Promissory Note With Balloon Payment With Interest

Description

How to fill out Promissory Note - Balloon Note?

Whether for commercial reasons or personal matters, everyone must handle legal circumstances eventually in their life.

Filling out legal documents requires meticulous care, starting with choosing the right form template.

With a vast collection at US Legal Forms available, you don’t need to waste time searching for the right template across the web. Use the library’s straightforward navigation to find the proper form for any circumstance.

- Locate the template you need by using the search bar or the catalog navigation.

- Review the form’s description to ensure it fits your situation, region, and county.

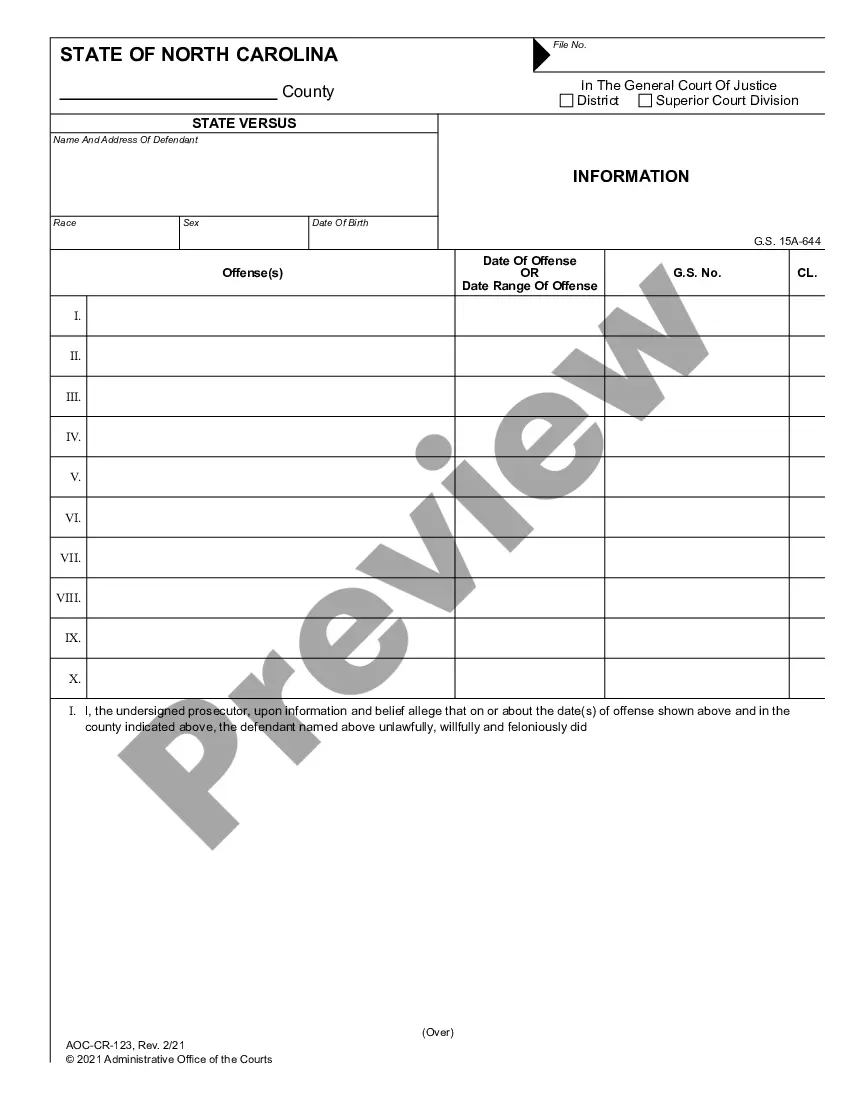

- Click on the form’s preview to view it.

- If it is the wrong form, return to the search feature to find the Promissory Note With Balloon Payment With Interest template you require.

- Obtain the file once it satisfies your specifications.

- If you already have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the file format you prefer and download the Promissory Note With Balloon Payment With Interest.

- After downloading, you can fill out the form using editing software or print it to complete manually.

Form popularity

FAQ

An unsecured promissory note with a balloon payment can be a great way to obtain financing for your business. The note doesn't require collateral, and the balloon payment gives your business time to grow before having to make a substantial repayment.

Most formal promissory notes will include interest, but it is not a requirement for a legally valid promissory note. If you do not want to charge your friend or family member interest, then make the loan interest-free or use 0% as your interest rate.

When the loan is interest-only, you only pay interest throughout the life of the loan. The final payment on the loan is called a balloon payment and equals the entire principal. This amount is due at the end of the loan period.

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

A balloon mortgage is a home loan with an initial period of low or interest-only payments. The borrower pays off the balance in full at the end of the term. A balloon mortgage is usually short-term, often five to seven years.