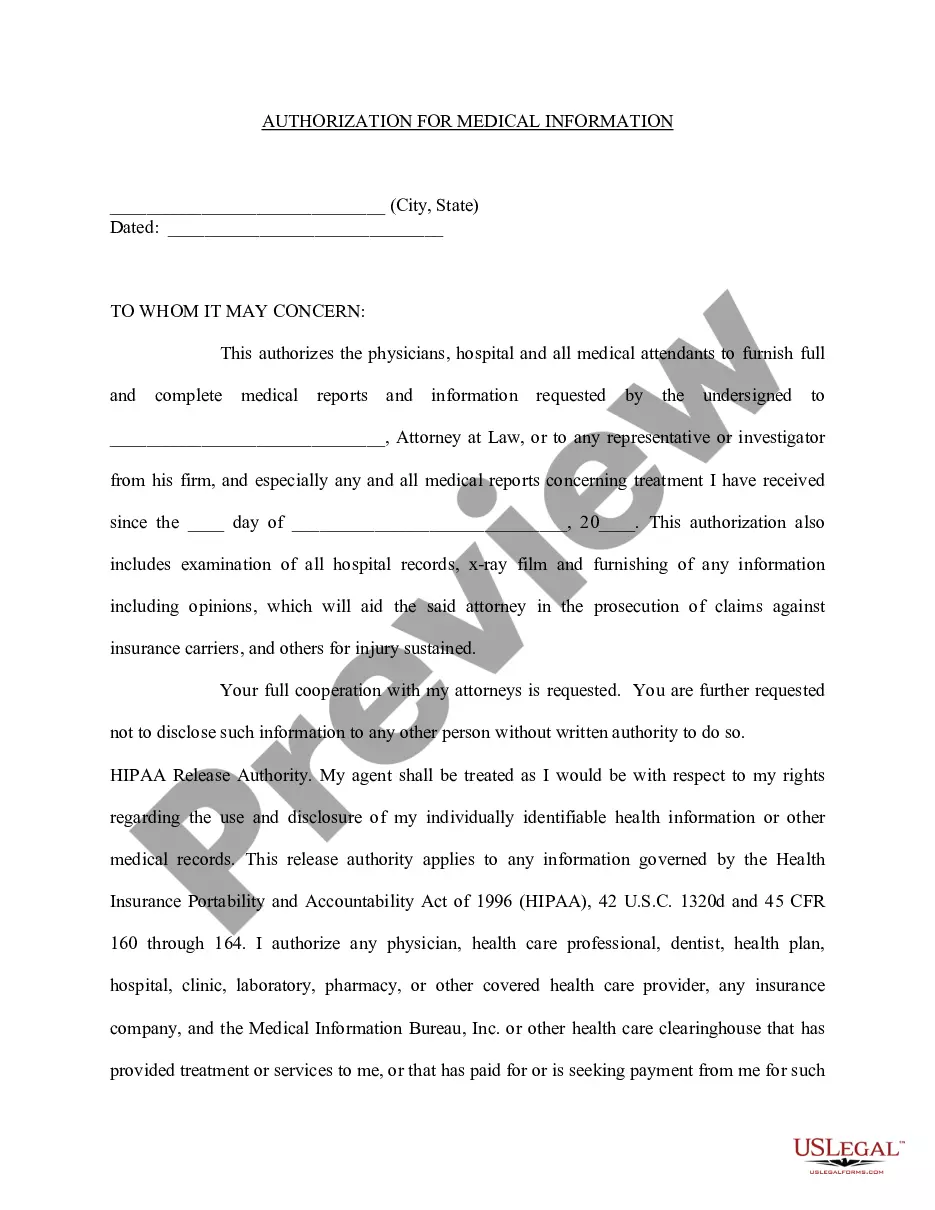

Interest States Statement Formula

Description

How to fill out Assignment Of Interest In United States Patent?

The Interest States Statement Formula displayed on this page is a reusable official template formulated by expert attorneys in accordance with national and local laws and regulations.

For over 25 years, US Legal Forms has offered individuals, entities, and legal professionals access to more than 85,000 authenticated, state-specific forms for any business or personal situation. It’s the quickest, easiest, and most dependable method to obtain the documents you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Subscribe to US Legal Forms to have confirmed legal templates for all of life's circumstances readily available.

- Search for the document you require and examine it.

- Select the pricing option that fits you and create an account. Utilize PayPal or a credit card for a swift transaction. If you possess an existing account, Log In and inspect your subscription to continue.

- Select the format you desire for your Interest States Statement Formula (PDF, Word, RTF) and save the sample on your device.

- Print the template for manual completion. Alternatively, make use of an online multifunctional PDF editor to efficiently and accurately complete and sign your form with a legally-binding electronic signature.

- Utilize the same document again whenever necessary. Access the My documents tab in your profile to redownload any forms you have previously acquired.

Form popularity

FAQ

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

Criminals will often: Change key information on your business registration. Commit cybercrime and bank fraud. Use stolen EINs to redirect your tax refund. Pose as an owner or officer to guarantee a line of credit or new loan. Rent space in your building and order goods under your name.

If you can't verify EIN number using the documents mentioned above, follow these steps: Call the IRS Business & Specialty Tax Line at 800-829-4933, which operates from a.m. to p.m., Monday through Friday. An assistant will ask for identifying information before providing the number. Why?

Are They Protected? No, EINs are not kept confidential and are a matter of public record. Therefore, it is important that you keep your EIN safe and secure to ensure that no one attempts to commit fraud by using your EIN.

Applying for an EIN for your California LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

An EIN (also informally called a ?federal ID number?) is obtained, free of charge, from the website of the federal Internal Revenue Service (IRS) agency (of the U.S. Treasury Department).

An EIN is 9 digits in length with the format of XX-X. An invalid employer identification number usually results when the number you entered in the federal EIN section of your TaxAct® W-2: was taken from the state section of your physical W2, doesn't match the federal EIN on your physical W2, or.

Keep business records and documents secure, and protect your EIN (employer identification number), account numbers, and other personal information. Educate staff on best cybersecurity practices. Don't share sensitive information over email or any web-based service. Invest in cybersecurity insurance.