Promissory Note For Revolving Line Of Credit

Description

How to fill out Line Of Credit Promissory Note?

Getting a go-to place to take the most current and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal papers calls for accuracy and attention to detail, which explains why it is vital to take samples of Promissory Note For Revolving Line Of Credit only from reliable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and check all the details concerning the document’s use and relevance for your situation and in your state or region.

Consider the following steps to finish your Promissory Note For Revolving Line Of Credit:

- Use the catalog navigation or search field to locate your sample.

- View the form’s information to check if it fits the requirements of your state and area.

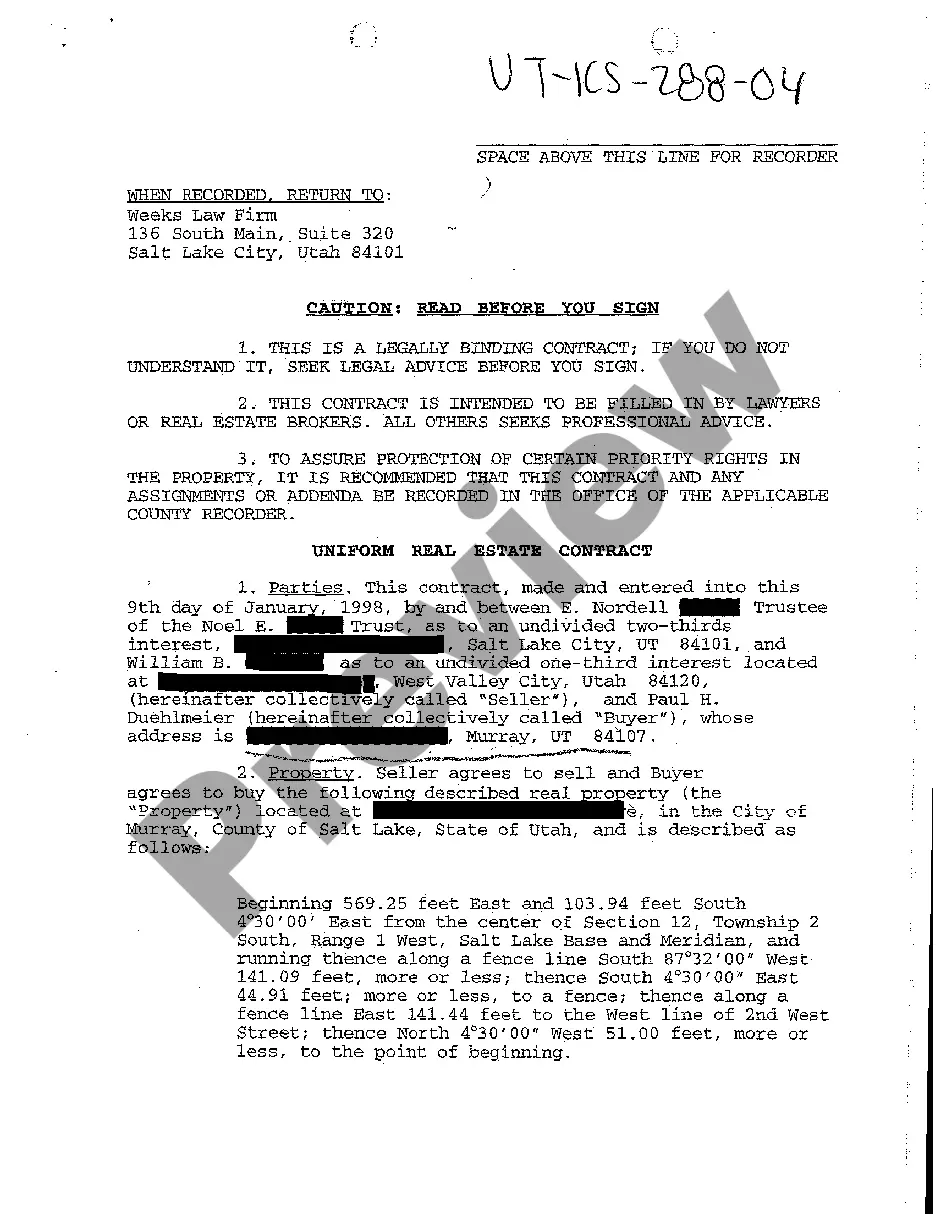

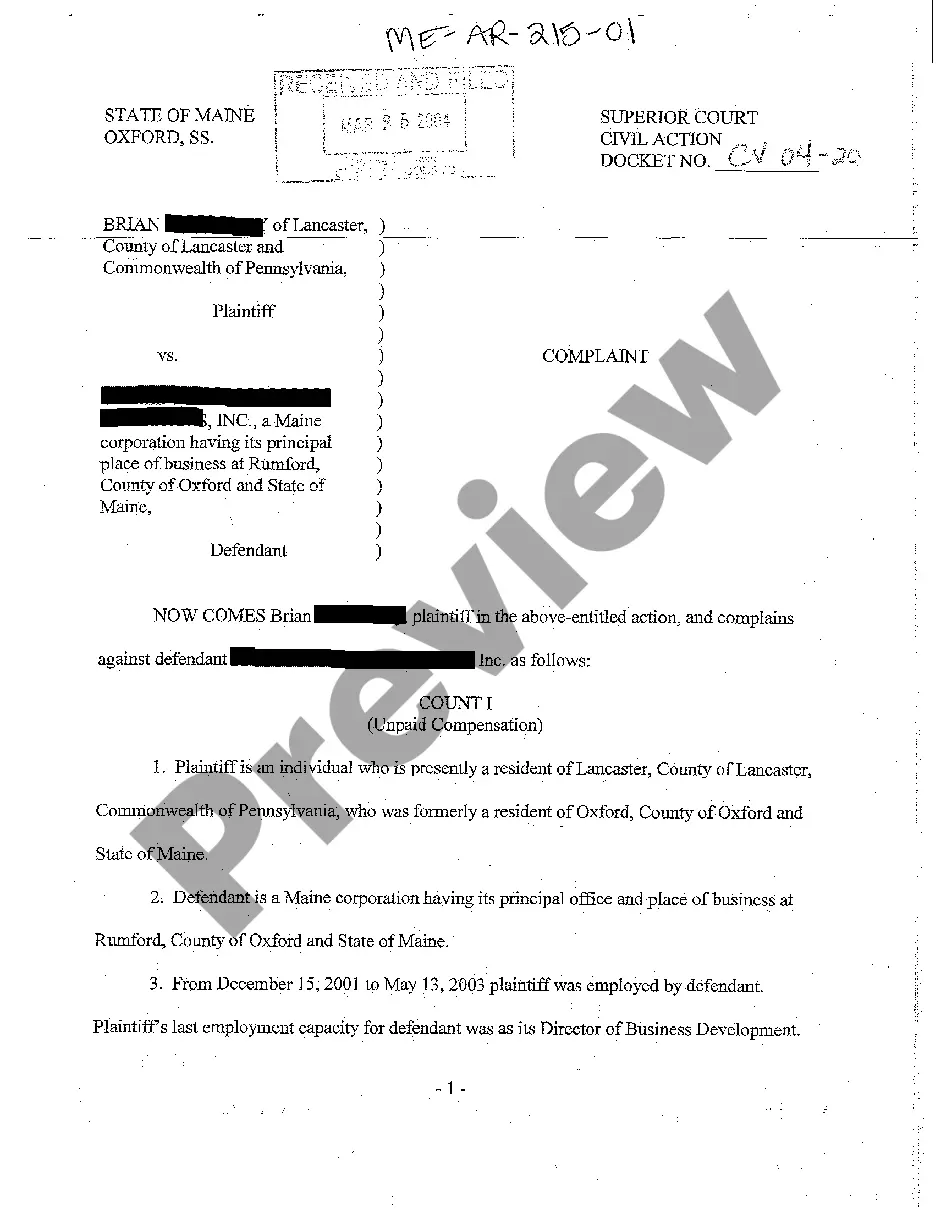

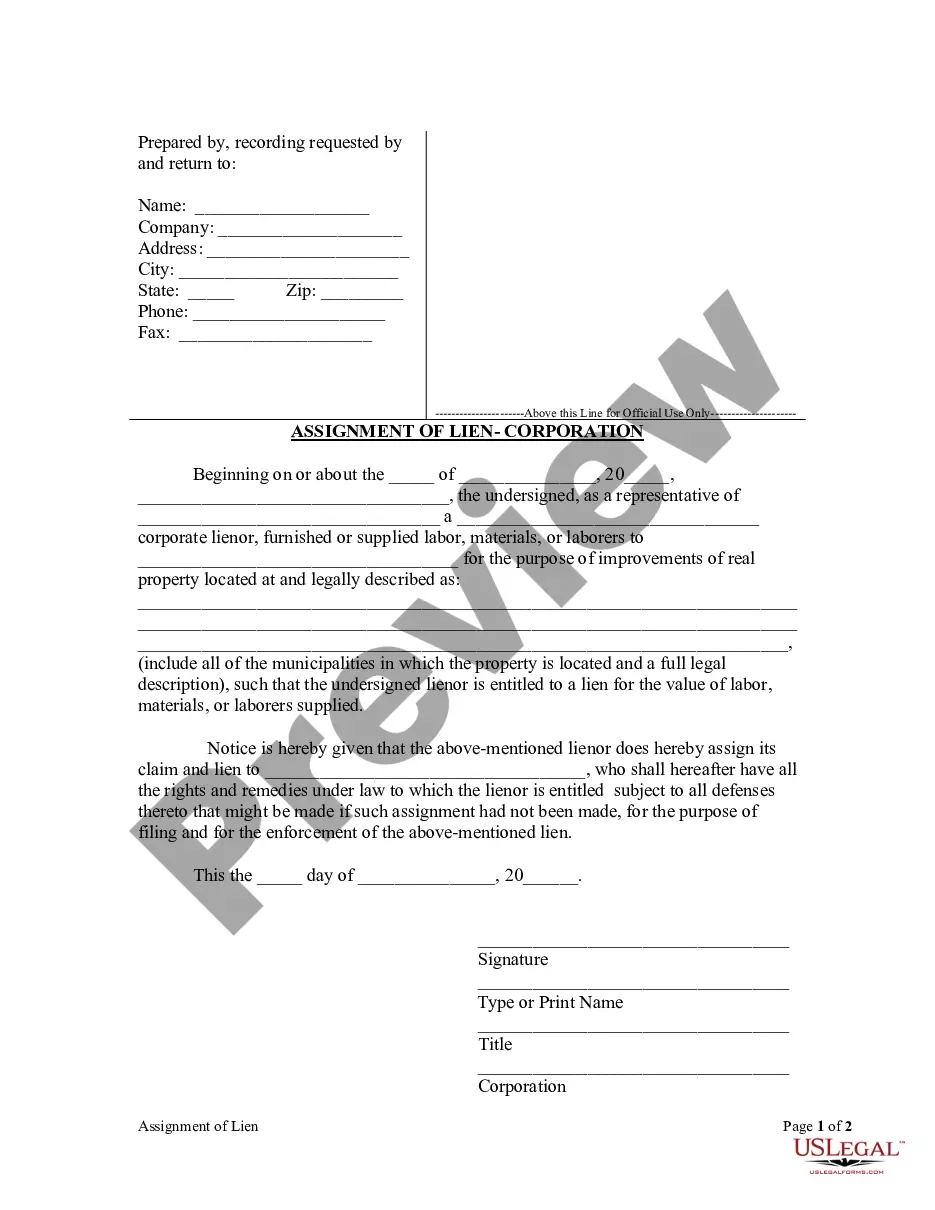

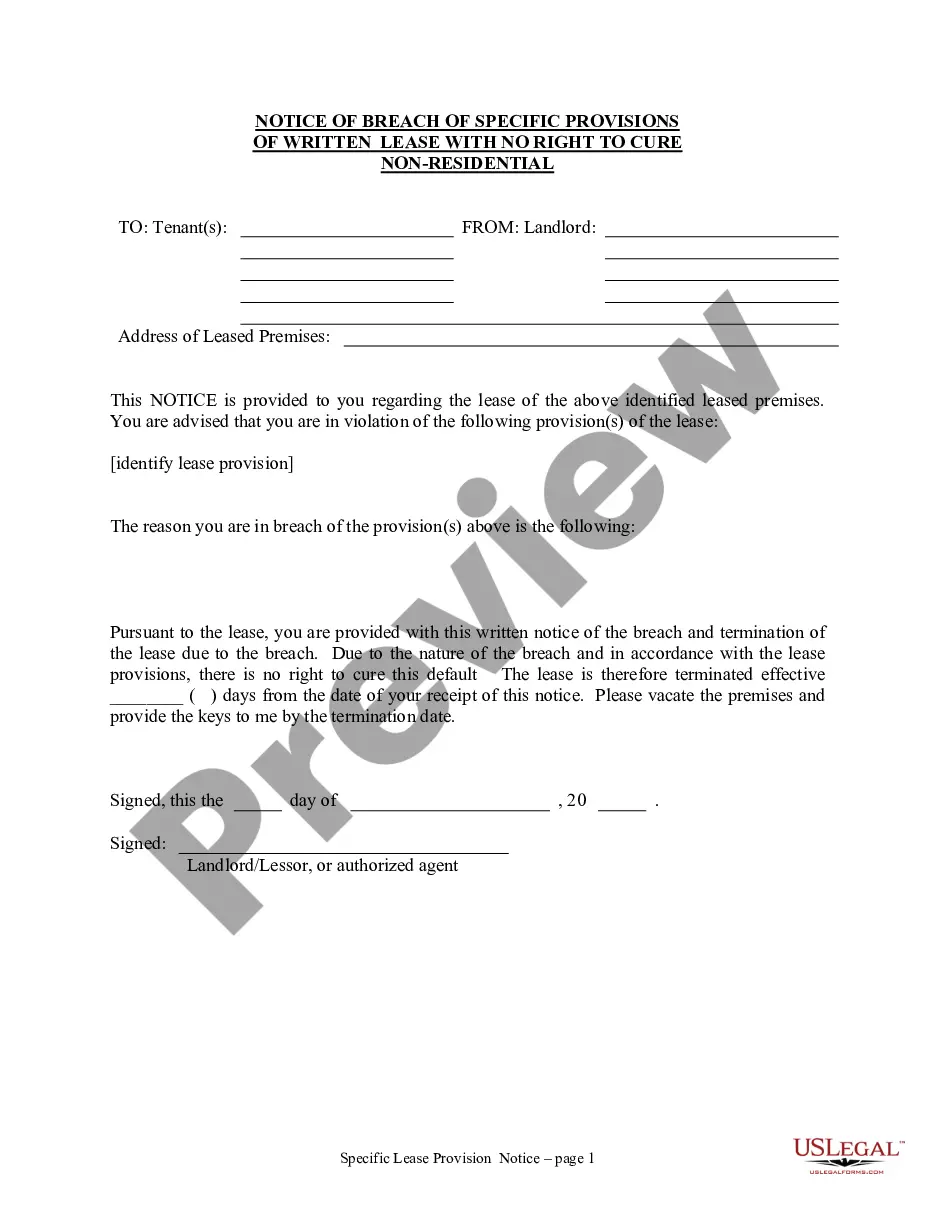

- View the form preview, if there is one, to make sure the form is definitely the one you are interested in.

- Go back to the search and look for the right template if the Promissory Note For Revolving Line Of Credit does not suit your requirements.

- When you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that suits your needs.

- Go on to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (credit card or PayPal).

- Pick the document format for downloading Promissory Note For Revolving Line Of Credit.

- When you have the form on your device, you may change it using the editor or print it and complete it manually.

Get rid of the inconvenience that accompanies your legal paperwork. Explore the extensive US Legal Forms catalog where you can find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

A revolving line of credit is a type of loan that allows you to borrow money when you need it and pay interest only on what you borrow. Then, if you repay any borrowed funds before the end of the draw period, you can borrow that money again. This is what makes a line of credit revolving.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

A revolving line of credit promissory note (RLOCPN) is a secured loan that allows businesses to borrow money against an established limit. These loans are generally used to cover short-term liquidity needs, such as working capital or inventory financing.

The Revolving Credit Promissory Note shall be a master note, and the principal amount of all Revolver Advances outstanding shall be evidenced by the Revolving Credit Promissory Note or any ledger or other record of the Lender, which shall be presumptive evidence of the principal owing and unpaid on such Note.