Change Amend Modify

Description

How to fill out Motion To Modify Or Amend Divorce Decree To Change Name Back To Married Name?

Legal papers managing can be mind-boggling, even for the most experienced experts. When you are looking for a Change Amend Modify and do not have the time to spend in search of the right and updated version, the processes could be stressful. A strong web form library can be a gamechanger for everyone who wants to take care of these situations efficiently. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms accessible to you whenever you want.

With US Legal Forms, you can:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any demands you might have, from individual to business documents, all in one location.

- Make use of advanced resources to accomplish and control your Change Amend Modify

- Access a resource base of articles, tutorials and handbooks and resources highly relevant to your situation and requirements

Help save effort and time in search of the documents you need, and employ US Legal Forms’ advanced search and Review tool to find Change Amend Modify and get it. In case you have a monthly subscription, log in for your US Legal Forms account, search for the form, and get it. Take a look at My Forms tab to see the documents you previously downloaded and to control your folders as you see fit.

Should it be the first time with US Legal Forms, create an account and get unrestricted access to all advantages of the library. Listed below are the steps to take after accessing the form you need:

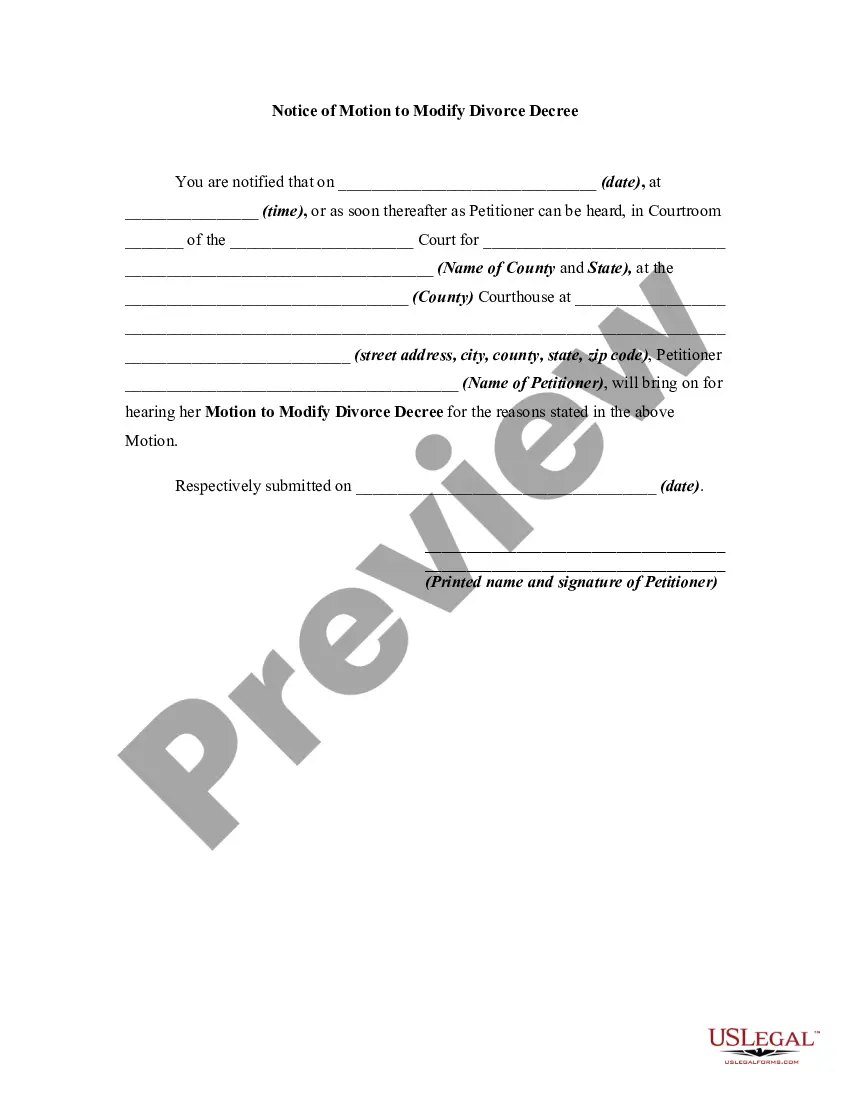

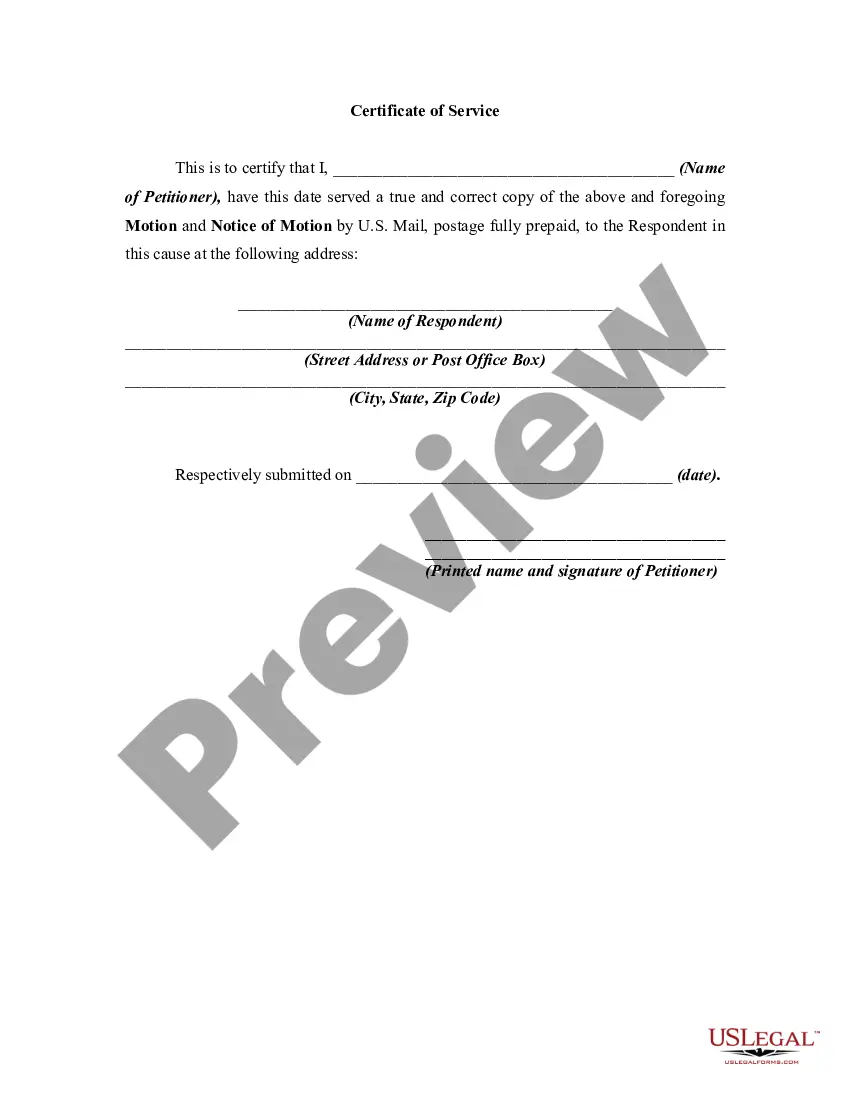

- Confirm this is the right form by previewing it and reading through its information.

- Ensure that the sample is approved in your state or county.

- Pick Buy Now once you are all set.

- Select a subscription plan.

- Pick the formatting you need, and Download, complete, sign, print and send out your document.

Take advantage of the US Legal Forms web library, supported with 25 years of experience and trustworthiness. Transform your daily document management into a smooth and intuitive process right now.

Form popularity

FAQ

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

Here's a step-by-step guide. Step 1: Collect your documents. Gather your original tax return and any new documents needed to prepare your amended return. ... Step 2: Get the right forms. The IRS form for amending a return is Form 1040-X. ... Step 3: Fill out Form 1040-X. ... Step 4: Submit your amended forms.

Yes. Since you've filed your return with the incorrect filing status, use Form 1040X to supply amended or additional tax information to change your return. Submit Form 1040X to the IRS. Form 1040X will be your new return.

4. How to amend include only the slips that need to be amended. use the report type code ?A? on the summary and slips. enter all data that has not changed for the slip and make changes to fields that require corrections. include only the totals from the amended slips on the amended summary.

Amending slips on paper Make sure you fill in all the necessary boxes, including the information that was correct on the original slip. Send two copies of the slips to the recipient. Send one copy of the amended slips with a letter explaining the reason for the amendment to your tax centre.