Pay Child Any Force

Description

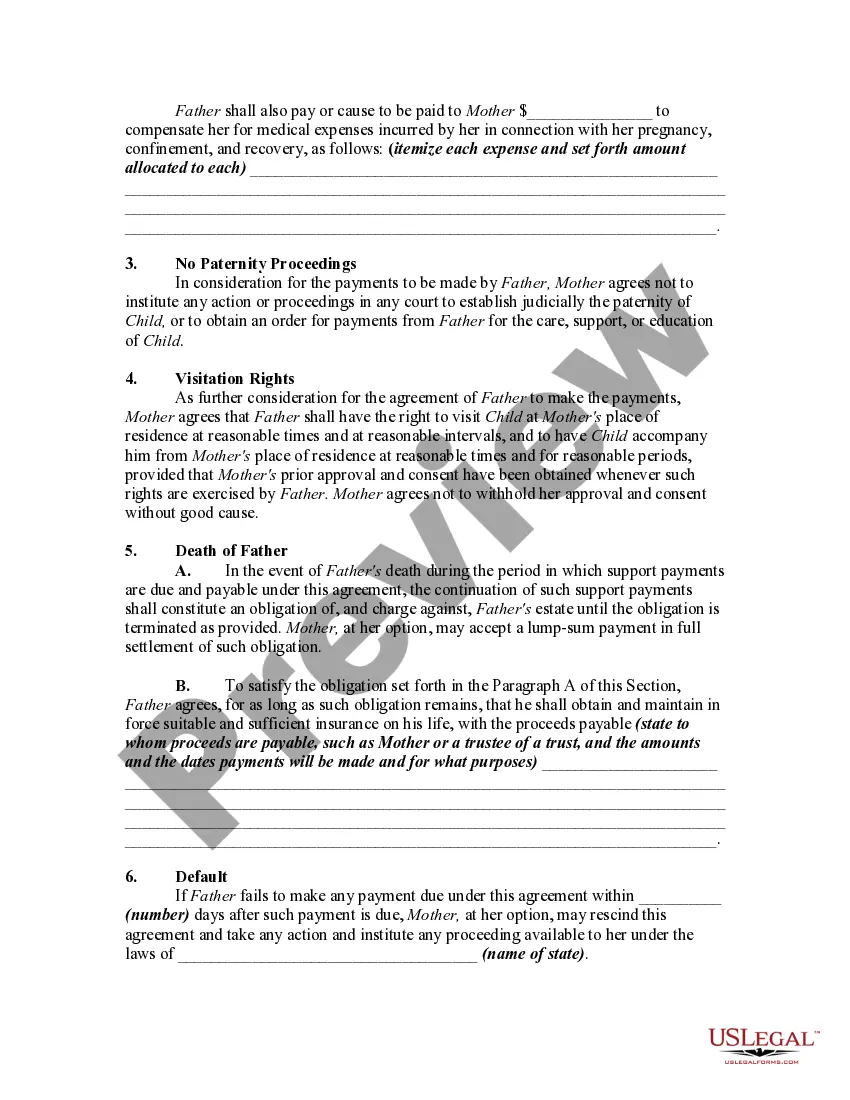

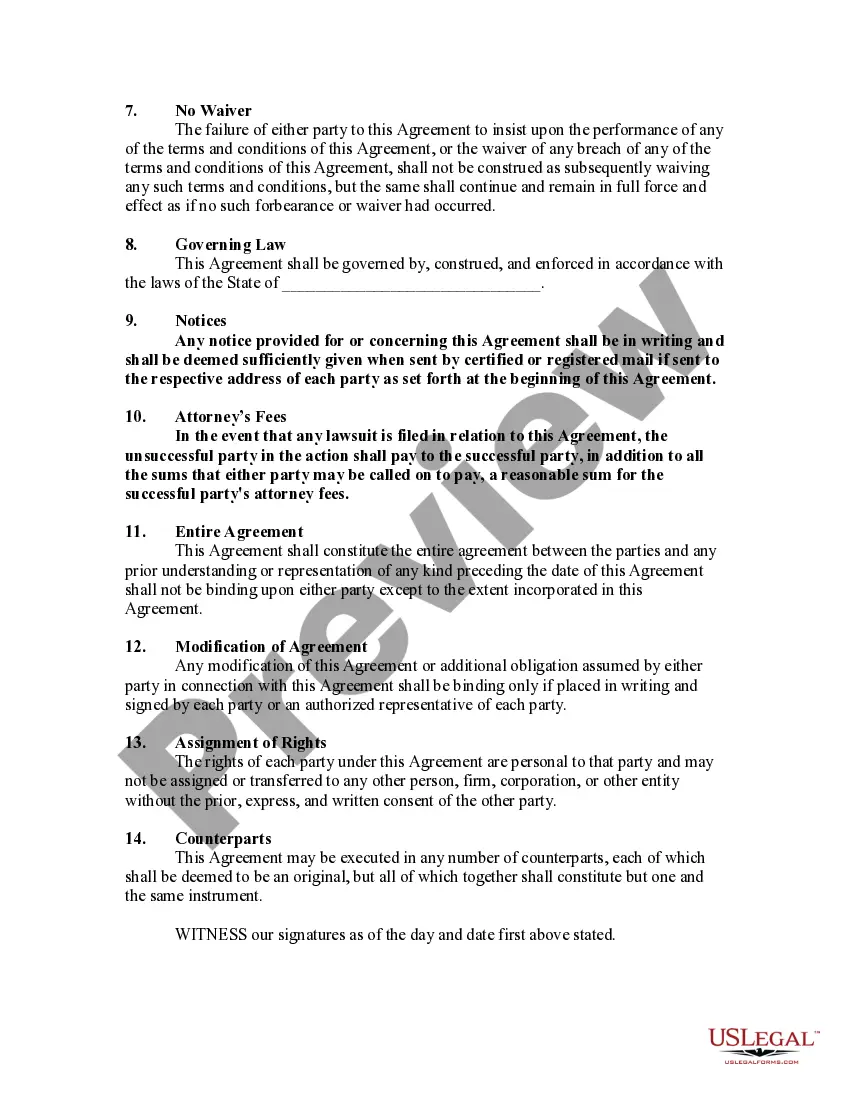

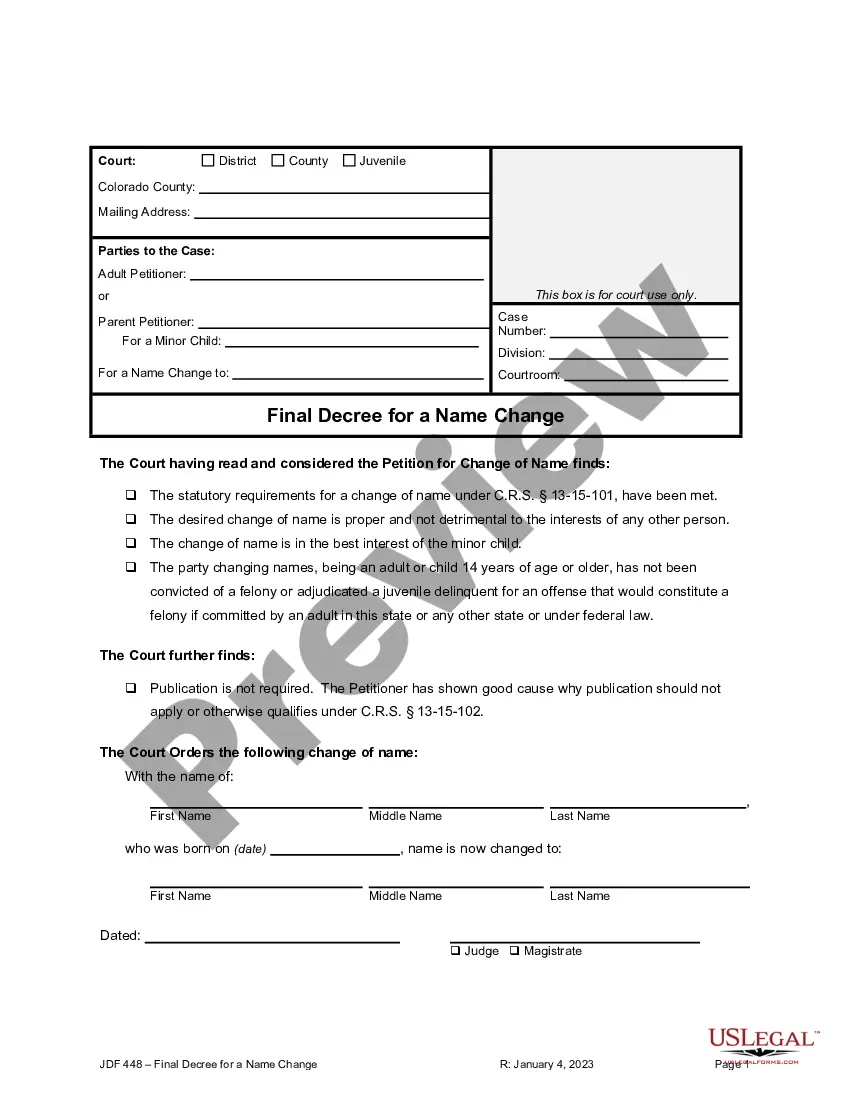

How to fill out Agreement By Natural Father To Support Child Born Out Of Lawful Wedlock?

Acquiring a reliable source for the latest and suitable legal templates is part of the challenge of navigating bureaucracy.

Searching for the correct legal documents demands accuracy and carefulness, which is why it’s essential to obtain Pay Child Any Force templates exclusively from trustworthy providers, such as US Legal Forms.

Eliminate the complications that come with your legal documentation. Explore the comprehensive US Legal Forms catalog to discover legal templates, review their applicability to your situation, and download them right away.

- Utilize the library navigation or search bar to find your template.

- Review the form details to verify it meets the specifications of your state and locality.

- Check the form preview, if available, to confirm the form is exactly what you are looking for.

- If the Pay Child Any Force does not align with your requirements, continue searching for the appropriate document.

- If you are confident about the form’s appropriateness, proceed to download it.

- As an authorized user, click Log in to verify your identity and access your selected documents in My documents.

- If you have not created an account yet, click Buy now to purchase the form.

- Select the payment plan that fits your needs.

- Complete the registration to finalize your acquisition.

- Conclude your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Pay Child Any Force.

- Once the document is on your device, you can modify it with the editor or print it for manual completion.

Form popularity

FAQ

The average child support payment in the United States typically ranges from $300 to $1,000 per month, depending on various factors, such as income and number of children. Different states have distinct guidelines to determine these amounts. Understanding these averages can help parents prepare for their financial commitments. Utilizing tools from uslegalforms can clarify how to manage and pay child any force responsibly.

The lowest amount of child support can vary significantly based on state laws and individual circumstances. Generally, courts establish a minimum amount to ensure the child's essential needs are met. It is crucial to remember that even the smallest amount has a meaningful impact. By using platforms like uslegalforms, parents can better understand their obligations and ensure they comply with the requirement to pay child any force.

When a parent provides financial support for their child, it is often referred to as child support. This financial obligation ensures that the child's basic needs are met, including food, clothing, and education. It is important for parents to understand their responsibilities in order to pay child any force effectively. Various legal resources, including uslegalforms, can help navigate the complexities of child support agreements.

Parents typically receive child support payments from the non-custodial parent to help cover essential costs such as housing, food, education, and healthcare. These payments ensure that children have what they need to thrive, even when parents live apart. If you are unsure about how to manage or calculate these payments, consider using resources from USLegalForms to assist you in understanding your entitlements or obligations to pay child any force. Having the right tools can make the process smoother.

In Mississippi, child support laws dictate that both parents are responsible for the financial wellbeing of their children. The state uses a formula to determine the amount of support, considering factors such as income, number of children, and necessary expenses. It's important to understand these laws to ensure that you fulfill your obligation to pay child any force, as court orders will enforce these responsibilities. Using USLegalForms can help you navigate and comply with these legal requirements.

Yes, US child support can be enforced in another country, but the process can be complicated. Many countries have treaties with the US that allow for cross-border child support enforcement. This means if a parent lives abroad but is required to pay child support, enforceable actions can still be taken. Utilizing resources like USLegalForms can provide guidance on how to effectively pay child any force, ensuring compliance regardless of where you live.

When an illegal immigrant has a child in the US, the child automatically acquires US citizenship. This scenario can lead to complex legal situations regarding child support and custody. Parents may need to navigate the legal system to ensure the child receives proper care and support, even if the parent is undocumented. Using services like USLegalForms can help you understand your options to pay child any force to ensure your child's needs are met.

The amount you can legally pay your child should reflect the fair market value for the services they provide. It should also comply with IRS rules on reasonable compensation. When structuring this aspect, remember to document everything correctly, and you may want to explore guidance from uslegalforms to ensure you adhere to the law while paying your child any force.

Yes, you can pay your child for work and potentially write off those expenses as business costs. However, this is subject to IRS regulations regarding reasonable compensation. To navigate this effectively, consider using uslegalforms to ensure documentation is complete and aligns with IRS requirements, allowing you to pay your child any force with peace of mind.

The $600 rule states that if you pay your child $600 or more in a tax year, you must report that income to the IRS. This applies to various forms of income, including wages for work performed. It’s crucial to document these payments correctly so that you can indeed pay your child any force without future issues.