Ftc Requirements

Description

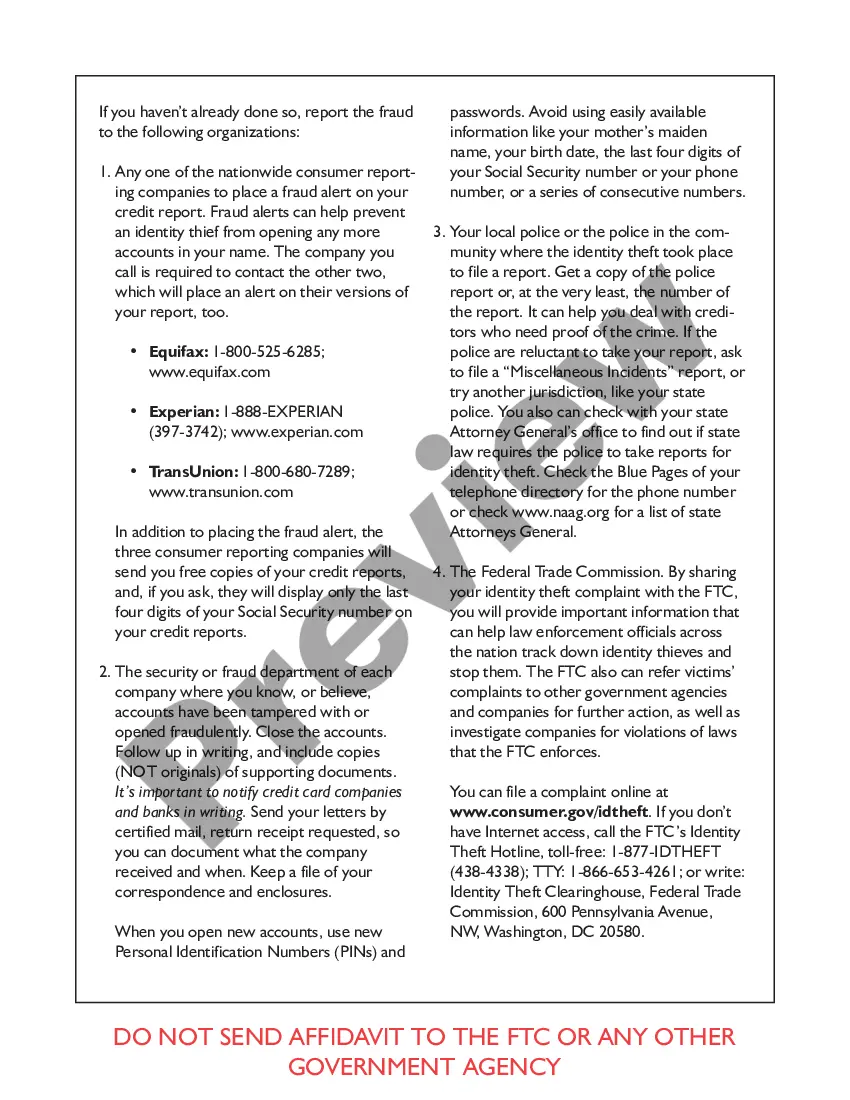

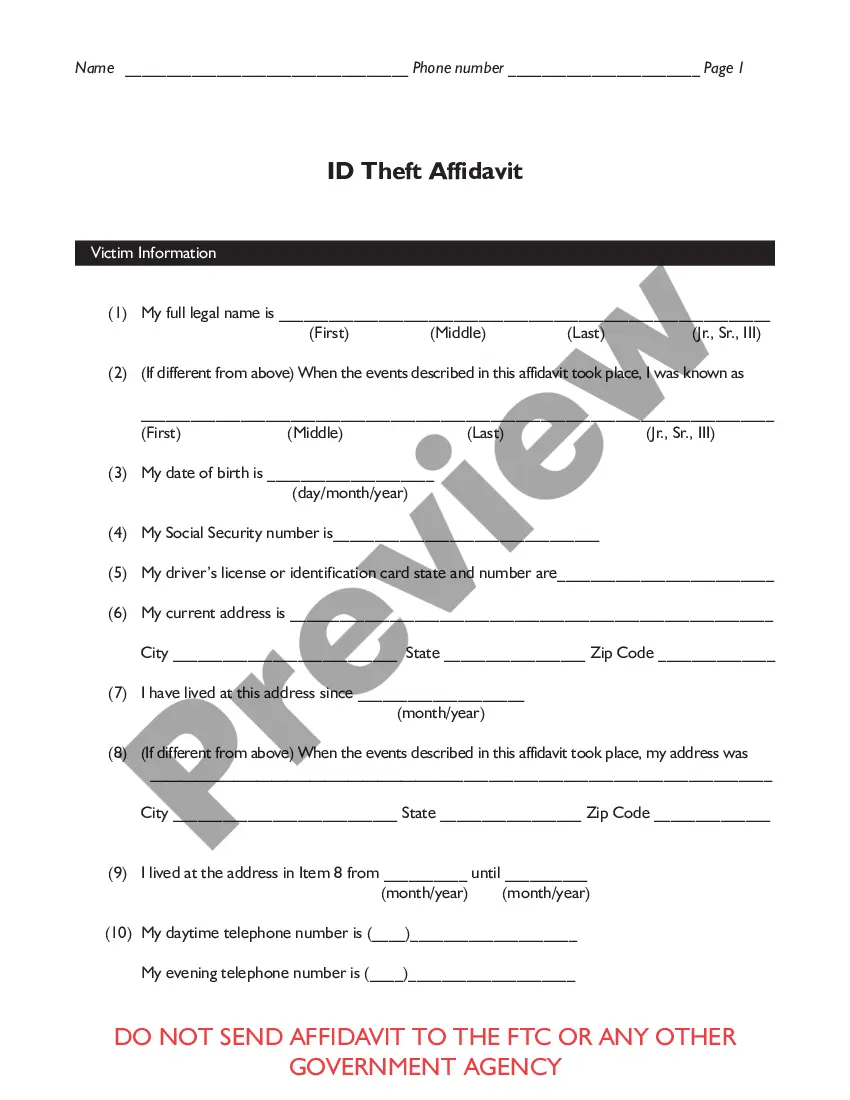

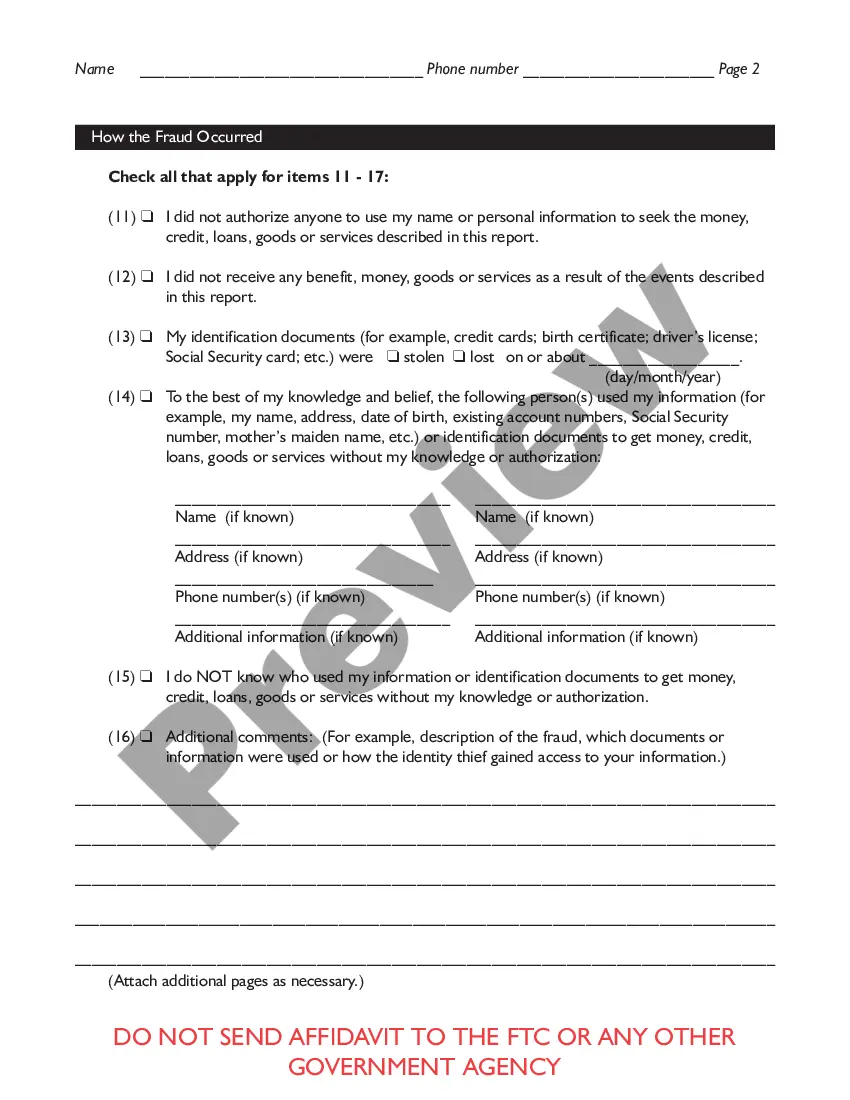

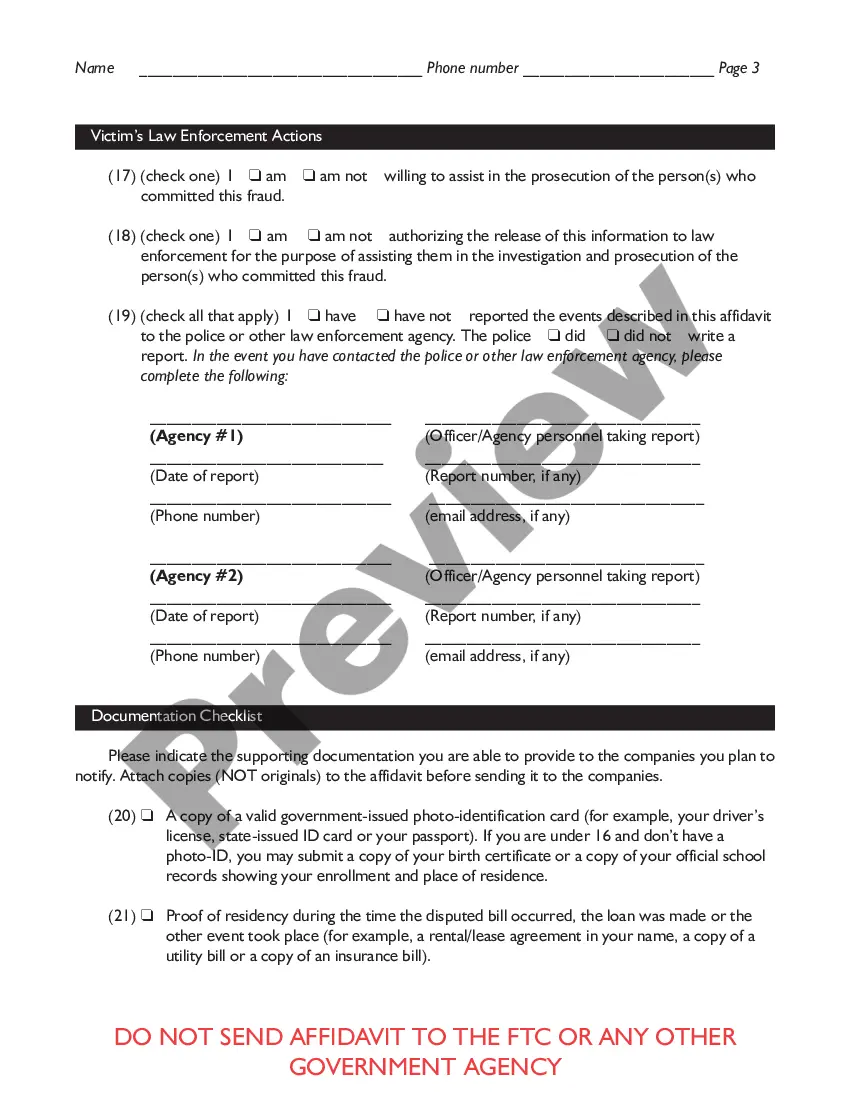

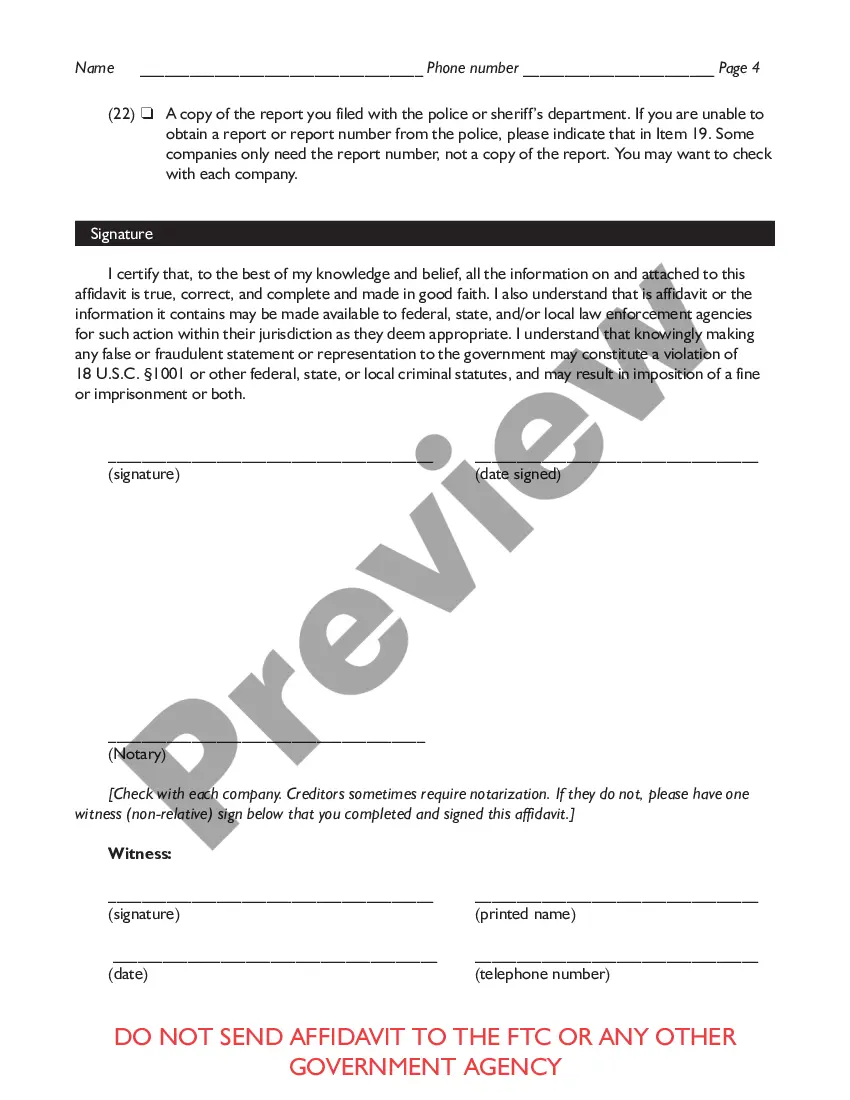

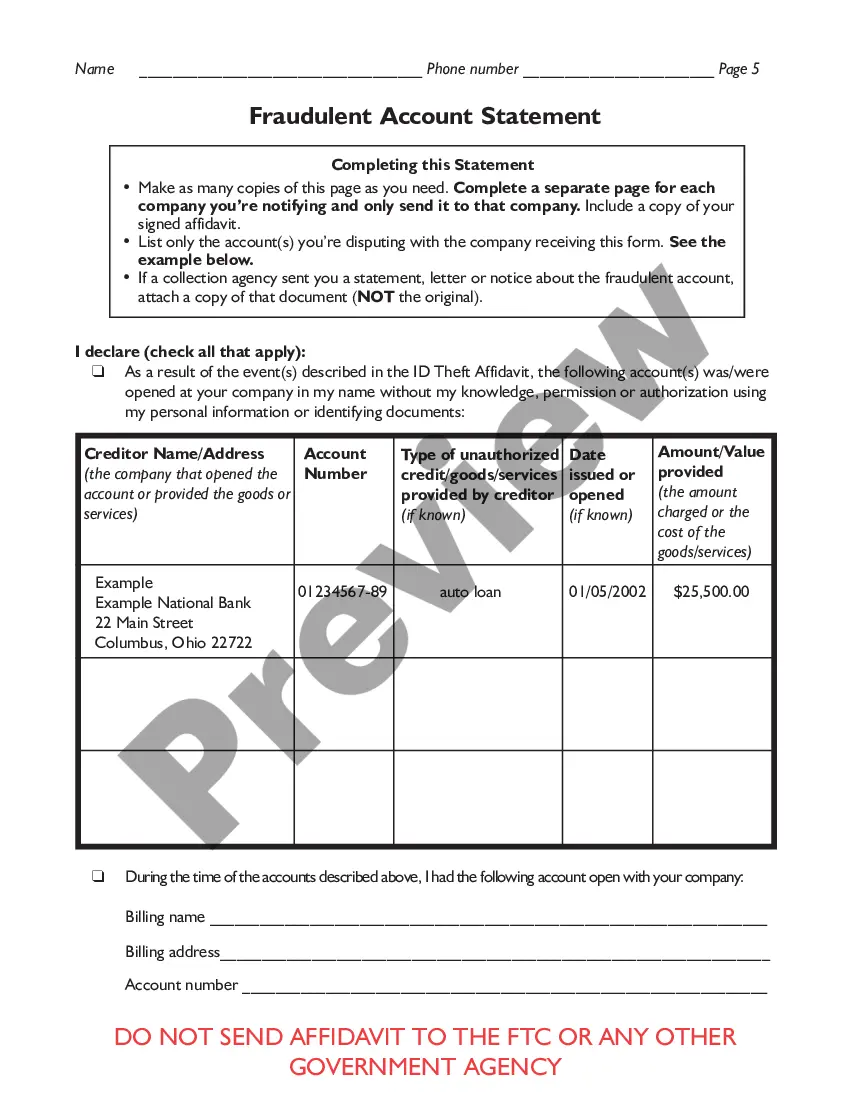

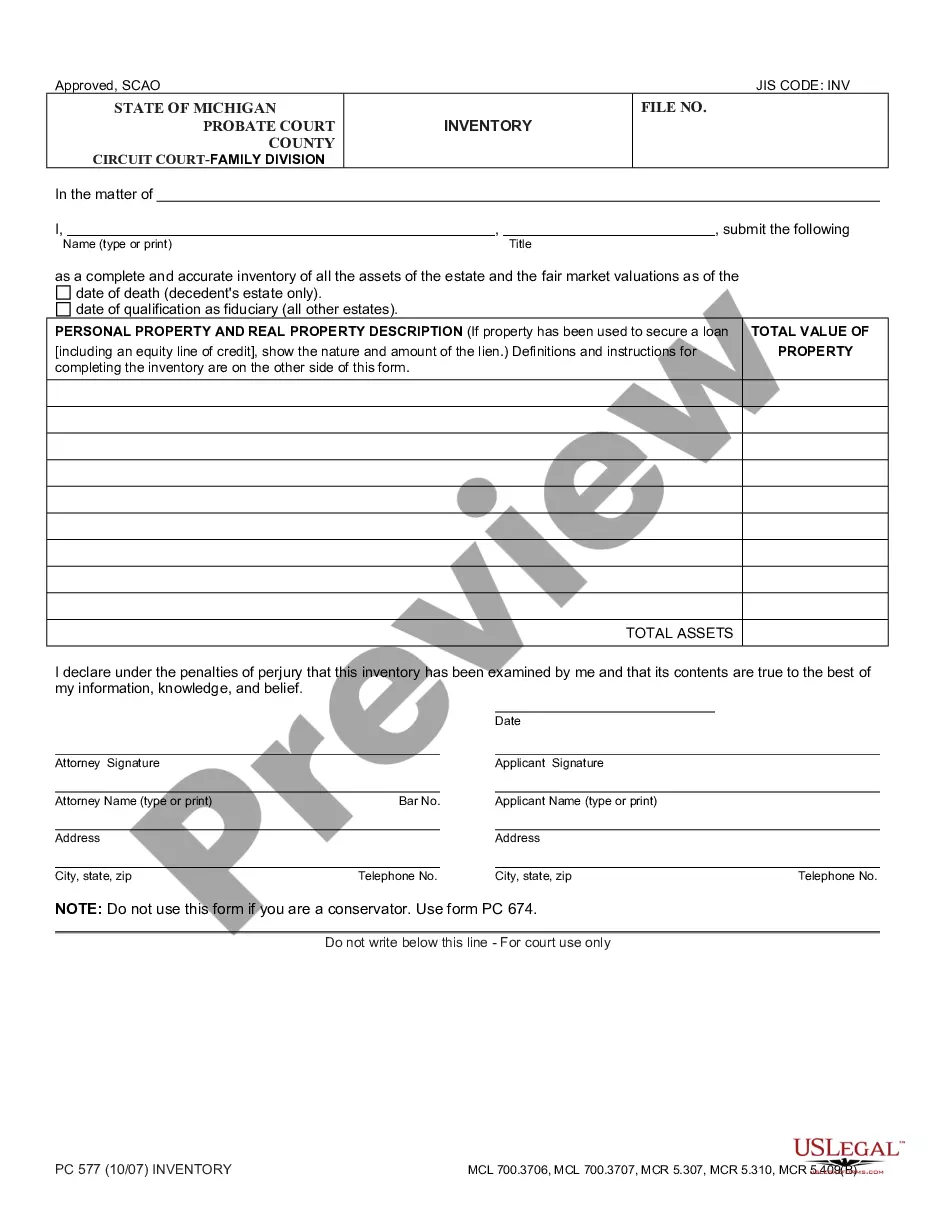

How to fill out Federal Trade Commission Affidavit Regarding Identity Theft?

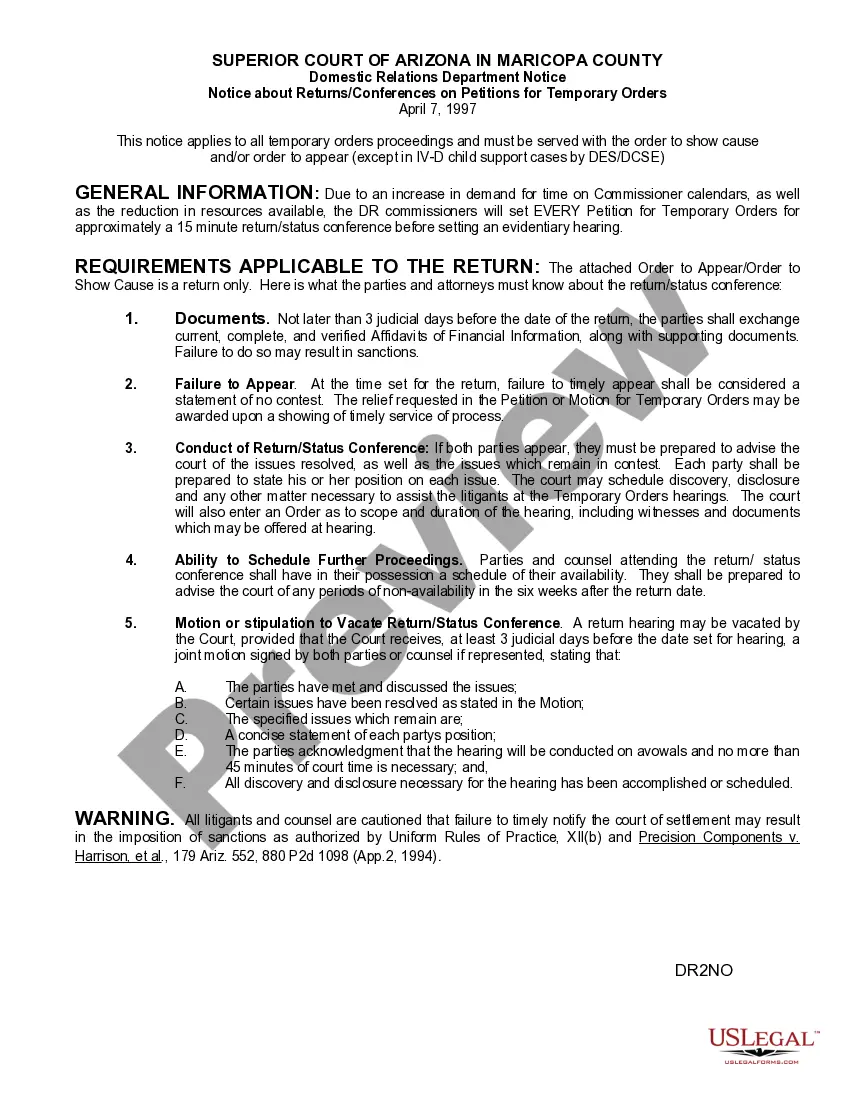

Regardless of whether for corporate reasons or personal matters, everyone must confront legal issues at some point in their lives. Filling out legal documents necessitates meticulous care, starting with selecting the right form template. For instance, if you choose an incorrect version of the Ftc Requirements, it will be declined upon submission. Thus, it is essential to have a trustworthy source of legal documents like US Legal Forms.

If you need to acquire a Ftc Requirements template, follow these straightforward steps: Find the sample you require by using the search box or browsing the catalog. Review the form’s details to ensure it aligns with your circumstances, state, and county. Click on the form’s preview to assess it. If it is the incorrect document, return to the search tool to locate the Ftc Requirements sample you need. Download the template once it meets your criteria. If you already possess a US Legal Forms account, simply click Log in to retrieve previously saved templates in My documents. If you do not have an account yet, you can obtain the form by clicking Buy now. Choose the suitable pricing option. Complete the profile registration form. Select your payment method: use a credit card or PayPal account. Choose the file format you prefer and download the Ftc Requirements. After it is downloaded, you can fill out the form with the assistance of editing software or print it and complete it by hand.

With a comprehensive US Legal Forms catalog available, you do not have to waste time searching for the appropriate sample online. Utilize the library’s user-friendly navigation to find the correct form for any situation.

- Find the sample you require by using the search box or browsing the catalog.

- Review the form’s details to ensure it aligns with your circumstances, state, and county.

- Click on the form’s preview to assess it.

- If it is the incorrect document, return to the search tool to locate the Ftc Requirements sample you need.

- Download the template once it meets your criteria.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously saved templates in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you prefer and download the Ftc Requirements.

- After it is downloaded, you can fill out the form with the assistance of editing software or print it and complete it by hand.

Form popularity

FAQ

Under the law, claims in advertisements must be truthful, cannot be deceptive or unfair, and must be evidence-based. For some specialized products or services, additional rules may apply.

FTC employees have an obligation to promptly report misconduct, fraud, waste, abuse, or mismanagement to the OIG and a duty to cooperate with the OIG. FTC contractors also have an obligation to notify the government whenever they become aware of a contract overpayment or fraud.

If you have been targeted by an illegal business practice or scam, report it at Reportfraud.ftc.gov.

Revised FTC Safeguards Rule deadline was June 9, 2023 A recently revised U.S. Federal Trade Commission (FTC) ruling ? the Safeguards Rule ? requires non-banking financial institutions to develop, deploy and maintain a comprehensive security program to keep customer financial data safe.

The Federal Trade Commission works for consumers to prevent fraudulent, deceptive, and unfair business practices and to provide information to help spot, stop, and avoid them. To file a complaint in English or Spanish, visit the FTC's online Complaint Assistant or call 1-877-FTC-HELP (1-877-382-4357).