Affidavit Property Form With Pf Withdrawal

Description

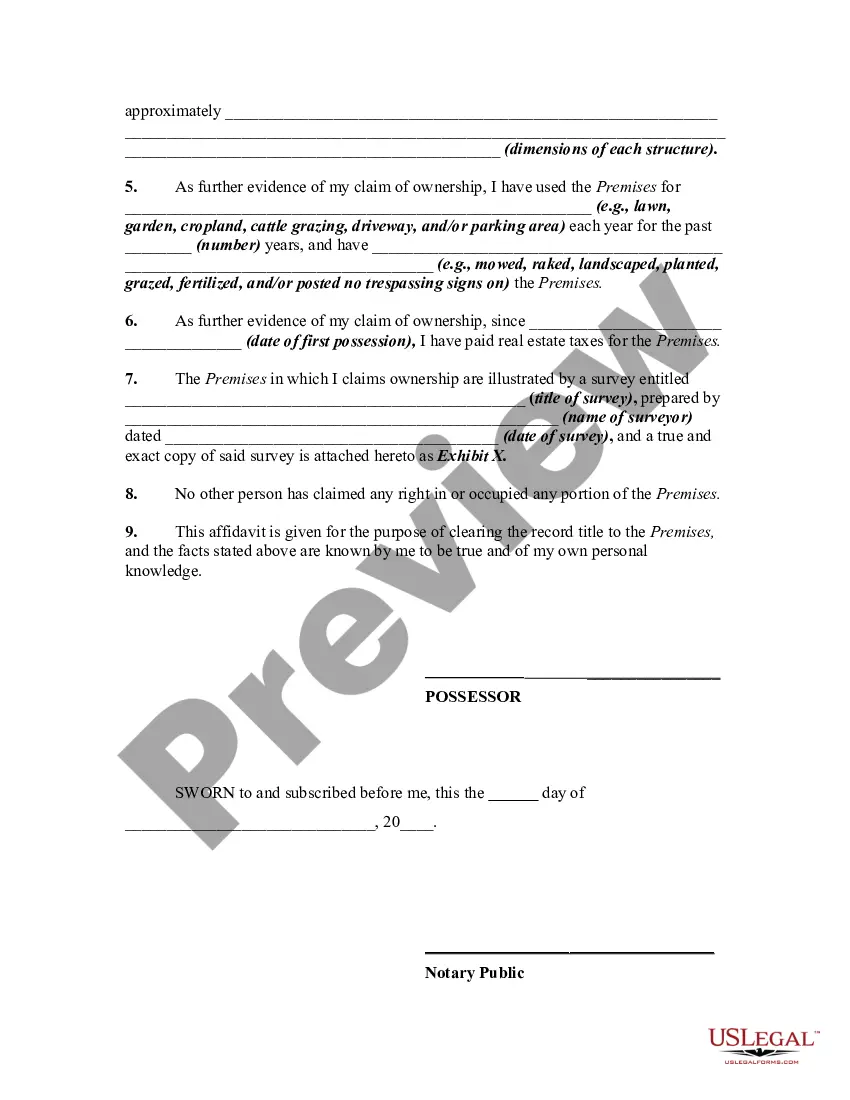

How to fill out Affidavit By Adverse Possessor That Property Held Adversely And Claim Of Title Is Based On Grant Of Ownership From Previous Owner - Squatters Rights?

Acquiring legal document examples that adhere to federal and state regulations is essential, and the internet provides numerous choices.

However, what is the benefit of spending time searching for the right Affidavit Property Form With Pf Withdrawal template online when the US Legal Forms digital library already has such documents compiled in one location.

US Legal Forms boasts the largest online legal repository with over 85,000 fillable templates created by lawyers for various professional and personal situations. They are easy to navigate, with all documents organized by state and intended use. Our experts keep abreast of legal changes, ensuring that your form is always current and compliant when obtaining an Affidavit Property Form With Pf Withdrawal from our site.

Click Buy Now once you have located the appropriate form and select a subscription plan. Create an account or Log In and make a payment using PayPal or a credit card. Choose the optimal format for your Affidavit Property Form With Pf Withdrawal and download it. All documents you discover through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents tab in your profile. Experience the most comprehensive and user-friendly legal documentation service!

- Obtaining an Affidavit Property Form With Pf Withdrawal is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in your preferred format.

- If you are a newcomer to our site, follow the instructions below.

- Review the template using the Preview option or through the text description to confirm it meets your requirements.

- Search for an alternative sample using the search tool at the top of the page if needed.

Form popularity

FAQ

PF Withdrawal: How to fill the Form 15G? Enter the name of the Assessee as per the name on the PAN card in Field 1 (Name of the Assessee). Enter the Pan card number in Field 2 (PAN of the Assessee). ... Fill in the individual's income tax status which should be individual or HUF in Field 3 (Status).

Select ?PF Advance (Form 31)? to withdraw your fund. Also provide the purpose of such advance, the amount required and the employee's address. Click on the certificate and submit your application. You may be required to submit scanned documents for the purpose you have filled out the form.

What are the Details to be Filled in PF Form 19? Provident Fund account number. Bank account number and IFSC code (It has to be the same account registered with one's current employer). Joining and exit date of employment. PAN details. Form 15G/15H.

Form 15G for provident fund (PF) withdrawal is a self-declaration form which ensures the applicant that there will be no deduction of TDS (tax deduction at source), if they withdraw their provident fund before, in a given financial year.

You must visit the EPFO website and enter your UAN (Universal Account Number), password and captcha. You then click on the 'Online Services Tab' and choose the option ?Claim (Form 31, Form 19, Form 10C and Form 10D)?. Enter your bank account number linked with your PF account and click on 'Verify'.