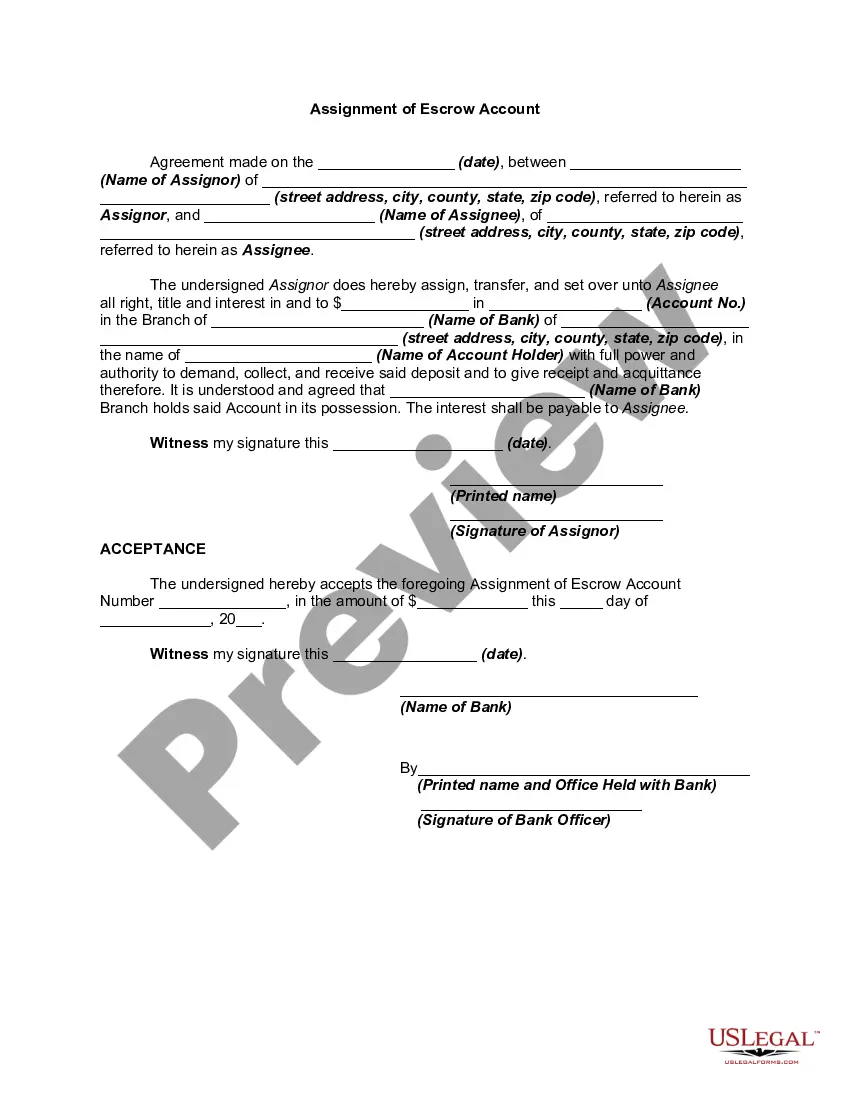

Escrow Account Meaning

Description

How to fill out Assignment Of Escrow Account?

- If you're a returning user, visit the US Legal Forms website to log into your account and successfully download your required form template. Ensure your subscription is current; if not, renew it based on your plan.

- For new users, start by reviewing the preview mode and form description to verify you've selected the appropriate document that aligns with your needs and local regulations.

- If the document doesn't meet your criteria, utilize the Search tab to find a more suitable template. Once you've found the right form, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting a subscription plan. You will need to create an account to access the expansive library.

- Complete your transaction by providing your payment details or using PayPal for your subscription.

- Download the template to your device for completion. You can access it anytime in the My Forms section of your profile.

US Legal Forms empowers users by providing an extensive library featuring over 85,000 fillable legal documents, more than competitors offer at similar costs.

Take advantage of the assistance from premium experts for accurate form completion, ensuring your documents are legally sound. Start your journey today with US Legal Forms!

Form popularity

FAQ

An escrow account is a financial arrangement where a third party holds funds until certain conditions are met. For example, in a real estate transaction, the buyer places the payment into an escrow account while the property title is verified. This ensures that both the buyer and seller fulfill their obligations before the funds are released. Understanding escrow account meaning helps parties feel secure throughout the process.

Many banks and financial institutions provide escrow accounts, but it is crucial to compare their terms and conditions. Larger banks often have specific services tailored to various transaction types, while local banks may offer more personalized assistance. Choosing the right institution can help clarify the escrow account meaning and ensure that your funds are held securely during important transactions.

The timeline to set up an escrow account typically depends on the service provider you choose and the necessary documentation. In many cases, you can expect to complete the setup in a few days, provided you have everything in order. Understanding escrow account meaning can help you appreciate the process and anticipate any requirements that could speed up your setup.

While you can technically set up your own escrow account, it is often more secure to rely on professional escrow services. Handling an escrow independently can lead to complications, as you might not have the legal protections that established companies offer. By using a service that specializes in escrow accounts, you can better understand escrow account meaning and its implications for secure transactions.

To set up an escrow account, you need to choose a trusted escrow service provider. Start by researching your options and compare their fees and services. Once you've selected a provider, you'll fill out an application and provide necessary documentation, such as identification and the purpose of the escrow. Understanding escrow account meaning is essential, as it ensures your funds are safeguarded during transaction processes.

In general, individuals or entities involved in specific transactions can open an escrow account. However, the process typically involves an agreement between all parties, and this may require certain documentation. Understanding the escrow account meaning helps clarify the responsibilities and benefits associated with these accounts. At USLegalForms, we offer resources to assist you in setting up your account smoothly.

Anyone involved in a real estate transaction, such as buyers, sellers, or even service providers, can be eligible for an escrow account. Eligibility often depends on the specifics of the agreement and the parties involved. Understanding the escrow account meaning further clarifies how this process works. At USLegalForms, we help you navigate potential requirements easily.

Having an escrow account can provide significant peace of mind. It ensures that your funds are securely held by a neutral third party until specific conditions are met. This arrangement can protect both buyers and sellers in a transaction. Understanding the escrow account meaning can help you decide if it aligns with your financial goals.

The meaning of an escrow bank account refers to a specialized account set up to hold funds on behalf of parties involved in a transaction until predetermined conditions are met. This account adds an extra layer of protection, ensuring that the transaction proceeds smoothly without risk of loss for either party. By using an escrow bank account, individuals engage in transactions with peace of mind, knowing that their funds are secure. Understanding escrow account meaning emphasizes its importance in financial dealings.

Having an escrow account is generally beneficial for both buyers and sellers. It instills confidence in the transaction by ensuring that funds are handled securely and released only upon fulfilling specific conditions. This arrangement minimizes the risk of fraud or financial loss, making it a wise choice for anyone engaged in significant transactions. Appreciating escrow account meaning helps you see how this tool fosters transparency and security.