Assignment Due Form For Tee June 2021 In Contra Costa

Description

Form popularity

FAQ

When are secured property taxes due? Current secured tax bill: 1st installment is due November 1 and is delinquent after December 10. 2nd installment payable by February 1 and delinquent after April 10.

Contra Costa County sales tax details The minimum combined 2025 sales tax rate for Contra Costa County, California is 8.75%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%.

New property owners will usually receive an exemption application enclosed with their notice of supplemental assessment, approximately 90 to 120 days after the deed is recorded. If you acquired the property more than 120 days ago, and have not received an application, please call (925) 313-7481 for an application. 9.

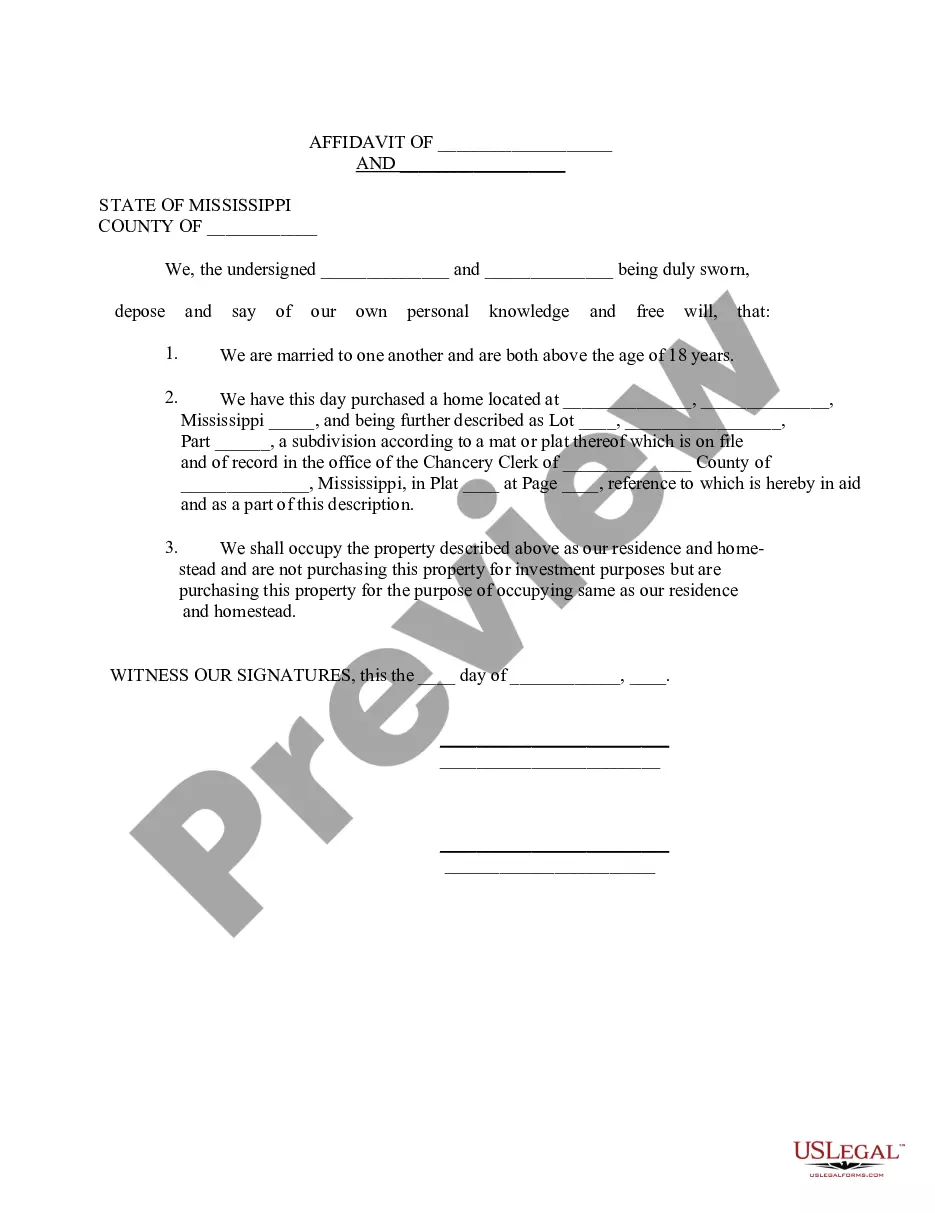

Homeowner's Exemption If you own and occupy the property as your principal place of residence, you are eligible for a Homeowners' Exemption of $7,000 in assessed value for that property. The exemption will reduce the annual property tax bill by at least $70 each year.