Interest States Statement With Interest

Description

How to fill out Assignment Of Interest In United States Patent?

Finding a reliable source for the most up-to-date and suitable legal templates is a significant part of navigating bureaucracy.

Selecting the correct legal documents demands accuracy and meticulousness, which is why it is crucial to obtain samples of Interest States Statement With Interest exclusively from reputable sources, such as US Legal Forms.

Once the form is saved on your device, you can alter it using the editor or print it to fill out manually. Eliminate the stress associated with legal paperwork by exploring the vast US Legal Forms library where you can discover legal templates, verify their applicability to your situation, and download them immediately.

- Utilize the library navigation or search option to find your sample.

- Review the form’s description to determine if it fits the criteria of your state and locality.

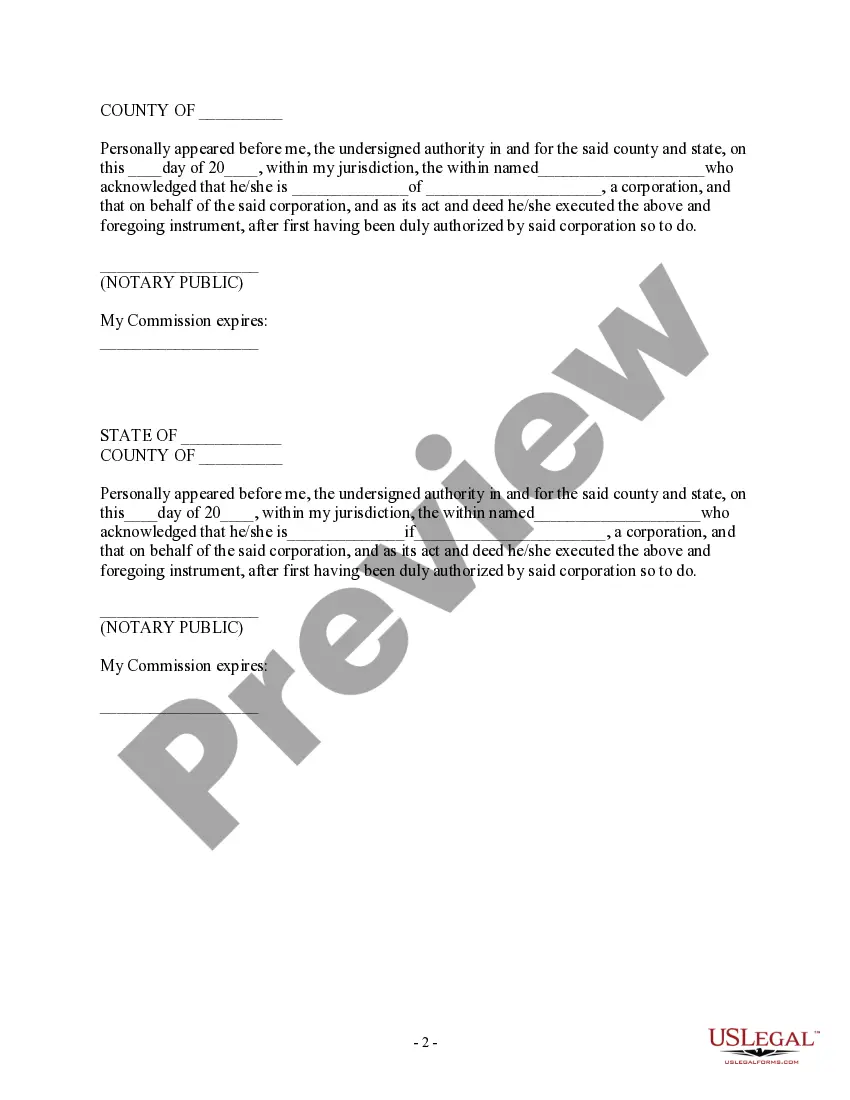

- Access the form preview, if available, to confirm that the template is indeed what you are looking for.

- Continue searching for the right template if the Interest States Statement With Interest does not meet your criteria.

- Once you are confident about the form’s suitability, download it.

- If you are a registered user, click Log in to verify your identity and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing option that meets your requirements.

- Proceed with registration to finish your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Interest States Statement With Interest.

Form popularity

FAQ

When writing a state of interest, focus on articulating why you are interested in that specific state or organization. Highlight relevant opportunities and how they align with your goals, ensuring to include aspects of the interest states statement with interest to emphasize your enthusiasm. This targeted approach creates a strong narrative.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

The Fair Credit Reporting Act in Oklahoma Oklahoma House Bill 2492 provides that prior to requesting a consumer report for work, you be notified and must be given an option of a copy free of charge. Oklahoma really adds nothing with what they attempted to add with a security freeze on your credit file.

In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

Federal Legislative Activity in 2023 Amend Section 604(c) of the FCRA to address the treatment of pre-screening report requests. Section 604(c) governs the furnishing of reports in connection with credit or insurance transactions that are not initiated by the consumer. [1]

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

Federal Legislative Activity in 2023 Amend Section 604(c) of the FCRA to address the treatment of pre-screening report requests. Section 604(c) governs the furnishing of reports in connection with credit or insurance transactions that are not initiated by the consumer. [1]

Consumers are entitled to one free credit report every 12 months from each of the three nationwide credit bureaus.

Consumer Rights Under the Fair Credit Reporting Act (FCRA) They can request their reports at the official, government-authorized website for that purpose: AnnualCreditReport.com. Under the FCRA, consumers also have a right to: Verify the accuracy of their report when it's required for employment purposes.