Trust Notice To Beneficiaries With Multiple

Description

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

Using legal document samples that comply with federal and state regulations is crucial, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the right Trust Notice To Beneficiaries With Multiple sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by lawyers for any business and personal case. They are simple to browse with all files grouped by state and purpose of use. Our experts stay up with legislative changes, so you can always be sure your form is up to date and compliant when acquiring a Trust Notice To Beneficiaries With Multiple from our website.

Getting a Trust Notice To Beneficiaries With Multiple is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, follow the guidelines below:

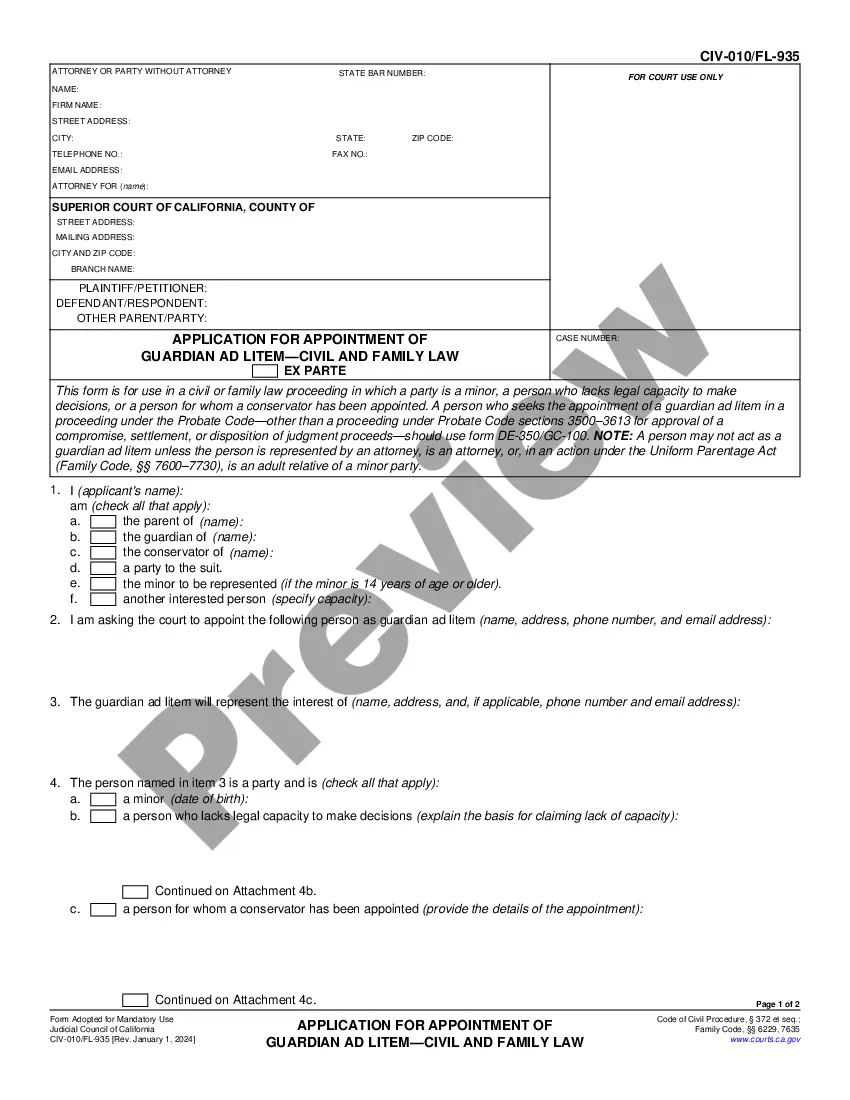

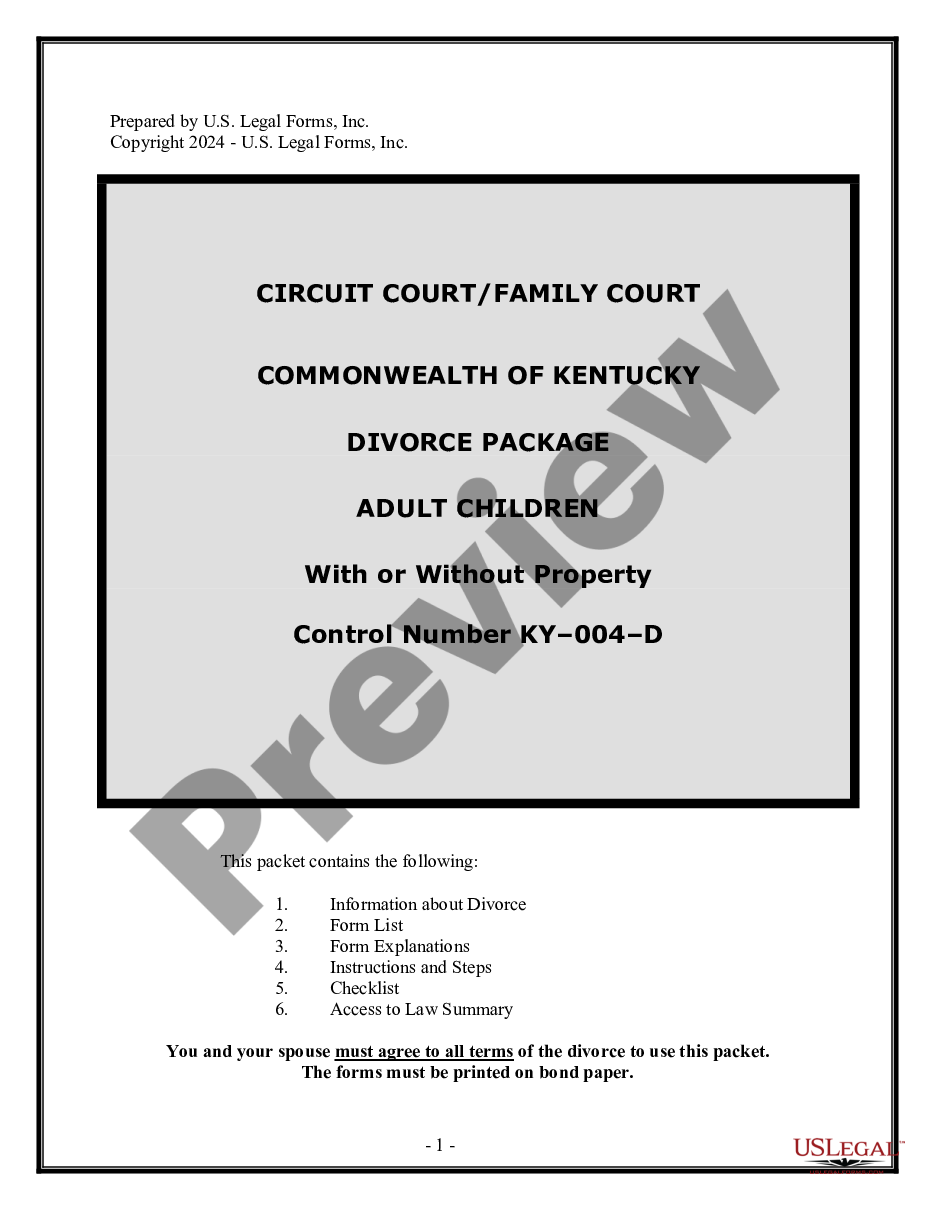

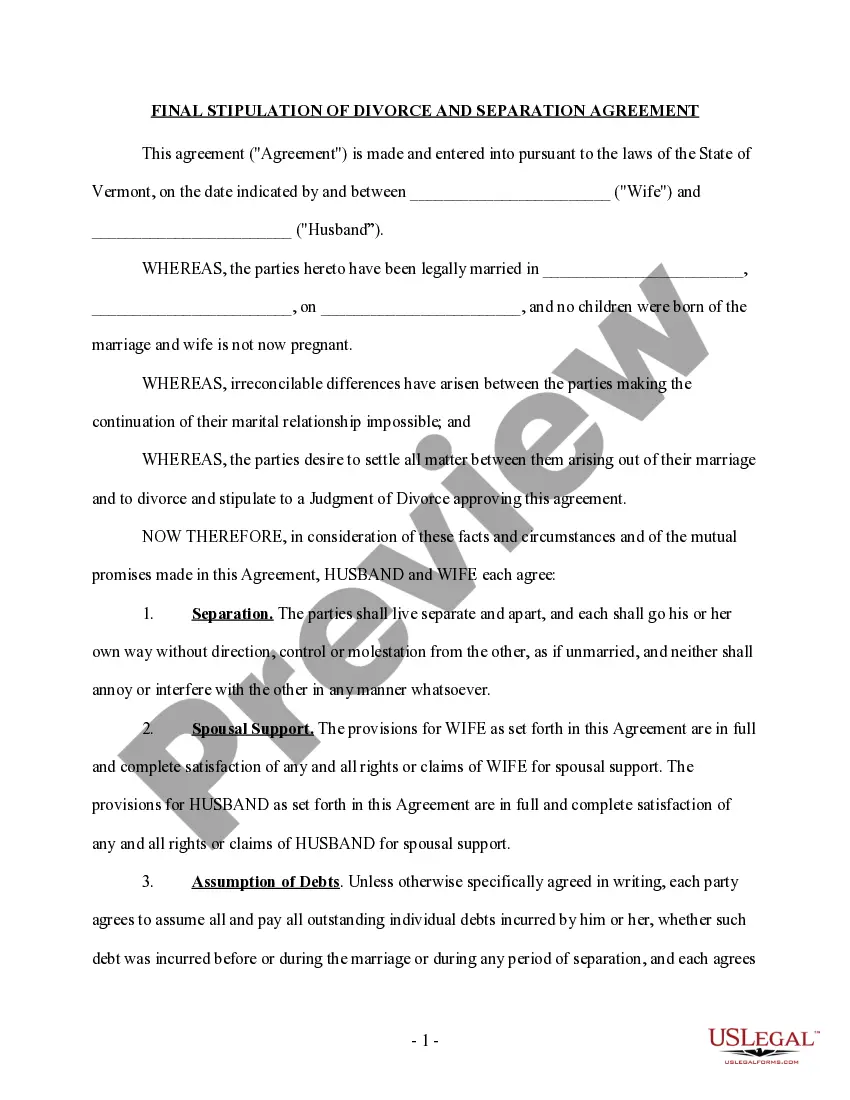

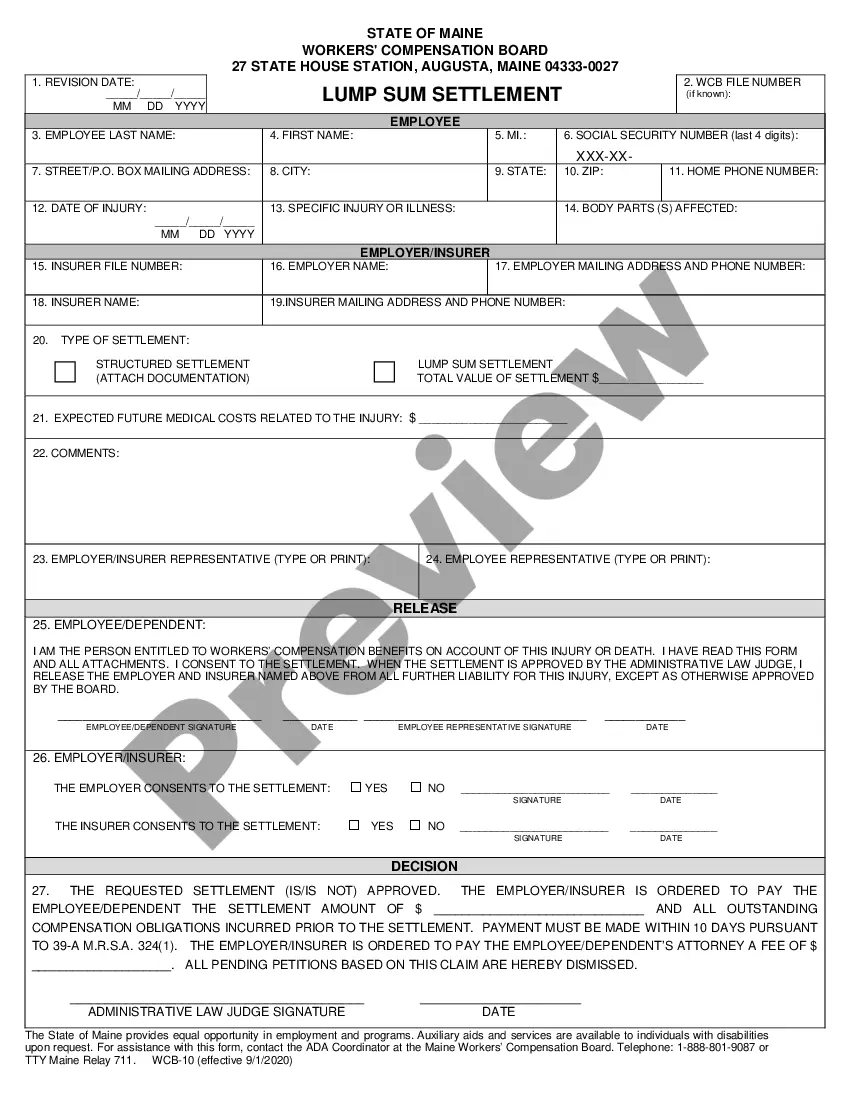

- Examine the template using the Preview feature or through the text outline to ensure it meets your requirements.

- Look for another sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the right form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Trust Notice To Beneficiaries With Multiple and download it.

All templates you find through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

If there is more than one beneficiary for a policy, each beneficiary must make a separate claim to receive their portion of the funds. The primary beneficiary is the first person (or, if multiple primary beneficiaries, persons) to receive the death benefit.

A much simpler way to provide for multiple beneficiaries, would be a trust. Within a trust you can turn the amounts you want beneficiaries receive into percentages. This ensures that any money left will be divided amongst all your loved ones and no one will be accidentally disinherited.

Usually you'll name primary and contingent beneficiaries. The primary beneficiary is the first person or entity named to receive the asset. The contingent is the "backup" in case the primary beneficiary is unable or unwilling to accept the asset. You can name multiple beneficiaries for several types of accounts.

Here are the essentials, in most states: Explain that the trust exists. ... Provide your name and contact information. ... Tell beneficiaries that they have the right to see a copy of the trust document and that you will send them one if they request it. ... Give the deadline for court challenges.

If the policyholder would like to name multiple beneficiaries to a single policy, he or she can specify any number of ?co-beneficiaries.? When multiple beneficiaries are listed, insurance companies can split the same death benefit amongst them.