Code For Theft

Description

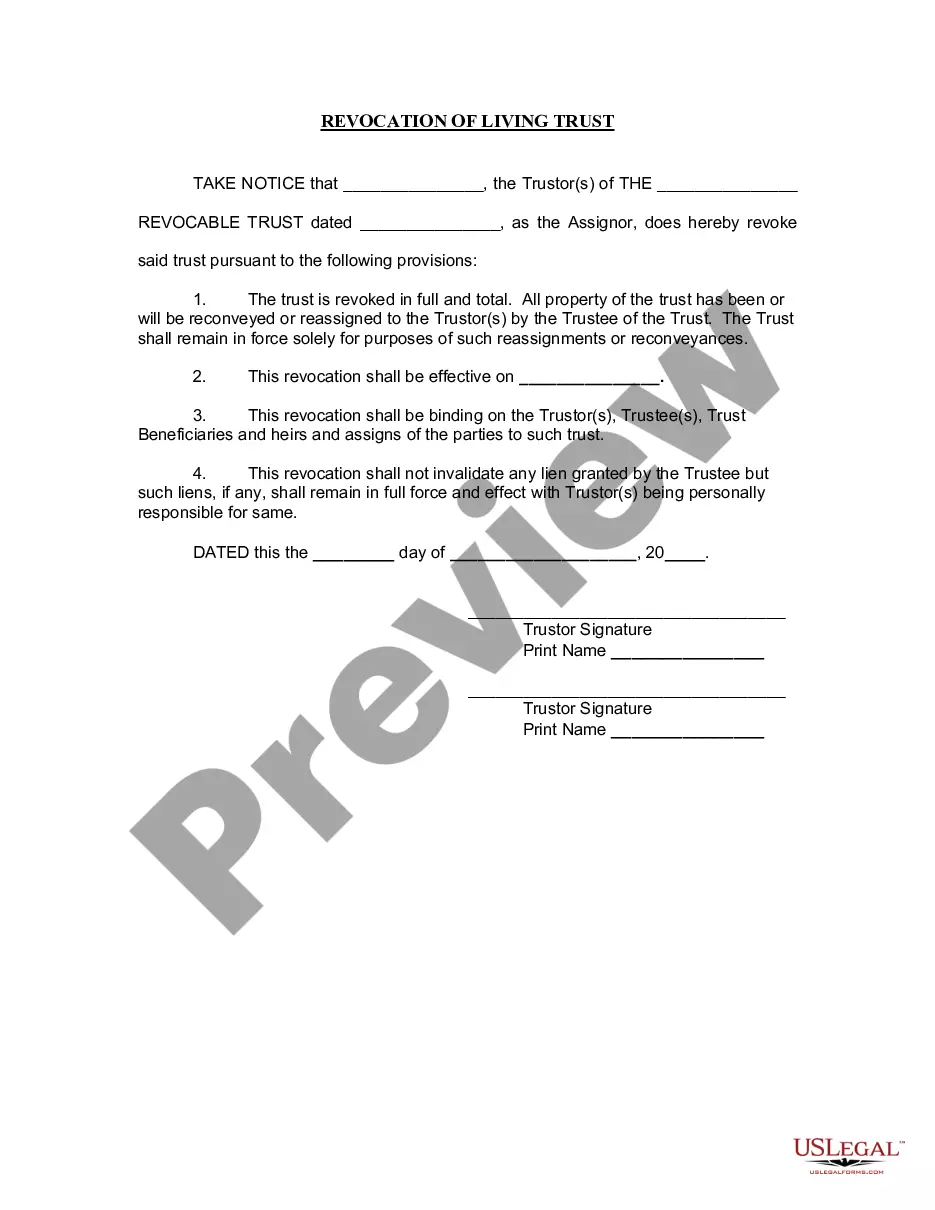

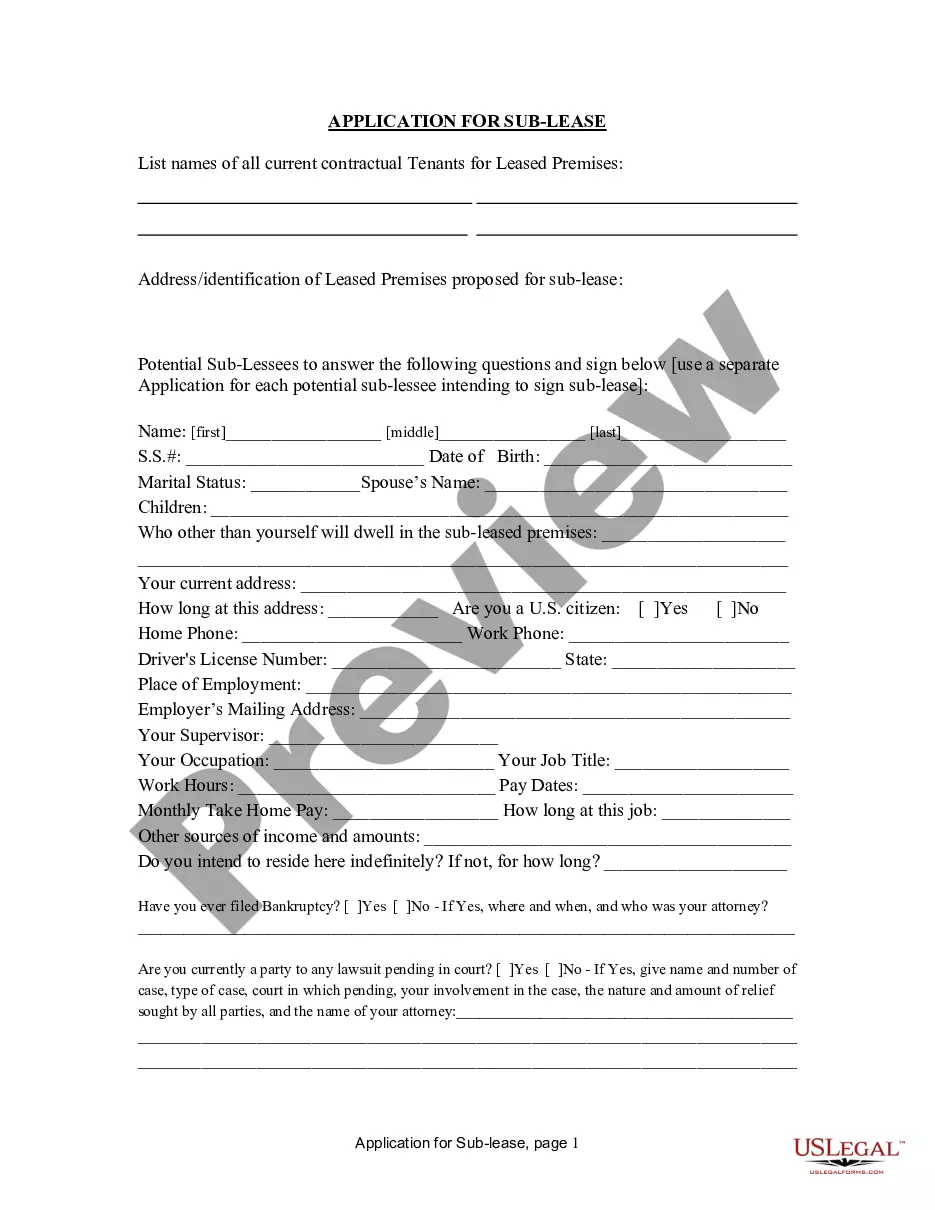

How to fill out Letter Notifying Law Enforcement Of Identity Theft?

Creating legal documents from the ground up can occasionally be somewhat daunting. Specific situations may require extensive research and significant financial investment.

If you're in search of a more direct and economical method for preparing Code For Theft or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents covers almost every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-compliant forms meticulously crafted for you by our legal professionals.

Utilize our platform whenever you require trustworthy and dependable services through which you can easily locate and download the Code For Theft. If you're familiar with our website and have previously established an account with us, simply Log In to your account, find the template, and download it or retrieve it later in the My documents section.

Ensure that the form you select adheres to the laws and regulations of your state and county. Select the appropriate subscription option to acquire the Code For Theft. Download the file, then complete, verify, and print it out. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and transform form completion into a straightforward and efficient process!

- Don't have an account? No worries.

- Registering takes just a few minutes, allowing you to explore the library.

- Before proceeding with the download of Code For Theft, consider these guidelines.

- Review the form preview and descriptions to ensure you've located the document you need.

Form popularity

FAQ

§ 1.165-8 Theft losses. (a) Allowance of deduction. (1) Except as otherwise provided in paragraphs (b) and (c) of this section, any loss arising from theft is allowable as a deduction under section 165(a) for the taxable year in which the loss is sustained.

To elect to deduct the loss as a casualty loss, complete Form 4684 as follows: On line 1, enter the name of the financial institution and "Insolvent Financial Institution." Skip lines 2 through 9. Enter the amount of the loss on line 10, and complete the rest of Section A.

The IRS Identity Protection (IP) PIN is a six-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number on fraudulent federal income tax returns. You can use the IRS online tool Get an IP PIN to obtain an IP PIN for your dependent.

You may use our Get an IP PIN online tool to retrieve your current IP PIN. If you don't already have an account on IRS.gov, you will be asked to register for an account and validate your identity. If you previously created an online account and obtained an IP PIN, access Get an IP PIN and log in to your account.