Change Name Married On Passport

Description

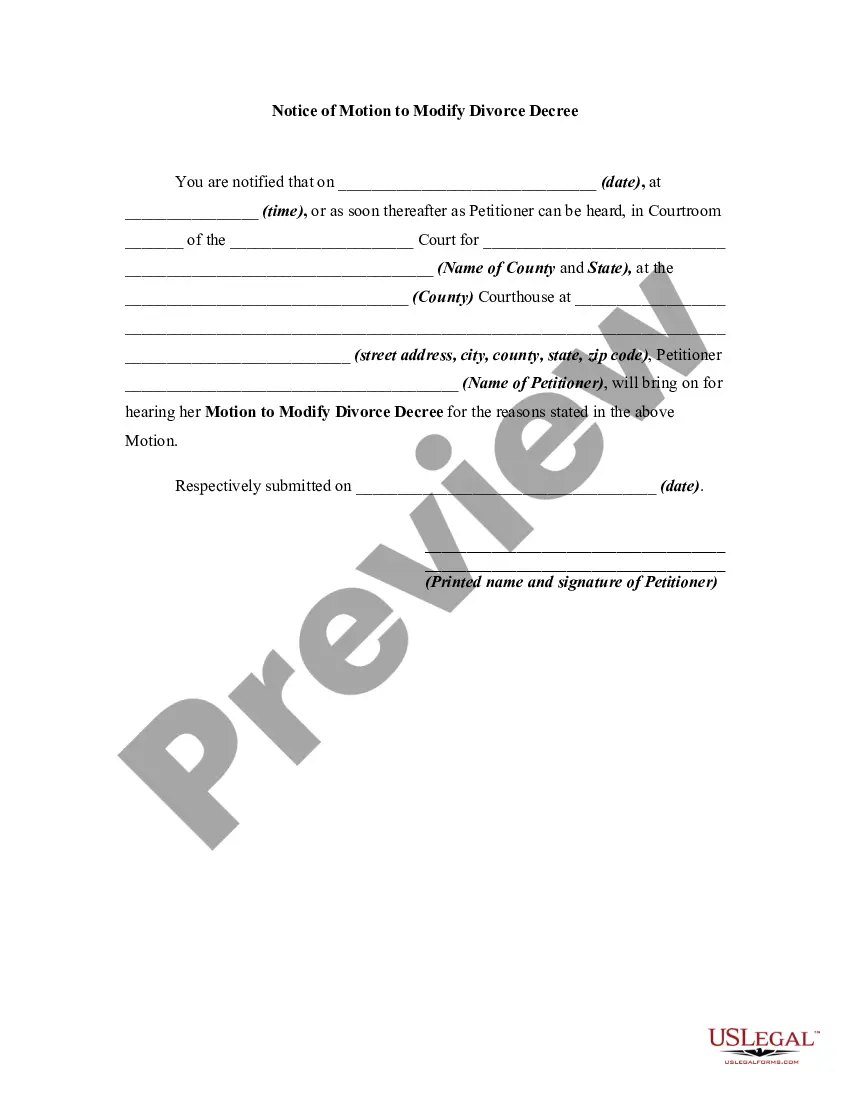

How to fill out Motion To Modify Or Amend Divorce Decree To Change Name Back To Married Name?

Creating legal documents from the ground up can occasionally be quite daunting.

Certain situations may require hours of investigation and thousands of dollars invested.

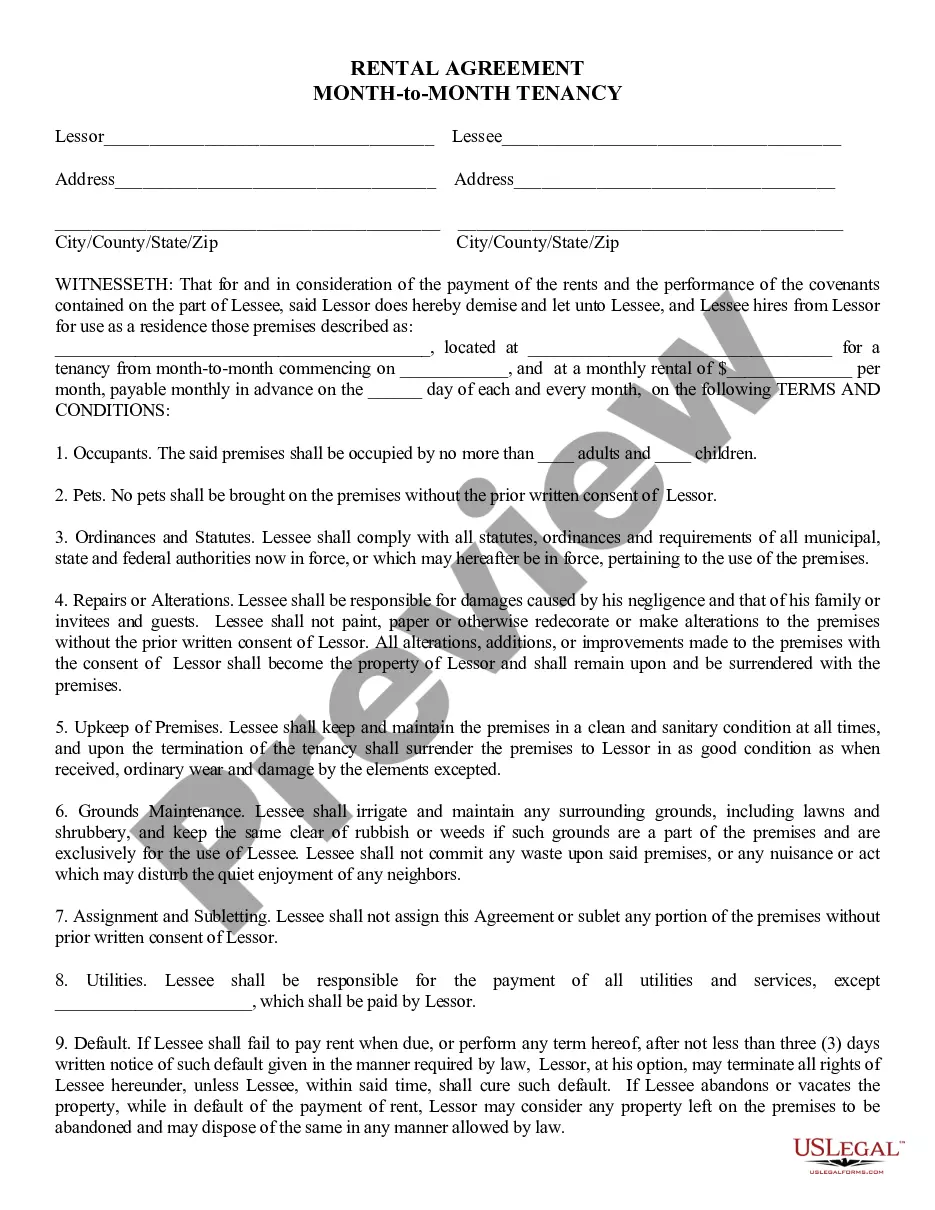

If you’re seeking a more straightforward and economical method of generating Change Name Married On Passport or other forms without extensive hassle, US Legal Forms is right at your service.

Our digital collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs.

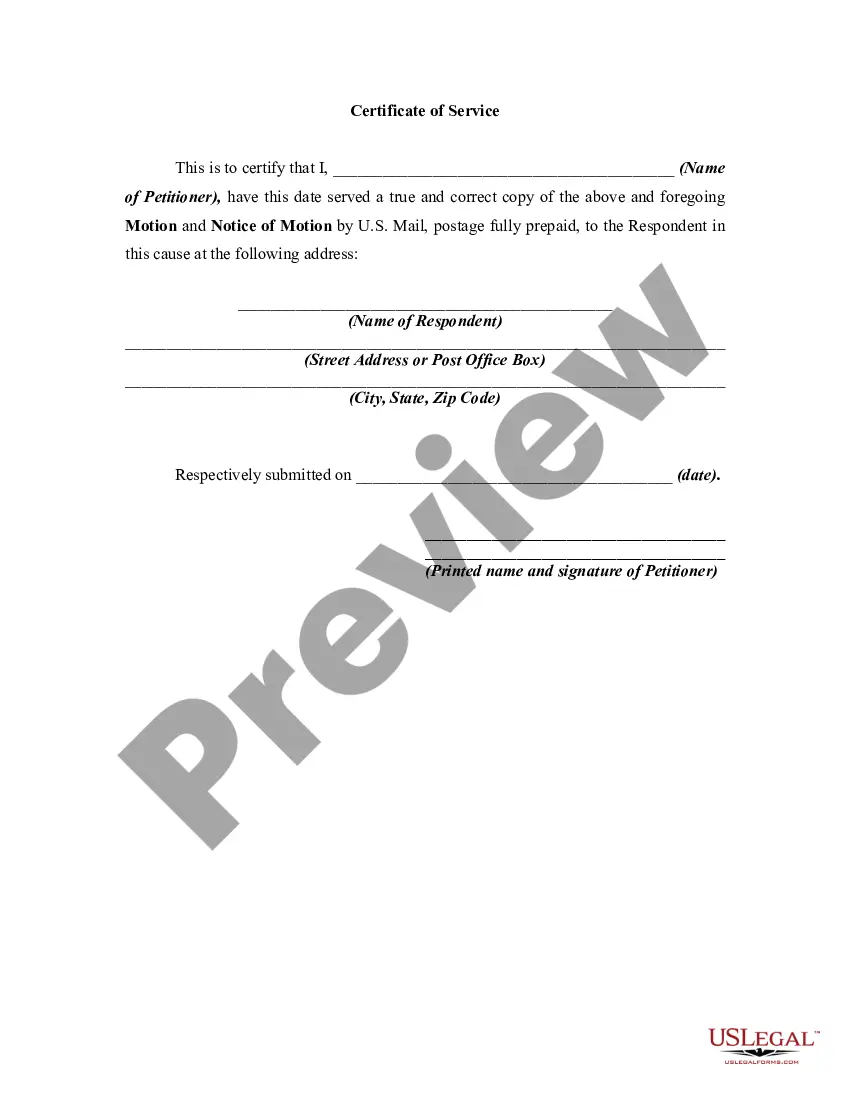

However, before you proceed to download Change Name Married On Passport, keep these suggestions in mind: Review the form previews and descriptions to confirm you've located the document you need. Ensure the template you select adheres to the laws and regulations of your state and county. Choose the appropriate subscription plan to acquire the Change Name Married On Passport. Download the form, then complete, certify, and print it out. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and simplify the process of form completion!

- With just a few clicks, you can quickly obtain state- and county-specific templates carefully crafted for you by our legal professionals.

- Utilize our website whenever you require trustworthy and dependable services through which you can easily find and download the Change Name Married On Passport.

- If you are not new to our site and have previously established an account with us, simply Log In to your account, find the form, and download it right away or re-download it whenever needed in the My documents section.

- No account? No worries. Setting one up takes mere minutes and allows you to browse the library.

Form popularity

FAQ

General Contact Information 517-335-8448 (phone) 517-335-8835 (fax) 1-800-942-1636 (toll-free) 517-335-8951 (voc)

Your loan servicer should let you know when your student loan debt is discharged. Anyone who chooses to opt out of the discharge will return to repayment when student loan repayment resumes, with interest resuming on September 1 and payments due starting in October. Subscribe to the CNBC Select Newsletter!

(1) A licensee or registrant may charge, contract for, receive, or collect on a secondary mortgage loan an interest rate not exceeding the interest rate permitted by the credit reform act, 1995 PA 162, MCL 445.1851 to 445.1864.

Michigan: A pilot program to pay monthly loan payments for school district employees. The new state School Aid budget includes $225 million that school districts can apply for to pay the monthly loan payments for employees.

You may be eligible for income-driven repayment (IDR) loan forgiveness if you've have been in repayment for 20 or 25 years. An IDR plan bases your monthly payment on your income and family size.

The Michigan State Loan Repayment Program (MSLRP) helps employers recruit and retain primary medical, dental, and mental healthcare providers by providing loan repayment to those entering into service obligations.

Borrowers are eligible for forgiveness if they have accumulated the equivalent of either 20 or 25 years of qualifying months depending on their loan type and income-driven repayment plan.

Michigan is amongst the top 10 states for most borrowers eligible for forgiveness, with the combined value of loans to be discharged valued by the department at over $1.2 billion. Debts will be wiped out within 30 days of eligible borrowers being notified by the Department of Education.