South Carolina Notice of Consumer's Right to Cure Default

Description

Key Concepts & Definitions

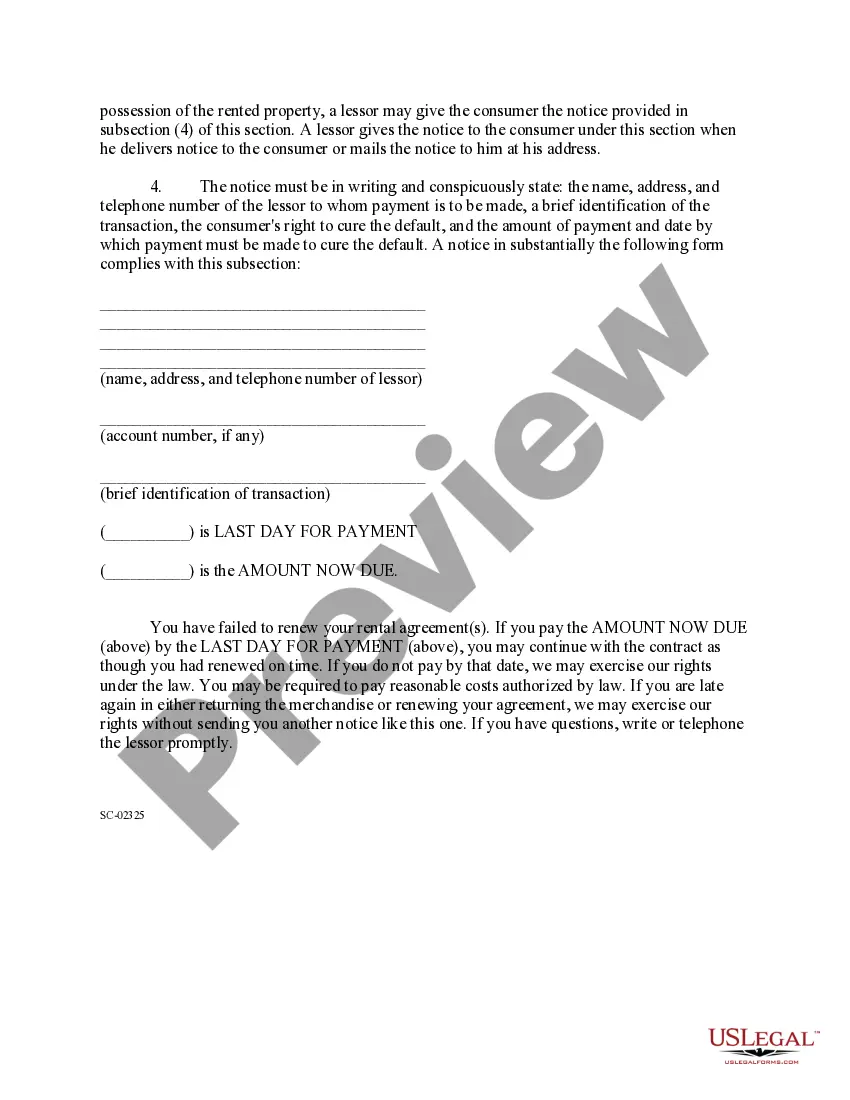

Notice of Consumer's Right to Cure Default: A legal notification from a lender to a borrower indicating that the borrower has violated terms of the credit agreement, but has an opportunity to resolve the issue to avoid further consequences, often within a specific timeframe. Cure default refers to the act of resolving these violations or breaches.

Consumer credit: This refers to the range of credit products available to individuals, distinct from business or commercial credit, used mainly for personal, family, or household purposes.

Step-by-Step Guide to Handling a Notice of Right to Cure Default

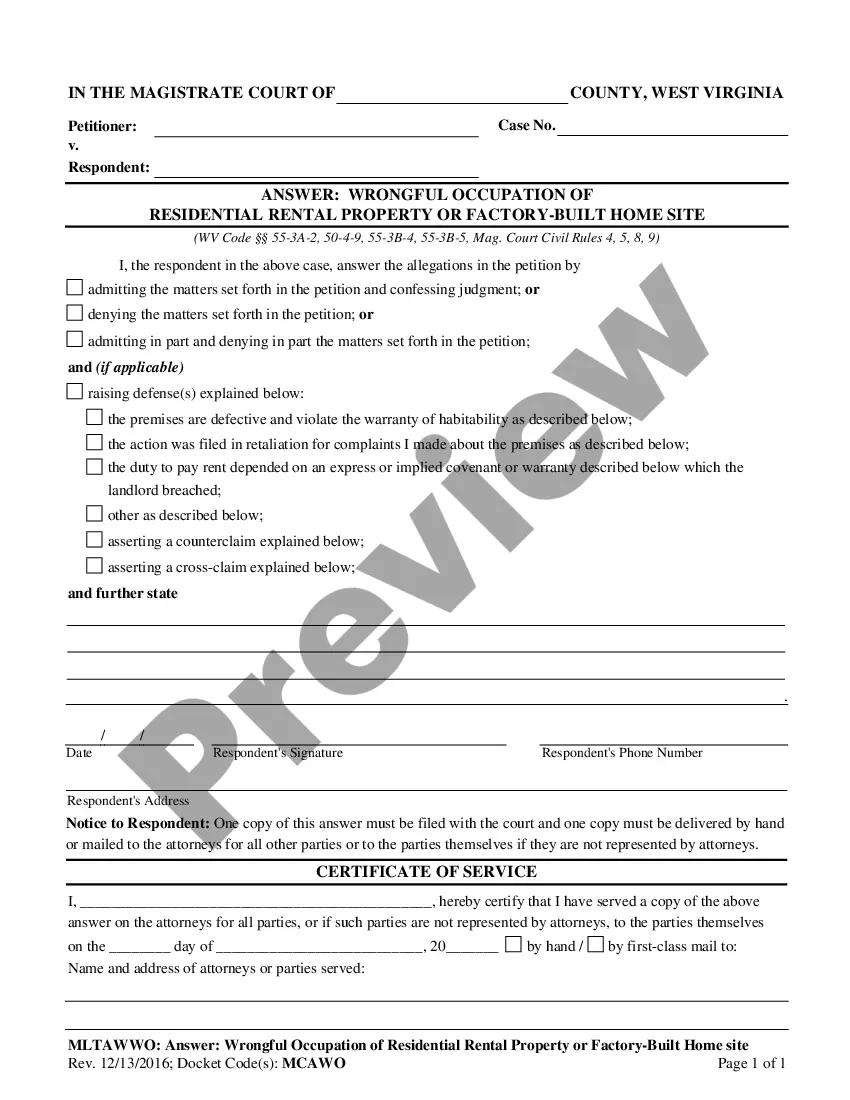

- Understand the Notice: Carefully read the notice to understand the specifics of the default and the rights available for curing the default under your states code such as West Virginia code laws or South Carolina's SC code.

- Review Credit Terms: Look back at your credit transaction agreement to understand the obligations and rights stated, specifically concerning defaults.

- Gather Financial Information: Collect all relevant financial documentation that pertains to your case.

- Contact the Creditor: Reach out to your creditor to discuss potential arrangements for curing the default, ensuring to document all communications.

- Rectify or Negotiate: Make the necessary payments to cure the default or negotiate a feasible payment plan with your creditor.

- Keep Records: Maintain all records of payments made and communications with your creditor as proofs of your efforts and resolution.

Risk Analysis: The Consequences of Ignoring a Cure Default Notice

- Credit Score Damage: Ignoring the notice can significantly affect your credit score, making future credit transactions more difficult or expensive.

- Increased Legal and Financial Liability: Failing to address the default may result in additional fines, penalties, or even a lawsuit.

- Loss of Property: In credit agreements involving collateral, you may risk losing the secured property.

FAQ

What does 'right to cure' mean? The right to cure gives a consumer the opportunity to remedy a breach within a specific period after being notified, thus potentially reversing the consequences of the default.

Is a notice of right to cure default applicable in all states? Most states have specific regulations regarding the notice of right to cure; however, the specifics, like the cure periods and consumer rights, may vary significantly from one state to another, such as between West Virginia and South Carolina.

Key Takeaways

- Action is Essential: Upon receiving a notice of cure default, immediate action is crucial.

- Understanding Legal Rights: Understanding your legal rights, including the specific codes and laws of your state, can significantly influence the outcome.

- Communication is Key: Open and documented communication with the creditor can facilitate a more favorable resolution.

How to fill out South Carolina Notice Of Consumer's Right To Cure Default?

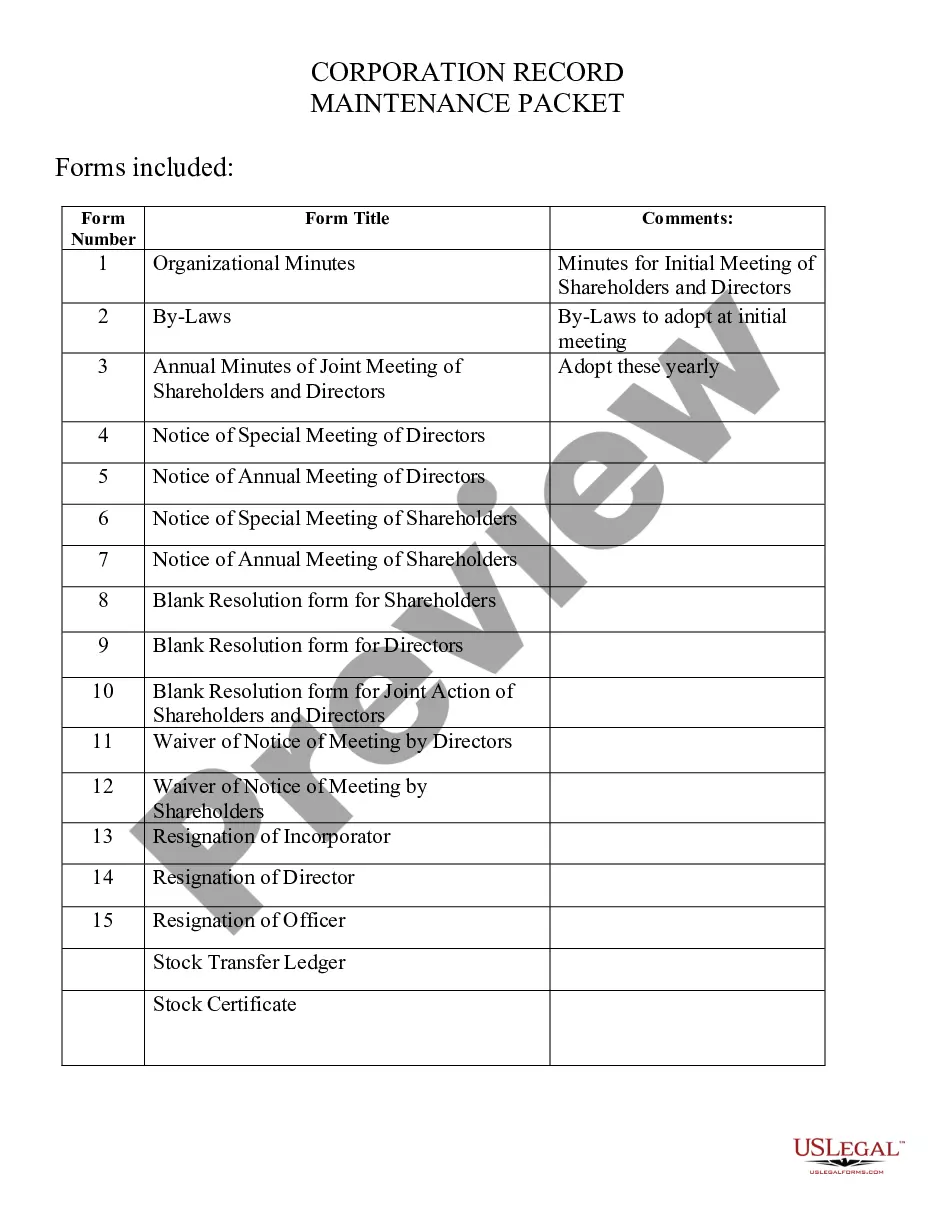

The work with documents isn't the most simple job, especially for those who almost never work with legal paperwork. That's why we recommend making use of correct South Carolina Notice of Consumer's Right to Cure Default samples made by skilled lawyers. It gives you the ability to eliminate difficulties when in court or handling formal institutions. Find the files you need on our website for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will immediately appear on the template web page. After accessing the sample, it will be saved in the My Forms menu.

Customers without an active subscription can easily get an account. Make use of this short step-by-step guide to get the South Carolina Notice of Consumer's Right to Cure Default:

- Make certain that the document you found is eligible for use in the state it’s required in.

- Verify the document. Use the Preview option or read its description (if available).

- Buy Now if this template is the thing you need or go back to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After finishing these easy actions, it is possible to complete the form in an appropriate editor. Recheck filled in data and consider asking an attorney to review your South Carolina Notice of Consumer's Right to Cure Default for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

5 Common Repo Questions Answered A: The repo man isn't legally allowed to enter locked and secured private property such as a garage to take away your vehicle. But they can repossess your car, without a court order, if it's sitting in your driveway, outside your home, or in a public space.

Under South Carolina law (S.C. Code § 15-3-530), the statute of limitations for most types of consumer and business debt is three (3) years. As an article from the U.S. Federal Trade Commission (FTC) explains, the statute of limitations typically begins ticking once a debtor fails to make payments on the debt.

South Carolina law allows a lender to sell a repossessed car if the borrower is unable to reclaim it. If the borrower has paid 60 percent or more of the loan, the borrower can force the lender to sell the repossessed car within 90 days.

If they take your car, then the lender will send you a Notice of Sale with what they plan to do with the car. By law, the lender must send a Notice of Sale or disposition. To redeem your car and stop the sale you might have to pay all of the late payments. You are usually given 10-14 days to do this.

If you don't take any action within the 15 days, the lender must offer the goods for sale. The lender can't sell, or offer to sell, the goods before the 15 days are up. You can reinstate or settle the agreement at any time before the lender sells, or agrees to sell, the goods.

If you stop paying, the lender can reclaim the property. It may choose to sue and get a judgment against you, but it's not required as long as the repossession is peaceful.

To eliminate or correct a violation or defect. For example, a landlord's cure or quit notice gives the tenant a set amount of time to correct, or cure, a lease violation or face an eviction lawsuit. contracts.

The Right to Cure Defined. The legal right to cure is essentially a principle found in contract law that allows one party in a contract, who has defaulted under a contract provision, to remedy their default by taking steps to ensure compliance or otherwise, cure the default.State Laws and Consumer Loans.