Claim Adverse File With Geico

Description

How to fill out Notice Of Claim Of Adverse Interest By Possessor Of Real Property - Squatters Rights?

Accessing legal document samples that meet the federal and regional regulations is crucial, and the internet offers many options to choose from. But what’s the point in wasting time searching for the correctly drafted Claim Adverse File With Geico sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life scenario. They are simple to browse with all papers arranged by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your form is up to date and compliant when getting a Claim Adverse File With Geico from our website.

Obtaining a Claim Adverse File With Geico is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the instructions below:

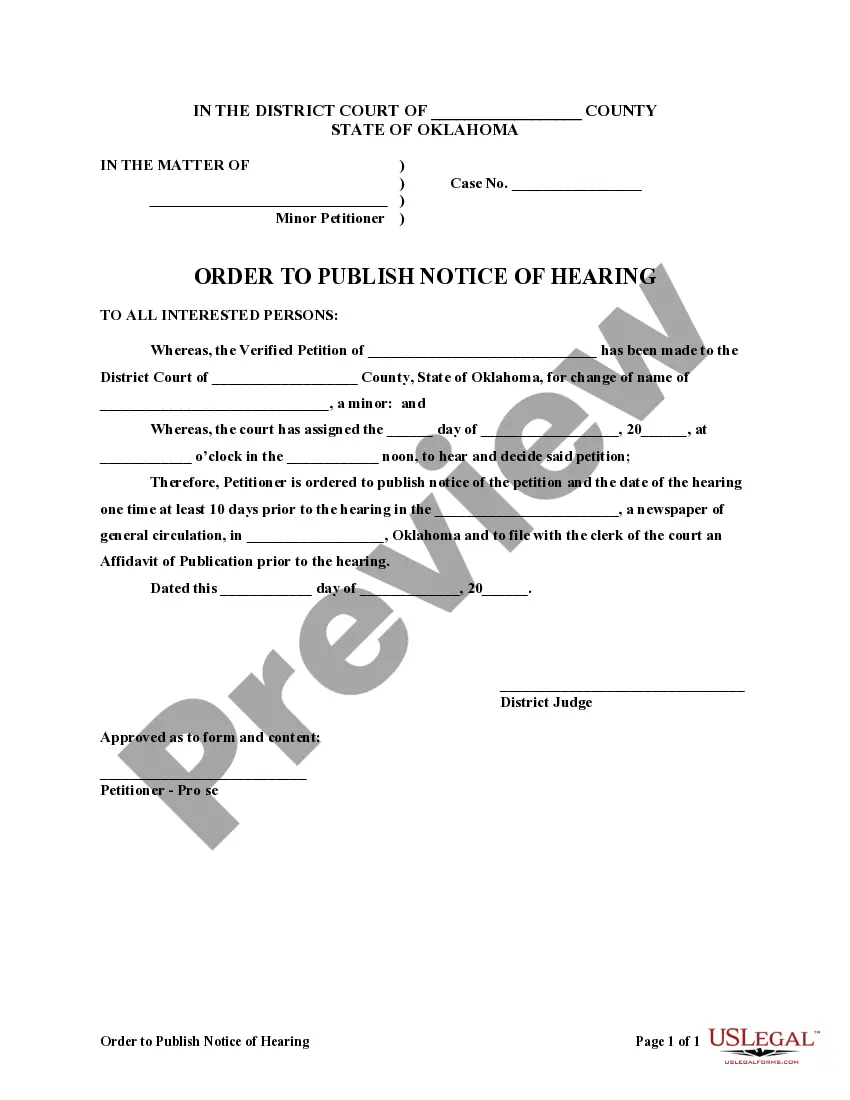

- Examine the template using the Preview feature or through the text outline to ensure it meets your needs.

- Browse for another sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the right form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Claim Adverse File With Geico and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Leif Olson, Car Insurance Writer Geico is decent at paying claims compared to the average insurance company, ing to J.D. Power's latest claims satisfaction survey.

When you file a claim, you'll be asked to provide some basic details, such as where and when the accident or incident took place, contact information for everyone involved and a description of what happened. You might also be asked to give an estimated cost of the damage from the accident?if you have that available.

A vehicle is a total loss (or totaled) if any of the following apply: The vehicle cannot be safely repaired. Repairs would cost more than the vehicle's estimated value. The damage meets your state's total loss guidelines.

Members in the class action lawsuit against Geico can receive payment for unpaid regulatory fees and unpaid sales taxes. As listed on the settlement website, individual payments may be $2,051.98 on average, with some members receiving higher or lower payments.

The lead plaintiffs typically get more money from the settlement than the other victims in a class action lawsuit. The reason for this is that the lead plaintiffs are chosen based on the severity of their injuries and the amount of their damages.