Child Support With For Child Custody

Description

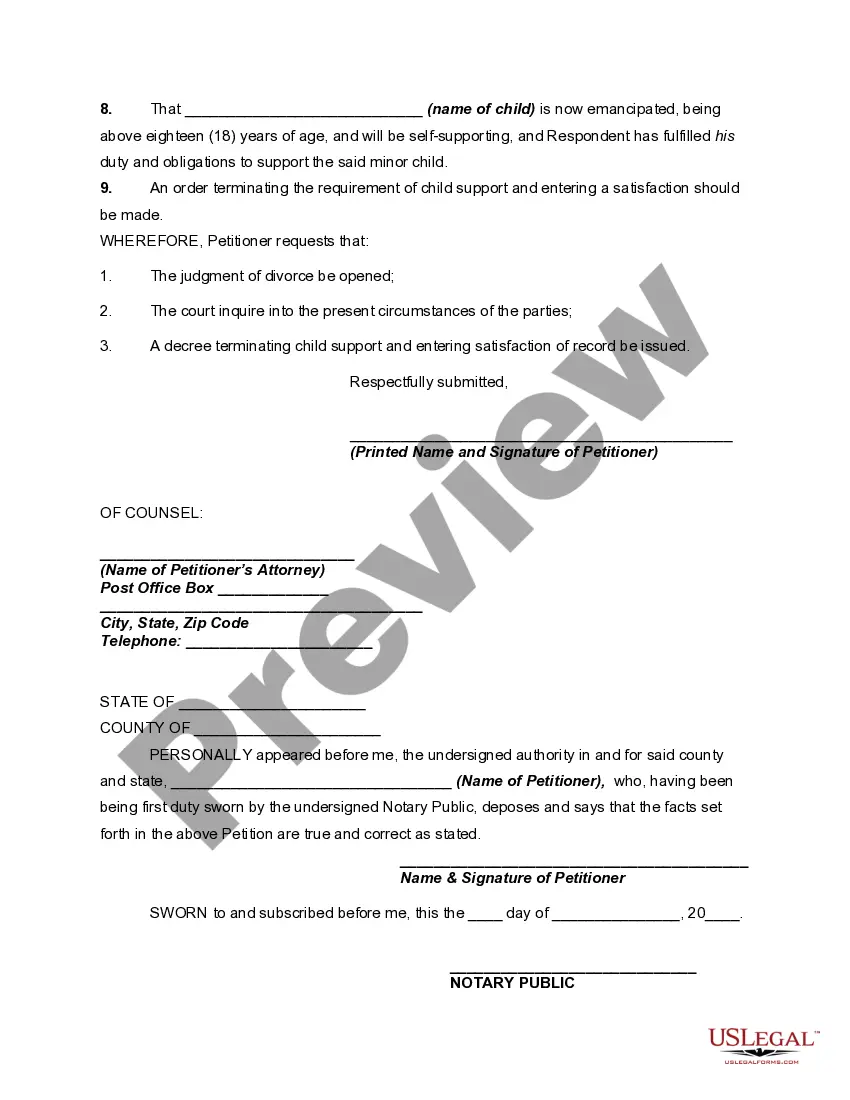

How to fill out Petition To Modify Or Amend Divorce Decree Stopping Child Support On The Grounds That Respondent Interfered With Visitation Rights And Child Is Now An Adult?

- If you are a returning user, simply log in to your account and download the required template by clicking the Download button. Ensure your subscription is active, and if not, renew it according to your payment plan.

- For first-time users, check the Preview mode and form description to verify you have selected the right template that complies with your local jurisdiction's needs.

- If the initial form does not meet your requirements, use the Search tab to find an alternative that suits your specific situation.

- Proceed to purchase the chosen document by clicking the Buy Now button and selecting your desired subscription plan. You will need to create an account to access the library's resources.

- Make your payment by entering your credit card information or using your PayPal account to complete the purchase.

- Finally, download your chosen form and save it on your device. You can access it anytime via the My Forms section of your profile.

By utilizing US Legal Forms, you gain access to a comprehensive library of over 85,000 legal forms, which can empower both individuals and attorneys to create legally sound documents quickly.

In conclusion, US Legal Forms is an invaluable resource for navigating child support with for child custody. Begin your journey today by exploring the vast resources available, and ensure your legal documents are properly executed. Visit our website to get started now!

Form popularity

FAQ

To write a letter of support for child custody, be clear and concise, beginning with your relationship to the family. Detail your observations regarding the parent's ability to provide for the child emotionally and financially, emphasizing the importance of child support with for child custody. This approach helps illustrate the parent's capability and commitment to raising a happy, healthy child.

A judge typically looks for honesty, sincerity, and specific examples in a character letter. They want to see how the parent interacts with the child and how they fulfill their responsibilities. It’s important to mention the significance of child support with for child custody arrangements, as this can influence the judge's decision.

When writing a support letter for Court, start by addressing the judge respectfully and stating your purpose. Provide detailed accounts of the parent's parenting skills and their commitment to the child's needs. Include how child support with for child custody plays a crucial role in maintaining stability for the child, which can help the Court understand your perspective.

To write a letter in support of child custody, begin with a respectful greeting, and clearly state your relationship to the child and the parents involved. Include specific examples of your observations regarding the child's well-being and the positive qualities of the custodial parent. Remember to focus on how the child support impacts custody arrangements positively, emphasizing the child's best interests.

In 50/50 custody setups, both parents share equal responsibility, meaning there isn’t necessarily a single primary parent. However, the designation of 'primary' can come into play during discussions about child support with for child custody or tax claims. It’s vital for parents to maintain open communication to ensure both understand their roles and responsibilities.

Various factors can influence which parent claims a child on taxes, including the child’s primary residence and agreements made between parents. In many cases, parents will have an arrangement that specifies who can claim the child yearly, balancing child support with for child custody. It's best to rely on a legal platform like USLegalForms to create or review such agreements to ensure compliance and clarity.

In a 50/50 custody split, the parents should ideally negotiate who gets to claim the child for tax purposes. Many couples switch claiming rights each year to balance benefits from the child support with for child custody arrangements. Having a clear written agreement is a smart way to navigate this situation and minimize potential disputes.

When parents share custody, typically, the custodial parent claims the child on their taxes, but the non-custodial parent can also claim the child if there is a mutual agreement. Often, the child support with for child custody settlements may outline who will claim the child each year. It's crucial for parents to communicate and ensure this understanding, which helps during tax season.

In a 50/50 custody arrangement, both parents can claim the child on their taxes, but typically, they must agree on who takes the credit each year. The IRS allows parents to take turns claiming the child, or one parent may claim the child while the other receives child support with for child custody. It’s essential to discuss this matter and put an agreement in writing to avoid any confusion.

In Massachusetts, the average child support payment can vary widely based on the income of the paying parent and the needs of the child. Usually, the court uses a formula to determine the appropriate amount, considering factors like parental income and time spent with each parent. Knowing the average child support with for child custody can help you set realistic expectations and plans. For personalized information, consider using uslegalforms to access resources that can assist you in navigating child support issues.