Continuing Writ Garnishment Florida Withholding

Description

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment And Notice Of Motion?

Legal documents handling can be daunting, even for the most proficient specialists.

When you are looking for a Continuing Writ Garnishment Florida Withholding and don’t have the opportunity to dedicate time to find the correct and current version, the tasks can be taxing.

Access a valuable resource pool of articles, guidelines, manuals, and materials pertinent to your situation and requirements.

Conserve time and effort while searching for the documents you require, and use US Legal Forms’ sophisticated search and Review function to retrieve Continuing Writ Garnishment Florida Withholding and download it.

Make sure that the template is accepted in your state or county. Choose Buy Now when you are ready. Select a subscription option. Choose the format you require, and Download, fill in, sign, print, and send your documents. Enjoy the US Legal Forms online catalog, backed with 25 years of expertise and reliability. Transform your everyday document management into a straightforward and user-friendly process today.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to see the documents you have previously downloaded and manage your folders as you desire.

- If it’s your first time using US Legal Forms, create a free account and gain unlimited access to the entire library's benefits.

- Here are the steps to follow after downloading the form you need.

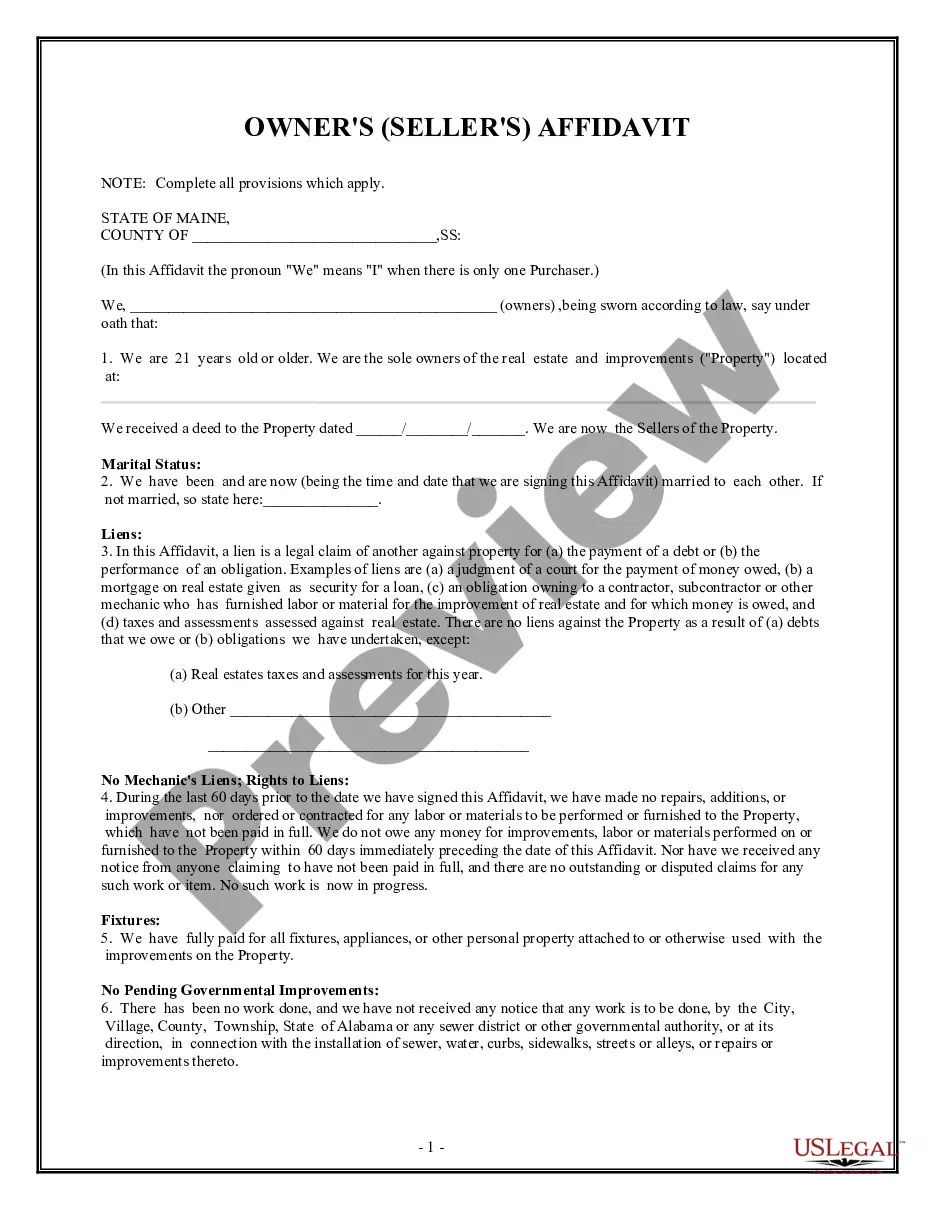

- Confirm it is the right form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms accommodates any requirements you may have, from personal to corporate papers, all in one location.

- Employ cutting-edge tools to complete and manage your Continuing Writ Garnishment Florida Withholding.

Form popularity

FAQ

In Florida, you cannot go to jail solely for not paying a judgment. However, ignoring court orders related to debts could lead to legal repercussions, including contempt of court. It is advisable to explore your options for debt management to avoid potential complications.

While avoiding payment is not advisable, some strategies may limit your financial exposure. You could negotiate a settlement with the creditor, seek bankruptcy protection, or claim exemptions under Florida law. Utilizing resources like USLegalForms can help provide a structured approach to managing these situations.

In Florida, a judgment can be enforced for up to 20 years. This means creditors can pursue collections during this time through various means, including continuing writ garnishment Florida withholding. It is crucial to stay informed about your situation, as understanding the duration can help you plan your financial steps.

Using US Legal Forms provides a straightforward approach to navigate garnishment processes, including the continuing writ garnishment Florida withholding. The platform offers easy access to accurate and legally compliant forms tailored to your needs. With a user-friendly interface, you can quickly find the necessary documents and instructions, ensuring a less stressful experience. Ultimately, this resource helps you effectively manage your garnishment issues with confidence.

General Partnership Similar to sole proprietorships, general partnerships are relatively easy and inexpensive to form. Partnerships require an agreement between two or more owners of a business. Profits and losses are split amongst the owners and each owner is responsible for company debt.

It will cost you $50 to register your LLC in Hawaii with the Hawaii Department of Commerce and Consumer Affairs Business Registration Division, plus an additional $1 State Archives fee. Filing online is the fastest way to complete the paperwork.

You don't have to file paperwork to form a partnership?you create a partnership when you agree to go into business with another person. While you can form a partnership without formally filing or registering the entity, partnerships must comply with licensing and tax requirements that apply to all businesses.

Copies and certified copies of documents filed with the Department can be purchased online through Hawaii Business Express. To do this, search under business name, open the selected record, and go to the last tab titled, ?Buy Available Docs.? Requests can also be made by phone, email, fax, mail, or in person.

How to form a Hawaii General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? File the Registration Statement. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

You can register a business in Hawaii online through Hawaii Business Express, which will walk you through the information and forms you need to provide. You start by creating a free eHawaii.gov account with your email address. The cost to file your articles for an LLC or corporation in Hawaii is $50.