Adding Beneficiaries To An Irrevocable Trust

Description

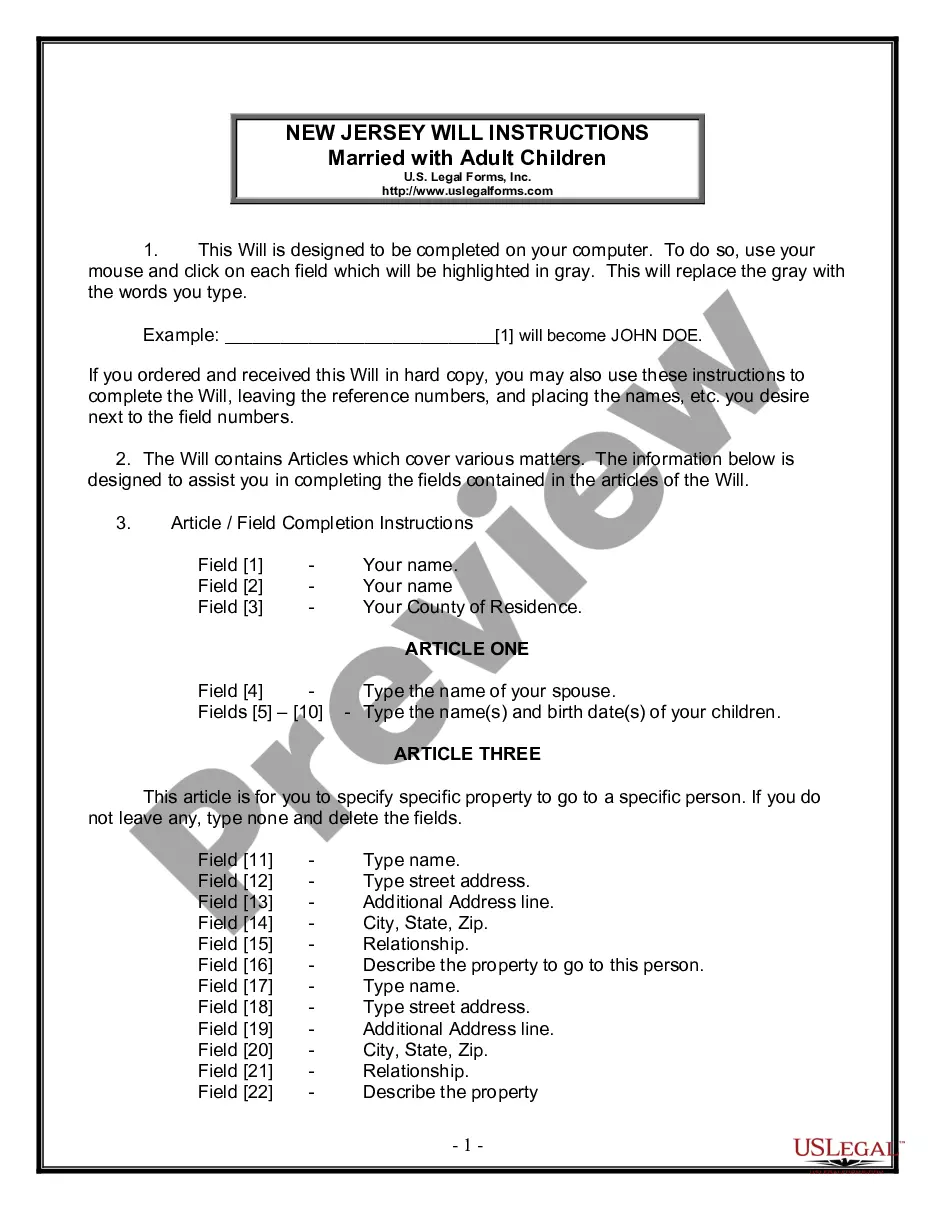

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

Accessing legal document samples that comply with federal and local regulations is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the right Adding Beneficiaries To An Irrevocable Trust sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life case. They are easy to browse with all documents collected by state and purpose of use. Our experts stay up with legislative updates, so you can always be confident your paperwork is up to date and compliant when getting a Adding Beneficiaries To An Irrevocable Trust from our website.

Obtaining a Adding Beneficiaries To An Irrevocable Trust is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

- Take a look at the template utilizing the Preview option or via the text outline to ensure it meets your requirements.

- Browse for another sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and select a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Adding Beneficiaries To An Irrevocable Trust and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

So, when asking the question ?can you change beneficiaries in an irrevocable trust?? the answer is generally ?no? you normally cannot change the aspects of an irrevocable trust, like changing beneficiaries.

Anyone other than the grantor may be named as a beneficiary of the Trust. Different family circumstances may dictate the need to structure the trust for different beneficiaries.

If the class of beneficiaries does not extend to that person, you can add a beneficiary by preparing a deed of variation. However, the original trust deed may prohibit certain persons from becoming beneficiaries. In this case, you may not be able to amend the trust deed to add them.

So, when asking the question ?can you change beneficiaries in an irrevocable trust?? the answer is generally ?no? you normally cannot change the aspects of an irrevocable trust, like changing beneficiaries. However, as with many things, there are always certain exceptions.

What Should I Avoid with My Irrevocable Trust? Use trust funds to pay for personal expenses. Use trust funds to pay for monthly bills, such as phone bills or utilities. Use trust assets to purchase vehicles. Gift assets from the trust to beneficiaries. Transfer assets into the trust without consulting your lawyer.