Modifying Amending Form 1065

Description

How to fill out Order Modifying Or Amending Divorce Decree To Change Name Back To Married Name?

The Altering Amending Form 1065 displayed on this webpage is a reusable legal document crafted by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has delivered individuals, companies, and legal practitioners more than 85,000 validated, state-specific documents for any business and personal event. It’s the quickest, easiest, and most reliable method to acquire the documentation you require, as the service ensures bank-grade data security and anti-malware safeguards.

Complete and sign the documents. Print the template to finish it manually. Alternatively, use an online versatile PDF editor to swiftly and precisely fill out and sign your form with a valid signature.

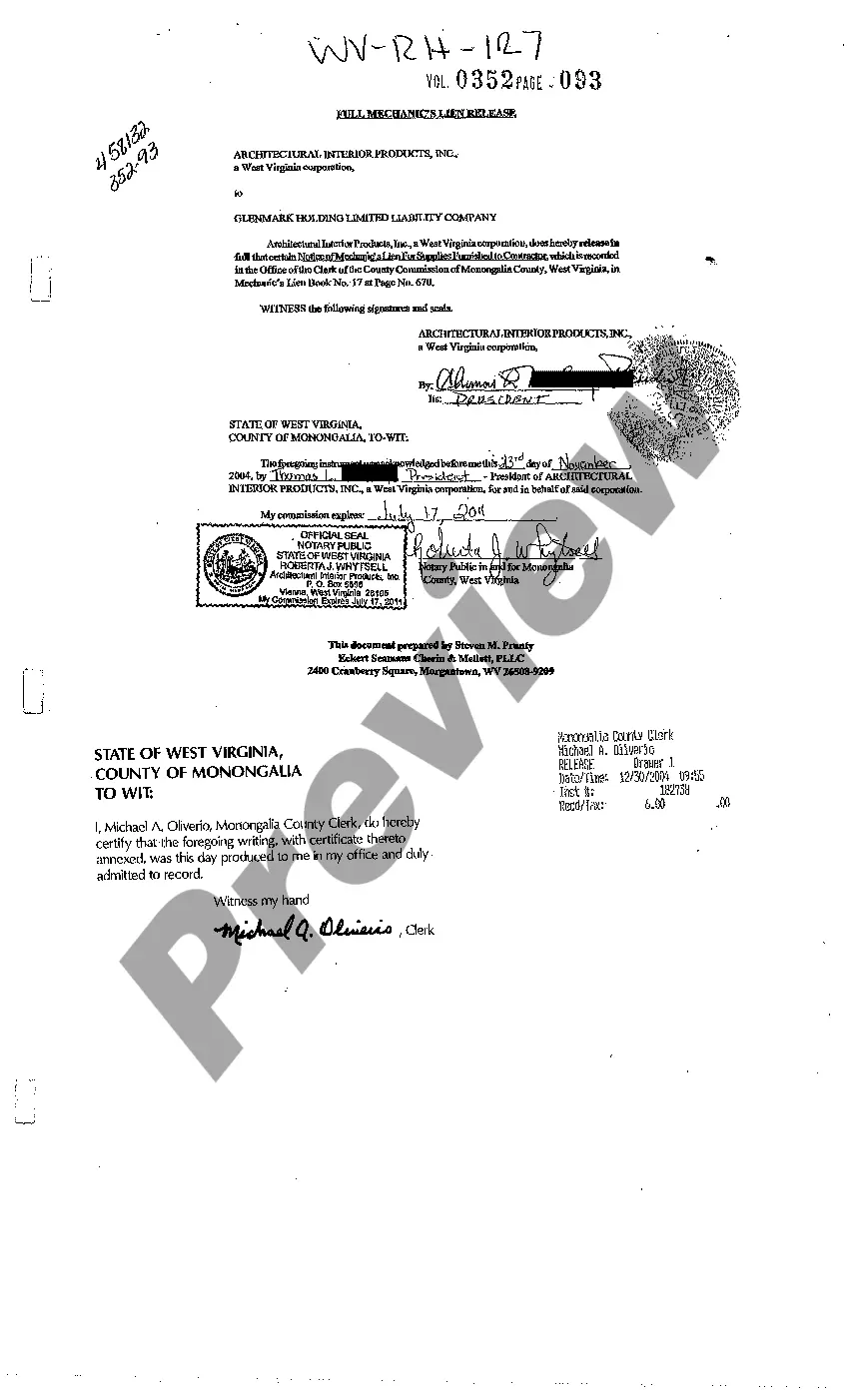

- Search for the form you require and examine it.

- Browse through the example you searched and preview it or review the form description to ensure it meets your requirements. If it does not, utilize the search bar to locate the fitting one. Click Buy Now when you have located the template you seek.

- Subscribe and sign in.

- Choose the pricing option that best suits you and establish an account. Utilize PayPal or a credit card to make a speedy payment. If you already have an account, Log In and check your subscription to proceed.

- Obtain the fillable document.

- Select the format you prefer for your Altering Amending Form 1065 (PDF, Word, RTF) and save the document on your device.

Form popularity

FAQ

Yes, you need to explain your changes when amending your return. This explanation helps the IRS understand the reasons behind your modifications. When modifying amending Form 1065, be clear and concise; using US Legal Forms can provide templates to help you articulate your changes effectively.

To amend, change, or correct a return you already filed, you should complete the Form 1065-X and provide the necessary information about the amendments. It is vital to submit this form according to the IRS instructions, either electronically or via mail. Platforms like US Legal Forms offer practical guidance on modifying amending Form 1065, ensuring clarity in your correction process.

Amended returns can indeed be submitted electronically, depending on the type of return and the software you are using. It’s essential to check compatibility with the IRS requirements for modifying amending Form 1065. US Legal Forms can assist you in ensuring your amendments are filed properly and on time.

Yes, you can amend an already submitted tax return. This process allows you to correct mistakes or add missed information. Modifying amending Form 1065 is a straightforward process, especially when you utilize tools available at US Legal Forms that simplify your filing.

To submit your amended return, first ensure that you have completed Form 1065-X. Then, you can file it either electronically or by mail, depending on the regulations at the time. Using US Legal Forms can guide you through the process of modifying amending Form 1065, making your filing experience easier.

Yes, you can electronically file an amended 1065 return, provided you meet the eligibility criteria set by the IRS. Using reputable software can help ensure that your amended return is filed correctly. US Legal Forms offers resources to help you with the details of modifying amending Form 1065 smoothly.

Certain tax returns cannot be filed electronically. These typically include Forms 1040X for individuals, and some versions of the partnership and corporate returns. It is essential to check the IRS guidelines or use reliable platforms like US Legal Forms to understand the filing methods available for your specific needs related to modifying amending Form 1065.

Yes, you can e-file an amended Form 1065. However, specific conditions apply, and you may need to use tax software that supports this feature. By utilizing tools like US Legal Forms, you can simplify the process of modifying amending Form 1065 efficiently.