Settlement Child Support With Va Disability

Description

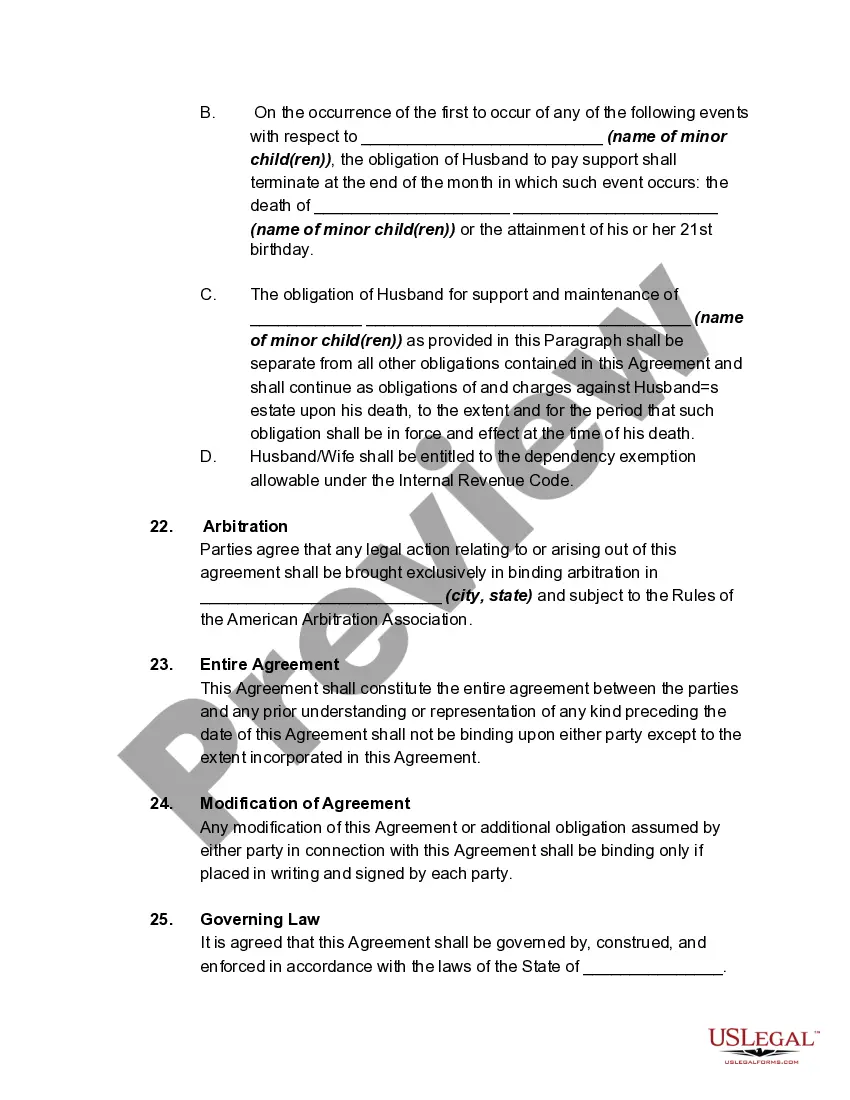

How to fill out Annulment Property Settlement, Child Support, And Custody Agreement?

Whether for business purposes or for individual matters, everybody has to handle legal situations sooner or later in their life. Completing legal documents demands careful attention, starting with choosing the appropriate form template. For instance, if you choose a wrong edition of a Settlement Child Support With Va Disability, it will be turned down once you send it. It is therefore essential to have a reliable source of legal papers like US Legal Forms.

If you have to obtain a Settlement Child Support With Va Disability template, stick to these easy steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Check out the form’s information to make sure it fits your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search function to find the Settlement Child Support With Va Disability sample you require.

- Get the template if it meets your needs.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Pick the proper pricing option.

- Finish the profile registration form.

- Pick your transaction method: use a bank card or PayPal account.

- Pick the file format you want and download the Settlement Child Support With Va Disability.

- Once it is downloaded, you are able to fill out the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time searching for the right template across the web. Take advantage of the library’s easy navigation to find the right form for any occasion.

Form popularity

FAQ

Disability benefits received from VA, such as disability compensation, pension payments and grants for home modifications, are not taxable.

Under Public Law 95-30, a Veteran's disability compensation may be garnished in order to pay alimony or child support pursuant to a court order only if the Veteran receives disability compensation in lieu of an equal amount of military retired pay, in ance with a total or partial military retired pay waiver.

Yes, the court can consider the VA compensation benefits as ?income? when deciding the amount of child support owed.

No. Under federal law, VA disability benefits are not marital property which courts can divide in a divorce. However, the VA disability payments are not invisible to the court, and do count as income when calculating child support or alimony.

Generally, federal laws protect your VA disability compensation and benefits from being garnished. For example, the IRS can't garnish your wages even if you file for bankruptcy or are in extreme debt.