Beneficiary Trust Agreement Without

Description

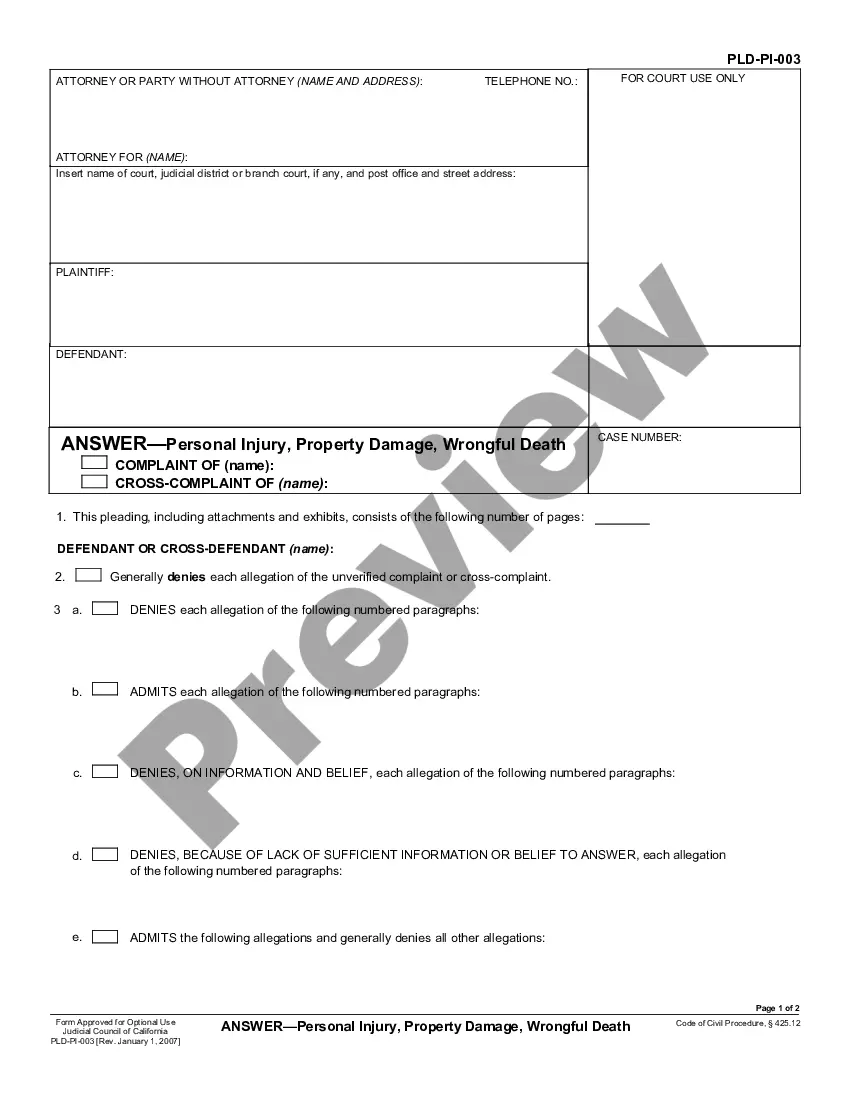

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

Managing legal paperwork and processes can be a lengthy addition to your day.

Beneficiary Trust Agreement Without and similar documents often require you to locate them and comprehend how to fill them out correctly.

Therefore, whether you're handling financial, legal, or personal issues, having a comprehensive and user-friendly online collection of forms readily available will be very beneficial.

US Legal Forms is the leading online resource for legal templates, boasting over 85,000 state-specific forms along with various tools to assist you in completing your documents easily.

Is this your first time using US Legal Forms? Create and set up a free account within minutes to access the form collection and Beneficiary Trust Agreement Without. Follow the steps outlined below to fill out your form: Ensure you have the correct document by utilizing the Review tool and examining the form description. Choose Buy Now when you're ready, and pick the monthly subscription plan that suits you best. Click Download, then complete, sign, and print the form. US Legal Forms has twenty-five years of experience assisting consumers with their legal documents. Get the form you require today and streamline any process effortlessly.

- Browse the collection of pertinent documents with just a single click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Secure your document management tasks with a top-tier service that enables you to prepare any form in minutes without unexpected or additional fees.

- Simply Log In to your account, find Beneficiary Trust Agreement Without and download it instantly from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

In most cases, beneficiary designations are required for life insurance, retirement funds, and annuities. They may also be required for bank and brokerage accounts. Designating a beneficiary ensures that intended heir receive assets directly.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.

Cons of listing a trust as your life insurance beneficiary However, the costs you're incurring now mean that you're saving your heirs the same set-up and transfer costs (as well as the potential costs associated with probate). Funding the trust also can be challenging.

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write ?children? on one of the lines; instead write the full names of each of your children on separate lines.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.