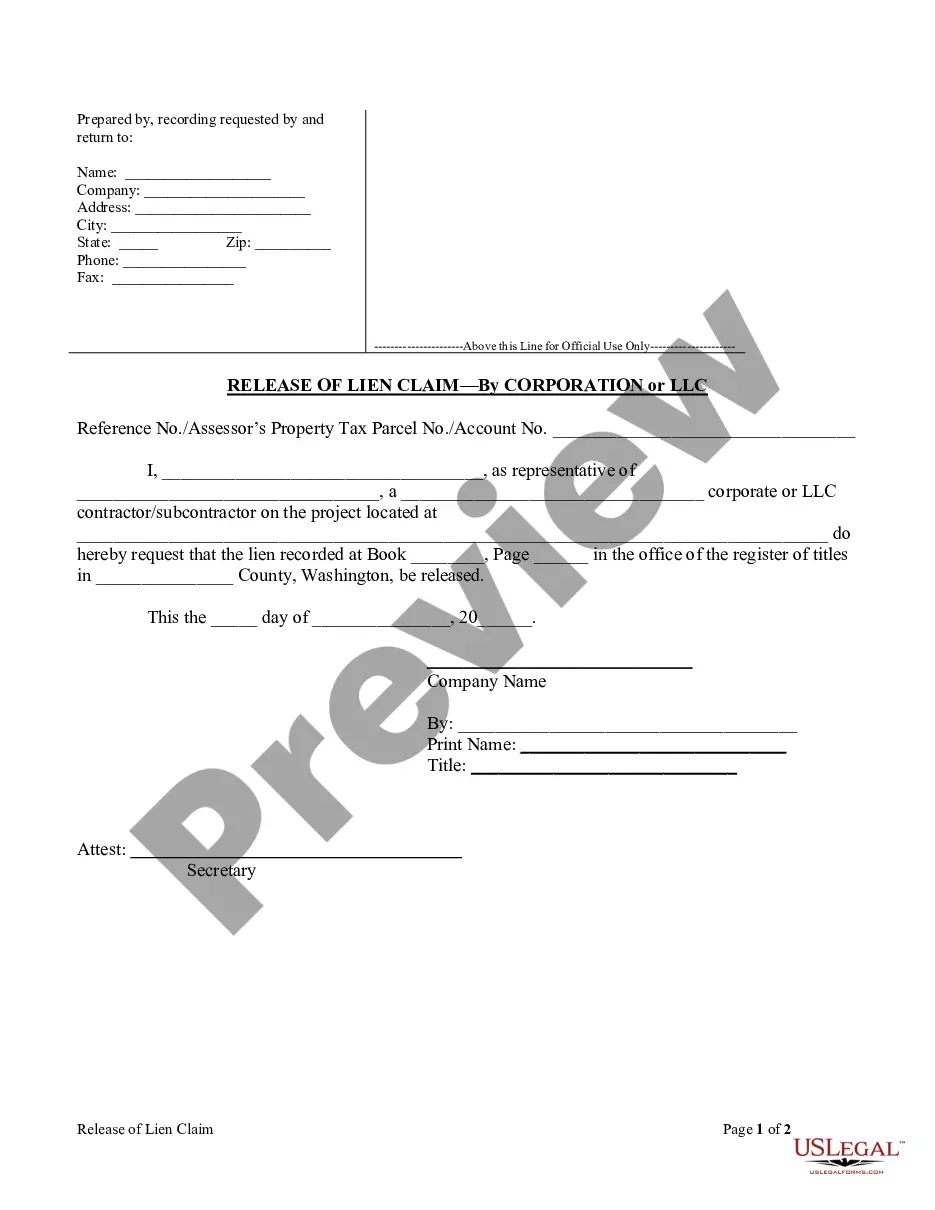

The Affidavit Support Form I-864a displayed on this page is a versatile legal document template created by qualified attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal practitioners with more than 85,000 validated, state-specific documents for any professional and personal situation. It is the fastest, simplest, and most reliable means to acquire the necessary paperwork, as the service ensures the highest degree of data protection and anti-malware safeguards.

Re-download your documents as needed. Access the My documents tab in your profile to retrieve any previously purchased forms. Enroll with US Legal Forms to access verified legal templates for all of life’s eventualities.

- Search for the form you require and review it.

- Browse the file you searched and preview it or examine the form description to confirm it meets your needs. If it does not, use the search bar to locate the appropriate one. Click Buy Now when you have located the template you seek.

- Register and Log In.

- Select the subscription plan that works for you and create an account. Use PayPal or a credit card for a quick transaction. If you already have an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format for your Affidavit Support Form I-864a (PDF, Word, RTF) and store the sample on your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, utilize an online multifunctional PDF editor to quickly and accurately complete and sign your form with an eSignature.

Form popularity

FAQ

When submitting the I-864A, you need to include additional documents to support your income claims and your relationship to the primary sponsor. These may include tax returns, bank statements, and proof of employment. The Affidavit support form i-864a requires this information to demonstrate your ability to provide adequate financial support. You can streamline your preparation by utilizing our user-friendly tools for document collection and submission.

How to Draft a Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

In general, a personal loan contract is just as legally binding between friends or family as it would be with a bank. However, a contract between friends or family might be simpler or have fewer terms.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

For example, if the note's terms are unclear or there is evidence that the note's maker did not intend to repay the debt, the court may invalidate the note. It is also possible for the payee to not be able to sign a promissory note if they knew the maker could not repay the debt at the time of signing it.

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).