Change Name Without Marriage

Description

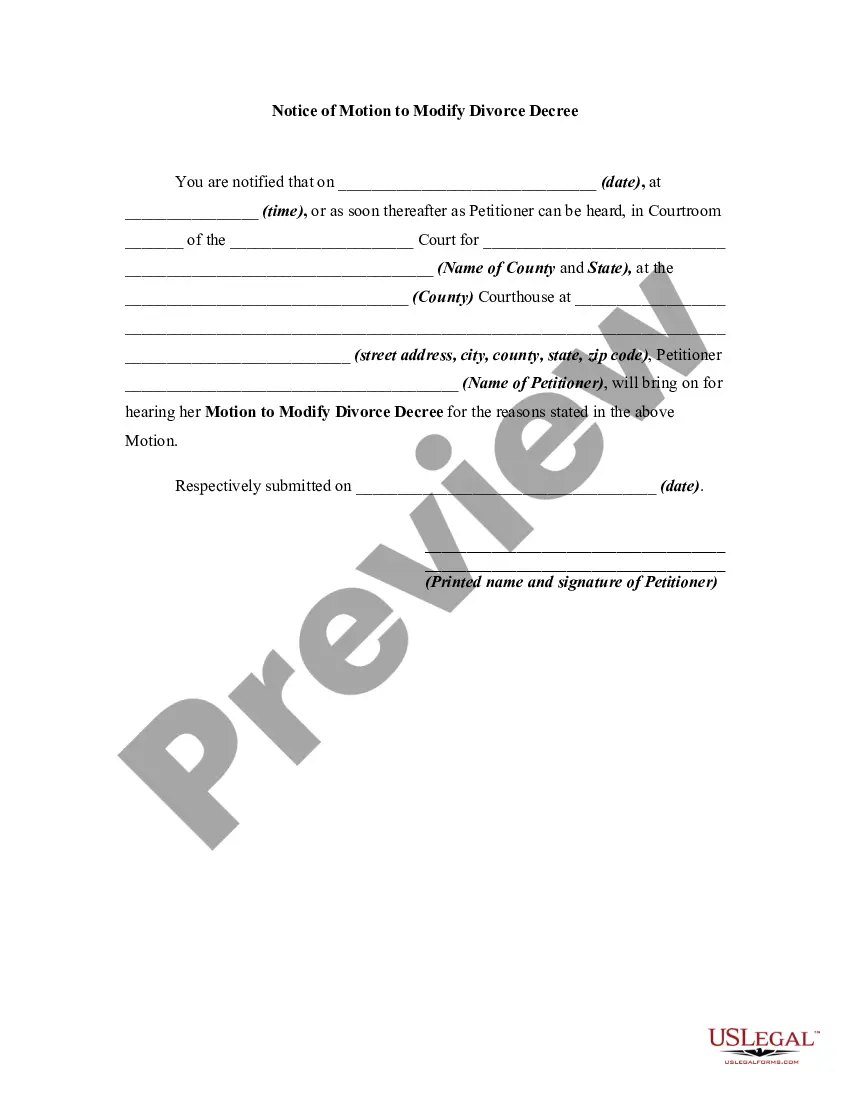

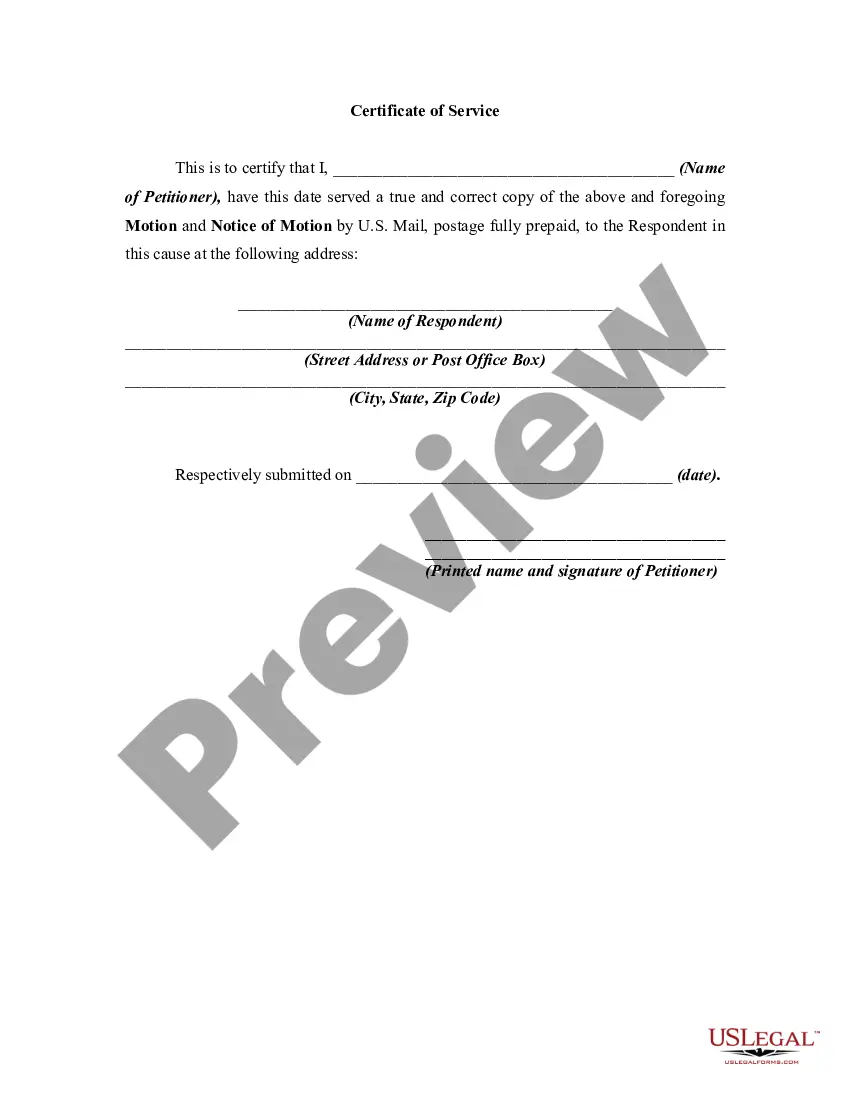

How to fill out Motion To Modify Or Amend Divorce Decree To Change Name Back To Married Name?

The Rename Document Without Matrimony you see on this page is a versatile official template created by experienced attorneys in compliance with national and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and lawyers with more than 85,000 confirmed, state-specific forms for any professional and personal event.

Join US Legal Forms to have verified legal templates for every situation in life readily available.

- Search for the document you require and examine it.

- Browse through the file you requested and preview it or check the form details to ensure it meets your requirements. If it doesn’t, utilize the search bar to find the appropriate one. Click Buy Now once you have located the template you need.

- Register and sign in.

- Select the pricing plan that suits your needs and create an account. Use PayPal or a credit card for immediate payment. If you already have an account, Log In and review your subscription to proceed.

- Acquire the editable template.

- Choose the format you desire for your Rename Document Without Matrimony (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the document.

- Print the template to finish it by hand. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with a valid signature.

- Download your paperwork again.

- Re-use the same document whenever necessary. Access the My documents tab in your profile to redownload any previously downloaded forms.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

Effective January 1, the small loan act applies to loans under $10,000 and not just $5,000 and certain other restrictions on scope are loosened. The anti-evasion provisions are also expanded. § 58-15-3(D). As of January 1, 2023, a fee of 5% of the principal may be charged for a loan of $500 or less.

Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage. There's no guarantee your request will be accepted, but there's no harm in asking. A record of on-time payments since the debt was paid will help your case.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: Misrepresenting the nature of the debt, including the amount owed. Falsely claiming that the person contacting you is an attorney.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

Ohio's statute of limitations is six years no matter the type of debt. And the six years is counted from the date a debt became overdue or when you last made a payment, whichever was more recent.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.