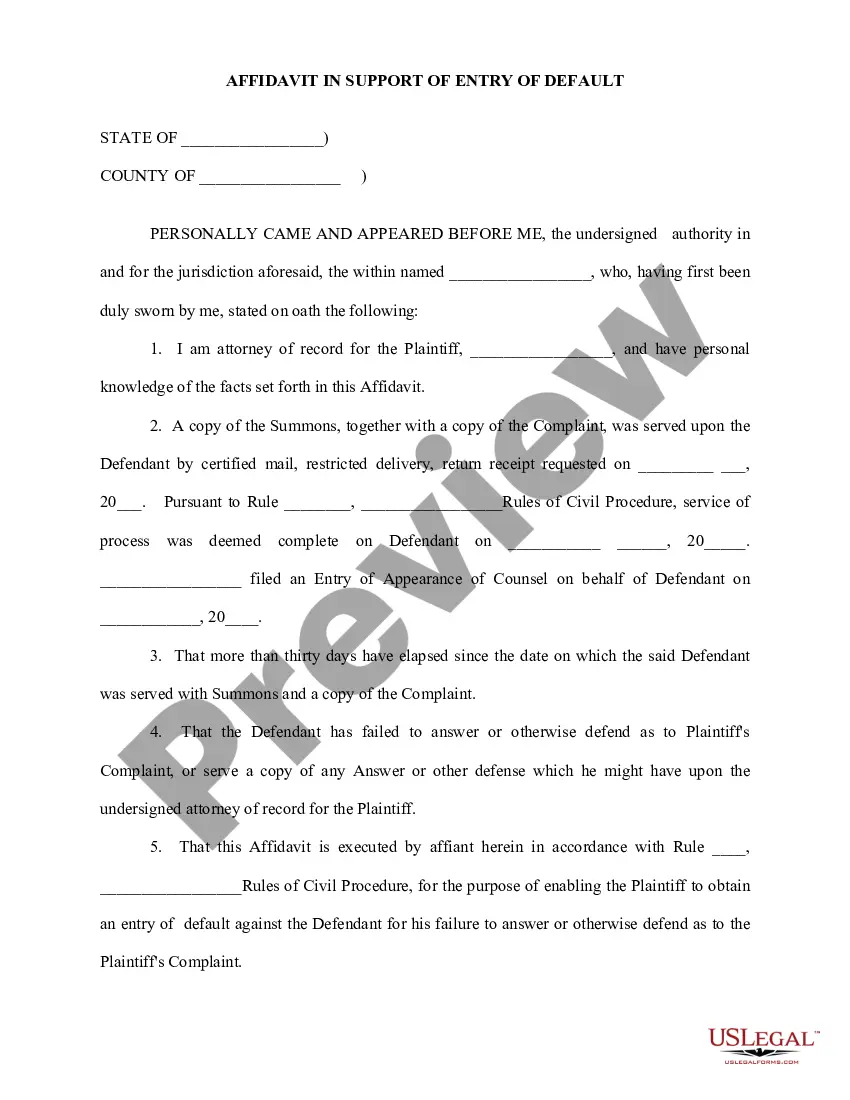

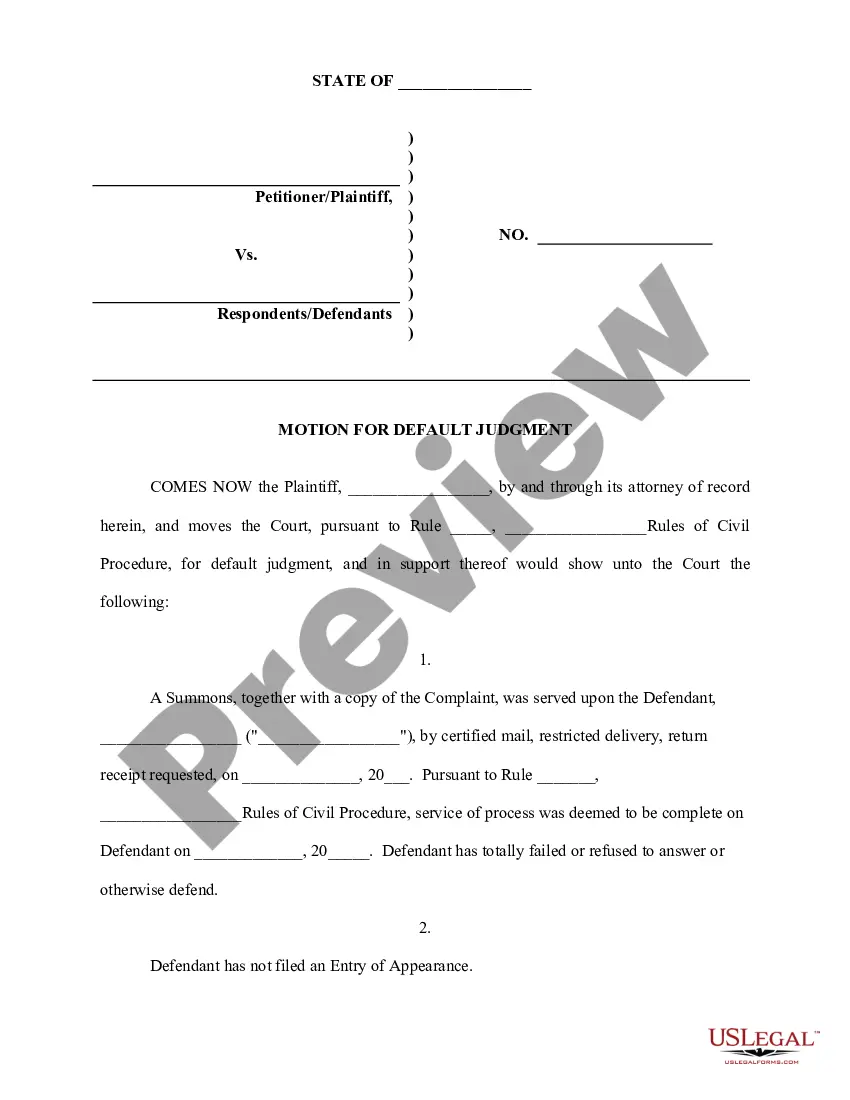

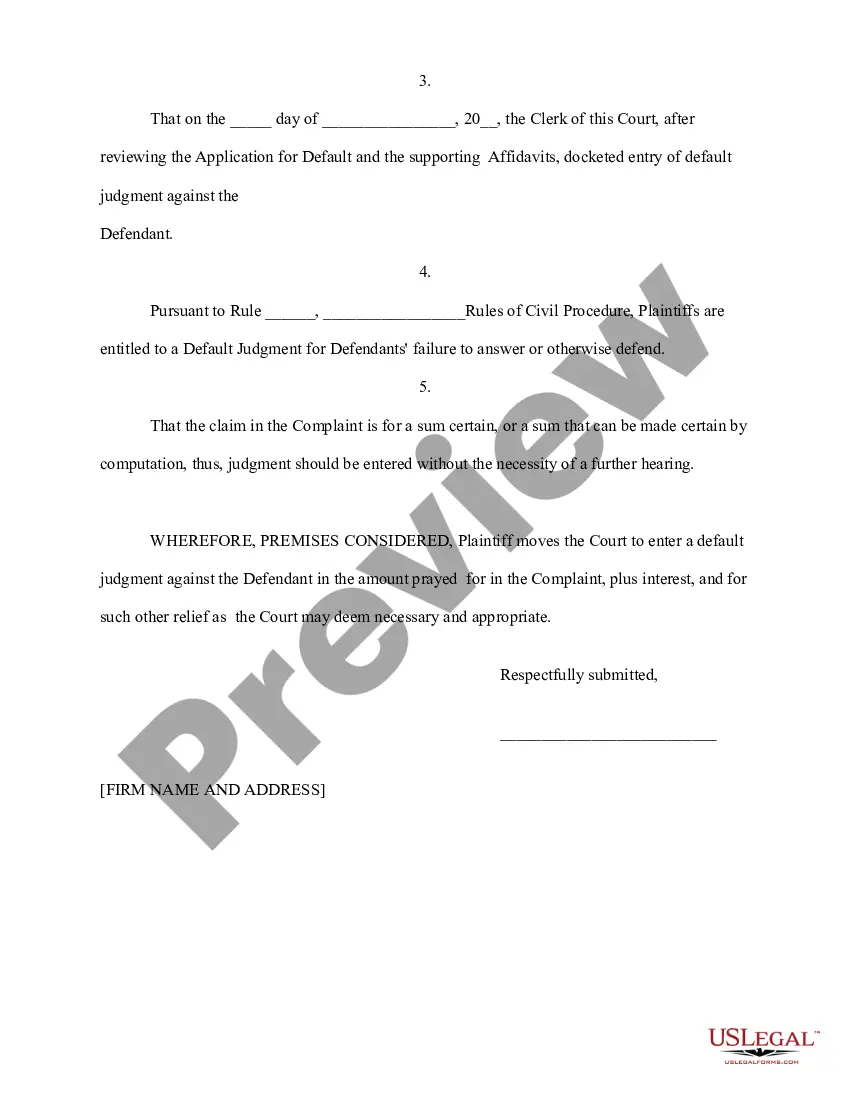

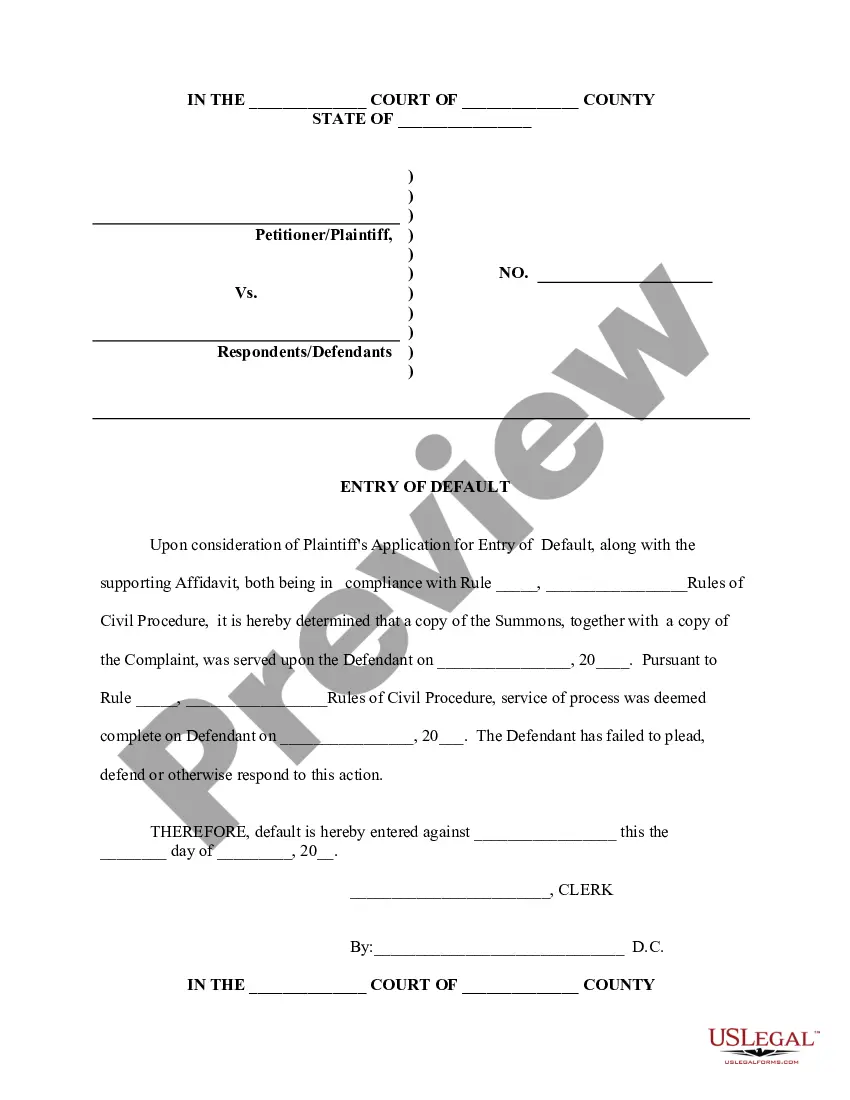

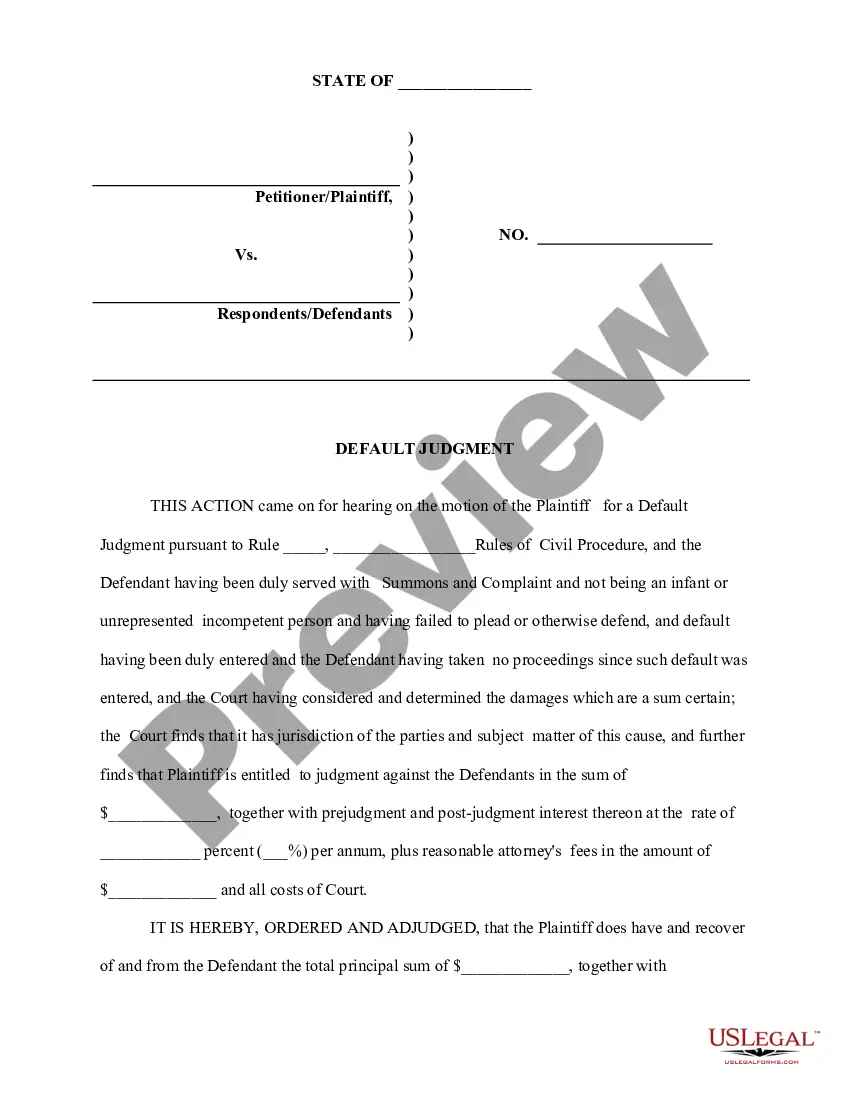

Application For Judgment Debt

Description

How to fill out Application For Entry Of Default - Affidavit - Motion - Entry Of Default - Default Judgment?

The Application For Judgment Debt you see on this page is a multi-usable formal template drafted by professional lawyers in line with federal and regional laws. For more than 25 years, US Legal Forms has provided individuals, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Application For Judgment Debt will take you just a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or review the form description to ensure it satisfies your requirements. If it does not, make use of the search bar to get the appropriate one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Select the format you want for your Application For Judgment Debt (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your papers one more time. Use the same document again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

After six years, your CCJ will be removed from your credit report, so lenders won't be able to see it when they're deciding whether or not to lend you money. When the CCJ is removed, your credit score should go up too ? making you an all-round stronger applicant for future finance.

Your credit score should increase considerably once your CCJ is removed from your credit record. However, it is hard to be specific as credit scores are always dependent on a number of factors. On average, our clients' scores increase by 200 points.

If you pay the debt in full within 1 month of the date of the CCJ, you can apply to the court have your entry in the Register removed. You'll need to get a certificate from the court to prove you've paid off the debt.

There are two options available to you: You can set up a CCJ payment plan to pay it at a more affordable rate: and you can apply to change the payment terms if you're still struggling to keep up with payments. You can apply to have the CCJ cancelled or 'set aside': if you think it should not have happened.

What happens if I ignore a CCJ? Ignoring a County Court judgment (CCJ) can cause problems. It goes on your credit file for six years from the date it was issued, and further action can be taken for the debt if you do not pay it. There are instructions in the claims pack, including the N9a form you use to respond.